|

市场调查报告书

商品编码

1665067

汽车燃料电池监测市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive Fuel Cell Monitor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

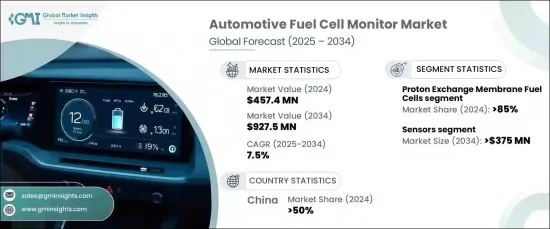

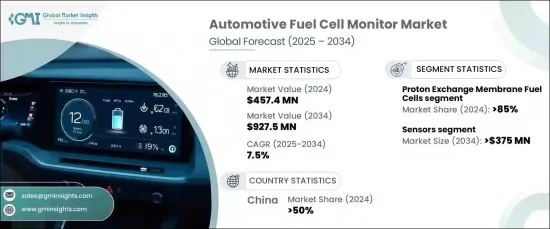

2024 年全球汽车燃料电池监视器市场价值为 4.574 亿美元,预计 2025 年至 2034 年的年复合成长率(CAGR) 为 7.5%。预计 2025 年至 2034 年的复合年增长率(CAGR) 为 7.5%。对清洁、永续能源解决方案的需求激增,推动了汽车燃料电池监测器市场的成长。

感测器技术的进步在改变燃料电池监控方面发挥关键作用。这些创新可以更准确、即时地追踪燃料电池的性能和健康状况。新兴的半导体技术,加上人工智慧和机器学习的力量,正在增强监控系统以预测潜在故障、优化性能并延长燃料电池组件的使用寿命。这些突破简化了燃料电池的监控,降低了成本,并显着提高了燃料电池系统的可靠性和效率。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 4.574 亿美元 |

| 预测值 | 9.275 亿美元 |

| 复合年增长率 | 7.5% |

市场按燃料电池类型细分,主要类别包括碱性燃料电池 (AFC)、质子交换膜燃料电池 (PEMFC)、磷酸燃料电池 (PAFC) 和固态氧化物燃料电池 (SOFC)。 2024 年,质子交换膜燃料电池 (PEMFC) 领域将占据市场主导地位,占有 85% 的份额。预计到 2034 年,该部分的收入将达到 7.5 亿美元。

汽车燃料电池监控器市场也按组件分类,包括控制单元、感测器、通讯模组等。预计到 2034 年,感测器领域将创收 3.75 亿美元。透过分散式光纤感测和先进的半导体感测器的集成,这些温度感测器现在可以提供关键燃料电池组件的即时映射。透过检测即使是微小的温度变化,它们有助于防止热应力并优化燃料电池系统的整体性能和寿命。

2024年,中国将占据全球汽车燃料电池监控器市场50%的份额。中国政府一直是这一成长的主要推动力,提供慷慨的补贴、税收优惠和国家发展计画来推动燃料电池汽车的普及。中国高度重视发展氢能基础设施和提升本地製造能力,正将自己定位为氢动力汽车技术的全球领导者。中国国有企业和私人企业都在投入大量资金来开发先进的燃料电池监控系统,以提高氢动力汽车的效率、可靠性和成本效益。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估计和计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 供应商概况

- 零件製造商

- 燃料电池系统供应商

- 汽车OEM

- 技术整合商

- 最终用途

- 成本明细

- 利润率分析

- 技术差异化

- 先进的传感器集成

- 人工智慧驱动的诊断

- 模组化系统设计

- 多层安全系统

- 其他的

- 重要新闻及倡议

- 专利分析

- 监管格局

- 衝击力

- 成长动力

- 全球脱碳倡议

- 车辆感测技术的进步

- 燃料电池成本大幅降低

- 燃料电池汽车基础设施投资不断成长

- 产业陷阱与挑战

- 燃料电池监测器的复杂技术集成

- 具竞争力的电池电动技术

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- 越野车

- 商用车

- 轻型商用车 (LCV)

- 重型商用车 (HCV)

第六章:市场估计与预测:按燃料电池,2021 - 2032 年

- 主要趋势

- 质子交换膜燃料电池 (PEMFC)

- 固态氧化物燃料电池 (SOFC)

- 碱性燃料电池(AFC)

- 磷酸燃料电池(PAFC)

第七章:市场估计与预测:按组件,2021 - 2032 年

- 主要趋势

- 感应器

- 控制单元

- 通讯模组

- 其他的

第 8 章:市场估计与预测:按监测功能,2021 - 2032 年

- 主要趋势

- 氢气监测

- 燃料电池堆监控

- 热管理

- 空气供应

- 洩漏检测

第 9 章:市场估计与预测:按销售管道,2021 - 2032 年

- 主要趋势

- OEM

- 售后市场

第 10 章:市场估计与预测:按地区,2021 - 2032 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第 11 章:公司简介

- AVL

- Bosch

- Dilico Engineering

- dSpace

- Gamma Technologies

- Hans Turck

- Horiba

- H-TEC Education

- Infineon

- IST

- Kolibrik

- Marquardt

- Nedstack

- PST Process Sensing

- Smart Testsolutions

- Texas Instruments

- Vaisala

- Vitronic

- Zeiss

The Global Automotive Fuel Cell Monitor Market was valued at USD 457.4 million in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 7.5% from 2025 to 2034. As governments across the globe continue to tighten emissions regulations and set ambitious carbon neutrality targets, automakers are increasing their investments in zero-emission technologies, especially fuel cell systems. This surge in demand for clean, sustainable energy solutions is driving the growth of the automotive fuel cell monitor market.

Advancements in sensor technology are playing a pivotal role in transforming fuel cell monitoring. These innovations allow for more accurate, real-time tracking of fuel cell performance and health. Emerging semiconductor technologies, coupled with the power of artificial intelligence and machine learning, are enhancing monitoring systems to predict potential failures, optimize performance, and extend the lifespan of fuel cell components. These breakthroughs are simplifying fuel cell monitoring, driving down costs, and significantly improving both the reliability and efficiency of fuel cell systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $457.4 Million |

| Forecast Value | $927.5 Million |

| CAGR | 7.5% |

The market is segmented by fuel cell type, with key categories including Alkaline Fuel Cells (AFC), Proton Exchange Membrane Fuel Cells (PEMFC), Phosphoric Acid Fuel Cells (PAFC), and Solid Oxide Fuel Cells (SOFC). In 2024, the Proton Exchange Membrane Fuel Cells (PEMFC) segment dominated the market, holding an 85% share. This segment is expected to generate USD 750 million by 2034. Researchers are making significant strides in developing next-generation membrane materials that offer enhanced durability, improved conductivity, and better resistance to temperature fluctuations, further advancing PEMFC technology.

The automotive fuel cell monitor market is also categorized by components, including control units, sensors, communication modules, and others. The sensors segment is projected to generate USD 375 million by 2034. Notably, temperature sensors are undergoing significant upgrades, offering higher precision and multi-point monitoring capabilities within fuel cell systems. With the integration of distributed fiber optic sensing and advanced semiconductor sensors, these temperature sensors can now provide real-time mapping of crucial fuel cell components. By detecting even small temperature variations, they help prevent thermal stress and optimize the overall performance and longevity of fuel cell systems.

In 2024, China held a dominant 50% share of the global automotive fuel cell monitor market. The Chinese government has been a major driver of this growth, offering generous subsidies, tax incentives, and national development plans to promote the adoption of fuel cell vehicles. With a strong focus on developing hydrogen infrastructure and advancing local manufacturing capabilities, China is positioning itself as a global leader in hydrogen-powered vehicle technology. Both state-owned enterprises and private companies in China are receiving significant investments to develop cutting-edge fuel cell monitoring systems that enhance the efficiency, reliability, and cost-effectiveness of hydrogen-powered vehicles.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component manufacturers

- 3.2.2 Fuel cell system providers

- 3.2.3 Automotive OEM

- 3.2.4 Technology integrators

- 3.2.5 End Use

- 3.3 Cost breakdown

- 3.4 Profit margin analysis

- 3.5 Technology differentiators

- 3.5.1 Advanced sensor integrations

- 3.5.2 AI-driven diagnostics

- 3.5.3 Modular system design

- 3.5.4 Multi-layered safety systems

- 3.5.5 Others

- 3.6 Key news & initiatives

- 3.7 Patent analysis

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Global decarbonization initiatives

- 3.9.1.2 Advancements in vehicle sensing technologies

- 3.9.1.3 Significant cost reductions in fuel cells

- 3.9.1.4 Growing fuel cell vehicle infrastructure investments

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Complex technical integration of fuel cell monitors

- 3.9.2.2 Competitive battery electric technologies

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Passenger vehicles

- 5.2.1 Hatchback

- 5.2.2 Sedan

- 5.2.3 SUV

- 5.3 Commercial vehicles

- 5.3.1 Light Commercial Vehicles (LCV)

- 5.3.2 Heavy Commercial Vehicles (HCV)

Chapter 6 Market Estimates & Forecast, By Fuel Cell, 2021 - 2032 ($Bn, Units)

- 6.1 Key trends

- 6.2 Proton Exchange Membrane Fuel Cells (PEMFC)

- 6.3 Solid Oxide Fuel Cells (SOFC)

- 6.4 Alkaline Fuel Cells (AFC)

- 6.5 Phosphoric Acid Fuel Cells (PAFC)

Chapter 7 Market Estimates & Forecast, By Component, 2021 - 2032 ($Bn, Units)

- 7.1 Key trends

- 7.2 Sensors

- 7.3 Control unit

- 7.4 Communication modules

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Monitoring Function, 2021 - 2032 ($Bn, Units)

- 8.1 Key trends

- 8.2 Hydrogen monitoring

- 8.3 Fuel cell stack monitoring

- 8.4 Thermal management

- 8.5 Air supply

- 8.6 leakage detection

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2032 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2032 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 AVL

- 11.2 Bosch

- 11.3 Dilico Engineering

- 11.4 dSpace

- 11.5 Gamma Technologies

- 11.6 Hans Turck

- 11.7 Horiba

- 11.8 H-TEC Education

- 11.9 Infineon

- 11.10 IST

- 11.11 Kolibrik

- 11.12 Marquardt

- 11.13 Nedstack

- 11.14 PST Process Sensing

- 11.15 Smart Testsolutions

- 11.16 Texas Instruments

- 11.17 Vaisala

- 11.18 Vitronic

- 11.19 Zeiss