|

市场调查报告书

商品编码

1851373

印度二手车市场:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)India Used Car - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

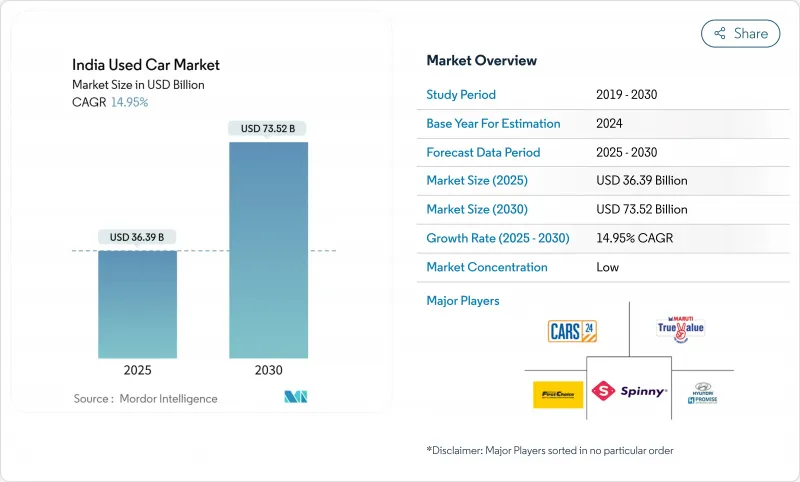

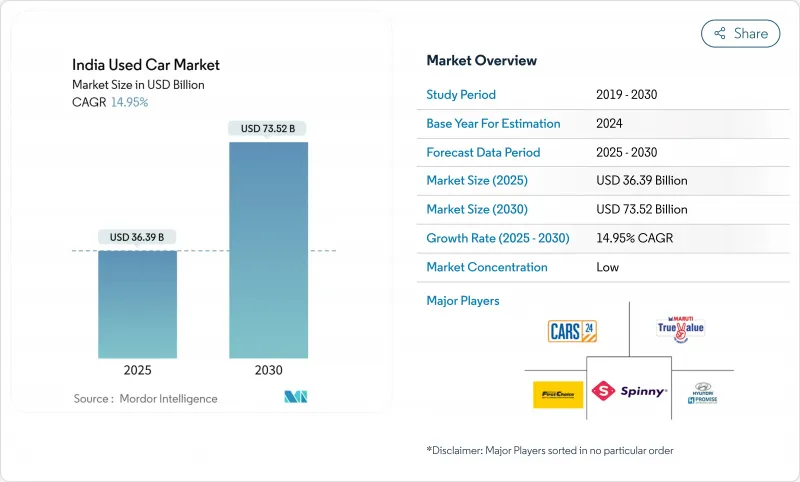

印度二手车市场预计到 2025 年将成长至 363.9 亿美元,到 2030 年将成长至 735.2 亿美元,复合年增长率为 14.95%。

快速的数位化、不断上涨的新车价格、日益完善的信贷管道以及不断变化的燃料结构偏好,持续重塑市场动态。随着价格透明、融资方案和保固服务等优势的提升,正规经销商和线上平台正在削弱传统的本地经销商主导地位,提振了消费者信心。供应限制,尤其是在3000至5000卢比价格频宽,正推动二手车年均价格上涨8%至10%,而报废政策和消费税(GST)的调整则加速了更换週期,使规模较大的企业占据优势。 SUV、紧凑型跨界车和纯电动车型透过拓展产品组合和目标客户群,开闢了新的成长点。

印度二手车市场趋势与洞察

有组织的数位零售平台的兴起

数位转型正为传统上不透明的市场带来前所未有的透明度,预计到2030年,有组织的零售市场份额将从30%增长到50%。 Cars24斥资50亿印度卢比进行技术投资,并聘请了100多名技术专家,显示建立即时评估演算法和维护追踪系统需要大量的资金投入。 CarTrade Tech每年拥有1.5亿不重复访客,自然流量占比高达90%,证明了其轻资产数位平台模式的扩充性。女性购车者对数位化交易的偏好尤其明显,她们的购车比例已从2024财年第三季的35%上升至46%,其中德里-NCR地区以48%的女性参与率领先。随着融资整合日益重要,平台整合也加速推进,Cars24 60%的交易都采用了融资解决方案。二、三线城市采用新技术将减少先前有利于本地经销商的资讯不对称,并在市场中产生民主化效应,透过改进价格发现机制使买卖双方受益。

新车价格上涨与折旧免税额加速

新车价格压力正从根本上改变消费者的购买决策,预计2023财年二手车销售量将达到517万辆,到2028财年将翻倍,达到1,000万辆。平均车龄已从6-8年缩短至4-5年,加快了供应速度,有利于二手车市场的发展。 Cars24的平均售价上涨至5.50印度卢比,反映了消费者对高端车的偏好,其中40%的销售量集中在4-8印度卢比的价格区间。供需失衡导致价格每年上涨8-10%,尤其影响首次购车者,他们占车主总数的63%,但却面临购车能力的限制。高阶车市场折旧免税额的现象最为显着,技术过时和功能更新正在加速更换週期。市场动态表明,二手车正成为人们进入汽车市场的主要途径,而新车销售越来越专注于更换用户,而非首次购车者。

品质不明和里程表造假

资讯不对称仍是市场扩张的主要障碍,品质评估的挑战在占市场份额70%的非正规市场尤为突出。传统的检测方法缺乏标准化,导致消费者不信任,限制了市场准入,并削弱了授权经销商的定价权。数位平台正在大力投资标准化检测通讯协定,例如Cars24就实施了200项检测流程和即时竞标机制,以确保价格透明且具竞争力。区块链技术在印度汽车产业的应用有望透过不可窜改的记录来解决可追溯性问题,但与全球汽车巨头相比,其应用仍然有限。品质不确定性问题在车龄超过八年的车辆中最为突出,因为评估车辆的机械状况需要专业知识,而许多买家缺乏这方面的知识。消费者教育和标准化的评级体係正成为竞争优势,正规企业利用科技建立信任,并以此证明其高于非正规企业的定价合理性。

细分市场分析

作为入门级出行解决方案,微型车/掀背车预计在2024年将占据34.23%的市场份额,而SUV将以16.20%的复合年增长率(2025-2030年)实现最快增长。福特翼搏(EcoSport)儘管已于2021年停产,但其持续的热销表明,某些车型凭藉其久经考验的可靠性和完善的售后服务,依然保持着强劲的二手车需求。随着消费者转向SUV和掀背车,轿车的偏好正在下降,传统的三厢轿车设计也逐渐失去年轻消费者的青睐,他们更看重车辆的离地间隙和灵活的载货空间。多功能车/MPV细分市场则满足了特定商用车和大家庭的需求,在二线城市保持稳定的需求,因为这些城市仍然普遍存在大家庭模式。

豪华车和跑车市场受益于都市区消费者对高端车型的追求,宝马、奥迪和宾士等品牌纷纷推出认证二手项目,以满足这一需求并维护品牌股权。这种市场区隔反映了更广泛的汽车发展趋势:SUV 正在成为各个价格分布的主流车型,这得益于燃油效率和乘坐舒适性的提升,弥补了传统 SUV 的不足。消费者偏好的变化预示着 SUV 市场份额将持续增长,尤其是在紧凑型和中型 SUV 领域,因为製造商将不断推出新车型以满足新车和二手车二手的需求。

到2024年,非正规本地经销商将维持71.43%的市场份额,这反映出市场分散性以及消费者在高价值交易中更倾向于建立人际关係。线上平台将实现最快成长,2025年至2030年的复合年增长率将达到27.50%,这主要得益于透明度倡议和融资整合,这些倡议解决了二手车交易中的传统痛点。原厂认证的特许经销商专案利用品牌信任和标准化流程,吸引註重品质、愿意为车辆状况和保固服务支付溢价的买家。大型多品牌线下经销商则占据中间位置,它们提供的车型选择比原厂认证专案更丰富,同时也提供线上平台所不具备的实车检验服务。

随着数位平台在技术基础设施和客户获取方面投入巨资,供应商格局正在迅速演变。 Cars24 高达 500 亿卢比的投资显示了其引领市场所需的雄厚资本。 CarTrade Tech 每年 1.5 亿不重复访客和 90% 的自然流量证明了数位平台模式的扩充性和客户获取效率。随着正规企业在资金筹措、物流和客户服务方面获得非正规经销商无法比拟的规模优势,市场整合似乎不可避免。然而,由于本地经销商拥有关係和成本优势,这项转型的时间表仍存在不确定性。

到2024年,汽油动力车将以61.47%的市占率占据主导地位,这得益于完善的加油基础设施和消费者对其的熟悉程度。同时,儘管基数较低,纯电动车(BEV)仍将以35.60%的复合年增长率(2025-2030年)实现显着成长。然而,电动车的成长轨迹面临二手车残值方面的挑战,51%的电动车车主由于充电和维护成本的担忧,正在考虑转换购买燃油车。柴油车在商业和远距运输场景中仍然具有吸引力,但由于排放法规和购买成本的上升,其偏好正在下降。压缩天然气(CNG)汽车在基础设施完善的市场中占据着一定的市场份额,尤其是在德里-NCR地区,当地的监管支援和成本优势正在推动其普及。

混合动力汽车是一种过渡性技术,它既能解决里程焦虑,又能提高燃油效率,但由于购买成本高且车型选择有限,其市场渗透率仍然有限。燃料类型的细分反映了印度能源转型的复杂性,基础设施的限制和成本考量导致了多种可行的动力传动系统选择,而非出现一种明显的技术赢家。市场动态表明,内燃机汽车在短期内仍将占据主导地位,而随着充电基础设施的扩展和电池成本的下降,电动车的普及速度将会加快。然而,鑑于目前二手车残值方面的挑战,这项转型的时间表仍存在不确定性。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 有组织的数位零售平台的兴起

- 新车价格高且折旧免税额迅速

- 扩大信贷供应和金融科技贷款

- SUV车型在保值方面越来越受欢迎

- 车辆报废政策旨在加快车辆周转率。

- 放弃车队模式,回归订阅模式

- 市场限制

- 品质不明和里程表造假

- 针对车龄超过8年的车辆,融资方案有限

- 更严格的排放法规/零排放车辆法规将降低旧式内燃机汽车的价值

- 微出行和叫车将降低对首批汽车的需求。

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按车辆类型

- 微型/掀背车

- 轿车

- 运动型多用途车

- 多用途车辆

- 豪华与运动

- 按供应商

- OEM认证特许经营

- 线上平台

- 大型多品牌线下经销商

- 当地非正规经销商

- 按燃料类型

- 汽油

- 柴油引擎

- CNG

- 杂交种

- 电动车

- 车龄

- 不到3年

- 3至5年

- 6至8岁

- 8年以上

- 以拥有车辆数量计算

- 第一任车主

- 第二任车主

- 第三任或以上所有者

- 按价格分布

- 不到30万

- 30万至50万

- 50万至80万

- 80万至120万

- 120万卢比以上

- 透过传输

- 手动的

- 自动的

- 按地区

- 印度北部

- 西印度群岛

- 南印度

- 东印度

- 印度中部

- 印度东北部

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- CARS24

- Maruti Suzuki True Value

- Mahindra First Choice Wheels

- Hyundai H Promise

- Honda Auto Terrace

- Toyota U Trust

- Ford Assured

- Big Boy Toyz

- BMW Premium Selection

- Audi Approved Plus

- Mercedes-Benz Certified

- CarTrade Exchange

- OLX Autos

- Spinny

- CarDekho Gaadi

- Droom Auto

- Truebil

- Quikr Cars

- Tata Motors Certified Advantage

- Volkswagen Das WeltAuto

- MG Reassure

- Renault Selection

- Nissan Intelligent Choice

第七章 市场机会与未来展望

The India used car market stands at USD 36.39 billion in 2025 and is forecast to advance to USD 73.52 billion by 2030, delivering a 14.95% CAGR.

Rapid digitization, higher new-car prices, deeper credit access, and shifting fuel-mix preferences continue to reshape market dynamics. Organized dealers and online platforms are eroding traditional local dominance as transparent pricing, embedded financing, and warranty services raise consumer confidence. Supply constraints, especially in the INR 3-5 lakh band, push annual resale prices up by 8-10%, while the scrappage policy and GST changes accelerate replacement cycles and favor scale players. SUVs, compact crossovers, and battery-electric models add new growth layers by widening the product mix and extending the addressable customer base.

India Used Car Market Trends and Insights

Rise of Organized and Digital Retail Platforms

Digital transformation is creating unprecedented transparency in a traditionally opaque market, with organized retail expected to grow from 30% to 50% market share by 2030. Cars24's INR 5 billion technology investment and hiring of 100+ tech experts demonstrate the capital intensity required to build real-time valuation algorithms and maintenance tracking systems. CarTrade Tech's achievement of 150 million yearly unique users with 90% organic traffic validates the asset-light digital platform model's scalability. The shift toward digital-first transactions is particularly pronounced among women buyers, who now represent 46% of purchases compared to 35% in Q3 FY2024, with Delhi-NCR leading at 48% female participation. Platform consolidation accelerates as financing integration becomes critical, with 60% of Cars24 transactions now including embedded lending solutions. Technology adoption in tier-2 and tier-3 cities reduces information asymmetry that historically favored local dealers, creating market democratization effects that benefit buyers and sellers through improved price discovery mechanisms.

High New-Car Prices and Faster Depreciation

New vehicle pricing pressures fundamentally reshape consumer purchase decisions, with used car sales reaching 5.17 million units in FY23 and projected to double to 10 million by FY28. The average ownership period has contracted from 6-8 to 4-5 years, creating increased supply velocity that benefits the used car ecosystem. Cars24's average selling price increase to INR 5.5 lakh reflects this premium migration, with 40% of sales concentrated in the INR 4-8 lakh range, where value-conscious buyers seek maximum utility. Supply-demand imbalances generate annual price appreciation of 8-10%, particularly affecting first-time buyers who represent 63% of ownership count but face increasing affordability constraints. The depreciation acceleration is most pronounced in premium segments, where technology obsolescence and feature updates drive faster replacement cycles. Market dynamics suggest that used cars are becoming the primary entry point for vehicle ownership, with new car sales increasingly concentrated among replacement buyers rather than first-time purchasers.

Quality Opacity and Odometer Fraud

Information asymmetry remains the primary barrier to market expansion, with quality assessment challenges particularly acute in the unorganized segment that controls 70% of the market share. Traditional inspection methods lack standardization, creating consumer distrust that limits market participation and constrains pricing power for legitimate dealers. Digital platforms are investing heavily in standardized inspection protocols, with Cars24 implementing 200-point inspection processes and live auction mechanisms to ensure competitive pricing transparency. Blockchain technology adoption in the Indian automotive industry could address traceability concerns through immutable record-keeping, though implementation remains limited compared to global automotive giants. The quality opacity problem is most pronounced in vehicles over 8 years old, where mechanical condition assessment requires specialized expertise that many buyers lack. Consumer education and standardized grading systems are emerging as competitive differentiators, with organized players leveraging technology to build trust and justify premium pricing over unorganized alternatives.

Other drivers and restraints analyzed in the detailed report include:

- Expanding Credit Availability and Fintech Lending

- Growing Preference for SUVs in Value-Retention

- Limited Financing for More Than 8-Year-Old Vehicles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Micro/hatchbacks command 34.23% market share in 2024, reflecting their role as entry-level mobility solutions, while SUVs demonstrate the fastest growth at 16.20% CAGR (2025-2030), driven by value retention perceptions and versatility demands. The Ford EcoSport's continued popularity despite production discontinuation in 2021 illustrates how certain models maintain strong resale demand due to proven reliability and service network availability. Sedans face declining preference as consumers migrate toward SUVs and hatchbacks, with traditional three-box designs losing appeal among younger buyers who prioritize ground clearance and cargo flexibility. MUV/MPV segments serve niche commercial and large family requirements, maintaining steady demand in tier-2 cities where joint family structures remain prevalent.

Luxury and sports car segments benefit from aspirational purchasing in metro cities, with brands like BMW, Audi, and Mercedes-Benz establishing certified pre-owned programs to capture this demand while maintaining brand equity. The segmentation reflects broader automotive trends where SUVs are becoming the dominant body style across price points, supported by improved fuel efficiency and ride quality that address traditional SUV limitations. Consumer preference evolution suggests continued SUV market share expansion, particularly in compact and mid-size categories, where manufacturers are launching new models to capture both new and eventual used car demand.

Unorganized local dealers maintain 71.43% market share in 2024, reflecting the market's fragmented nature and consumers' preference for personal relationships in high-value transactions. Online platforms achieve the fastest growth at 27.50% CAGR (2025-2030), driven by transparency initiatives and financing integration that address traditional pain points in used car transactions. OEM-certified franchise programs leverage brand trust and standardized processes to capture quality-conscious buyers willing to pay premiums for assured vehicle condition and warranty coverage. Large multi-brand offline dealers occupy the middle ground, offering a wider selection than OEM programs while providing physical inspection capabilities that online platforms cannot match.

The vendor landscape is experiencing rapid evolution as digital platforms invest heavily in technology infrastructure and customer acquisition, with Cars24's INR 5 billion investment demonstrating the capital requirements for market leadership. CarTrade Tech's 150 million yearly unique users with 90% organic traffic validate the digital platform model's scalability and customer acquisition efficiency. Market consolidation appears inevitable as organized players gain scale advantages in financing, logistics, and customer service that unorganized dealers cannot match. However, the transition timeline remains uncertain given local dealers' embedded relationships and cost advantages.

Petrol vehicles dominate with a 61.47% market share in 2024, benefiting from widespread refueling infrastructure and consumer familiarity, while battery-electric vehicles demonstrate an exceptional 35.60% CAGR (2025-2030) despite a current low base. The EV growth trajectory faces headwinds from resale value concerns, with 51% of EV owners considering switching to ICE vehicles due to charging anxiety and maintenance costs. Diesel vehicles face declining preference due to emission norms and higher acquisition costs, though they maintain appeal in commercial applications and long-distance usage scenarios. CNG vehicles occupy a niche position in markets with established infrastructure, particularly in Delhi-NCR, where regulatory support and cost advantages drive adoption.

Hybrid vehicles represent a transitional technology that addresses range anxiety while providing fuel efficiency benefits, though market penetration remains limited due to higher acquisition costs and limited model availability. The fuel type segmentation reflects India's energy transition complexity, where infrastructure limitations and cost considerations create multiple viable powertrain options rather than clear technology winners. Market dynamics suggest continued ICE dominance in the near term, with electric vehicle adoption accelerating as charging infrastructure expands and battery costs decline. However, the transition timeline remains uncertain given the challenges of the current resale value.

The India Used Car Market Report is Segmented by Vehicle Type (Micro/Hatchback, SUV, and More), Vendor Type (OEM-Certified Franchise, and More), Fuel Type (Petrol, Battery-Electric, and More), Vehicle Age (Less Than 3 Years, and More), Ownership Count (First-Owner, and More), Transmission (Manual and Automatic), Price Band, and Region. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- CARS24

- Maruti Suzuki True Value

- Mahindra First Choice Wheels

- Hyundai H Promise

- Honda Auto Terrace

- Toyota U Trust

- Ford Assured

- Big Boy Toyz

- BMW Premium Selection

- Audi Approved Plus

- Mercedes-Benz Certified

- CarTrade Exchange

- OLX Autos

- Spinny

- CarDekho Gaadi

- Droom Auto

- Truebil

- Quikr Cars

- Tata Motors Certified Advantage

- Volkswagen Das WeltAuto

- MG Reassure

- Renault Selection

- Nissan Intelligent Choice

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise of organised and digital retail platforms

- 4.2.2 High new-car prices and faster depreciation

- 4.2.3 Expanding credit availability and fintech lending

- 4.2.4 Growing preference for SUVs in value-retention

- 4.2.5 Vehicle-scrappage policy accelerating turnover

- 4.2.6 Mobility-fleet de-fleeting and subscription returns

- 4.3 Market Restraints

- 4.3.1 Quality opacity and odometer fraud

- 4.3.2 Limited financing for more than 8-year-old vehicles

- 4.3.3 Stricter emission / ZEV norms devaluing older ICE stock

- 4.3.4 Micro-mobility and ride-hailing reducing first-car demand

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Vehicle Type

- 5.1.1 Micro/Hatchback

- 5.1.2 Sedan

- 5.1.3 Sport Utility Vehicle

- 5.1.4 Multi-Purpose Vehicle

- 5.1.5 Luxury and Sports

- 5.2 By Vendor Type

- 5.2.1 OEM-Certified Franchise

- 5.2.2 Online Platforms

- 5.2.3 Large Multi-brand Offline Dealers

- 5.2.4 Unorganized Local Dealers

- 5.3 By Fuel Type

- 5.3.1 Petrol

- 5.3.2 Diesel

- 5.3.3 CNG

- 5.3.4 Hybrid

- 5.3.5 Battery-Electric

- 5.4 By Vehicle Age

- 5.4.1 Less than 3 Years

- 5.4.2 3 to 5 Years

- 5.4.3 6 to 8 Years

- 5.4.4 More than 8 Years

- 5.5 By Ownership Count

- 5.5.1 First-Owner

- 5.5.2 Second-Owner

- 5.5.3 Third-Owner and Above

- 5.6 By Price Band

- 5.6.1 Less than ₹3 lakh

- 5.6.2 ₹3 to ₹5 lakh

- 5.6.3 ₹5 to ₹8 lakh

- 5.6.4 ₹8 to ₹12 lakh

- 5.6.5 More than ₹12 lakh

- 5.7 By Transmission

- 5.7.1 Manual

- 5.7.2 Automatic

- 5.8 By Region

- 5.8.1 North India

- 5.8.2 West India

- 5.8.3 South India

- 5.8.4 East India

- 5.8.5 Central India

- 5.8.6 North-East India

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 CARS24

- 6.4.2 Maruti Suzuki True Value

- 6.4.3 Mahindra First Choice Wheels

- 6.4.4 Hyundai H Promise

- 6.4.5 Honda Auto Terrace

- 6.4.6 Toyota U Trust

- 6.4.7 Ford Assured

- 6.4.8 Big Boy Toyz

- 6.4.9 BMW Premium Selection

- 6.4.10 Audi Approved Plus

- 6.4.11 Mercedes-Benz Certified

- 6.4.12 CarTrade Exchange

- 6.4.13 OLX Autos

- 6.4.14 Spinny

- 6.4.15 CarDekho Gaadi

- 6.4.16 Droom Auto

- 6.4.17 Truebil

- 6.4.18 Quikr Cars

- 6.4.19 Tata Motors Certified Advantage

- 6.4.20 Volkswagen Das WeltAuto

- 6.4.21 MG Reassure

- 6.4.22 Renault Selection

- 6.4.23 Nissan Intelligent Choice

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment