|

市场调查报告书

商品编码

1684617

冷凝式食品加工工业用热水锅炉市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Condensing Food Processing Industrial Hot Water Boiler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024 年全球冷凝式食品加工工业热水锅炉市场规模达到 7,670 万美元,预计 2025 年至 2034 年期间的复合年增长率为 6.1%。推动这一成长的因素有很多,包括快速的城市化、持续的工业发展步伐,以及旨在减少碳排放的日益严格的环境法规。对节能解决方案的日益增长的需求促使各行各业的企业采用先进的加热技术。冷凝锅炉效率更高、对环境的影响更小,在註重永续发展的产业中越来越受欢迎。锅炉设计的创新,例如数位监控系统、尖端燃烧控制以及更耐用的材料,进一步推动了产品的采用。这些进步使产业更容易降低营运成本、提高能源效率并实现永续发展目标。

由于人们对能源价格上涨和排放标准更严格的担忧,预计到 2034 年天然气冷凝食品加工工业热水锅炉将创收 6,500 万美元。随着能源成本上升和环境压力加剧,企业越来越多地寻求优化燃料消耗和减少排放的解决方案。这些天然气锅炉在经济性、能源效率和可靠性方面实现了平衡,从而脱颖而出,成为工业食品加工应用的热门选择。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 7,670 万美元 |

| 预测值 | 1.388 亿美元 |

| 复合年增长率 | 6.1% |

预计到 2034 年,容量等级为 25-50 MMBTU/小时的锅炉的需求将以每年 6% 的速度成长。这些中檔设备非常适合各种应用,包括灭菌、巴氏杀菌和干燥过程。它们提供一致、高性能热量的能力对于维持食品的品质和安全至关重要,随着消费者在包装和即食食品上的支出增加,这一点变得更加重要。食品安全标准和卫生水平不断提高的趋势将继续推动食品加工行业对可靠热水锅炉的需求。

在美国,冷凝式食品加工工业热水锅炉市场预计到 2034 年将创收 2,000 万美元。这些系统的可扩展性和冗余性使其成为管理不同的热水需求同时确保稳定的性能的理想选择。即时监控和远端管理等先进的控制技术在业界变得越来越普遍,使企业更容易优化能源使用并减少停机时间。税收优惠和退税等支持能源效率的政府政策也促进了这些系统的采用,从而促进了市场成长。在技术进步和政府支持的共同影响下,美国市场已准备好大幅扩张。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 市场估计和预测参数

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 战略展望

- 创新与永续发展格局

第 5 章:市场规模与预测:按燃料,2021 – 2034 年

- 主要趋势

- 天然气

- 油

- 煤炭

- 其他的

第六章:市场规模及预测:依产能,2021 – 2034 年

- 主要趋势

- < 10 百万英热单位/小时

- 10 - 25 百万英热单位/小时

- 25 - 50 百万英热单位/小时

- 50 - 75 百万英热单位/小时

- > 75 百万英热单位/小时

第 7 章:市场规模及预测:按地区,2021 – 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 德国

- 义大利

- 俄罗斯

- 西班牙

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 土耳其

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

第八章:公司简介

- ALFA LAVAL

- Babcock Wanson

- Bosch Industriekessel

- California Boiler

- Cleaver-Brooks

- EPCB Boiler

- Forbes Marshall

- Fulton

- Hoval

- Hurst Boiler & Welding

- Johnston Boiler

- Miura America

- Thermax

- Thermodyne Boilers

- Viessmann

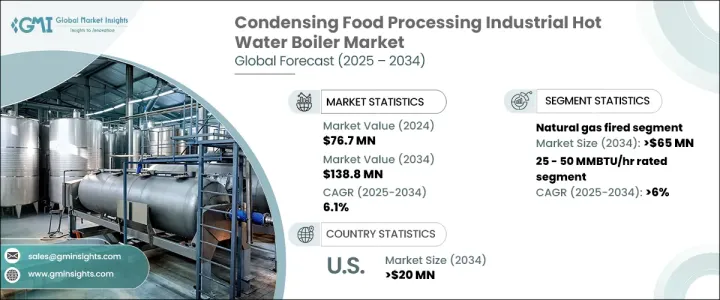

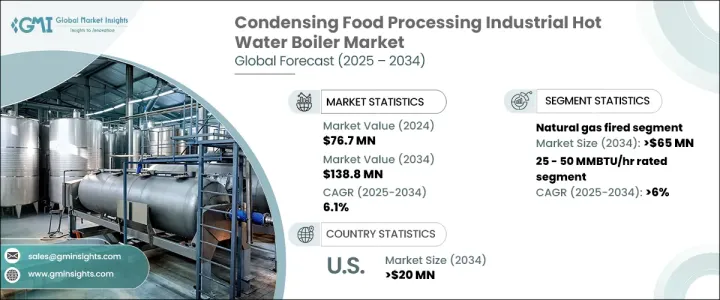

The Global Condensing Food Processing Industrial Hot Water Boiler Market reached USD 76.7 million in 2024 and is expected to expand at a CAGR of 6.1% from 2025 to 2034. Several factors are driving this surge, including rapid urbanization, the continuous pace of industrial development, and increasingly stringent environmental regulations aimed at reducing carbon emissions. The growing need for energy-efficient solutions pushes businesses across various industries to adopt advanced heating technologies. Condensing boilers, with their enhanced efficiency and lower environmental footprint, are gaining traction among industries focused on sustainability. Innovations in boiler design, such as digital monitoring systems, cutting-edge combustion controls, and more durable materials, are further fueling product adoption. These advancements are making it easier for industries to reduce operational costs, improve energy efficiency, and meet sustainability targets.

Natural gas-fired condensing food processing industrial hot water boilers are expected to generate USD 65 million by 2034, driven by concerns over rising energy prices and stricter emission standards. As energy costs rise and environmental pressures intensify, businesses are increasingly seeking solutions that optimize fuel consumption and cut emissions. These natural gas boilers stand out by offering a balance of affordability, energy efficiency, and reliability, making them a popular choice for industrial food processing applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $76.7 Million |

| Forecast Value | $138.8 Million |

| CAGR | 6.1% |

The demand for boilers with a capacity rating of 25-50 MMBTU/hr is anticipated to grow at 6% annually through 2034. These mid-range units are well-suited for a variety of applications, including sterilization, pasteurization, and drying processes. Their ability to deliver consistent, high-performance heat is critical in maintaining the quality and safety of food products, which is becoming even more important as consumer spending on packaged and ready-to-eat foods increases. The trend towards higher food safety standards and hygiene will continue to drive demand for reliable hot water boilers in the food processing industry.

In the U.S., the condensing food processing industrial hot water boilers market is expected to generate USD 20 million by 2034. The scalability and redundancy of these systems make them ideal for managing varying hot water needs while ensuring stable performance. Advanced control technologies, such as real-time monitoring and remote management, are becoming more common in the industry, making it easier for businesses to optimize energy use and reduce downtime. Government policies that support energy efficiency, such as tax incentives and rebates, are also contributing to the adoption of these systems, enhancing market growth. With the combined influence of technological advancements and government support, the U.S. market is primed for significant expansion.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Fuel, 2021 – 2034 (Units, MMBTU/hr & USD Million)

- 5.1 Key trends

- 5.2 Natural gas

- 5.3 Oil

- 5.4 Coal

- 5.5 Others

Chapter 6 Market Size and Forecast, By Capacity, 2021 – 2034 (Units, MMBTU/hr & USD Million)

- 6.1 Key trends

- 6.2 < 10 MMBTU/hr

- 6.3 10 - 25 MMBTU/hr

- 6.4 25 - 50 MMBTU/hr

- 6.5 50 - 75 MMBTU/hr

- 6.6 > 75 MMBTU/hr

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (Units, MMBTU/hr & USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 France

- 7.3.3 Germany

- 7.3.4 Italy

- 7.3.5 Russia

- 7.3.6 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Turkey

- 7.5.4 South Africa

- 7.5.5 Egypt

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 ALFA LAVAL

- 8.2 Babcock Wanson

- 8.3 Bosch Industriekessel

- 8.4 California Boiler

- 8.5 Cleaver-Brooks

- 8.6 EPCB Boiler

- 8.7 Forbes Marshall

- 8.8 Fulton

- 8.9 Hoval

- 8.10 Hurst Boiler & Welding

- 8.11 Johnston Boiler

- 8.12 Miura America

- 8.13 Thermax

- 8.14 Thermodyne Boilers

- 8.15 Viessmann