|

市场调查报告书

商品编码

1666580

重型卡车市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Heavy Duty Trucks Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

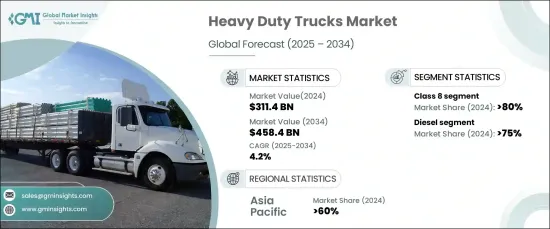

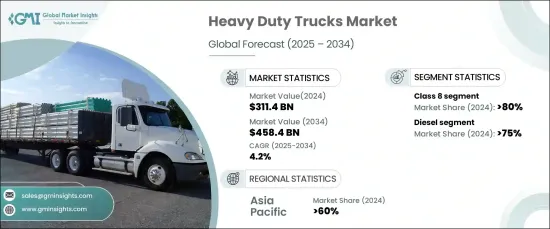

2024 年全球重型卡车市场价值为 3,114 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 4.2%。跨境贸易发展势头强劲,需要能够长距离处理大量货物的先进重型车辆。各地区为简化贸易物流和改善基础设施而进行的合作努力,正在促进重型卡车,特别是 8 级车辆的普及。

技术创新正在重塑市场格局,提高车辆性能、安全性和营运效率。自动驾驶、远端资讯处理和连接解决方案等先进功能越来越多地整合到重型卡车中,使其对车队营运商更具吸引力。这些技术优化了车队管理,提高了驾驶员安全性,降低了营运成本,从而促进了对现代化卡车车型的需求。随着车队营运商优先考虑性能和成本效率,全球采用技术先进的重型卡车的现象正在增加。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 3114亿美元 |

| 预测值 | 4584亿美元 |

| 复合年增长率 | 4.2% |

市场按车辆等级细分,其中 8 级卡车占据主导地位,到 2024 年占据 80% 以上的市场份额。他们高效长距离运输重物的能力巩固了他们在全球供应链中的地位。此外,节油引擎和智慧系统等尖端功能的结合使其成为车队营运商的首选。

燃料类型细分显示柴油卡车占据主导地位,到 2024 年,柴油卡车占据了 75% 以上的市场份额。其持续的突出地位得益于完善的加油基础设施,确保了无缝运作。儘管人们逐渐转向替代燃料,但柴油卡车凭藉其久经考验的性能和多功能性仍然是重型运输的基石。

亚太地区引领重型卡车市场,到 2023 年将贡献 60% 的收入份额。电子商务行业的蓬勃发展和物流网络的不断扩大进一步增加了对重型卡车的需求。此外,政府主导的基础设施计划和经济发展策略继续推动该地区的市场成长。随着亚太地区作为全球经济中心的地位不断加强,重型卡车市场预计将保持强劲势头。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 供应商概况

- 原物料供应商

- 零件供应商

- 製造商

- 技术提供者

- 经销商

- 最终用途

- 利润率分析

- 技术与创新格局

- 专利分析

- 监管格局

- 定价分析

- 衝击力

- 成长动力

- 自动驾驶技术需求不断成长

- 长途货运活动增加,重型卡车利用率提高

- 由于法规严格,引进先进的排放控制系统

- 全球物流网路与电子商务的扩张

- 卡车运输效率和安全性能的技术进步

- 产业陷阱与挑战

- 先进技术整合成本高

- 经济放缓影响货运需求

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按类别,2021 - 2034 年

- 主要趋势

- 第七类

- 车轴类型

- 4X2

- 6X2

- 6X4

- 车轴类型

- 第八类

- 车轴类型

- 4X2

- 6X2

- 6X4

- 驾驶室类型

- 日间计程车

- 卧舖司机室

- 车轴类型

第六章:市场估计与预测:按燃料,2021 - 2034 年

- 主要趋势

- 柴油引擎

- 天然气

- 油电混合

- 汽油

第七章:市场估计与预测:按马力,2021 - 2034 年

- 主要趋势

- 300HP以下

- 300马力至400马力

- 400马力至500马力

- 500HP以上

第 8 章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 货运配送

- 实用程式服务

- 建筑和采矿

- 其他的

第 9 章:市场估计与预测:按所有权划分,2021 - 2034 年

- 主要趋势

- 车队营运商

- 独立营运商

第 10 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 俄罗斯

- 比利时

- 瑞典

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第 11 章:公司简介

- BYD Auto

- Daimler Trucks

- Dongfeng

- Freightliner

- Hino Motors

- Isuzu Motors

- Kenworth

- MAN

- Navistar

- PACCAR Inc

- Peterbilt

- SCANIA

- SINOTRUK

- TRATON GROUP

- Volvo

The Global Heavy Duty Trucks Market was valued at USD 311.4 billion in 2024 and is expected to grow at a CAGR of 4.2% from 2025 to 2034. This growth is largely attributed to the increasing global need for efficient goods transportation, driven by thriving commerce and expanding trade activities. Cross-border trade has gained momentum, necessitating advanced heavy-duty vehicles capable of handling substantial cargo volumes over long distances. Collaborative efforts among regions to streamline trade logistics and improve infrastructure are bolstering the adoption of heavy-duty trucks, particularly Class 8 vehicles.

Technological innovations are reshaping the market landscape, enhancing vehicle performance, safety, and operational efficiency. Advanced features like autonomous driving, telematics, and connectivity solutions are increasingly being integrated into heavy-duty trucks, making them more appealing to fleet operators. These technologies optimize fleet management, improve driver safety, and reduce operating costs, fostering demand for modernized truck models. With fleet operators prioritizing performance and cost efficiency, the adoption of technologically advanced heavy-duty trucks is on the rise globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $311.4 Billion |

| Forecast Value | $458.4 Billion |

| CAGR | 4.2% |

The market is segmented by vehicle class, with Class 8 trucks dominating the sector, accounting for over 80% of the market share in 2024. Known for their robust design and high gross vehicle weight rating (GVWR) exceeding 33,000 pounds, Class 8 trucks are indispensable for industries like logistics, construction, and agriculture. Their ability to transport heavy loads efficiently over long distances has solidified their position in global supply chains. Additionally, the incorporation of cutting-edge features such as fuel-efficient engines and smart systems makes them a preferred choice for fleet operators.

Fuel type segmentation reveals the dominance of diesel-powered trucks, which held over 75% of the market share in 2024. Diesel trucks are renowned for their unmatched power, reliability, and extensive range, making them essential for long-haul transportation and heavy-duty applications. Their continued prominence is supported by a well-established refueling infrastructure, ensuring seamless operations. Despite the gradual shift toward alternative fuels, diesel trucks remain a cornerstone of heavy-duty transportation due to their proven performance and versatility.

Asia Pacific leads the heavy-duty trucks market, contributing 60% of the revenue share in 2023. Rapid industrialization and urbanization across countries like China and India have heightened the demand for efficient transportation solutions. The booming e-commerce sector and expanding logistics networks further amplify the need for heavy-duty trucks. Additionally, government-led infrastructure initiatives and economic development strategies continue to propel market growth in the region. As Asia Pacific strengthens its position as a global economic hub, the heavy-duty trucks market is expected to maintain strong momentum.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component suppliers

- 3.2.3 Manufacturers

- 3.2.4 Technology providers

- 3.2.5 Distributors

- 3.2.6 End Use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Regulatory landscape

- 3.7 Pricing analysis

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Escalating demand for autonomous driving technologies

- 3.8.1.2 Increasing long-haul freight activities bolstering heavy duty truck utilization

- 3.8.1.3 Introduction of advanced emission control systems due to strict regulations

- 3.8.1.4 Expansion of logistic networks and e-commerce globally

- 3.8.1.5 Technological advancements in trucking efficiency and safety features

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High cost of advanced technology integration

- 3.8.2.2 Economic slowdown affecting freight demand

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter’s analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Class, 2021 - 2034 ($Bn, Unit)

- 5.1 Key trends

- 5.2 Class 7

- 5.2.1 Axle type

- 5.2.1.1 4X2

- 5.2.1.2 6X2

- 5.2.1.3 6X4

- 5.2.1 Axle type

- 5.3 Class 8

- 5.3.1 Axle type

- 5.3.1.1 4X2

- 5.3.1.2 6X2

- 5.3.1.3 6X4

- 5.3.2 Cab type

- 5.3.2.1 Day cab

- 5.3.2.2 Sleeper cab

- 5.3.1 Axle type

Chapter 6 Market Estimates & Forecast, By Fuel, 2021 - 2034 ($Bn, Unit)

- 6.1 Key trends

- 6.2 Diesel

- 6.3 Natural gas

- 6.4 Hybrid electric

- 6.5 Gasoline

Chapter 7 Market Estimates & Forecast, By Horsepower, 2021 - 2034 ($Bn, Unit)

- 7.1 Key trends

- 7.2 Below 300HP

- 7.3 300HP-400HP

- 7.4 400HP-500HP

- 7.5 Above 500HP

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Unit)

- 8.1 Key trends

- 8.2 Freight delivery

- 8.3 Utility services

- 8.4 Construction & mining

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Ownership, 2021 - 2034 ($Bn, Unit)

- 9.1 Key trends

- 9.2 Fleet operator

- 9.3 Independent operator

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Unit)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Russia

- 10.3.6 Belgium

- 10.3.7 Sweden

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 BYD Auto

- 11.2 Daimler Trucks

- 11.3 Dongfeng

- 11.4 Freightliner

- 11.5 Hino Motors

- 11.6 Isuzu Motors

- 11.7 Kenworth

- 11.8 MAN

- 11.9 Navistar

- 11.10 PACCAR Inc

- 11.11 Peterbilt

- 11.12 SCANIA

- 11.13 SINOTRUK

- 11.14 TRATON GROUP

- 11.15 Volvo