|

市场调查报告书

商品编码

1667149

重型车辆租赁市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Heavy Duty Vehicle Rental Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

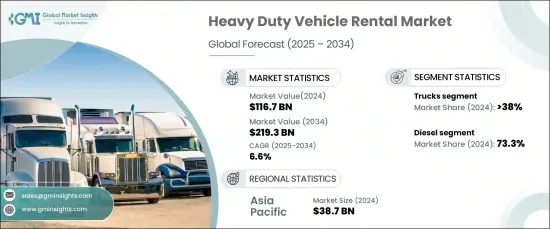

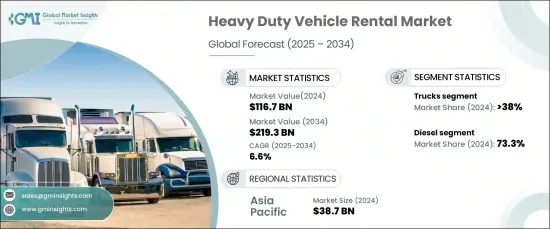

2024 年全球重型车辆租赁市场价值为 1,167 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 6.6%。随着维护费用的飙升,许多公司选择汽车租赁服务,因为租赁可以让他们满足交通需求,而无需承担不断上涨的维护成本的财务负担。

租赁重型车辆为企业提供了一个实用的解决方案,因为它省去了购买车辆的高昂前期成本。由于租赁费通常涵盖维护和维修费用,公司可以避免意外开支。这种灵活性有助于企业优化预算,特别是对于短期专案或季节性需求。租赁重型车辆是一种经济审慎的选择,确保公司无需进行长期投资即可获得必要的车辆。租赁汽车而非购买汽车的趋势日益增长,这有利于提高企业的财务稳定性和营运效率。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1167亿美元 |

| 预测值 | 2193亿美元 |

| 复合年增长率 | 6.6% |

市场分为卡车、巴士、拖车和其他车辆。卡车领域占据最大的市场份额,到 2024 年将达到 38% 以上。这些灵活的租赁选择对于需求波动(例如季节性需求或意外的工作量激增)的企业特别有利。卡车在建筑、物流、采矿和农业等众多行业中发挥关键作用,使其成为重型车辆租赁市场的重要组成部分。

卡车的需求量很大,因为它们对于长距离和短距离运输原材料、货物和设备至关重要。它们能够承载重物并在各种地形上行驶,这使得它们对于具有多样化物流需求的公司而言是不可或缺的。租赁卡车是一种比购买卡车更经济的方式,因为它允许企业扩大车队规模而无需大量的前期资本投资。租赁卡车的选择为公司提供了根据需要调整车队的灵活性,这使其成为运输需求不断变化的行业的一个有吸引力的选择。

就推进类型而言,市场包括柴油、天然气、电动、混合电动等。 2024 年柴油车占据市场主导地位,占有 73.3% 的份额。柴油汽车因其行驶里程长而广受欢迎,适合长途行驶。此外,柴油车的加油时间比电动车更快,这有助于最大限度地减少企业的停工时间。这些因素使柴油车成为各种租赁和营运需求的理想选择,为企业提供了范围和灵活性。

亚太地区是重型车辆租赁最大的市场,2024 年的租赁规模将达到 387 亿美元。亚太地区的企业倾向于为特定专案或短期需求租赁车辆,因为这样可以避免长期的财务承诺。租赁公司提供可客製化的计划,在需要时提供车辆使用权,帮助公司根据需求扩大业务规模,而无需投资购买车辆。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 供应商概况

- 原物料供应商

- 零件供应商

- 製造商

- 技术提供者

- 经销商

- 最终用途

- 利润率分析

- 技术与创新格局

- 专利分析

- 监管格局

- 定价分析

- 买家行为与偏好

- 衝击力

- 成长动力

- 维护和维修成本高

- 消除购买重型车辆高昂前期成本的需求日益增加

- 提高车辆类型、持续时间和数量的灵活性

- 车队管理中的各种技术的集成

- 产业陷阱与挑战

- 司机短缺

- 燃料成本上涨

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 卡车

- 巴士

- 预告片

- 其他的

第 6 章:市场估计与预测:按推进方式,2021 - 2034 年

- 主要趋势

- 柴油引擎

- 天然气

- 电的

- 油电混合

- 其他的

第 7 章:市场估计与预测:按服务供应商,2021 - 2034 年

- 主要趋势

- OEM

- 第三方公司

第 8 章:市场估计与预测:按租金,2021 - 2034 年

- 主要趋势

- 短期

- 长期

第 9 章:市场估计与预测:按最终用途,2021 - 2034 年

- 主要趋势

- 建造

- 物流和运输

- 矿业

- 石油和天然气

- 农业

- 其他的

第 10 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第 11 章:公司简介

- Avis Budget

- Bennett International Group

- Budget Truck Rental

- Daimler Truck

- DOZR

- Enterprise Truck Rental

- Herc Rental

- Hino Trucks Rental Services

- Idealease

- Keen Transport

- Manhattan Beer

- PacLease

- Penske Truck Rental

- Ryder System

- Scania Rents

- Sixt SE

- Toyota

- Transwest Rentals

- U-Haul International

- Volvo Truck Rentals

The Global Heavy Duty Vehicle Rental Market was valued at USD 116.7 billion in 2024 and is projected to grow at a CAGR of 6.6% from 2025 to 2034. This growth is driven by the rising Consumer Price Index (CPI) in vehicle maintenance and repair, which has caused businesses to look for more cost-effective alternatives. As maintenance expenses soar, many companies are opting for vehicle rental services, as renting allows them to meet transportation needs without the financial burden of rising upkeep costs.

Renting heavy-duty vehicles offers businesses a practical solution by eliminating the high upfront costs of purchasing vehicles. With rental fees often covering maintenance and repairs, companies can avoid unexpected expenses. This flexibility helps businesses optimize their budgets, especially for short-term projects or seasonal demands. Renting heavy-duty vehicles provides a financially prudent option, ensuring that companies can access the necessary vehicles without committing to long-term investments. The growing trend of renting vehicles instead of purchasing them is fostering greater financial stability and operational efficiency for businesses.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $116.7 Billion |

| Forecast Value | $219.3 Billion |

| CAGR | 6.6% |

The market is segmented into trucks, buses, trailers, and other vehicles. The truck segment holds the largest market share, accounting for over 38% in 2024. This segment's growth is driven by the availability of rental programs that guarantee reliable and uninterrupted service. These flexible rental options are particularly beneficial for businesses with fluctuating needs, such as seasonal demands or unexpected workload surges. Trucks play a critical role across numerous industries, including construction, logistics, mining, and agriculture, making them an essential part of the heavy-duty vehicle rental market.

Trucks are in high demand because they are essential for raw materials, transporting goods, and equipment over both long and short distances. Their ability to handle heavy loads and perform in various terrains makes them indispensable for companies with diverse logistical needs. Renting trucks is a cost-effective alternative to purchasing, as it allows businesses to scale their fleets without the significant upfront capital investment. The option to rent trucks provides companies with the flexibility to adjust their fleets as needed, making it an attractive choice for industries with ever-changing transportation requirements.

Regarding propulsion types, the market includes diesel, natural gas, electric, hybrid electric, and others. Diesel vehicles dominated the market in 2024, holding a 73.3% share. Diesel-powered vehicles are popular because of their extended driving range, making them suitable for long-distance tasks. Additionally, diesel vehicles have faster refueling times than electric options, which helps minimize downtime for businesses. These factors make diesel vehicles an appealing choice for various rental and operational needs, offering businesses both range and flexibility.

The Asia Pacific region is the largest market for heavy-duty vehicle rentals, accounting for USD 38.7 billion in 2024. The demand for flexible rental solutions is driving growth in this region. Businesses in the Asia Pacific prefer renting vehicles for specific projects or short-term requirements, as it allows them to avoid long-term financial commitments. Rental companies offer customizable plans that provide access to vehicles when needed, helping companies scale their operations based on demand without having to invest in purchasing vehicles.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component suppliers

- 3.2.3 Manufacturers

- 3.2.4 Technology providers

- 3.2.5 Distributors

- 3.2.6 End use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Regulatory landscape

- 3.7 Pricing analysis

- 3.8 Buyer behavior and preferences

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 High maintenance & repair costs

- 3.9.1.2 Rising need for eliminating the high upfront costs of purchasing heavy-duty vehicles

- 3.9.1.3 Increased flexibility in terms of vehicle types, duration, and quantity

- 3.9.1.4 Integration of various technologies in fleet management

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Shortage of drivers

- 3.9.2.2 Rising cost of fuel

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Fleet Size)

- 5.1 Key trends

- 5.2 Trucks

- 5.3 Buses

- 5.4 Trailers

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Fleet Size)

- 6.1 Key trends

- 6.2 Diesel

- 6.3 Natural gas

- 6.4 Electric

- 6.5 Hybrid electric

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Service Provider, 2021 - 2034 ($Bn, Fleet Size)

- 7.1 Key trends

- 7.2 OEM

- 7.3 3rd party companies

Chapter 8 Market Estimates & Forecast, By Rental, 2021 - 2034 ($Bn, Fleet Size)

- 8.1 Key trends

- 8.2 Short term

- 8.3 Long term

Chapter 9 Market Estimates & Forecast, By End use, 2021 - 2034 ($Bn, Fleet Size)

- 9.1 Key trends

- 9.2 Construction

- 9.3 Logistics and transportation

- 9.4 Mining

- 9.5 Oil and gas

- 9.6 Agriculture

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Fleet Size)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Avis Budget

- 11.2 Bennett International Group

- 11.3 Budget Truck Rental

- 11.4 Daimler Truck

- 11.5 DOZR

- 11.6 Enterprise Truck Rental

- 11.7 Herc Rental

- 11.8 Hino Trucks Rental Services

- 11.9 Idealease

- 11.10 Keen Transport

- 11.11 Manhattan Beer

- 11.12 PacLease

- 11.13 Penske Truck Rental

- 11.14 Ryder System

- 11.15 Scania Rents

- 11.16 Sixt SE

- 11.17 Toyota

- 11.18 Transwest Rentals

- 11.19 U-Haul International

- 11.20 Volvo Truck Rentals