|

市场调查报告书

商品编码

1740977

蒸汽涡轮机服务市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Steam Turbine Service Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

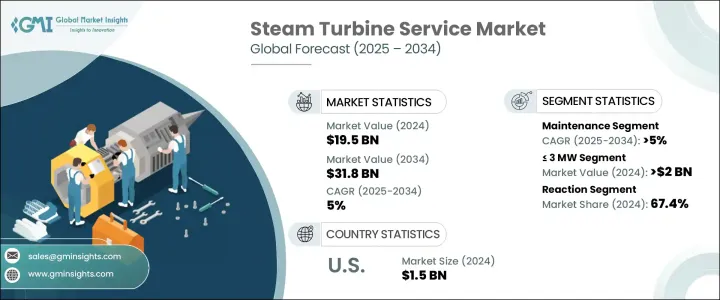

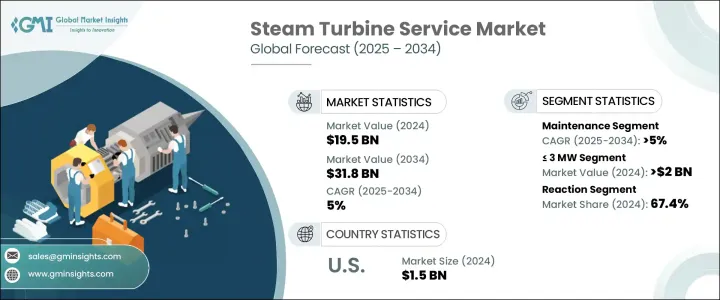

2024年,全球蒸汽涡轮机服务市场规模达195亿美元,预计到2034年将以5%的复合年增长率成长,达到318亿美元。这主要得益于火力发电需求的不断成长、老化汽轮机机组的升级改造以及对营运效率优化的日益重视。蒸汽涡轮机服务涵盖维护、维修和大修 (MRO) 活动,旨在提升发电、石油天然气和工业製造等行业汽轮机的生命週期和性能。随着企业越来越重视减少停机时间和提高能源产出,他们也越来越多地投资于预测性维护、数位监控和先进的维修解决方案,以确保汽轮机保持最佳性能。

政府提倡提高能源效率并推行更严格的排放标准,进一步鼓励电力生产商和工业营运商投资蒸汽涡轮机的定期维护。老化燃煤和燃气电厂的现代化改造,以及热电联产 (CHP) 计画的兴起,正在推动对综合服务解决方案的需求。服务提供者还提供客製化合同,包括长期服务协议 (LTSA) 和基于绩效的合同,以满足最终用户不断变化的营运需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 195亿美元 |

| 预测值 | 318亿美元 |

| 复合年增长率 | 5% |

蒸汽涡轮机服务市场主要以容量细分,额定功率大于100兆瓦的汽轮机在2024年将占据市场主导地位,市场规模达144亿美元。大容量汽轮机主要用于公用事业规模的火力发电厂、核电厂和工业热电联产厂,这些场合的运作可靠性和高效率至关重要。这些高容量汽轮机的定期翻新、零件更换和性能升级需求推动了其服务需求,这些需求旨在延长其使用寿命,并保持符合不断变化的电网法规和能源效率标准。

从设计角度来看,反作用式蒸汽涡轮机细分市场在2024年占据了服务市场的主导地位,估值达131亿美元。反作用式汽轮机以其高效处理高压蒸汽而闻名,广泛应用于大型火力发电和核能专案。反作用式汽轮机运作环境复杂,需要频繁检查、精确维修和先进的诊断服务,以防止代价高昂的故障并维持发电量。服务供应商越来越多地利用3D扫描、远端监控和积层製造等技术,为全球反作用式汽轮机机组提供更快、更精准的维护解决方案。

就服务类型而言,维修领域在2024年占据了最大的市场份额,达到82亿美元。随着许多蒸汽涡轮机达到或超过其设计寿命,对维修服务的需求(包括叶片翻新、转子焊接、机壳修復和效率改造)正在上升。及时维修不仅可以防止重大故障,还可以恢復性能、优化燃料消耗,并推迟与全面更换汽轮机相关的资本支出。服务提供者正在透过行动服务单元、现场维修和数位孪生技术扩展其维修能力,以最大限度地减少停机时间并改善客户服务。

2024年,亚太地区引领全球蒸汽涡轮机服务市场,产值达96亿美元,这得益于其庞大的火力发电厂装机基数和强劲的工业活动。中国、印度、日本和韩国等国家正在推动区域成长,因为各国政府和公用事业公司正在大力投资维护和升级现有汽轮机资产,以满足不断增长的电力需求和永续发展目标。对电网稳定性的追求、燃煤电力基础设施的现代化以及对清洁煤技术不断增长的投资,为该地区的服务提供者创造了丰厚的利润。此外,大型原始设备製造商和第三方服务供应商提供具有竞争力的在地化服务,进一步巩固了亚太地区在市场上的主导地位。

西门子能源、通用电气 (GE)、三菱电力、EthosEnergy 和苏尔寿有限公司等领先公司正透过策略服务、数位化措施和区域服务中心扩张来巩固其市场地位。这些公司越来越注重提供全面的服务组合——涵盖现场服务、状态监控、升级解决方案和远端诊断——以满足公用事业和工业客户不断变化的需求。对于寻求利用全球蒸汽涡轮机服务市场稳步成长的公司而言,人工智慧驱动的预测性维护平台、模组化维修技术和灵活的服务协议等创新正变得至关重要。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略展望

- 创新与永续发展格局

第五章:市场规模及预测:依产能,2021 - 2034 年

- 主要趋势

- ≤3兆瓦

- > 3 兆瓦 - 100 兆瓦

- > 100 兆瓦

第六章:市场规模及预测:依设计,2021 - 2034 年

- 主要趋势

- 反应

- 衝动

第七章:市场规模及预测:依服务,2021 - 2034

- 主要趋势

- 维护

- 维修

- 大修

- 其他的

第八章:市场规模及预测:依最终用途,2021 - 2034

- 主要趋势

- 工业的

- 公用事业

第九章:市场规模及预测:依服务供应商,2021 - 2034 年

- 主要趋势

- OEM

- 非OEM

第 10 章:市场规模与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 俄罗斯

- 德国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 印尼

- 马来西亚

- 泰国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 伊朗

- 埃及

- 南非

- 奈及利亚

- 土耳其

- 摩洛哥

- 拉丁美洲

- 巴西

- 阿根廷

- 智利

第 11 章:公司简介

- EthosEnergy

- Fincantieri

- Fortum

- GE Vernova

- Goltens

- Mechanical Dynamics & Analysis

- Metalock Engineering

- Mitsubishi Power

- Power Services Group

- ST Cotter Turbine Services

- Siemens Energy

- Soderqvist Engineering Sweden

- Steam Turbine Services

- Sulzer

- Toshiba America Energy Systems

- Trillium Flow Technologies

- Triveni Turbine

- WEG

The Global Steam Turbine Service Market was valued at USD 19.5 billion in 2024 and is estimated to grow at a CAGR of 5% to reach USD 31.8 billion by 2034, driven by the rising demand for thermal power generation, the aging turbine fleet requiring upgrades, and increased focus on optimizing operational efficiency. Steam turbine service encompasses maintenance, repair, and overhaul (MRO) activities designed to enhance the lifecycle and performance of turbines across industries such as power generation, oil and gas, and industrial manufacturing. With a growing emphasis on reducing downtime and improving energy output, companies are increasingly investing in predictive maintenance, digital monitoring, and advanced repair solutions to ensure optimal turbine functionality.

Government initiatives promoting energy efficiency and stricter emission standards are further encouraging power producers and industrial operators to invest in the regular servicing of their steam turbines. Modernization of aging coal- and gas-based plants, along with the emergence of combined heat and power (CHP) projects, is fueling the demand for comprehensive service solutions. Service providers are also offering customized contracts, including long-term service agreements (LTSA) and performance-based contracts, to meet the evolving operational requirements of end-users.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $19.5 Billion |

| Forecast Value | $31.8 Billion |

| CAGR | 5% |

The Steam Turbine Service Market is primarily segmented by capacity, with turbines rated >100 MW leading the market in 2024, generating USD 14.4 billion. Large-capacity turbines are predominantly used in utility-scale thermal power plants, nuclear facilities, and industrial cogeneration plants, where operational reliability and high efficiency are critical. The demand for servicing these high-capacity turbines is being propelled by the need for periodic refurbishment, parts replacement, and performance upgrades to extend operational life and maintain compliance with changing grid regulations and efficiency norms.

By design, the reaction steam turbine segment dominated the service market in 2024 with a valuation of USD 13.1 billion. Reaction turbines, known for their efficiency at handling high-pressure steam conditions, are widely deployed in large-scale thermal and nuclear power generation. The complex operating environments of reaction turbines necessitate frequent inspections, precision repairs, and advanced diagnostic services to prevent costly failures and sustain output levels. Service providers are increasingly leveraging technologies such as 3D scanning, remote monitoring, and additive manufacturing to deliver faster and more precise maintenance solutions for reaction turbine fleets globally.

In terms of service type, the repair segment held the largest market share in 2024, accounting for USD 8.2 billion. As many steam turbines are reaching or surpassing their design lifespans, demand for repair services - including blade refurbishment, rotor welding, casing restoration, and efficiency retrofits - is rising. Timely repairs not only prevent major breakdowns but also restore performance, optimize fuel consumption, and defer the capital expenditure associated with complete turbine replacements. Service providers are expanding their repair capabilities with mobile service units, in-situ repairs, and digital twin technologies to minimize downtime and improve customer service.

Asia Pacific led the global Steam Turbine Service Market in 2024, generating USD 9.6 billion, supported by its large installed base of thermal power plants and robust industrial activity. Countries like China, India, Japan, and South Korea are driving regional growth, as governments and utilities invest heavily in maintaining and upgrading existing turbine assets to meet surging electricity demand and sustainability goals. The push for grid stability, modernization of coal-fired power infrastructure, and rising investments in clean coal technologies are creating lucrative opportunities for service providers across the region. Additionally, the presence of major OEMs and third-party service providers offering competitive, localized services further strengthens Asia Pacific's dominance in the market.

Leading companies such as Siemens Energy, General Electric (GE), Mitsubishi Power, EthosEnergy, and Sulzer Ltd. are reinforcing their market position through strategic service offerings, digitalization initiatives, and regional service center expansions. These players are increasingly focused on providing comprehensive service portfolios - encompassing field services, condition monitoring, upgrade solutions, and remote diagnostics - to cater to the evolving needs of utilities and industrial clients. Innovations such as AI-powered predictive maintenance platforms, modular repair techniques, and flexible service agreements are becoming pivotal for companies seeking to capitalize on the steady growth of the global Steam Turbine Service Market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 ≤ 3 MW

- 5.3 > 3 MW - 100 MW

- 5.4 > 100 MW

Chapter 6 Market Size and Forecast, By Design, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Reaction

- 6.3 Impulse

Chapter 7 Market Size and Forecast, By Service, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Maintenance

- 7.3 Repair

- 7.4 Overhaul

- 7.5 Others

Chapter 8 Market Size and Forecast, By End Use, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 Industrial

- 8.3 Utility

Chapter 9 Market Size and Forecast, By Service Provider, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Non-OEM

Chapter 10 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.2.3 Mexico

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 France

- 10.3.3 Russia

- 10.3.4 Germany

- 10.3.5 Spain

- 10.3.6 Italy

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 South Korea

- 10.4.4 India

- 10.4.5 Australia

- 10.4.6 Indonesia

- 10.4.7 Malaysia

- 10.4.8 Thailand

- 10.5 Middle East & Africa

- 10.5.1 Saudi Arabia

- 10.5.2 UAE

- 10.5.3 Iran

- 10.5.4 Egypt

- 10.5.5 South Africa

- 10.5.6 Nigeria

- 10.5.7 Turkey

- 10.5.8 Morocco

- 10.6 Latin America

- 10.6.1 Brazil

- 10.6.2 Argentina

- 10.6.3 Chile

Chapter 11 Company Profiles

- 11.1 EthosEnergy

- 11.2 Fincantieri

- 11.3 Fortum

- 11.4 GE Vernova

- 11.5 Goltens

- 11.6 Mechanical Dynamics & Analysis

- 11.7 Metalock Engineering

- 11.8 Mitsubishi Power

- 11.9 Power Services Group

- 11.10 S.T. Cotter Turbine Services

- 11.11 Siemens Energy

- 11.12 Soderqvist Engineering Sweden

- 11.13 Steam Turbine Services

- 11.14 Sulzer

- 11.15 Toshiba America Energy Systems

- 11.16 Trillium Flow Technologies

- 11.17 Triveni Turbine

- 11.18 WEG