|

市场调查报告书

商品编码

1666698

家用冰箱和冰柜市场机会、成长动力、产业趋势分析和 2024 - 2032 年预测Household Refrigerators and Freezers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2024 - 2032 |

||||||

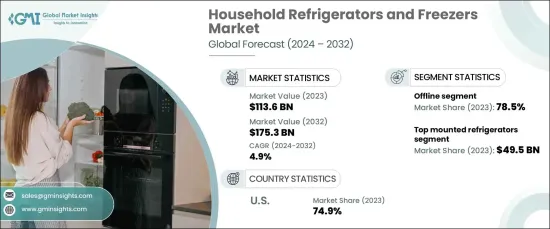

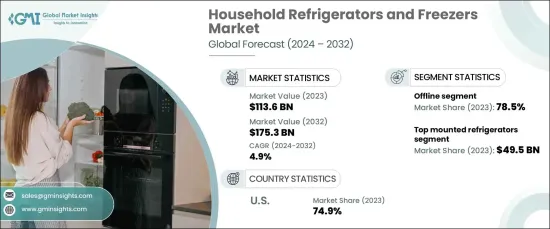

2023 年全球家用冰箱和冰柜市场价值为 1,136 亿美元,预计 2024 年至 2032 年期间的复合年增长率为 4.9%。

製造商正透过引入自动除霜和精确温度控制等先进技术来提高能源效率。政府支持环保家电的政策和激励措施进一步放大了这一趋势,使永续选择对消费者更具吸引力。

| 市场范围 | |

|---|---|

| 起始年份 | 2023 |

| 预测年份 | 2024-2032 |

| 起始值 | 1136亿美元 |

| 预测值 | 1753亿美元 |

| 复合年增长率 | 4.9% |

智慧技术的融合正在重塑家电市场。现代冰箱和冷冻机现在具有 Wi-Fi 连接、互动式触控萤幕和虚拟助理相容性,提供更大的便利性和个人化。这些进步使用户能够远端控制电器、接收警报和优化食物储存,从而增强整体用户体验。

都市化,特别是发展中地区的都市化,有助于提高可支配收入和扩大中产阶级。这种转变推动了对先进家用电器的需求,这些电器透过提供高效、便利和创新的功能来满足现代生活方式。

就产品类型而言,市场包括顶置式、底置式、对开门式和法式门冰箱等类别。其中,顶置式冰箱占据市场主导地位,销售额可观,成长轨迹稳健。它们之所以受欢迎,是因为其成本效益和高效的冷却动力,吸引了广泛的消费者群体。

就分销管道而言,市场分为线上和线下部分。线下通路占据最大的市场份额,因为消费者通常更喜欢在购买之前亲自评估电器。实体店提供了亲身体验产品、获得个人化帮助以及享受促销或延长保固的机会,从而增强了消费者的信任和满意度。

从地区来看,美国引领北美家用冰箱和冰柜市场,占有相当大的份额。高可支配收入和智慧家庭技术的广泛采用等因素推动了对先进和优质家电的需求。人们对智慧冰箱的日益青睐,符合将技术融入日常生活以实现便利和高效的日益增长的趋势。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 节能电器需求不断成长

- 技术进步和智慧功能

- 都市化和可支配所得不断提高

- 产业陷阱与挑战

- 延长更换週期

- 消费者的价格敏感性

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按产品,2021-2032 年

- 主要趋势

- 顶置式冰箱

- 底部安装冰箱

- 并排冰箱

- 法式对开门冰箱

第六章:市场估计与预测:依产能,2021-2032 年

- 主要趋势

- 小于 15 立方英尺。英尺。

- 16 立方英尺英尺到 30 立方英尺。英尺。

- 超过30立方英尺。英尺。

第七章:市场估计与预测:依结构,2021-2032 年

- 主要趋势

- 内建

- 独立式

第 8 章:市场估计与预测:按价格范围,2021 年至 2032 年

- 主要趋势

- 低的

- 中等的

- 高的

第 9 章:市场估计与预测:依最终用途,2021-2032 年

- 主要趋势

- 住宅

- 商业的

第 10 章:市场估计与预测:按配销通路,2021-2032 年

- 主要趋势

- 在线的

- 电子商务

- 公司网站

- 离线

- 百货公司

- 大卖场/超市

- 专业零售商

- 其他的

第 11 章:市场估计与预测:按地区,2021-2032 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 12 章:公司简介

- BSH

- Electrolux

- GE Appliances

- Godrej

- Haier

- Hisense

- Hitachi

- LG

- Liebherr

- Midea

- Panasonic

- Samsung

- Sub-Zero

- Toshiba

- Whirlpool

The Global Household Refrigerators And Freezers Market was valued at USD 113.6 billion in 2023 and is projected to grow at a 4.9% CAGR from 2024 to 2032. Rising environmental awareness among consumers drives demand for energy-efficient appliances that reduce electricity consumption and have minimal environmental impact.

Manufacturers are responding by introducing advanced technologies like automatic defrost and precise temperature control to enhance energy efficiency. Government policies and incentives supporting eco-friendly appliances further amplify this trend, making sustainable options more attractive to consumers.

| Market Scope | |

|---|---|

| Start Year | 2023 |

| Forecast Year | 2024-2032 |

| Start Value | $113.6 Billion |

| Forecast Value | $175.3 Billion |

| CAGR | 4.9% |

The integration of smart technologies is reshaping the household appliances market. Modern refrigerators and freezers now feature Wi-Fi connectivity, interactive touch screens, and virtual assistant compatibility, offering greater convenience and personalization. These advancements enable users to control appliances remotely, receive alerts, and optimize food storage, enhancing the overall user experience.

Urbanization, particularly in developing regions, contributes to higher disposable incomes and the expansion of the middle class. This shift is fueling demand for advanced household appliances that cater to modern lifestyles by providing efficiency, convenience, and innovative features.

In terms of product types, the market includes categories such as top-mounted, bottom-mounted, side-by-side, and French door refrigerators. Among these, top-mounted refrigerators dominate the market with significant revenue and a steady growth trajectory. Their popularity is attributed to cost-effectiveness and efficient cooling dynamics, appealing to a broad consumer base.

Regarding distribution channels, the market is divided into online and offline segments. Offline channels account for the largest market share, as consumers often prefer to assess appliances in person before making purchases. Physical stores provide the opportunity to experience products firsthand, receive personalized assistance, and benefit from promotions or extended warranties, enhancing consumer trust and satisfaction.

Regionally, the U.S. leads the North American household refrigerators and freezers market, holding a significant share. Factors such as high disposable incomes and the widespread adoption of smart home technologies drive demand for advanced and premium appliances. The increasing preference for smart refrigerators aligns with the growing trend of integrating technology into daily living for convenience and efficiency.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021-2032

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand for energy-efficient appliances

- 3.6.1.2 Technological advancements and smart features

- 3.6.1.3 Increasing urbanization and disposable income

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Extended replacement cycles

- 3.6.2.2 Price sensitivity among consumers

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021-2032 (USD Billion)

- 5.1 Key trends

- 5.2 Top mounted refrigerators

- 5.3 Bottom mounted refrigerators

- 5.4 Side-by-side refrigerators

- 5.5 French door refrigerators

Chapter 6 Market Estimates & Forecast, By Capacity, 2021-2032 (USD Billion)

- 6.1 Key trends

- 6.2 Less than 15 cu. Ft.

- 6.3 16 cu. Ft to 30 cu. Ft.

- 6.4 More than 30 cu. Ft.

Chapter 7 Market Estimates & Forecast, By Structure, 2021-2032 (USD Billion)

- 7.1 Key trends

- 7.2 Built-in

- 7.3 Freestanding

Chapter 8 Market Estimates & Forecast, By Price Range, 2021-2032 (USD Billion)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High

Chapter 9 Market Estimates & Forecast, By End use, 2021-2032 (USD Billion)

- 9.1 Key trends

- 9.2 Residential

- 9.3 Commercial

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021-2032 (USD Billion)

- 10.1 Key trends

- 10.2 Online

- 10.2.1 E-commerce

- 10.2.2 Company websites

- 10.3 Offline

- 10.3.1 Departmental stores

- 10.3.2 Hypermarkets/supermarkets

- 10.3.3 Specialty retailers

- 10.3.4 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021-2032 (USD Billion)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.4.6 Indonesia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 BSH

- 12.2 Electrolux

- 12.3 GE Appliances

- 12.4 Godrej

- 12.5 Haier

- 12.6 Hisense

- 12.7 Hitachi

- 12.8 LG

- 12.9 Liebherr

- 12.10 Midea

- 12.11 Panasonic

- 12.12 Samsung

- 12.13 Sub-Zero

- 12.14 Toshiba

- 12.15 Whirlpool