|

市场调查报告书

商品编码

1665197

氰化钠市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Sodium Cyanide Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

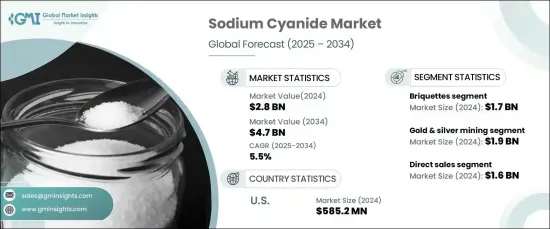

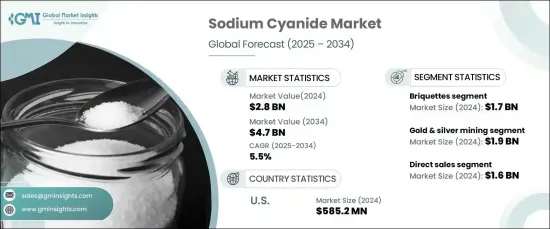

2024 年全球氰化钠市场规模达到 28 亿美元,预计 2025 年至 2034 年期间将以 5.5% 的强劲复合年增长率增长。该化合物在工业过程中的多功能性和有效性,特别是在金和银的提取中,使其成为全球市场上的重要参与者。氰化钠因其有效提取金属的能力而受到高度重视,从而推动了其在世界各地采矿作业中的广泛应用。此外,随着全球市场不断强调永续性,注重减少环境影响的生产方法的改进也支持了对氰化钠的需求。

团块部分引领氰化钠市场,到 2024 年价值将达到 17 亿美元。煤球因其易于处理、储存和运输而受到青睐,使其成为大规模采矿作业的理想选择。固体形式的团块最大限度地降低了溢出和污染的风险,确保在关键的采矿过程中更安全、更有效地使用。颗粒也越来越受欢迎,特别是在精确剂量至关重要的行业。它们尺寸统一且与自动化系统的兼容性使其成为需要高精度应用的有吸引力的选择。虽然粉状氰化钠的市场份额较小,但它仍然是实验室实验和有机合成等专门任务的重要组成部分,凸显了这种化合物的多样化应用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 28亿美元 |

| 预测值 | 47亿美元 |

| 复合年增长率 | 5.5% |

氰化钠的需求主要源于其在金银开采中的作用,这占据了市场很大一部分份额,到 2024 年其价值将达到 19 亿美元。氰化钠是氰化法製程中不可或缺的原料,可以高效率提取贵金属。由于黄金在投资、电子产品和珠宝生产中发挥的作用,全球对黄金的需求持续增长,采矿活动也在扩大,尤其是在新兴市场。预计未来几年这些金属的开采量不断增加将维持对氰化钠不断增长的需求。

在美国,2024 年氰化钠市场价值为 5.852 亿美元,预计到 2034 年将以 5.7% 的复合年增长率稳步增长。此外,化学加工中的工业应用进一步支持了市场的成长轨迹。对环境永续性的日益重视也推动了清洁生产技术的创新,这有望提高未来氰化钠使用的安全性和效率。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 金矿开采业的成长

- 技术进步

- 新兴经济体

- 产业陷阱与挑战

- 环境问题和监管限制

- 毒性和安全风险

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依形式,2021-2034

- 主要趋势

- 煤炭球

- 颗粒

- 粉末

第 6 章:市场估计与预测:按最终用途产业,2021-2034 年

- 主要趋势

- 金银开采

- 珠宝製造

- 灭鼠剂

- 橡胶加工化学品

- 染料和颜料

- 其他的

第 7 章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 直接销售

- 分销商和批发商

- 网上销售

第 8 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Australian Gold Reagents

- AnQore

- Asahi Kasei

- Changsha Hekang Chemical

- Cyanco International

- Draslovka

- Evonik Industries

- Gujarat Alkalies and Chemicals

- LUKOIL

- Orica

- Taekwang Industrial

- Wesfarmers

The Global Sodium Cyanide Market reached USD 2.8 billion in 2024 and is projected to expand at a robust CAGR of 5.5% from 2025 to 2034. This growth is being fueled by increasing demand across various industries, with precious metal mining being a major contributor. The compound's versatility and effectiveness in industrial processes, particularly in gold and silver extraction, make it a key player in global markets. Sodium cyanide is highly valued for its ability to efficiently extract metals, driving its widespread use in mining operations worldwide. Furthermore, as global markets continue to emphasize sustainability, the demand for sodium cyanide is also being supported by improvements in production methods that focus on reducing environmental impact.

The briquettes segment leads the sodium cyanide market, valued at USD 1.7 billion in 2024. This form is expected to maintain a steady growth rate of 5.7% CAGR throughout the forecast period. Briquettes are favored for their ease of handling, storage, and transportation, making them ideal for large-scale mining operations. The solid form of briquettes minimizes the risks of spillage and contamination, ensuring safer and more efficient usage in critical mining processes. Pellets are also gaining traction, particularly in industries where precise dosing is crucial. Their uniform size and compatibility with automated systems make them an attractive choice for applications requiring high levels of accuracy. While powdered sodium cyanide holds a smaller market share, it remains an essential component for laboratory experiments and specialized tasks like organic synthesis, highlighting the diverse applications of this compound.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.8 Billion |

| Forecast Value | $4.7 Billion |

| CAGR | 5.5% |

The demand for sodium cyanide is primarily driven by its role in gold and silver mining, which represented a significant portion of the market at USD 1.9 billion in 2024. This segment is expected to experience a CAGR of 5.7% over the next decade. Sodium cyanide is indispensable in the cyanidation process, enabling the extraction of precious metals with high efficiency. As global demand for gold continues to grow, driven by its role in investments, electronics, and jewelry production, mining activities are expanding, particularly in emerging markets. The increasing extraction of these metals is expected to sustain the rising demand for sodium cyanide in the years ahead.

In the U.S., the sodium cyanide market was valued at USD 585.2 million in 2024 and is projected to grow at a steady CAGR of 5.7% through 2034. Strong mining operations across various states contribute to this market growth, particularly in the extraction of gold and silver, which remains the primary use of sodium cyanide in the country. Additionally, industrial applications in chemical processing further support the growth trajectory of the market. A growing emphasis on environmental sustainability is also driving innovation in cleaner production technologies, which is expected to enhance the safety and efficiency of sodium cyanide use in the future.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Growth of gold mining industry

- 3.6.1.2 Technological advancements

- 3.6.1.3 Emerging economies

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Environmental concerns and regulatory constraints

- 3.6.2.2 Toxicity and safety risks

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Form, 2021-2034 (USD Million) (Tons)

- 5.1 Key trends

- 5.2 Briquettes

- 5.3 Pellets

- 5.4 Powder

Chapter 6 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Million) (Tons)

- 6.1 Key trends

- 6.2 Gold & silver mining

- 6.3 Jewelry manufacturing

- 6.4 Rodenticide

- 6.5 Rubber processing chemicals

- 6.6 Dyes and pigments

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million) (Tons)

- 7.1 Key trends

- 7.2 Direct sales

- 7.3 Distributors & wholesalers

- 7.4 Online sales

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Australian Gold Reagents

- 9.2 AnQore

- 9.3 Asahi Kasei

- 9.4 Changsha Hekang Chemical

- 9.5 Cyanco International

- 9.6 Draslovka

- 9.7 Evonik Industries

- 9.8 Gujarat Alkalies and Chemicals

- 9.9 LUKOIL

- 9.10 Orica

- 9.11 Taekwang Industrial

- 9.12 Wesfarmers