|

市场调查报告书

商品编码

1664850

石油和天然气市场中的物联网 (IoT) 机会、成长动力、产业趋势分析和 2025 - 2034 年预测Internet of Things (IoT) in Oil and Gas Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

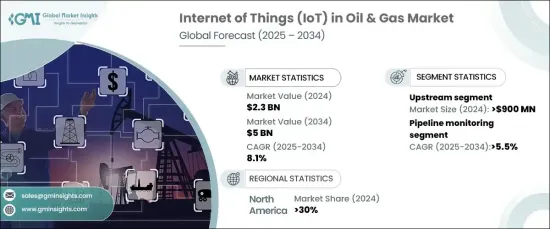

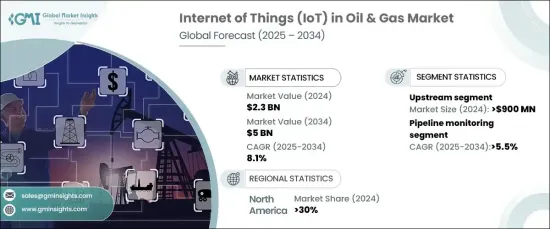

2024 年全球石油和天然气物联网市场价值为 23 亿美元,预计 2025 年至 2034 年的复合年增长率为 8.1%。

石油和天然气行业的公司正在采用物联网解决方案来加强资产管理、简化生产流程并确保更好地遵守环境法规。随着这些技术越来越融入营运中,策略合作伙伴关係正在帮助加速它们在产业各个职能领域的实施。物联网应用透过收集即时资料、远端监控和预测性维护彻底改变了营运方式,进而提高了营运效能和安全标准。这些进步使公司能够及早发现潜在问题,降低风险并最大限度地减少停机时间。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 23亿美元 |

| 预测值 | 50亿美元 |

| 复合年增长率 | 8.1% |

此外,对绿色技术和永续性的日益重视正在加速物联网在石油和天然气营运中的应用。随着环境问题和监管压力加剧,该行业越来越多地转向物联网解决方案来优化能源使用和追踪排放。物联网技术还可以帮助检测诸如气体洩漏等危险,并监测环境影响,从而有助于永续实践。这不仅降低了营运成本,而且符合能源效率、减少碳足迹和长期永续性的更广泛目标。

物联网在促进更绿色、更永续的营运方面发挥着重要作用,因为它支持产业向生态友善实践的转型。预计到 2032 年,绿色技术市场将产生可观的收入,年增长率将超过 19%。此次扩张凸显了永续性在石油和天然气领域日益增长的重要性。

市场依营运分为上游、中游和下游。 2024年,上游领域将占据相当大的份额,这得益于对监测钻井和油井作业的物联网解决方案的需求。物联网设备提供有关设备健康状况、井况和钻井效率的即时洞察,从而增强勘探和生产过程。

随着物联网技术增强管道监控、储存和运输系统,中游领域也预计将显着成长。这些解决方案可以实现即时资料收集,从而提高管道完整性并降低洩漏风险。

在应用方面,石油和天然气市场的物联网包括管线监控、车队和资产管理、钻井和井管理、生产最佳化、环境监测、安全管理等。其中,由于对即时监控和预测分析的需求不断增加以维持管道的安全高效运行,管道监控预计将强劲成长。

北美在石油和天然气领域的物联网市场中处于领先地位,占 2024 年全球收入的很大一部分。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 供应商概况

- 技术提供者

- 平台提供者

- 石油和天然气营运商

- 经销商

- 最终用户

- 利润率分析

- 技术与创新格局

- 专利分析

- 监管格局

- 使用案例

- 使用案例1

- 好处

- 投资报酬率

- 使用案例2

- 好处

- 投资报酬率

- 使用案例1

- 案例研究

- 案例研究 1

- 消费者姓名

- 挑战

- 解决方案

- 影响

- 案例研究 2

- 消费者姓名

- 挑战

- 解决方案

- 影响

- 案例研究 1

- 衝击力

- 成长动力

- 即时监控和自动化技术的采用日益增多

- 扩大对数位转型计画的投资

- 更重视预测分析与预防性维护

- 更加重视提高安全标准和环境合规性

- 产业陷阱与挑战

- 与物联网设备相关的资料安全和隐私问题

- 缺乏具备物联网和数位技术专业知识的熟练劳动力

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依供应量,2021 - 2034 年

- 主要趋势

- 平台

- 服务

第六章:市场估计与预测:按运营,2021 - 2034 年

- 主要趋势

- 上游

- 中游

- 下游

第 7 章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 管道监控

- 车队和资产管理

- 钻井与油井管理

- 生产优化

- 环境监测

- 安全与紧急管理

- 其他的

第 8 章:市场估计与预测:按最终用途,2021 - 2034 年

- 主要趋势

- 国家石油公司 (NOC)

- 独立石油公司(IOC)

第 9 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- ABB

- Baker Hughes

- British Petroleum (BP)

- China National Petroleum Corporation (CNPC)

- Cisco

- ConocoPhillips

- Emerson Electric

- Equinor

- ExxonMobil

- Gazprom

- General Electric

- Halliburton

- Honeywell

- Repsol

- Schlumberger

- Shell

- Siemens Energy

- TotalEnergies

- Woodside Petroleum

- Yokogawa

The Global Internet Of Things In Oil And Gas Market was valued at USD 2.3 billion in 2024 and is projected to grow at a CAGR of 8.1% from 2025 to 2034. The increasing focus on real-time monitoring, operational efficiency, and improved safety measures are key factors driving the adoption of IoT technologies in the industry.

Companies in the oil and gas sector are embracing IoT solutions to enhance asset management, streamline production processes, and ensure better environmental compliance. As these technologies become more integrated into operations, strategic partnerships are helping speed up their implementation across various functions within the industry. IoT applications are revolutionizing operations by enabling the collection of real-time data, remote monitoring, and predictive maintenance, which in turn boosts operational performance and safety standards. These advancements allow companies to detect potential issues early, reducing risks and minimizing downtime.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.3 Billion |

| Forecast Value | $5 Billion |

| CAGR | 8.1% |

Moreover, the growing emphasis on green technologies and sustainability is accelerating the adoption of IoT in oil and gas operations. As environmental concerns and regulatory pressures intensify, the sector is increasingly turning to IoT solutions to optimize energy usage and track emissions. IoT technologies also help detect hazards, such as gas leaks, and monitor environmental impacts, contributing to sustainable practices. This not only reduces operational costs but also aligns with broader goals for energy efficiency, carbon footprint reduction, and long-term sustainability.

The IoT's role in promoting greener, more sustainable operations is significant, as it supports the industry's transition to eco-friendly practices. The green technology market is projected to generate substantial revenue by 2032, reflecting a robust annual growth rate of over 19%. This expansion highlights the growing importance of sustainability in the oil and gas sector.

The market is segmented based on operations into upstream, midstream, and downstream. In 2024, the upstream segment held a substantial share, driven by the demand for IoT solutions in monitoring drilling and well operations. IoT devices provide real-time insights into equipment health, well conditions, and drilling efficiency, enhancing exploration and production processes.

The midstream segment is also expected to see significant growth, with IoT technologies enhancing pipeline monitoring, storage, and transportation systems. These solutions enable real-time data collection to improve pipeline integrity and reduce the risk of leaks.

In terms of applications, the IoT in oil and gas market includes pipeline monitoring, fleet and asset management, drilling and well management, production optimization, environmental monitoring, safety management, and more. Among these, pipeline monitoring is expected to grow at a robust pace due to the increasing demand for real-time monitoring and predictive analytics to maintain safe and efficient pipeline operations.

North America is leading the IoT market in oil and gas, accounting for a significant portion of global revenue in 2024. The region's strong oil and gas infrastructure, combined with substantial investments in digital technologies, is driving the adoption of IoT solutions for asset management, safety, and pipeline monitoring.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Technology providers

- 3.2.2 Platform providers

- 3.2.3 Oil & gas operators

- 3.2.4 Distributors

- 3.2.5 End users

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Regulatory landscape

- 3.7 Used cases

- 3.7.1 Used case 1

- 3.7.1.1 Benefits

- 3.7.1.2 ROI

- 3.7.2 Used case 2

- 3.7.2.1 Benefits

- 3.7.2.2 ROI

- 3.7.1 Used case 1

- 3.8 Case study

- 3.8.1 Case study 1

- 3.8.1.1 Consumer name

- 3.8.1.2 Challenge

- 3.8.1.3 Solution

- 3.8.1.4 Impact

- 3.8.2 Case study 2

- 3.8.2.1 Consumer name

- 3.8.2.2 Challenge

- 3.8.2.3 Solution

- 3.8.2.4 Impact

- 3.8.1 Case study 1

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising adoption of real-time monitoring and automation technologies

- 3.9.1.2 Expanding investments in digital transformation initiatives

- 3.9.1.3 Enhanced focus on predictive analytics and preventive maintenance

- 3.9.1.4 Greater emphasis on improving safety standards and environmental compliance

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Data security and privacy concerns related to IoT devices

- 3.9.2.2 Shortage of skilled workforce with expertise in IoT and digital technologies

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Offering, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Platform

- 5.3 Service

Chapter 6 Market Estimates & Forecast, By Operation, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Upstream

- 6.3 Midstream

- 6.4 Downstream

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Pipeline monitoring

- 7.3 Fleet & asset management

- 7.4 Drilling & well management

- 7.5 Production optimization

- 7.6 Environmental monitoring

- 7.7 Safety & emergency management

- 7.8 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 National oil companies (NOCs)

- 8.3 Independent oil companies (IOCs)

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 Baker Hughes

- 10.3 British Petroleum (BP)

- 10.4 China National Petroleum Corporation (CNPC)

- 10.5 Cisco

- 10.6 ConocoPhillips

- 10.7 Emerson Electric

- 10.8 Equinor

- 10.9 ExxonMobil

- 10.10 Gazprom

- 10.11 General Electric

- 10.12 Halliburton

- 10.13 Honeywell

- 10.14 Repsol

- 10.15 Schlumberger

- 10.16 Shell

- 10.17 Siemens Energy

- 10.18 TotalEnergies

- 10.19 Woodside Petroleum

- 10.20 Yokogawa