|

市场调查报告书

商品编码

1684605

食品工业热加工设备市场机会、成长动力、产业趋势分析与预测 2025 - 2034Food Industry Heat Processing Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

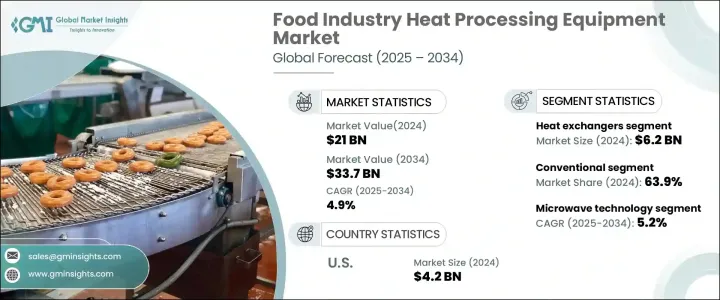

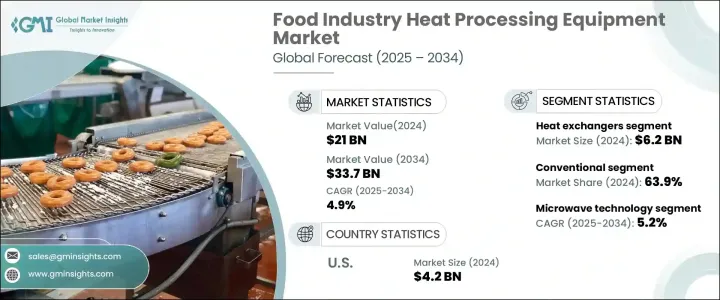

2024 年全球食品工业热加工设备市场价值为 210 亿美元,预计在 2025 年至 2034 年期间将以 4.9% 的复合年增长率稳步增长。这一增长主要得益于全球人口的增长和消费者生活方式的改变,这推动了对即食和加工食品的需求。由于消费者优先考虑便利性、延长保质期和始终如一的质量,采用先进的热加工设备对于食品製造商来说变得至关重要。这些系统不仅提高了生产效率,而且还确保遵守严格的食品安全标准和永续发展目标。

微波和感应系统等热处理技术的进步透过提供更高的精度和能源效率正在彻底改变市场。这些创新与全球减少能源消耗和减少食物浪费的努力一致,使其成为製造商的首选。据国际食品保护协会(IAFP)称,强调节能解决方案和严格食品安全要求的监管框架进一步鼓励采用尖端设备。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 210亿美元 |

| 预测值 | 337亿美元 |

| 复合年增长率 | 4.9% |

热交换器市场在 2024 年将达到 62 亿美元,预计到 2034 年将以 5.2% 的复合年增长率成长。热交换器在巴氏杀菌、灭菌和烹饪等应用中效率极高,对于加工乳製品和饮料等对温度敏感的产品不可或缺。它们能够提供精确的温度控制,同时提高能源效率,巩固了其作为产业关键组件的地位。国际食品工业供应商协会 (IAFIS) 的数据显示,热交换器因其可靠性和运作优势而占据了相当大的市场份额。

就热技术类型而言,传统系统在 2024 年占据市场主导地位,占有 63.9% 的份额。这些技术,包括基于燃气和电力的加热,由于其可用性、成本效益以及在各种食品加工操作中的多功能性而仍然被广泛采用。同时,微波技术预计到 2034 年将以 5.2% 的复合年增长率成长,迅速在产业中获得发展动力。微波加热以其操作效率和快速处理能力而闻名,已成为热处理领域的主导力量。

美国食品业热加工设备市场在 2024 年创下了 42 亿美元的产值,预计到 2034 年将以 5% 的复合年增长率成长。该国广泛的食品生产能力加上技术进步正在推动这一成长。对加工食品的需求不断增长,加上对节能解决方案的日益关注,极大地促进了该地区的市场扩张。食品加工供应商协会(FPSA)的见解强调了美国市场对持续创新和永续性的重视,使其成为采用先进热加工设备的全球领导者。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测参数

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 零售商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 加工食品和即食食品的需求不断增长

- 热处理设备的技术进步

- 更加重视能源效率和永续性

- 不断提高的食品安全和品质标准

- 产业陷阱与挑战

- 初期投资成本高

- 复杂的维护和操作要求

- 成长动力

- 技术格局

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 热交换器

- 巴氏灭菌器和灭菌器

- 蒸发器

- 脱水设备

- 炸锅

- 烤箱

- 其他(烫漂机、烘烤机等)

第六章:市场估计与预测:按运营,2021 – 2034 年

- 主要趋势

- 手动的

- 半自动

- 全自动

第 7 章:市场估计与预测:按热技术,2021 年至 2034 年

- 主要趋势

- 传统(天然气、电力)。

- 红外线的

- 微波

- 就职

第 8 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 烘焙和糖果(麵包、蛋糕)。

- 肉类、家禽和海鲜。

- 乳製品(牛奶、起司)。

- 水果和蔬菜。

- 饮料(果汁、软性饮料)。

- 零食(薯片、坚果)。

第 9 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 直接的

- 间接

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Alfa Laval

- Barry-Wehmiller Companies, Inc.

- Bühler Group

- FMT Food Machinery & Technology

- GEA Group

- Heat and Control, Inc.

- IDMC Limited

- JBT Corporation

- Krones AG

- Marel

- Scherjon Dairy Equipment

- SPX FLOW

- Tetra Pak

- Thermo Fisher Scientific

- TSC Food Processing Equipment

The Global Food Industry Heat Processing Equipment Market, valued at USD 21 billion in 2024, is set to grow at a steady CAGR of 4.9% between 2025 and 2034. This growth is fueled by the increasing global population and changing consumer lifestyles, which are driving demand for ready-to-eat and processed food products. As consumers prioritize convenience, extended shelf life, and consistent quality, the adoption of advanced heat processing equipment is becoming essential for food manufacturers. These systems not only enhance production efficiency but also ensure compliance with stringent food safety standards and sustainability goals.

Advancements in heat processing technologies, such as microwave and induction systems, are revolutionizing the market by offering greater precision and energy efficiency. These innovations align with global efforts to reduce energy consumption and minimize food waste, making them a preferred choice among manufacturers. According to the International Association for Food Protection (IAFP), regulatory frameworks emphasizing energy-efficient solutions and strict food safety requirements are further encouraging the adoption of cutting-edge equipment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $21 Billion |

| Forecast Value | $33.7 Billion |

| CAGR | 4.9% |

The heat exchangers segment reached USD 6.2 billion in 2024 and is forecast to grow at a CAGR of 5.2% through 2034. Heat exchangers are highly efficient in applications like pasteurization, sterilization, and cooking, making them indispensable for processing temperature-sensitive products such as dairy and beverages. Their ability to provide precise temperature control while promoting energy efficiency has solidified their position as a critical component in the industry. Data from the International Association for Food Industry Suppliers (IAFIS) highlights the significant market share of heat exchangers, driven by their reliability and operational benefits.

In terms of heat technology types, conventional systems dominated the market in 2024, capturing a 63.9% share. These technologies, including gas and electricity-based heating, remain widely adopted due to their availability, cost-effectiveness, and versatility across various food processing operations. Meanwhile, microwave technology is expected to grow at a CAGR of 5.2% through 2034, rapidly gaining traction in the industry. Known for its operational efficiency and quick processing capabilities, microwave heating is establishing itself as a dominant force in heat processing.

The U.S. market for food industry heat processing equipment generated USD 4.2 billion in 2024 and is anticipated to grow at a 5% CAGR through 2034. The country's extensive food production capacity, combined with technological advancements, is driving this growth. Rising demand for processed foods, coupled with a growing focus on energy-efficient solutions, significantly contributes to market expansion in the region. Insights from the Food Processing Suppliers Association (FPSA) underscore the U.S. market's emphasis on continuous innovation and sustainability, positioning it as a global leader in the adoption of advanced heat processing equipment.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand for processed and ready-to-eat foods

- 3.6.1.2 Technological advancements in heat processing equipment

- 3.6.1.3 Increasing focus on energy efficiency and sustainability

- 3.6.1.4 Growing food safety and quality standards

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial investment costs

- 3.6.2.2 Complex maintenance and operational requirements

- 3.6.1 Growth drivers

- 3.7 Technological landscape

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Heat Exchangers

- 5.3 Pasteurizers & Sterilizers

- 5.4 Evaporators

- 5.5 Dehydration Equipment

- 5.6 Fryers

- 5.7 Ovens

- 5.8 Others (blanchers, roasters, etc.)

Chapter 6 Market Estimates and Forecast, By Operation, 2021 – 2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Semi-automatic

- 6.4 Fully automatic

Chapter 7 Market Estimates and Forecast, By Heat Technology, 2021 – 2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Conventional (gas, electricity).

- 7.3 Infrared

- 7.4 Microwave

- 7.5 Induction

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Bakery and confectionery (bread, cakes).

- 8.3 Meat, poultry, and seafood.

- 8.4 Dairy products (milk, cheese).

- 8.5 Fruits and vegetables.

- 8.6 Beverages (juices, soft drinks).

- 8.7 Snacks (chips, nuts).

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 Alfa Laval

- 11.2 Barry-Wehmiller Companies, Inc.

- 11.3 Bühler Group

- 11.4 FMT Food Machinery & Technology

- 11.5 GEA Group

- 11.6 Heat and Control, Inc.

- 11.7 IDMC Limited

- 11.8 JBT Corporation

- 11.9 Krones AG

- 11.10 Marel

- 11.11 Scherjon Dairy Equipment

- 11.12 SPX FLOW

- 11.13 Tetra Pak

- 11.14 Thermo Fisher Scientific

- 11.15 TSC Food Processing Equipment