|

市场调查报告书

商品编码

1667159

船用选择性催化还原系统市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Marine Selective Catalytic Reduction Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

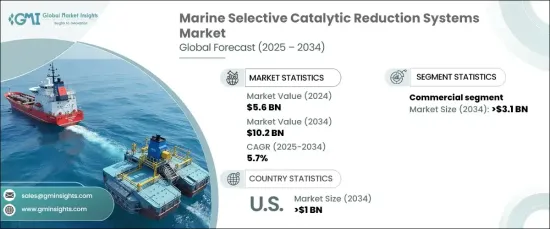

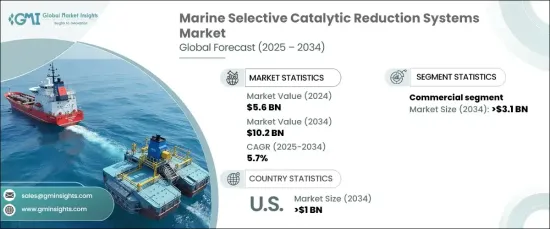

2024 年全球船用选择性催化还原系统市值为 56 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 5.7%。 SCR 系统的工作原理是使用催化转换器和尿素基试剂,引发化学反应,将有害的 NOx 转化为无害的氮和水蒸气。这些系统在帮助船舶营运商遵守严格的环境法规(包括国际海事组织的 Tier III 标准)方面发挥着至关重要的作用,最大限度地减少了海上活动对生态的影响。

对遵守全球和区域环境标准的日益重视预计将加速船舶 SCR 系统的采用。随着法规的收紧,这些系统为符合国际海事法的减少排放提供了有效的解决方案。此外,SCR 系统减轻海洋作业对环境影响的能力进一步促进了其应用,特别是考虑到全球对污染和气候变迁的担忧日益增加。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 56亿美元 |

| 预测值 | 102亿美元 |

| 复合年增长率 | 5.7% |

预计到 2034 年,船舶 SCR 系统市场的商业应用部分将达到 31 亿美元。航运公司越来越注重采用永续的做法,随着利害关係人环保意识的增强,满足监管标准的压力也将越来越大。此外,随着主要航运枢纽执行当地的氮氧化物排放控制标准以及国际法规,商业船舶营运商将被迫安装 SCR 系统以确保合规。

预计到 2034 年,美国船舶选择性催化还原系统市场规模将达到 10 亿美元。随着排放标准愈发严格,对高效能 SCR 系统的需求将会愈加强烈,尤其是随着全球船舶建造专案数量的不断增加。这些因素共同凸显了 SCR 系统在实现排放合规性和改善船舶工业环境永续性方面发挥的关键作用。

目录

第 1 章:方法论与范围

- 研究设计

- 基础估算与计算

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL 分析

第四章:竞争格局

- 介绍

- 战略仪表板

- 创新与技术格局

第 5 章:市场规模与预测:按应用,2021 – 2034 年

- 主要趋势

- 商业的

- 货柜船

- 油轮

- 散货船

- 滚入/滚出

- 其他的

- 海上

- 埃因霍温

- 卵泡素

- 主机

- 其他的

- 休閒娱乐

- 邮轮

- 渡轮

- 游艇

- 其他的

- 海军

- 其他的

第六章:市场规模及预测:按地区,2021 – 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 义大利

- 挪威

- 法国

- 俄罗斯

- 丹麦

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 越南

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 安哥拉

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

第七章:公司简介

- Caterpillar

- Ceco Environmental

- DEC Marine

- H+H Engineering & Service

- HHI Engine & Machinery

- Hitachi Zosen Corporation

- Hug Engineering

- Lindenberg-Anlagen

- Mitsubishi Heavy Industries

- Nett Technologies

- Panasia

- Wartsila

The Global Marine Selective Catalytic Reduction Systems Market was valued at USD 5.6 billion in 2024 and is projected to expand at a CAGR of 5.7% from 2025 to 2034. These advanced emission control technologies are designed to reduce nitrogen oxides in marine engine exhaust gases. SCR systems work by using a catalytic converter and a urea-based reagent, triggering a chemical reaction that converts harmful NOx into harmless nitrogen and water vapor. These systems play a crucial role in helping marine operators comply with strict environmental regulations, including the International Maritime Organization's Tier III standards, minimizing the ecological impact of maritime activities.

The growing emphasis on adhering to both global and regional environmental standards is expected to accelerate the adoption of marine SCR systems. As regulations tighten, these systems offer an effective solution for reducing emissions in line with international maritime laws. In addition, the ability of SCR systems to mitigate the environmental footprint of marine operations further boosts their adoption, especially considering rising global concerns over pollution and climate change.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.6 Billion |

| Forecast Value | $10.2 Billion |

| CAGR | 5.7% |

The commercial application segment of the marine SCR systems market is anticipated to reach USD 3.1 billion by 2034. The growth of international trade and the dominance of commercial vessels are expected to drive increased demand for SCR systems. Shipping companies are becoming more focused on adopting sustainable practices, and as environmental awareness among stakeholders increases, the pressure to meet regulatory standards will grow. Additionally, as key shipping hubs enforce local NOx emission control standards alongside international regulations, commercial vessel operators will be compelled to install SCR systems to ensure compliance.

U.S. marine selective catalytic reduction systems market is projected to reach USD 1 billion by 2034. Stringent regulations aimed at reducing emissions, combined with the push to modernize aging fleets, are expected to drive the demand for advanced emission control technologies. As emission standards become more rigid, the need for efficient SCR systems will intensify, especially with the increasing number of shipbuilding projects worldwide. These factors collectively highlight the critical role of SCR systems in achieving emission compliance and improving the environmental sustainability of the marine industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market Definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Application, 2021 – 2034 (USD Billion & Units)

- 5.1 Key trends

- 5.2 Commercial

- 5.2.1 Container vessels

- 5.2.2 Tankers

- 5.2.3 Bulk carriers

- 5.2.4 Roll On/Roll off

- 5.2.5 Others

- 5.3 Offshore

- 5.3.1 PSV

- 5.3.2 FSV

- 5.3.3 MPSV

- 5.3.4 Others

- 5.4 Recreational

- 5.4.1 Cruise ships

- 5.4.2 Ferries

- 5.4.3 Yachts

- 5.4.4 Others

- 5.5 Navy

- 5.6 Others

Chapter 6 Market Size and Forecast, By Region, 2021 – 2034 (USD Billion & Units)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.3 Europe

- 6.3.1 Germany

- 6.3.2 UK

- 6.3.3 Italy

- 6.3.4 Norway

- 6.3.5 France

- 6.3.6 Russia

- 6.3.7 Denmark

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 Japan

- 6.4.3 India

- 6.4.4 South Korea

- 6.4.5 Australia

- 6.4.6 Vietnam

- 6.5 Middle East & Africa

- 6.5.1 Saudi Arabia

- 6.5.2 UAE

- 6.5.3 South Africa

- 6.5.4 Angola

- 6.6 Latin America

- 6.6.1 Brazil

- 6.6.2 Argentina

- 6.6.3 Mexico

Chapter 7 Company Profiles

- 7.1 Caterpillar

- 7.2 Ceco Environmental

- 7.3 DEC Marine

- 7.4 H+H Engineering & Service

- 7.5 HHI Engine & Machinery

- 7.6 Hitachi Zosen Corporation

- 7.7 Hug Engineering

- 7.8 Lindenberg-Anlagen

- 7.9 Mitsubishi Heavy Industries

- 7.10 Nett Technologies

- 7.11 Panasia

- 7.12 Wartsila