|

市场调查报告书

商品编码

1666951

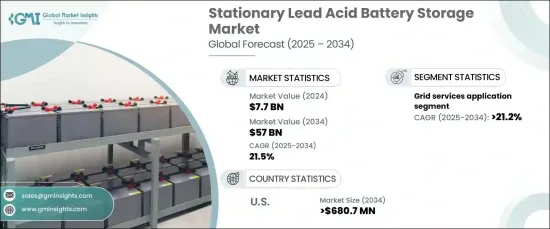

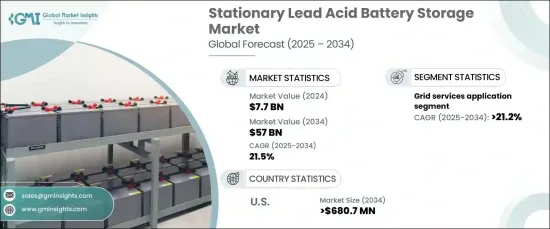

固定式铅酸电池储存市场机会、成长动力、产业趋势分析与预测 2025 - 2034Stationary Lead Acid Battery Storage Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024 年全球固定式铅酸电池储存市场价值为 77 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 21.5%。这些电池因其成本效益和提供可靠、持久的能量储存的能力而特别受重视。它们的多功能性使其成为商业、工业和住宅应用的首选。技术进步显着提高了它们的性能、效率和耐用性,儘管出现了替代能源储存技术,但仍确保了它们的相关性。关键产业对不间断电源的需求不断增长,这持续推动了需求,因为这些电池非常适合满足持续的能源需求。

固定式铅酸电池对于满足对电力有稳定需求的产业的备用电源需求至关重要。它们具有较高的放电率和较长的使用寿命,因而成为高度可靠的大规模储能係统。这些电池还提供了一种可持续的解决方案,因为它们具有成本效益且相对容易回收。新兴市场由于价格低廉且回收基础设施完善而越来越多地采用铅酸电池系统。然而,锂离子电池等新技术带来了竞争,而铅酸电池因其在高容量应用中提供可靠性能的能力仍然受到青睐。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 77亿美元 |

| 预测值 | 570亿美元 |

| 复合年增长率 | 21.5% |

预测期内,电网服务中铅酸电池系统的使用预计将大幅成长,复合年增长率为 21.2%。它们的可靠性和成本优势使其适用于尖峰负载管理和紧急电源等重要的电网操作。公用事业公司重视这些电池,因为它们具有稳定电网、整合再生能源和有效满足大规模能源需求的能力。该领域的强劲成长潜力凸显了其在全球能源储存领域持续的重要性。

预计到 2034 年,美国固定式铅酸电池储存市场规模将超过 6.807 亿美元。这些电池还透过管理电网负载和整合再生能源储存来支援公用事业。设计创新提高了安全性并延长了生命週期性能,进一步提高了其采用率。虽然有关铅处理和处置的更严格规定带来了挑战,但它们也激励了电池回收技术的进步,有助于实现其永续性。

目录

第 1 章:方法论与范围

- 市场定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL 分析

第四章:竞争格局

- 战略仪表板

- 创新与永续发展格局

第 5 章:市场规模与预测:按应用,2021 – 2034 年

- 主要趋势

- 电网服务

- 仪表后面

- 离网

第六章:市场规模及预测:按地区,2021 – 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 德国

- 义大利

- 俄罗斯

- 西班牙

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 土耳其

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

第七章:公司简介

- CD Technologies

- Duracell

- Enersys

- Exide Industries

- Furukawa Battery

- GS Yuasa

- Johnson Controls

- Lockheed Martin

- Narada

- Panasonic

- Ritar

- Siemens

The Global Stationary Lead Acid Battery Storage Market, valued at USD 7.7 billion in 2024, is expected to grow at a CAGR of 21.5% from 2025 to 2034. The increasing demand for reliable energy storage solutions across various sectors is fueling this growth. These batteries are particularly valued for their cost-effectiveness and ability to provide dependable, long-lasting energy storage. Their versatility makes them a preferred choice in commercial, industrial, and residential applications. Technological advancements have significantly improved their performance, efficiency, and durability, ensuring their relevance despite the emergence of alternative energy storage technologies. The rising need for uninterrupted power supply across critical sectors continues to drive demand, as these batteries are well-suited to meet consistent energy requirements.

Stationary lead-acid batteries are crucial in supporting backup power needs in industries with consistent power demands. Their high discharge rates and extended lifespan make them highly dependable for large-scale energy storage systems. These batteries also offer a sustainable solution, as they are cost-effective and relatively easy to recycle. Emerging markets increasingly adopt lead-acid battery systems due to their affordability and established recycling infrastructure. However, newer technologies such as lithium-ion batteries present competition, and lead-acid batteries remain favored for their ability to deliver reliable performance for high-capacity applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.7 Billion |

| Forecast Value | $57 Billion |

| CAGR | 21.5% |

The use of lead-acid battery systems in grid services is projected to grow significantly over the forecast period, with a CAGR of 21.2%. Their reliability and cost advantages make them suitable for essential grid operations such as peak load management and emergency power supply. Utilities value these batteries for their capacity to stabilize grids, integrate renewable energy sources, and meet large-scale energy demands efficiently. The strong growth potential in this segment highlights their continued importance in the global energy storage landscape.

The stationary lead-acid battery storage market in the United States is anticipated to surpass USD 680.7 million by 2034. The demand for dependable backup power in industrial and commercial settings is a key growth driver. These batteries also support utilities by managing grid loads and integrating renewable energy storage. Innovations in design have improved safety and extended lifecycle performance, further enhancing their adoption. While stricter regulations surrounding lead handling and disposal present challenges, they also incentivize advancements in battery recycling technologies, contributing to their sustainability.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's Analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL Analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Application, 2021 – 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 Grid services

- 5.3 Behind the meter

- 5.4 Off grid

Chapter 6 Market Size and Forecast, By Region, 2021 – 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.2.3 Mexico

- 6.3 Europe

- 6.3.1 UK

- 6.3.2 France

- 6.3.3 Germany

- 6.3.4 Italy

- 6.3.5 Russia

- 6.3.6 Spain

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 Australia

- 6.4.3 India

- 6.4.4 Japan

- 6.4.5 South Korea

- 6.5 Middle East & Africa

- 6.5.1 Saudi Arabia

- 6.5.2 UAE

- 6.5.3 Turkey

- 6.5.4 South Africa

- 6.5.5 Egypt

- 6.6 Latin America

- 6.6.1 Brazil

- 6.6.2 Argentina

Chapter 7 Company Profiles

- 7.1 CD Technologies

- 7.2 Duracell

- 7.3 Enersys

- 7.4 Exide Industries

- 7.5 Furukawa Battery

- 7.6 GS Yuasa

- 7.7 Johnson Controls

- 7.8 Lockheed Martin

- 7.9 Narada

- 7.10 Panasonic

- 7.11 Ritar

- 7.12 Siemens