|

市场调查报告书

商品编码

1666579

生物燃料市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Biofuel Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

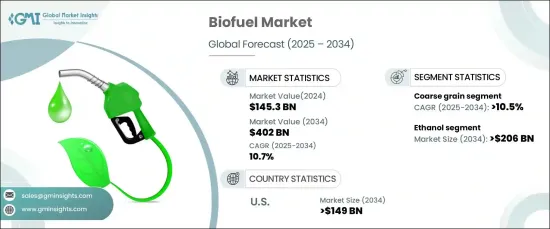

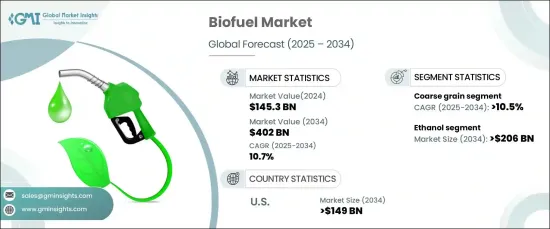

2024 年全球生物燃料市场价值为 1,453 亿美元,预计将出现显着增长,2025 年至 2034 年期间的复合年增长率为 10.7%。生物燃料被视为全球向再生能源转型的关键参与者,越来越多地融入交通运输、发电和工业活动等各个领域。在世界各国寻求应对气候变迁的当儿,生物燃料在帮助各国和企业在不破坏现有基础设施的情况下实现永续发展目标方面发挥关键作用。随着企业和政府加大努力实现长期环境目标,这个充满活力的产业将大幅成长。

企业持续采取永续发展措施以及运输业对生物燃料的使用日益增多是市场扩张的主要驱动力。越来越多的公司开始使用生质燃料来帮助实现碳减排目标。生物燃料与传统燃料系统的无缝整合使其成为有吸引力的选择。这些燃料可以轻鬆地与传统燃料混合,使产业能够在维护现有基础设施的同时减少对环境的影响。因此,生物燃料为那些注重永续性且不需要大量资本投资的企业提供了一种经济有效的解决方案。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1453亿美元 |

| 预测值 | 4020亿美元 |

| 复合年增长率 | 10.7% |

乙醇是主要的生物燃料产品,预计到 2034 年其产值将达到 2,060 亿美元。持续发展的纤维素乙醇(源自农业残留物等非食品来源)预计将进一步刺激需求。随着永续性继续成为全球议程的中心议题,纤维素乙醇的生产和使用与减少燃料生产对环境影响的努力完美契合,使得乙醇成为更具吸引力的选择。

粗粮原料市场,尤其是玉米,预计到 2034 年将以 10.5% 的复合年增长率增长。农业实践的进步提高了农作物产量并降低了生产成本,使得以玉米为基础的乙醇更具经济可行性。此外,乙醇生产过程中产生的副产品,如酒糟,可以作为宝贵的动物饲料,有助于乙醇产业的整体经济永续发展。

在联邦政府授权和州级推广再生燃料计画的推动下,美国生质燃料市场预计到 2034 年将创收 1,490 亿美元。乙醇主要来自玉米,透过在 E10 和 E15 等燃料混合物中的使用引领市场。此外,在加州低碳燃料标准(LCFS)等措施的支持下,再生柴油产量的不断增长也增强了这一势头。作为实现交通运输领域净零排放策略的一部分,美国也大力投资包括纤维素乙醇在内的先进生物燃料,使美国成为生物燃料创新的全球领导者。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 市场估计和预测参数

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL 分析

第四章:竞争格局

- 介绍

- 战略展望

- 创新与永续发展格局

第 5 章:市场规模与预测:按燃料,2021 – 2034 年

- 主要趋势

- 生质柴油

- 乙醇

- 其他的

第六章:市场规模与预测:依原料,2021 – 2034 年

- 主要趋势

- 粗粒

- 糖料作物

- 植物油

- 其他的

第 7 章:市场规模与预测:按应用,2021 – 2034 年

- 主要趋势

- 运输

- 航空

- 其他的

第 8 章:市场规模与预测:按地区,2021 – 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 西班牙

- 英国

- 义大利

- 亚太地区

- 中国

- 印度

- 印尼

- 澳洲

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第九章:公司简介

- ADM

- Borregaard

- BTG Bioliquids

- Cargill

- Chevron

- Clariant

- COFCO

- CropEnergies

- FutureFuel

- Munzer Bioindustrie

- My Eco Energy

- Neste

- POET

- Praj Industries

- The Andersons

- TotalEnergies

- UPM

- Verbio

- Wilmar International

- Zilor

The Global Biofuel Market, valued at USD 145.3 billion in 2024, is projected to witness significant growth, expanding at a CAGR of 10.7% between 2025 and 2034. This rapid growth is being fueled by rising environmental awareness, the increasing push for sustainable energy solutions, and supportive government policies aimed at reducing carbon emissions. Biofuels, seen as a key player in the global transition to renewable energy, are increasingly integrated across various sectors, including transportation, power generation, and industrial activities. As the world seeks to address climate change, biofuels are playing a pivotal role in helping countries and corporations meet their sustainability targets without disrupting current infrastructure. This dynamic sector is positioned for substantial growth as businesses and governments intensify their efforts to achieve long-term environmental goals.

The continued adoption of sustainability initiatives by corporations and the growing use of biofuels in the transportation industry are major drivers of market expansion. Companies are increasingly turning to biofuels to help meet their carbon reduction targets. The seamless integration of biofuels with conventional fuel systems is making them an appealing option. These fuels can be easily blended with traditional fuels, allowing industries to reduce their environmental impact while maintaining existing infrastructure. Biofuels, therefore, present a cost-effective solution for businesses aiming to prioritize sustainability without needing significant capital investments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $145.3 Billion |

| Forecast Value | $402 Billion |

| CAGR | 10.7% |

Ethanol, a major biofuel product, is expected to generate USD 206 billion by 2034. This growth is driven by its widespread use in fuel blends, thanks to its effectiveness in reducing greenhouse gas emissions. The ongoing development of cellulosic ethanol, derived from non-food sources like agricultural residues, is expected to further fuel demand. As sustainability continues to take center stage in the global agenda, the production and use of cellulosic ethanol align perfectly with efforts to reduce the environmental impact of fuel production, making ethanol an even more attractive option.

The coarse grain feedstock market, particularly corn, is expected to grow at a CAGR of 10.5% through 2034. Corn remains the dominant feedstock for ethanol production due to favorable biofuel mandates that promote renewable fuel blends. Advances in agricultural practices have improved crop yields and reduced production costs, making corn-based ethanol even more economically viable. Additionally, the byproducts of ethanol production, such as distillers' grains, serve as valuable animal feed, contributing to the overall economic sustainability of the ethanol industry.

The U.S. biofuel market is projected to generate USD 149 billion by 2034, driven by federal mandates and state-level programs designed to promote renewable fuels. Ethanol, primarily sourced from corn, leads the market through its use in fuel blends like E10 and E15. Furthermore, the growing production of renewable diesel, backed by initiatives like California's Low Carbon Fuel Standard (LCFS), adds to the momentum. The U.S. is also significantly investing in advanced biofuels, including cellulosic ethanol, as part of its strategy to achieve net-zero emissions in the transportation sector, positioning the nation as a global leader in biofuel innovation.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Fuel, 2021 – 2034 (MToe, USD Billion)

- 5.1 Key trends

- 5.2 Biodiesel

- 5.3 Ethanol

- 5.4 Others

Chapter 6 Market Size and Forecast, By Feedstock, 2021 – 2034 (MToe, USD Billion)

- 6.1 Key trends

- 6.2 Coarse grain

- 6.3 Sugar crop

- 6.4 Vegetable oil

- 6.5 Others

Chapter 7 Market Size and Forecast, By Application, 2021 – 2034 (MToe, USD Billion)

- 7.1 Key trends

- 7.2 Transportation

- 7.3 Aviation

- 7.4 Others

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (MToe, USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 France

- 8.3.3 Spain

- 8.3.4 UK

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Indonesia

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 ADM

- 9.2 Borregaard

- 9.3 BTG Bioliquids

- 9.4 Cargill

- 9.5 Chevron

- 9.6 Clariant

- 9.7 COFCO

- 9.8 CropEnergies

- 9.9 FutureFuel

- 9.10 Munzer Bioindustrie

- 9.11 My Eco Energy

- 9.12 Neste

- 9.13 POET

- 9.14 Praj Industries

- 9.15 The Andersons

- 9.16 TotalEnergies

- 9.17 UPM

- 9.18 Verbio

- 9.19 Wilmar International

- 9.20 Zilor