|

市场调查报告书

商品编码

1716601

燃气火管工业锅炉市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Gas Fire Tube Industrial Boiler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

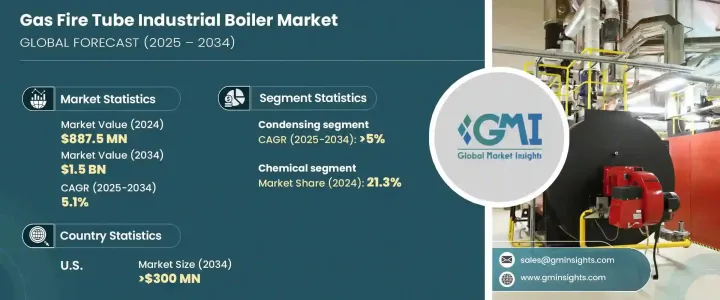

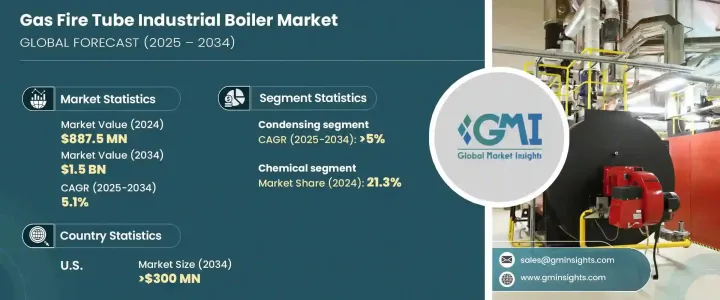

2024 年全球燃气火管工业锅炉市场规模达到 8.875 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 5.1%。这一成长主要得益于主要经济体工业化步伐的加快,以及能源基础设施投资的增加。向更清洁能源的转变,以及注重减少排放和提高效率的锅炉技术的进步,预计将进一步推动市场发展。

远端监控和预测性维护解决方案的日益增长的趋势将继续推动对火管工业锅炉的需求。这种转变与全球日益关注永续经济成长和智慧建筑管理系统的采用相一致。此外,锅炉技术的不断进步,例如数位监控和复杂的燃烧控制系统,可能会推动各行业对产品的采用率提高。用于开发使用可持续、耐腐蚀材料的高效能锅炉的投资也显着增加,这将为市场参与者带来新的机会。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 8.875亿美元 |

| 预测值 | 15亿美元 |

| 复合年增长率 | 5.1% |

工业发展、现代化以及对高效、可靠的蒸汽发电系统不断增长的需求将进一步渗透到市场。此外,对节能供热技术的重视,加上锅炉系统中数位技术的集成,将为业务带来更美好的前景。随着对清洁能源解决方案的推动力度不断加大,对支持这些绿色措施的锅炉的需求也日益增长,进一步促进了市场扩张。

市场根据技术分为冷凝系统和非冷凝系统,这两种系统都因其对环境的影响最小、效率提高和供暖成本节省而越来越受欢迎。尤其是冷凝式机组,预计到 2034 年,受能源成本上升和环境法规趋严的推动,其复合年增长率将超过 5%。政府对节能设备的激励和回扣也将在加速采用方面发挥关键作用。

在应用方面,化学工业在 2024 年将以 21.3% 的份额引领市场。新兴经济体不断增加的基础设施投资和高效锅炉系统的采用将继续刺激该行业的成长。在美国,燃气火管工业锅炉市场价值在 2022 年为 1.922 亿美元,到 2024 年将成长至 2.133 亿美元,预计到 2034 年将超过 3 亿美元。

由于严格的能源效率法规和气候变迁缓解策略的实施,北美市场预计将以超过 4.5% 的复合年增长率扩张。该地区在低温系统中采用耐腐蚀材料以及在高海拔地区开发工业项目可能会推动市场持续成长。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略展望

- 创新与永续发展格局

第五章:市场规模及预测:依产能,2021 - 2034 年

- 主要趋势

- < 10 百万英热单位/小时

- 10 - 25 百万英热单位/小时

- 25 - 50 百万英热单位/小时

- 50 - 75 百万英热单位/小时

- > 75 百万英热单位/小时

第六章:市场规模及预测:依应用,2021 - 2034

- 主要趋势

- 食品加工

- 纸浆和造纸

- 化学

- 炼油厂

- 原生金属

- 其他的

第七章:市场规模及预测:依技术分类,2021 - 2034 年

- 主要趋势

- 冷凝

- 无凝结

第八章:市场规模及预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 法国

- 英国

- 波兰

- 义大利

- 西班牙

- 奥地利

- 德国

- 瑞典

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 菲律宾

- 日本

- 韩国

- 澳洲

- 印尼

- 中东和非洲

- 沙乌地阿拉伯

- 伊朗

- 阿联酋

- 奈及利亚

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

- 智利

第九章:公司简介

- ALFA LAVAL

- Babcock & Wilcox

- Babcock Wanson

- Clayton Industries

- Cleaver-Brooks

- EPCB Boiler

- Fulton

- Hurst Boiler & Welding

- IHI Corporation

- Johnston Boiler

- Miura America

- Rentech Boilers

- Thermax

- Thermodyne Boilers

- Viessmann

The Global Gas Fire Tube Industrial Boiler Market reached USD 887.5 million in 2024 and is projected to expand at a CAGR of 5.1% between 2025 and 2034. This growth is largely driven by the increasing pace of industrialization across key economies, coupled with rising investments in energy infrastructure. The shift towards cleaner energy sources, along with advancements in boiler technologies that focus on emissions reduction and enhanced efficiency, is expected to further boost the market.

The increasing trend towards remote monitoring and predictive maintenance solutions will continue to fuel demand for fire tube industrial boilers. This shift is aligned with the growing global focus on sustainable economic growth and the adoption of smart building management systems. In addition, continuous advancements in boiler technologies, such as digital monitoring and sophisticated combustion control systems, are likely to drive higher product adoption across industries. There is also a noticeable increase in investments aimed at developing high-efficiency boilers using sustainable, corrosion-resistant materials, which will open new opportunities for market players.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $887.5 Million |

| Forecast Value | $1.5 Billion |

| CAGR | 5.1% |

Industrial development, modernization, and a rising demand for efficient and reliable steam generation systems are set to further penetrate the market. Additionally, the emphasis on energy-efficient heating technologies, combined with the integration of digital technologies in boiler systems, will provide an enhanced outlook for the business. As the push for clean energy solutions intensifies, there is a growing demand for boilers that support these green initiatives, further contributing to market expansion.

The market is segmented by technology into condensing and non-condensing systems, both of which are gaining traction due to their minimal environmental impact, improved efficiency, and cost savings in heating. The condensing segment, in particular, is expected to grow steadily at a CAGR of over 5% until 2034, driven by higher energy costs and stricter environmental regulations. Government incentives and rebates for energy-efficient equipment will also play a key role in accelerating adoption.

In terms of application, the chemical sector led the market with a 21.3% share in 2024. The increasing infrastructure investments and adoption of high-efficiency boiler systems in emerging economies will continue to stimulate growth in this sector. In the U.S., the market for gas fire tube industrial boilers was valued at USD 192.2 million in 2022, growing to USD 213.3 million in 2024, and expected to surpass USD 300 million by 2034.

The North American market is expected to expand at a CAGR of over 4.5% due to stringent energy efficiency regulations and the implementation of climate change mitigation strategies. The region's adoption of corrosion-resistant materials in low-temperature systems and the development of industrial projects in high-altitude areas are likely to drive continued market growth.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Capacity, 2021 - 2034 (Units, MMBTU/hr & USD Million)

- 5.1 Key trends

- 5.2 < 10 MMBTU/hr

- 5.3 10 - 25 MMBTU/hr

- 5.4 25 - 50 MMBTU/hr

- 5.5 50 - 75 MMBTU/hr

- 5.6 > 75 MMBTU/hr

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (Units, MMBTU/hr & USD Million)

- 6.1 Key trends

- 6.2 Food processing

- 6.3 Pulp & paper

- 6.4 Chemical

- 6.5 Refinery

- 6.6 Primary metal

- 6.7 Others

Chapter 7 Market Size and Forecast, By Technology, 2021 - 2034 (Units, MMBTU/hr & USD Million)

- 7.1 Key trends

- 7.2 Condensing

- 7.3 Non-condensing

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (Units, MMBTU/hr & USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 France

- 8.3.2 UK

- 8.3.3 Poland

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Austria

- 8.3.7 Germany

- 8.3.8 Sweden

- 8.3.9 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Philippines

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.4.6 Australia

- 8.4.7 Indonesia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 Iran

- 8.5.3 UAE

- 8.5.4 Nigeria

- 8.5.5 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

- 8.6.3 Chile

Chapter 9 Company Profiles

- 9.1 ALFA LAVAL

- 9.2 Babcock & Wilcox

- 9.3 Babcock Wanson

- 9.4 Clayton Industries

- 9.5 Cleaver-Brooks

- 9.6 EPCB Boiler

- 9.7 Fulton

- 9.8 Hurst Boiler & Welding

- 9.9 IHI Corporation

- 9.10 Johnston Boiler

- 9.11 Miura America

- 9.12 Rentech Boilers

- 9.13 Thermax

- 9.14 Thermodyne Boilers

- 9.15 Viessmann