|

市场调查报告书

商品编码

1745946

欧洲的照明设备市场The European Market for Lighting Fixtures |

||||||

欧洲照明设备市场规模约200亿欧元。德国、英国和法国是欧洲照明设备市场最大的消费国。

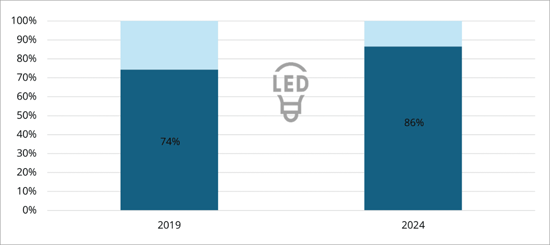

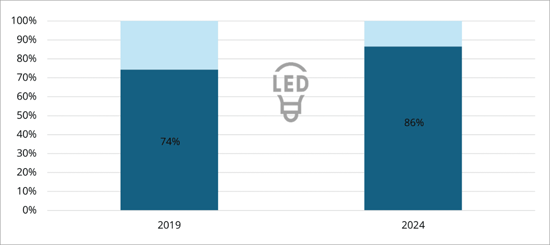

CSIL表示,照明设备市场前景光明。日益增长的节能意识和日益严格的环境法规推动了对高效照明解决方案的需求,带来了巨大的成长机会。这是因为LED产品作为一种成熟的技术,目前已占欧洲照明设备总消费量的近90%,这推动了互联照明和智慧照明的扩张,而互联照明是新兴的主要趋势之一,并且正在逐步重塑竞争格局。

本报告提供欧洲的照明设备的市场分析·预测,彙整欧洲30个国家的照明设备的生产,消费,国际贸易趋势,各用途的详细分析,技术开发趋势,竞争情形,市场占有率,主要製造业的简介等资讯。

主要企业

|

|

|

亮点

欧洲:照明设备市场上LED的普及率

2019年·2024年占有率 (%)

出处CSIL

目录 (摘要)

调查手法

摘要整理

第1章 情势:各国的趋势,市场区隔,及的数值

- 各国市场趋势与数值

- 欧洲的LED安装库存

- 欧洲的主要群组及其市场占有率

- 2025~2027年的预测

第2章 业绩:各国基础资料和宏观经济指标

- 北欧 (丹麦,芬兰,挪威,瑞典)

- 西欧 (比利时,法国,爱尔兰,荷兰,英国)

- 中欧 (DACH:奥地利,德国,瑞士)

- 南欧 (希腊,义大利,葡萄牙,西班牙)

- 中东欧 (保加利亚,克罗埃西亚,赛普勒斯,捷克,爱沙尼亚,匈牙利,立陶宛,拉脱维亚,马尔他,波兰,罗马尼亚,斯洛维尼亚,斯洛伐克)

第3章 国际贸易

- 贸易收支,进出口的转变

- 进出口前十名国家,主要目的地·原产地进出口额,各产品种类进出口额

- 各国及目的地/原产地的各地区的进出口

第4章 市场结构

- 产品与用途

- 住宅 (室内) 照明:风格和各产品的销售额

- 商务用 (室内) 照明:各产品的销售额

- 商业用照明:目的地销售额

- 产业用照明:目的地销售额

- 室外照明:产品及目的地的销售额

- 目的地各市场区隔的预测

- LED照明

- 革新趋势

- 连网型照明

- 连网型应用

- 智慧财产权

第5章 流通管道

- 概要:综合照明,住宅及商务用照明市场

- 照明的专家

- 家具连锁,家具店,百货商店

- 批发商

- 电子商务

第6章 竞争系统:各用途的企业占有率

- 照明设备全体:欧洲的主要企业市场占有率 (消费·生产)

- 各市场的竞争系统:住宅室内 (设计领域重点) 、饭店,办公室,零售,艺术会场,娱乐,与与学校基础设施,工厂,危险环境,海洋,医疗保健,紧急,园艺,住宅室外,建筑室外,马路,隧道,圣诞节区域照明

第7章 竞争系统:各国企业占有率

- 各国竞争系统 (北欧,西欧,中欧 、南欧,中东欧)

- 从欧洲欧洲外市场及海外的出口

附录

The CSIL Market Research Report "The European market for lighting fixtures" offers a detailed analysis of the lighting fixtures industry across 30 European countries, providing insights, statistics, and the main indicators to go in-depth into this sector, and is structured as follows:

1. SCENARIO: OVERVIEW OF THE LIGHTING FIXTURES IN EUROPE

The European lighting fixtures sector is analysed through tables and graphs showing production, consumption, and international trade at both European and Country level, highlighting the two main market segments in Europe:

- Residential lighting

- Professional lighting (commercial, industrial, outdoor lighting)

The chapter also provides a panorama of the leading European groups with their market shares.

Forecasts on lighting fixtures consumption for 2025, 2026, and 2027 conclude the chapter.

2. THE EUROPEAN LIGHTING FIXTURES BUSINESS PERFORMANCE

This section offers statistics on lighting fixtures (Production, consumption, international trade) and comparison with selected country key macroeconomic indicators to assess sector performance for the time series 2019-2024, with forecasts for 2025-2027.

Data are provided at the European and Country level, by area:

- Northern Europe (Denmark, Finland, Norway, Sweden)

- Western Europe (Belgium, France, Ireland, Netherlands, United Kingdom)

- Central Europe (DACH: Austria, Germany, Switzerland)

- Southern Europe (Greece, Italy, Portugal, Spain)

- Central Eastern Europe (Bulgaria, Croatia, Cyprus, Czech Republic, Estonia, Hungary, Lithuania, Latvia, Malta, Poland, Romania, Slovenia, Slovakia)

3. THE DYNAMICS OF LIGHTING FIXTURES' TRADE

A comprehensive overview of international trade in lighting fixtures, focusing on exports and imports for the 30 European countries over the past six years (2019-2024).

4. MARKET STRUCTURE: APPLICATIONS, PRODUCTS, AND TECHNOLOGIES IN THE LIGHTING INDUSTRY

Analysis of the structure of the European lighting fixtures market, breaking down data by segment:

- Residential lighting: Breakdown of Lighting Fixtures market by style and by products.

- Professional lighting: breakdown by products and by destination for Commercial and Industrial lighting.

- Outdoor lighting: breakdown by products and by destination.

A selection of the main companies operating in each segment and forecasts by segment and destination are also provided.

Special focus is given to the main sector trends, including the growth of LED and smart / connected lighting technologies; sustainability; human-centric lighting (HCL); miniaturization trends; evolution of USB / portable lamps.

The study also examines intellectual property developments and patent activity within the European lighting industry.

5. LIGHTING FIXTURES DISTRIBUTION IN EUROPE

An overview of the European lighting fixtures distribution through tables showing the breakdown of lighting fixtures sales by distribution channel (Direct sales / Contract / Projects; Lighting specialists; Furniture chains / furniture stores / department stores; Wholesalers; E-commerce) for residential and professional lighting, and for most of the leading companies and the largest markets.

6. THE COMPETITIVE SYSTEM: THE LARGEST MANUFACTURERS OF LIGHTING FIXTURES IN EUROPE

Insights into the leading local and foreign players in each application segment and each European Country, providing:

- Sales data and market shares of top lighting fixtures companies.

- Company profiles of selected leading market players providing sales performance and strategies.

- Focus on European lighting fixtures exports outside Europe (Middle East and Africa, Asia-Pacific, North, Central and South America).

7. ANNEXES: INTERNATIONAL TRADE AND FINANCIAL ANALYSIS

- International trade tables by country. Detailed tables on lighting fixtures exports and imports by single country (30 European Countries considered), for the last 6 years, broken down by country and by geographic area of destination/origin.

- Financial Analysis builds on a sample of around 120 European companies active in the lighting sector, a study of their main profitability ratios (ROA, ROE, and EBITDA), and measures their employee ratios.

- Directory of companies mentioned in this report: around 450 companies included

The CSIL Market Research Report "The European Market for Lighting Fixtures" offers comprehensive analysis and data to help answer relevant questions:

- What is the size of the Lighting Fixtures Market in Europe, and the largest consuming and importing countries in the area?

- How is the European lighting fixtures market structured and segmented?

- What are the leading groups and companies in the European Lighting Fixtures industry?

- How is the distribution of Lighting Fixtures in Europe structured? And, what are the main channels?

- What are the main innovation trends in the European lighting sector?

- What is the forecast for the lighting market in Europe and by Country?

NOTES:

- CONSIDERED PRODUCTS: Batten lights, Bollards, Ceiling luminaires, Chandeliers, Christmas lighting, Downlights, Embedded, Emergency lighting, Floodlights, Floor light, High and Low Bay, LED panels, Light poles, Linear lighting, Modular systems, Projectors, Spotlights, Step lighting / Guide Light, Strip lighting, Suspensions, Table lighting, Track lights, Wall luminaires.

- DESTINATIONS: Residential; Commercial (Hospitality; Office; Retail; Museums and Art venues; Entertainment; Schools and Infrastructure); Industrial (Industrial plants; Hazardous environments; Marine; Horticulture; Healthcare; Emergency); Outdoor (Residential outdoor; Urban Landscape; Christmas and Events; Streets and major roads; Tunnels and Galleries; Sport facilities, parking, oil stations).

- GEOGRAPHICAL COVERAGE: Austria (AT), Belgium (BE), Bulgaria (BG), Croatia (HR), Cyprus (CY), Czech Republic (CZ), Denmark (DK), Estonia (EE), Finland (FI), France (FR), Germany (DE), Greece (GR), Hungary (HU), Ireland (IE), Italy (IT), Latvia (LV), Lithuania (LT), Malta (MT), Netherlands (NL), Norway (NO), Poland (PL), Portugal (PT), Romania (RO), Slovakia (SK), Slovenia (SL), Spain (ES), Sweden (SE), Switzerland (CH), United Kingdom (UK).

Selected companies

Among the companies mentioned in this study:

|

|

|

Highlights:

Europe. Incidence of LED on total lighting fixtures market,

2019 and 2024.

Percentage share

Source: CSIL

The European market for lighting fixtures amounts to around EUR 20 billion. Germany, the United Kingdom, and France are the largest consuming countries of this segment within Europe.

According to CSIL, the lighting fixtures market perspectives appear to be solid. The growing demand for efficient lighting solutions, driven by greater focus on energy savings and increasingly stringent environmental regulations, presents promising growth opportunities. This has driven LED products, an established and mature technology, to account for nearly 90% of total lighting fixtures consumption in Europe and is driving the expansion of connected and smart lighting, one of the key emerging sector trends, which is progressively reshaping the competitive landscape.

Table of Contents (Abstract)

Methodology

- Research tools and terminology, Contents

Executive summary

1. Scenario: Trends, market segment and figures by country

- 1.1. Market evolution and figures by country

- 1.2. LED installed stock in Europe

- 1.2. Leading groups in Europe and their market shares

- 1.3. Forecasts 2025-2027

2. Business performance: basic data and macroeconomic indicators by country

- 2.1. Northern Europe (Denmark, Finland, Norway, Sweden)

- 2.2. Western Europe (Belgium, France, Ireland, Netherlands, United Kingdom)

- 2.3. Central Europe (DACH: Austria, Germany, Switzerland)

- 2.4. Southern Europe (Greece, Italy, Portugal, Spain)

- 2.5. Central-Eastern Europe (Bulgaria, Croatia, Cyprus, Czech Republic, Estonia, Hungary, Lithuania, Latvia, Malta, Poland, Romania, Slovenia, Slovakia)

3. International trade

- 3.1. Trade balance, exports and imports evolution

- 3.2. Top 10 exporting/importing Countries, exports/imports by main destinations/origin, export/import by product segment

- 3.3. Exports and imports by country and by geographical area of destination/origin

4. Market structure

- 4.1. Products and applications

- 4.2. Residential (indoor) lighting: sales breakdown by style and products

- 4.3. Professional (indoor) lighting: sales breakdown by products

- 4.3.1. Commercial lighting: sales breakdown by destinations

- 4.3.2. Industrial lighting: sales breakdown by destinations

- 4.4. Outdoor lighting: sales breakdown by products and destinations

- 4.5. Forecasts by destination segments

- 4.6. LED lighting

- 4.7. Innovation trends

- 4.8. Connected lighting

- 4.9. Connected applications

- 4.10. Intellectual Property

5. Distribution channels

- 5.1. Overview: Total Lighting, Residential and Professional Lighting Market

- 5.2. Lighting specialists

- 5.3. Furniture chains, furniture stores, department stores

- 5.4. Wholesalers

- 5.5. E-commerce

6. The competitive system: company market shares by application

- 6.1. Total lighting fixtures: leading players in Europe and market shares (consumption and production)

- 6.2. The European competitive system by market destination: Residential indoor (with a focus on design segment), Hospitality, Office, Retail, Art venues, Entertainment, Schools & Infrastructure, Industrial plants, Hazardous conditions, Marine, Healthcare, Emergency, Horticulture, Residential outdoor, Architectural outdoor, Street, Tunnel, Christmas and Area Lighting

7. The competitive system: company market shares by Country

- 7.1. The European competitive system by Country (Northern Europe, Western Europe, Central Europe (DACH), Southern Europe, Central-Eastern Europe)

- 7.2. Exports from Europe to Extra-European markets and Overseas

Annexes

- Annex 1. International trade tables by Country

- Annex 2. Financial Analysis: Key financial indicators and Employment analysis in a sample of over 100 manufacturers

- Annex 3. List of selected European lighting companies mentioned in the Report