|

市场调查报告书

商品编码

1683230

非洲氰化钠市场 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Africa Sodium Cyanide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

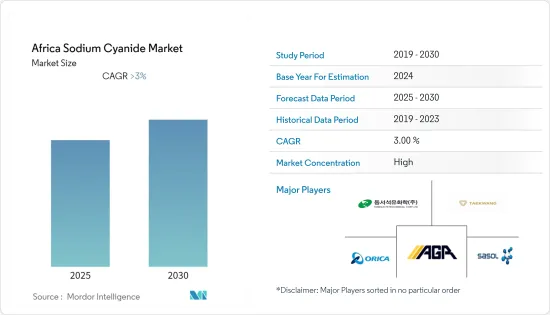

预测期内,非洲氰化钠市场预计将以超过 3% 的复合年增长率成长。

由于许多国家供应链中断和封锁,COVID-19 对工业成长产生了中等影响。然而,南非和加纳等国家的采矿业正在蓬勃发展,这可能会增加氰化钠的消费量。

关键亮点

- 市场成长的主要动力是对金矿开采的需求不断增长。

- 相反,氰化钠的毒性预计会阻碍市场的成长。

- 预计新矿的发现将为市场提供新的成长机会。

- 由于其在采矿业中的蓬勃发展,南非在探索市场中占据了主导地位。

氰化钠市场趋势

采矿业需求增加

- 全世界生产的氰化钠大部分用于采矿和冶金,特别是用于提取金和银。氰化钠是加工黄金最经济、最容易加工和环境永续的技术之一。

- 通常,使用氰化钠透过浸出从矿石中提取黄金。在此过程中,利用工业机械将矿石粉碎成小块。然后将粉末加入氰化钠(NaCN)溶液中进行加工。

- 在此过程中,金分子与 NaCN 形成强键,使其具有水溶性。添加锌会将金和氰化物分子分离,使金重新变成固体,以备冶炼过程。

- 非洲矿产资源丰富,是世界矿业基地。除了采矿大国南非外,加纳、马利共和国、布吉纳法索等国家也迅速发展采矿业。

- 非洲拥有丰富的金属和矿产蕴藏量,包括黄金、钻石、钴、矾土、铁矿石、煤和铜,是许多必需矿产品的主要生产国。

- 西非是黄金探勘的黄金地点。近年来,该地区尚未开发的矿产蕴藏量吸引了来自世界各地公司的大量投资。西非黄金资产大幅成长,其中约367项资产处于探勘阶段,24项处于经济评估阶段,61项处于生产或建设阶段。

- 2021年非洲金矿总产量为680.3吨,与前一年同期比较成长约0.5%。

- 自 2010 年以来,黄金产量不断增加,到 2022 年将达到约 3,000 吨。非洲是世界第三大黄金生产国,有超过 21 个国家参与金矿开采。加纳是非洲第二大黄金供应国,也是世界最大黄金生产国之一,2022 年黄金生产约 90 吨。

- 预测期内,氰化钠在采矿和冶金领域的应用预计会增加。

南非占市场主导地位

- 南非的自然资源极为丰富,地表下蕴藏量地球上最有价值的矿物。采矿业对该国来说是一个非常重要的产业。

- 南非每年生产超过2.5亿吨煤炭。据估计,其中近75%的煤炭在国内使用。南非近80%的能源需求由煤炭满足,整个非洲大陆消耗的煤炭90%以上产自南非。

- 此外,2021年南非的煤炭产量为5.55艾焦耳,比前一年下降了近5%。

- 直到2007年,南非一直是世界最大的黄金生产国。然而,由于该国采矿业的放缓,其产量自此大幅下降。 2022 年,南非生产了约 110 吨黄金。

- 该国主要金矿包括 South Deep、Kromdraai、Mponeng、 酵母 Rand 和 Tautona。

- 南非化学工业是采矿业和农业部门的上游部门。这也是非洲主要的化学工业之一。由于该国拥有丰富的原材料资源,增加外国投资可能会为该国未来化学产业创造巨大的成长机会。

- 据化学与相关工业协会称,化学工业是南非经济的关键部门。其约占该国製造业销售额的25%。

- 萨索尔的化学品业务是南非唯一的氰化钠溶液製造商,该溶液销往当地金矿开采业,用于开采和浸出黄金。在南非,Sasol Polymers Sasolburg 经营氰化钠生产工厂 1 和 2,这两家工厂已重新认证,完全符合《国际氰化物控制规范》(《氰化物规范》)。

- 因此,预计上述因素将推动南非采矿业和化学工业氰化钠的消费。

氰化钠产业概况

非洲氰化钠市场基本整合,主要企业在生产能力方面占据相当大的份额。市场的主要企业包括 TAEKWANG INDUSTRIAL、TSPC、Sasol、Orica Limited、Australian Gold Reagents Pty Ltd 等(不分先后顺序)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 金矿开采活动导致需求增加

- 化学和聚合物合成的需求不断增加

- 限制因素

- 氰化钠毒性

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔(市场规模(基于数量))

- 最终用户产业

- 矿业

- 化学

- 其他的

- 地区

- 迦纳

- 布吉纳法索

- 埃及

- 坦尚尼亚

- 辛巴威

- 马利共和国

- 刚果民主共和国

- 苏丹

- 几内亚

- 南非

- 非洲其他地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场排名分析

- 公司简介

- Australian Gold Reagents Pty Ltd

- Evonik Industries AG

- HeBei ChengXin

- Honeywell International Inc.

- Orica Limited

- Sasol

- TAEKWANG INDUSTRIAL CO., LTD

- TSPC

- The Chemours Company

第七章 市场机会与未来趋势

- 发现新矿

The Africa Sodium Cyanide Market is expected to register a CAGR of greater than 3% during the forecast period.

COVID-19 moderately impacted industry growth due to many countries' supply chain disruptions and lockdowns. However, the surging mining industry in South Africa and Ghana, among others, is likely to increase sodium cyanide consumption.

Key Highlights

- The primary factor driving the studied market growth is the increasing demand for gold mining activities.

- Conversely, sodium cyanide toxicity is expected to hinder the studied market's growth.

- The discovery of new mines is expected to offer new growth opportunities to the market studied.

- South Africa dominated the market studied owing to its surging application in the mining industry.

Sodium Cyanide Market Trends

Increasing Demand from Mining Industry

- A significant portion of the sodium cyanide produced worldwide is used in mining and metallurgy, especially in extracting gold and silver. It is one of the most economically viable, easily processable, and environmentally sustainable technologies for processing gold.

- Typically, gold is extracted from its ore using sodium cyanide through leeching. In this process, the ore is crushed into a fine powder using industrial machinery. Then, the dust is added to a sodium cyanide (NaCN) solution and processed.

- During the process, the gold molecules form strong bonds with the NaCN and become water-soluble. Applying zinc separates the cyanide molecules from the gold and turns the gold back into a solid, preparing it for the smelting process.

- Africa includes abundant mineral sources, making it a hub for the global mining industry. Apart from South Africa, a significant mining industry, the countries like Ghana, Mali, and Burkina Faso, also include rapidly growing mining industries.

- Africa is a major producer of many essential mineral commodities, with bountiful reserves of metals and minerals such as gold, diamond, cobalt, bauxite, iron ore, coal, and copper across the continent.

- West Africa is a prime spot for gold exploration. It attracted significant investments from companies worldwide in the past few years, owing to the largely untouched mineral reserves present in the region. There is a significant growth in the gold assets in West Africa, with around 367 assets in the exploration stage, 24 assets under economic assessment, and 61 assets in the production or construction stage.

- The total gold mine production in Africa amounted to 680.3 metric tons in 2021, an increase of roughly 0.5% compared to the previous year.

- From 2010 onward, there was an increase in gold production, which reached approximately 3,000 metric tons in 2022. More than 21 countries in Africa, the third-largest producer of gold in the world, are involved in gold mining. Ghana, the second-largest supplier of gold in Africa and one of the world's top producers, generated about 90 metric tons of gold in 2022.

- The application of sodium cyanide in mining and metallurgy is expected to increase during the forecast period.

South Africa to Dominate the Market

- South Africa is incredibly rich in natural resources, with large reserves of some of the most valuable minerals on the planet below its surface. The mining industry became hugely important to the country.

- South Africa produces over 250 million tons of coal every year. It is estimated that almost 75% of this coal is used domestically. Nearly 80% of the energy needs of South Africa are taken care of by coal, and over 90% of the coal consumed on the entire African continent is produced in South Africa.

- Additionally, coal production in South Africa amounted to 5.55 exajoules in 2021, down by nearly 5% from the previous year.

- South Africa was the world's leading gold producer until 2007. However, production declined significantly from that time onward due to the stagnation of the country's mining industry. In 2022, approximately 110 metric tons of gold were produced in South Africa.

- Some of the major gold mines in the country include the South Deep gold mine, the Kromdraai gold mine, the Mponeng gold mine, the East Rand gold mine, and the Tautona gold mine, among others.

- The South African chemical industry is an upstream sector for the country's mining and agricultural sectors. It is also one of the major chemical industries in Africa. As the country includes significant raw material sources, an increase in foreign investment may create significant growth opportunities in the country's chemical sector in the future.

- According to the Chemical and Allied Industries Association, the chemicals industry is a crucial sector of the South African economy. It accounts for about 25% of the nation's manufacturing sales.

- The Chemicals business of Sasol is South Africa's sole manufacturer of sodium cyanide solution, which is sold to the local gold mining industry to extract and elute gold. In South Africa, Sasol Polymers Sasolburg operates Sodium Cyanide Production Plants 1 and 2, which are recertified in full compliance with the International Cyanide Management Code (Cyanide Code).

- Therefore, the factors above are expected to boost sodium cyanide consumption in mining and chemical sectors across South Africa.

Sodium Cyanide Industry Overview

The sodium cyanide market in Africa is majorly consolidated, with the top four players accounting for a significant share in production capacities. Major players in the market include TAEKWANG INDUSTRIAL CO., LTD, TSPC, Sasol, Orica Limited, and Australian Gold Reagents Pty Ltd, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Gold Mining Activities

- 4.1.2 Increasing Demand for Use in Chemical and Polymer Synthesis

- 4.2 Restraints

- 4.2.1 Toxicity of Sodium Cyanide

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 End-user Industry

- 5.1.1 Mining

- 5.1.2 Chemical

- 5.1.3 Other End-user Industries

- 5.2 Geography

- 5.2.1 Ghana

- 5.2.2 Burkina Faso

- 5.2.3 Egypt

- 5.2.4 Tanzania

- 5.2.5 Zimbabwe

- 5.2.6 Mali

- 5.2.7 Democratic Republic of Congo

- 5.2.8 Sudan

- 5.2.9 Guinea

- 5.2.10 South Africa

- 5.2.11 Rest of Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Company Profiles

- 6.3.1 Australian Gold Reagents Pty Ltd

- 6.3.2 Evonik Industries AG

- 6.3.3 HeBei ChengXin

- 6.3.4 Honeywell International Inc.

- 6.3.5 Orica Limited

- 6.3.6 Sasol

- 6.3.7 TAEKWANG INDUSTRIAL CO., LTD

- 6.3.8 TSPC

- 6.3.9 The Chemours Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Discovery of New Mines