|

市场调查报告书

商品编码

1666897

固定式液流电池储存市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Stationary Flow Battery Storage Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024 年全球固定式液流电池储存市场价值为 44 亿美元,预计将呈指数级增长,到 2034 年预计复合年增长率为 25.9%。随着世界各国加快向清洁能源转型,液流电池正成为解决间歇性再生能源发电挑战的重要技术。这些电池具有卓越的优势,包括长时间储能、可扩展性和延长循环寿命,使其成为公用事业规模应用不可或缺的一部分。

市场的关键驱动因素包括全球推动脱碳、政府激励措施以及降低成本和提高性能的技术进步。随着人们对气候变迁和能源安全的担忧日益加剧,固定式液流电池正成为微电网、负载平衡和电网稳定等能源密集应用的首选。这些系统有效地储存了风能和太阳能产生的多余能量,在发电量低的时期提供稳定的电力供应。它们的模组化设计和永续性进一步增强了它们的吸引力,与再生能源整合和碳中和的全球目标完全一致。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 44亿美元 |

| 预测值 | 474亿美元 |

| 复合年增长率 | 25.9% |

在液流电池技术中,钒氧化还原液流电池脱颖而出,成为游戏规则的改变者,预计到 2034 年该领域将创造 306 亿美元的收入。与其他类型的电池不同,钒氧化还原电池的两种电解质均使用相同的元素,可防止交叉污染并确保长期稳定的性能。它们的低维护要求和提供可靠、长时间储能的能力正在推动全球再生能源专案的广泛采用。随着太阳能和风能的不断扩大,对钒电池的需求将激增,进一步巩固其在市场上的主导地位。

电能时移应用是电网管理的关键组成部分,预计到 2034 年将以惊人的 27.9% 的复合年增长率成长。透过解决电网不平衡问题和提高能源可靠性,时移解决方案在支援再生能源的采用和实现脱碳目标方面发挥关键作用。对能源效率和可靠性的日益重视凸显了这些应用日益增长的重要性。

在美国,固定式液流电池储存市场预计到 2034 年将达到 4.907 亿美元。液流电池具有无与伦比的长时间储存大量能量的能力,对于平衡再生能源的间歇性至关重要。联邦和州级政策,包括税收抵免和财政激励,正在加速液流电池系统的部署,以实现调峰、负载平衡和电网弹性增强等关键应用。

目录

第 1 章:方法论与范围

- 市场定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL 分析

第四章:竞争格局

- 战略仪表板

- 创新与永续发展格局

第 5 章:市场规模与预测:依技术,2021 – 2034 年

- 主要趋势

- 钒氧化还原

- 锌溴

- 其他的

第 6 章:市场规模与预测:按应用,2021 – 2034 年

- 主要趋势

- 电能时移

- 频率调节

- 再生能源整合

- 其他的

第 7 章:市场规模及预测:按地区,2021 – 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 德国

- 义大利

- 俄罗斯

- 西班牙

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 世界其他地区

第八章:公司简介

- Elestor

- ESS

- Everflow

- Invinity Energy Systems

- Largo

- Primus Power

- Redflow

- Voltstorage

- VRB Energy

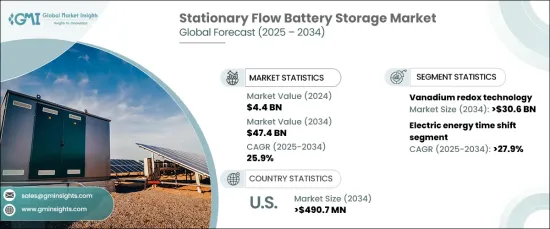

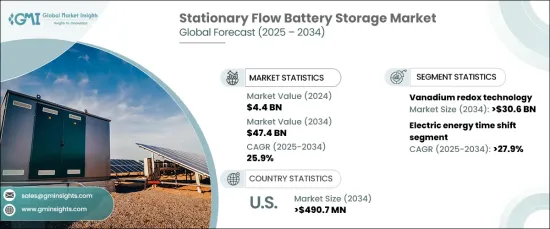

The Global Stationary Flow Battery Storage Market, valued at USD 4.4 billion in 2024, is poised to witness exponential growth with a projected CAGR of 25.9% through 2034. This robust expansion reflects the increasing demand for large-scale energy storage systems designed to integrate renewable energy sources while enhancing grid stability. As nations worldwide accelerate their transition toward clean energy, flow batteries are emerging as a vital technology for addressing the challenges posed by intermittent renewable energy generation. These batteries offer exceptional benefits, including long-duration energy storage, scalability, and extended cycle life, making them indispensable for utility-scale applications.

Key drivers of the market include the global push toward decarbonization, government incentives, and technological advancements that are reducing costs and improving performance. With growing concerns over climate change and energy security, stationary flow batteries are becoming a preferred choice for energy-intensive applications, such as microgrids, load balancing, and grid stabilization. These systems effectively store excess energy generated by wind and solar power, delivering a steady power supply during periods of low generation. Their modular design and sustainability further enhance their appeal, aligning perfectly with global objectives for renewable energy integration and carbon neutrality.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.4 Billion |

| Forecast Value | $47.4 Billion |

| CAGR | 25.9% |

Among flow battery technologies, vanadium redox flow batteries stand out as a game-changer, with the segment projected to generate USD 30.6 billion by 2034. These batteries are celebrated for their high energy efficiency, long cycle life, and scalability. Unlike other battery types, vanadium redox batteries utilize the same element for both electrolytes, preventing cross-contamination and ensuring stable performance over time. Their low maintenance requirements and ability to provide reliable, long-duration energy storage are driving the widespread adoption in renewable energy projects worldwide. As solar and wind power continue to expand, the demand for vanadium redox batteries is set to surge, further solidifying their dominance in the market.

The electric energy time-shift application, a critical component of grid management, is anticipated to grow at an impressive CAGR of 27.9% through 2034. This innovative application enables the storage of excess energy produced during off-peak hours, allowing it to be deployed during periods of high demand. By addressing grid imbalances and enhancing energy reliability, time-shifting solutions play a pivotal role in supporting renewable energy adoption and achieving decarbonization goals. The growing emphasis on energy efficiency and reliability underscores the increasing importance of these applications.

In the United States, the stationary flow battery storage market is expected to reach USD 490.7 million by 2034. The rapid expansion is fueled by the widespread adoption of renewable energy and initiatives to modernize the national power grid. Flow batteries, with their unparalleled ability to store large energy volumes for extended durations, are essential for balancing the intermittency of renewables. Federal and state-level policies, including tax credits and financial incentives, are accelerating the deployment of flow battery systems for critical applications such as peak shaving, load leveling, and grid resilience enhancement.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 – 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 Vanadium redox

- 5.3 Zinc bromine

- 5.4 Others

Chapter 6 Market Size and Forecast, By Application, 2021 – 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 Electric energy time shift

- 6.3 Frequency regulation

- 6.4 Renewable integration

- 6.5 Others

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD Million & MW)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 France

- 7.3.3 Germany

- 7.3.4 Italy

- 7.3.5 Russia

- 7.3.6 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.5 Rest of World

Chapter 8 Company Profiles

- 8.1 Elestor

- 8.2 ESS

- 8.3 Everflow

- 8.4 Invinity Energy Systems

- 8.5 Largo

- 8.6 Primus Power

- 8.7 Redflow

- 8.8 Voltstorage

- 8.9 VRB Energy