|

市场调查报告书

商品编码

1721590

火管低温工业锅炉市场机会、成长动力、产业趋势分析及2025-2034年预测Fire Tube Low Temperature Industrial Boiler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

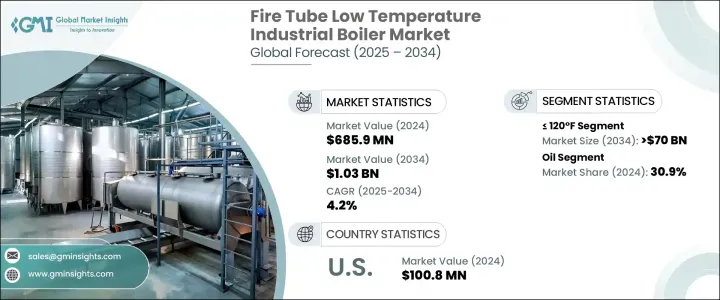

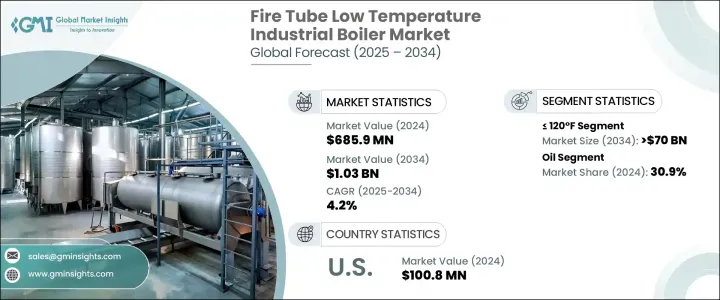

2024 年全球火管低温工业锅炉市场价值为 6.859 亿美元,预计到 2034 年将以 4.2% 的复合年增长率成长,达到 10.3 亿美元。这一上升趋势反映了由工业现代化、更严格的环境法规以及对节能、低排放供热技术日益增长的需求所推动的更广泛的行业转型。全球各行各业都面临着越来越大的压力,需要采用可持续的运作方式并减少碳足迹,这迫使它们转型为符合新能源法规和环境要求的先进低温锅炉。在新兴经济体中,老化的工业基础设施对升级暖气系统产生了迫切的需求,而已开发国家则积极以高性能替代品取代过时的设备。

市场参与者发现依赖受控加热环境的行业(例如食品加工、製药和化学品)的兴趣日益浓厚。这些行业优先考虑支援一致温度管理且不影响产品品质的加热系统。研发投资正在增加,公司引入耐腐蚀材料、智慧感测器和高效燃烧器系统,以提高可靠性并降低营运成本。燃烧控制和传热效率的技术进步正在帮助製造商实现更好的系统集成,提高营运效率,同时保持法规遵循。向清洁燃料使用和再生能源整合的转变进一步为创新和市场扩张打开了大门。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 6.859亿美元 |

| 预测值 | 10.3亿美元 |

| 复合年增长率 | 4.2% |

随着各行各业对节能、低排放暖气解决方案的需求不断增长,显着的成长即将到来。食品加工产业对精确和恆定温度的需求,加上对产品设计的投资增加和对能源效率标准的遵守,将增强该产业的前景。此外,严格的环保法规提倡使用低排放锅炉,加上政府减少碳足迹的激励措施,将进一步扩大对低温工业锅炉的需求。

受各种工业应用对高效低温加热系统的需求不断增长的推动,<= 120°F 火管低温工业锅炉市场预计到 2034 年将产生 7000 万美元的产值。这些锅炉通常用于精确温度调节对于维持产品品质至关重要的产业,特别是食品加工、製药和化学品等领域。例如,在食品加工中,低温锅炉对于确保产品均匀加热而不损害其完整性或口感至关重要。这种锅炉非常适合巴氏杀菌、干燥和灭菌等工艺,这些工艺需要仔细控制温度以避免损坏敏感材料。

火管低温工业锅炉市场依燃料类型分为天然气、石油、煤炭和其他替代燃料。其中,燃油锅炉在 2024 年占 30.9% 的份额。特别是在偏远地区,燃油锅炉至关重要,因为这些地区无法获得其他燃料来源或不切实际。这些地区的食品製造商通常依靠油动力系统来满足其特定的营运需求,特别是需要高温蒸气进行灭菌、干燥和巴氏杀菌的製程。燃油锅炉在这些环境中受到青睐,因为它们能够提供可靠且一致的热量输出,这对于确保食品的品质和安全至关重要。

2024 年,美国火管低温工业锅炉市场价值为 1.008 亿美元。受向节能环保锅炉系统采用的重大转变的推动,该市场将经历强劲增长。人们越来越重视永续性,并将太阳能和风能等再生能源融入工业加热过程,这推动了这一转变。随着各行各业寻求遵守更严格的环境法规并减少碳足迹,采用更绿色的技术变得越来越重要。

火管低温工业锅炉行业的主要参与者包括 Thermodyne Boilers、Babcock Wanson、Victory Energy Operations、Hurst Boiler & Welding、Miura America、Babcock & Wilcox、Cleaver-Brooks、Thermex、Clayton Industries、Walchandnagar、Itech Corporation、Johnston Boult、Renton、Filton Industries.为了巩固其在火管低温工业锅炉市场的地位,企业正在采取几项关键策略。许多人都专注于技术进步,以提高锅炉的效率和可持续性。这包括开发具有增强热交换系统、先进燃烧器技术和整合智慧控制的锅炉,以实现更好的能源管理。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略展望

- 创新与永续发展格局

第五章:市场规模及预测:依温度,2021 - 2034 年

- 主要趋势

- ≤ 120°F

- > 120°F - 140°F

- > 140°F - 160°F

- > 160°F - 180°F

第六章:市场规模及预测:依产能,2021 - 2034 年

- 主要趋势

- < 10 百万英热单位/小时

- 10 - 25 百万英热单位/小时

- 25 - 50 百万英热单位/小时

- 50 - 75 百万英热单位/小时

- 75 - 100 百万英热单位/小时

- 100 - 175 百万英热单位/小时

- 175 - 250 百万英热单位/小时

- > 250 百万英热单位/小时

第七章:市场规模及预测:依燃料,2021 - 2034

- 主要趋势

- 天然气

- 油

- 煤炭

- 其他的

第八章:市场规模及预测:依技术分类,2021 - 2034 年

- 主要趋势

- 冷凝

- 无凝结

第九章:市场规模及预测:依应用,2021 - 2034

- 主要趋势

- 食品加工

- 纸浆和造纸

- 化学

- 炼油厂

- 原生金属

- 其他的

第 10 章:市场规模与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 法国

- 英国

- 波兰

- 义大利

- 西班牙

- 奥地利

- 德国

- 瑞典

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 菲律宾

- 日本

- 韩国

- 澳洲

- 印尼

- 中东和非洲

- 沙乌地阿拉伯

- 伊朗

- 阿联酋

- 奈及利亚

- 南非

- 拉丁美洲

- 阿根廷

- 智利

- 巴西

第 11 章:公司简介

- Babcock & Wilcox

- Babcock Wanson

- Clayton Industries

- Cleaver-Brooks

- EPCB Boiler

- Fulton

- Hurst Boiler & Welding

- IHI Corporation

- Johnston Boiler

- Miura America

- Rentech Boilers

- Thermax

- Thermodyne Boilers

- Victory Energy Operations

- Walchandnagar Industries

The Global Fire Tube Low Temperature Industrial Boiler Market was valued at USD 685.9 million in 2024 and is estimated to grow at a CAGR of 4.2% to reach USD 1.03 billion by 2034. This upward trend reflects a broader industry transformation driven by industrial modernization, stricter environmental regulations, and increasing demand for energy-efficient, low-emission heating technologies. Industries across the globe are under growing pressure to adopt sustainable operations and reduce their carbon footprint, pushing them to transition toward advanced, low-temperature boilers that align with new energy codes and environmental mandates. In emerging economies, aging industrial infrastructure is creating urgent demand for upgraded heating systems, while developed nations are actively replacing outdated units with high-performance alternatives.

Market players are seeing increased interest from sectors that rely on controlled heating environments, such as food processing, pharmaceuticals, and chemicals. These industries are prioritizing heating systems that support consistent temperature management without compromising product quality. Investments in R&D are on the rise, with companies introducing corrosion-resistant materials, smart sensors, and efficient burner systems that enhance reliability and minimize operational costs. Technological advancements in combustion control and heat transfer efficiency are helping manufacturers achieve better system integration, boosting operational productivity while maintaining regulatory compliance. The shift toward clean fuel usage and renewable integration is further opening doors for innovation and market expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $685.9 Million |

| Forecast Value | $1.03 Billion |

| CAGR | 4.2% |

Significant growth is on the horizon, driven by the surging demand for energy-efficient and low-emission heating solutions across various industrial operations. The food processing sector's need for precise and consistent temperatures, combined with heightened investments in product design and adherence to energy efficiency standards, will bolster the industry's landscape. Moreover, stringent environmental mandates advocating for low-emission boilers, alongside government incentives to reduce carbon footprints, will further amplify the demand for low-temperature industrial boilers.

The <= 120°F fire tube low temperature industrial boiler market is anticipated to generate USD 70 million by 2034, driven by the increasing demand for efficient, low-temperature heating systems in various industrial applications. These boilers are commonly used in industries where precise temperature regulation is critical for maintaining product quality, particularly in sectors like food processing, pharmaceuticals, and chemicals. In food processing, for example, low-temperature boilers are essential to ensure that products are heated evenly without compromising their integrity or taste. This type of boiler is ideal for processes like pasteurization, drying, and sterilization, where the temperature needs to be carefully controlled to avoid damage to sensitive materials.

The fire tube low-temperature industrial boiler market is categorized based on fuel type into natural gas, oil, coal, and other alternatives. Among these, the oil-fired segment held a 30.9% share in 2024. In particular, oil-based boilers are essential in remote areas where access to other fuel sources may be limited or impractical. Food manufacturers in such regions often rely on oil-powered systems to meet their specific operational needs, particularly for processes that require high-temperature steam for sterilization, drying, and pasteurization. Oil-fired boilers are favored in these settings due to their ability to provide reliable and consistent heat output, which is crucial for ensuring the quality and safety of food products.

U.S. Fire Tube Low-Temperature Industrial Boiler Market was valued at USD 100.8 million in 2024. The market is set to experience robust growth, driven by a significant shift towards the adoption of energy-efficient and environmentally friendly boiler systems. This transition is being propelled by a growing emphasis on sustainability and the integration of renewable energy sources, such as solar and wind, into industrial heating processes. The move towards greener technologies is becoming increasingly important as industries seek to comply with stricter environmental regulations and reduce their carbon footprint.

Major players operating in the fire tube low temperature industrial boiler industry include Thermodyne Boilers, Babcock Wanson, Victory Energy Operations, Hurst Boiler & Welding, Miura America, Babcock & Wilcox, Cleaver-Brooks, Thermex, Clayton Industries, Walchandnagar Industries, IHI Corporation, Johnston Boiler, Rentech Boilers, Fulton, EPCB Boiler, and Cleaver-Brooks. In order to strengthen their position in the fire tube low-temperature industrial boiler market, companies are adopting several key strategies. Many are focusing on technological advancements to improve the efficiency and sustainability of their boilers. This includes the development of boilers with enhanced heat exchange systems, advanced burner technologies, and integrated smart controls for better energy management.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Temperature, 2021 - 2034 (Units, MMBTU/hr & USD Million)

- 5.1 Key trends

- 5.2 ≤ 120°F

- 5.3 > 120°F - 140°F

- 5.4 > 140°F - 160°F

- 5.5 > 160°F - 180°F

Chapter 6 Market Size and Forecast, By Capacity, 2021 - 2034 (Units, MMBTU/hr & USD Million)

- 6.1 Key trends

- 6.2 < 10 MMBTU/hr

- 6.3 10 - 25 MMBTU/hr

- 6.4 25 - 50 MMBTU/hr

- 6.5 50 - 75 MMBTU/hr

- 6.6 75 - 100 MMBTU/hr

- 6.7 100 - 175 MMBTU/hr

- 6.8 175 - 250 MMBTU/hr

- 6.9 > 250 MMBTU/hr

Chapter 7 Market Size and Forecast, By Fuel, 2021 - 2034 (Units, MMBTU/hr & USD Million)

- 7.1 Key trends

- 7.2 Natural gas

- 7.3 Oil

- 7.4 Coal

- 7.5 Others

Chapter 8 Market Size and Forecast, By Technology, 2021 - 2034 (Units, MMBTU/hr & USD Million)

- 8.1 Key trends

- 8.2 Condensing

- 8.3 Non-condensing

Chapter 9 Market Size and Forecast, By Application, 2021 - 2034 (Units, MMBTU/hr & USD Million)

- 9.1 Key trends

- 9.2 Food processing

- 9.3 Pulp & paper

- 9.4 Chemical

- 9.5 Refinery

- 9.6 Primary metal

- 9.7 Others

Chapter 10 Market Size and Forecast, By Region, 2021 - 2034 (Units, MMBTU/hr & USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.2.3 Mexico

- 10.3 Europe

- 10.3.1 France

- 10.3.2 UK

- 10.3.3 Poland

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Austria

- 10.3.7 Germany

- 10.3.8 Sweden

- 10.3.9 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Philippines

- 10.4.4 Japan

- 10.4.5 South Korea

- 10.4.6 Australia

- 10.4.7 Indonesia

- 10.5 Middle East & Africa

- 10.5.1 Saudi Arabia

- 10.5.2 Iran

- 10.5.3 UAE

- 10.5.4 Nigeria

- 10.5.5 South Africa

- 10.6 Latin America

- 10.6.1 Argentina

- 10.6.2 Chile

- 10.6.3 Brazil

Chapter 11 Company Profiles

- 11.1 Babcock & Wilcox

- 11.2 Babcock Wanson

- 11.3 Clayton Industries

- 11.4 Cleaver-Brooks

- 11.5 EPCB Boiler

- 11.6 Fulton

- 11.7 Hurst Boiler & Welding

- 11.8 IHI Corporation

- 11.9 Johnston Boiler

- 11.10 Miura America

- 11.11 Rentech Boilers

- 11.12 Thermax

- 11.13 Thermodyne Boilers

- 11.14 Victory Energy Operations

- 11.15 Walchandnagar Industries