|

市场调查报告书

商品编码

1666952

液冷式家用备用发电机组市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Liquid Cooled Home Standby Gensets Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

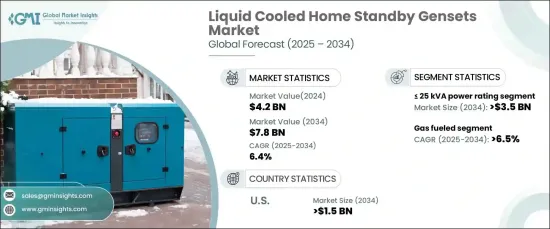

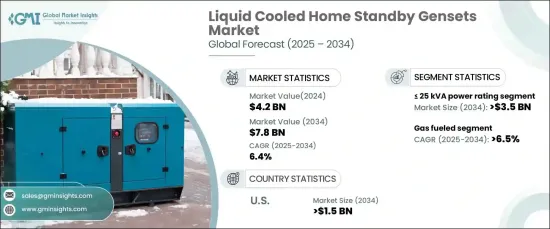

2024 年全球液冷家用备用发电机组市场价值为 42 亿美元,预计 2025-2034 年期间的复合年增长率为 6.4%。暴风雨、强风和冰冻等恶劣天气事件的发生频率不断增加,推动了对可靠备用电源解决方案的需求。这些事件通常会导致持续数小时至数週的长时间停电,凸显了各种应用中对备用发电机的迫切需求。

额定功率 <= 25 kVA 的发电机组预计在 2034 年产生 35 亿美元的收入。从补充电源到家庭必需品的转变正在重塑市场动态。此外,一些地区的电网无法提供稳定可靠的电力供应,这迫使消费者采用这些系统,从而促进整体市场成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 42亿美元 |

| 预测值 | 78亿美元 |

| 复合年增长率 | 6.4% |

由于紧凑的设计、轻量化的结构和营运效率,预计到 2034 年,燃气燃料领域的复合年增长率将达到 6.5%。这些设备因其能够提供可靠的性能并满足日益增长的可持续电力基础设施需求而成为住宅用户的首选。人们对备用电源解决方案的认识不断提高以及多层住宅开发的日益普及,进一步加速了燃气液冷发电机组的采用。

预计到 2034 年,美国液冷家用备用发电机组市场将创收 15 亿美元。技术进步、消费者对电力可靠性的日益关注以及能源需求的增加等因素推动了这一成长。此外,旨在提高效率和减少排放的创新正在进一步推动市场渗透。

住宅基础设施建设的激增,加上消费者对紧急情况下不间断电源的需求不断增加,将支持液冷式家用备用发电机组市场的稳定成长。随着对可靠、永续和高效电力解决方案的重视程度不断提高,该行业已准备好满足全球家庭不断变化的能源需求。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 市场估计和预测参数

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL 分析

第四章:竞争格局

- 介绍

- 战略展望

- 创新与永续发展格局

第五章:市场规模及预测:依功率等级,2021 – 2034 年

- 主要趋势

- ≤ 25 千伏安

- > 25 千伏安 - 50 千伏安

- > 50 千伏安 - 100 千伏安

- >100千伏安

第六章:市场规模及预测:依燃料,2021 – 2034 年

- 主要趋势

- 柴油引擎

- 气体

- 其他的

第 7 章:市场规模及预测:依阶段,2021 – 2034 年

- 主要趋势

- 单相

- 三相

第 8 章:市场规模与预测:按地区,2021 – 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 俄罗斯

- 英国

- 德国

- 法国

- 西班牙

- 奥地利

- 义大利

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 印尼

- 马来西亚

- 泰国

- 越南

- 菲律宾

- 中东

- 沙乌地阿拉伯

- 阿联酋

- 卡达

- 土耳其

- 伊朗

- 阿曼

- 非洲

- 埃及

- 奈及利亚

- 阿尔及利亚

- 南非

- 安哥拉

- 肯亚

- 莫三比克

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 智利

第九章:公司简介

- Ashok Leyland

- Atlas Copco

- Briggs & Stratton

- Cummins

- Eaton

- Generac Power Systems

- Gillette Generators

- Kirloskar

- Kohler

- MITSUBISHI HEAVY INDUSTRIES

- Multiquip

- TRANE

- Volvo Penta

- WINCO

- Yamaha Motor

The Global Liquid Cooled Home Standby Gensets Market was valued at USD 4.2 billion in 2024 and is projected to grow at a CAGR of 6.4% during 2025-2034. Increasing occurrences of severe weather events, including storms, high winds, and freezing conditions, are driving demand for reliable backup power solutions. These events often result in extended power outages lasting from hours to weeks, underscoring the critical need for standby generators across a range of applications.

Gensets with a power rating of <= 25 kVA are expected to generate USD 3.5 billion in 2034. Their growing popularity in homes and apartments highlights their role as an indispensable utility, particularly during emergencies. The shift from being a supplementary power source to a household necessity is reshaping market dynamics. Furthermore, the inability of grid networks in several regions to deliver consistent and reliable electricity supply is pushing consumers to adopt these systems, enhancing overall market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.2 Billion |

| Forecast Value | $7.8 Billion |

| CAGR | 6.4% |

The gas-fueled segment is anticipated to grow at a CAGR of 6.5% through 2034, driven by its compact design, lightweight structure, and operational efficiency. These units are becoming the preferred choice for residential users due to their ability to deliver dependable performance while addressing the rising demand for sustainable power infrastructure. The growing awareness of backup power solutions and the increasing prevalence of multi-story residential developments are further accelerating the adoption of gas-fueled liquid-cooled gensets.

U.S. liquid-cooled home standby gensets market is expected to generate USD 1.5 billion by 2034. Liquid-cooled standby gensets are gaining widespread acceptance among homeowners seeking robust and long-lasting backup power systems for larger homes and energy-intensive applications such as HVAC systems, smart home devices, and security systems. Factors such as advancements in technology, rising consumer focus on power reliability, and increasing energy requirements are fueling this growth. Additionally, innovations aimed at enhancing efficiency and reducing emissions are further boosting market penetration.

The surge in residential infrastructure development, combined with heightened consumer demand for uninterrupted power during emergencies, is poised to support steady growth in the liquid-cooled home standby gensets market. As the emphasis on reliable, sustainable, and efficient power solutions continues to grow, the industry is well-positioned to meet the evolving energy needs of households worldwide.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's Analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL Analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Power Rating, 2021 – 2034 ('000 Units & USD Million)

- 5.1 Key trends

- 5.2 ≤ 25 kVA

- 5.3 > 25 kVA - 50 kVA

- 5.4 > 50 kVA - 100 kVA

- 5.5 > 100 kVA

Chapter 6 Market Size and Forecast, By Fuel, 2021 – 2034 ('000 Units & USD Million)

- 6.1 Key trends

- 6.2 Diesel

- 6.3 Gas

- 6.4 Others

Chapter 7 Market Size and Forecast, By Phase, 2021 – 2034 ('000 Units & USD Million)

- 7.1 Key trends

- 7.2 Single phase

- 7.3 Three phase

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 ('000 Units & USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Russia

- 8.3.2 UK

- 8.3.3 Germany

- 8.3.4 France

- 8.3.5 Spain

- 8.3.6 Austria

- 8.3.7 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 India

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.4.6 Indonesia

- 8.4.7 Malaysia

- 8.4.8 Thailand

- 8.4.9 Vietnam

- 8.4.10 Philippines

- 8.5 Middle East

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Qatar

- 8.5.4 Turkey

- 8.5.5 Iran

- 8.5.6 Oman

- 8.6 Africa

- 8.6.1 Egypt

- 8.6.2 Nigeria

- 8.6.3 Algeria

- 8.6.4 South Africa

- 8.6.5 Angola

- 8.6.6 Kenya

- 8.6.7 Mozambique

- 8.7 Latin America

- 8.7.1 Brazil

- 8.7.2 Mexico

- 8.7.3 Argentina

- 8.7.4 Chile

Chapter 9 Company Profiles

- 9.1 Ashok Leyland

- 9.2 Atlas Copco

- 9.3 Briggs & Stratton

- 9.4 Cummins

- 9.5 Eaton

- 9.6 Generac Power Systems

- 9.7 Gillette Generators

- 9.8 Kirloskar

- 9.9 Kohler

- 9.10 MITSUBISHI HEAVY INDUSTRIES

- 9.11 Multiquip

- 9.12 TRANE

- 9.13 Volvo Penta

- 9.14 WINCO

- 9.15 Yamaha Motor