|

市场调查报告书

商品编码

1684658

工业雷射系统市场机会、成长动力、产业趋势分析与预测 2025 - 2034Industrial Laser Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

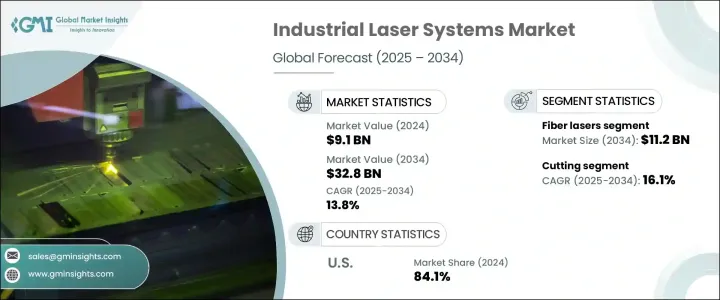

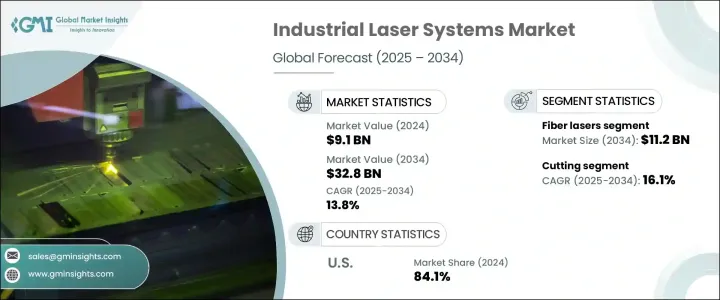

2024 年全球工业雷射系统市场价值为 91 亿美元,航太2025 年至 2034 年的复合年增长率为 13.8%。工业雷射系统因其在切割、焊接、雕刻和打标等过程中提供高精度和高效率的能力,在现代生产线中变得越来越不可或缺。随着各行各业努力提高营运效率、精度并降低成本,对这些先进雷射技术的需求持续成长。自动化和工业 4.0 计画专注于数位化製造和智慧工厂解决方案,进一步扩大了对这些系统的需求。工业雷射系统不仅能确保更高的生产力,还使企业能够满足各个领域对复杂设计和高品质输出日益增长的需求。

预计到 2034 年光纤雷射器市场规模将达到 112 亿美元,成为市场的主要驱动力之一。光纤雷射器因其无与伦比的能源效率、可靠性和多功能性而获得了巨大的发展空间。它们能够与从金属到塑胶等各种材料无缝协作,再加上其卓越的光束质量,使其成为需要高精度雷射操作的行业的首选。此外,光纤雷射器因其低维护和紧凑的设计而受到好评,这使其成为广泛工业应用的理想选择。随着技术进步的不断发展,光纤雷射的应用范围不断扩大,为该领域带来了可观的成长预测。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 91亿美元 |

| 预测值 | 328亿美元 |

| 复合年增长率 | 13.8% |

在各种应用中,切割领域预计将是成长最快的,预测期内预计复合年增长率为 16.1%。随着各行各业寻求最大限度地减少材料浪费并优化营运效率,对精密和高速切割解决方案的需求正在激增。雷射切割系统能够对多种材料进行精确加工,具有灵活性、准确性和一致性。随着工业生产日益自动化,雷射切割系统正成为尖端製造流程中不可或缺的一部分,尤其是整合了可提高性能和产量的高功率雷射技术。

2024 年,美国占据工业雷射系统市场的 84.1% 的份额。这种主导地位归功于该国完善的製造业基础设施,以及在自动化和雷射技术开发方面的大量投资。此外,政府的支持性政策以及持续的研发资金正在加速该产业的成长。工业雷射系统与数位製造和智慧工厂计划的结合只会扩大其应用范围,推动美国各种工业应用的持续需求

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 各行各业对自动化的采用日益增多

- 雷射技术的进步

- 对微型化和高精度零件的需求不断增长

- 拓展新兴产业应用

- 政府对製造技术的支持与投资

- 产业陷阱与挑战

- 初期投资及营运成本高

- 技术复杂性和熟练劳动力有限

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按雷射类型,2021-2034 年

- 主要趋势

- 光纤雷射

- 固体雷射

- CO2 雷射器

- 二极体雷射

- 其他雷射类型

第 6 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 切割

- 焊接

- 标记

- 钻孔

- 雕刻

- 其他工业应用

第 7 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 半导体和电子产品製造

- 汽车製造

- 航太和国防

- 医疗设备

- 金属加工及机械

- 消费性电子产品

- 其他工业部门

第 8 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- ALPHA Laser GmbH

- Amada Co., Ltd.

- Bystronic AG

- Coherent, Inc.

- EKSPLA

- FANUC Corporation

- Hanslaser Technology Co., Ltd.

- IPG Photonics Corporation

- Jenoptik AG

- Lasea SA

- Laserline GmbH

- Lumentum Holdings Inc.

- Lumibird Group

- Mitsubishi Electric Corporation

- NKT Photonics A/S

- Prima Industrie SpA

- Synrad, Inc.

- Telesis Technologies, Inc.

- Trumpf GmbH + Co. KG

- Universal Laser Systems, Inc.

The Global Industrial Laser Systems Market, valued at USD 9.1 billion in 2024, is poised for significant growth, with a projected CAGR of 13.8% from 2025 to 2034. This surge is largely driven by the accelerating adoption of automation across various industries such as manufacturing, automotive, electronics, and aerospace. Industrial laser systems are becoming indispensable in modern production lines due to their ability to deliver high precision and efficiency in processes like cutting, welding, engraving, and marking. As industries strive for greater operational efficiency, precision, and reduced costs, the demand for these advanced laser technologies continues to grow. Automation and Industry 4.0 initiatives, which focus on digital manufacturing and smart factory solutions, further amplify the need for these systems. Industrial laser systems not only ensure higher productivity but also enable businesses to meet the increasing demand for intricate designs and high-quality outputs across various sectors.

The fiber laser segment is expected to achieve USD 11.2 billion by 2034, becoming one of the market's leading drivers. Fiber lasers are gaining significant traction due to their unmatched energy efficiency, reliability, and versatility. Their ability to work seamlessly with a variety of materials-ranging from metals to plastics-coupled with their exceptional beam quality, makes them the preferred choice for industries requiring high-precision laser operations. Moreover, fiber lasers are celebrated for their low maintenance and compact design, which make them ideal for a wide array of industrial applications. As technological advancements continue to unfold, the range of applications for fiber lasers expands, contributing to this segment's impressive growth forecast.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.1 Billion |

| Forecast Value | $32.8 Billion |

| CAGR | 13.8% |

Among various applications, the cutting segment is projected to be the fastest-growing, with an anticipated CAGR of 16.1% during the forecast period. The demand for precise and high-speed cutting solutions is skyrocketing as industries seek to minimize material waste and optimize operational efficiency. Laser cutting systems enable the precise processing of numerous materials, providing flexibility, accuracy, and consistency. As industrial production increasingly embraces automation, laser cutting systems are becoming integral to cutting-edge manufacturing processes, particularly with the integration of high-power laser technologies that enhance performance and throughput.

In 2024, the United States accounted for a dominant 84.1% share of the industrial laser systems market. This dominance can be attributed to the country's well-established manufacturing infrastructure, along with substantial investments in automation and laser technology development. Moreover, supportive government policies, along with ongoing research and development funding, are accelerating growth in this sector. The integration of industrial laser systems with digital manufacturing and smart factory initiatives only broadens their adoption, driving sustained demand across diverse industrial applications in the U.S.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising adoption of automation across industries

- 3.6.1.2 Advancements in laser technology

- 3.6.1.3 Growing demand for miniaturized and high-precision components

- 3.6.1.4 Expanding applications in emerging industries

- 3.6.1.5 Government support and investments in manufacturing technologies

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial investment and operating costs

- 3.6.2.2 Technical complexity and limited skilled workforce

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type of Laser, 2021-2034 (USD Billion)

- 5.1 Key trends

- 5.2 Fiber lasers

- 5.3 Solid-state lasers

- 5.4 CO2 lasers

- 5.5 Diode lasers

- 5.6 Other laser types

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 Cutting

- 6.3 Welding

- 6.4 Marking

- 6.5 Drilling

- 6.6 Engraving

- 6.7 Other industrial applications

Chapter 7 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion)

- 7.1 Key trends

- 7.2 Semiconductor and electronics manufacturing

- 7.3 Automotive manufacturing

- 7.4 Aerospace and defense

- 7.5 Medical devices

- 7.6 Metal fabrication and machinery

- 7.7 Consumer electronics

- 7.8 Other industrial sectors

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 ALPHA Laser GmbH

- 9.2 Amada Co., Ltd.

- 9.3 Bystronic AG

- 9.4 Coherent, Inc.

- 9.5 EKSPLA

- 9.6 FANUC Corporation

- 9.7 Hanslaser Technology Co., Ltd.

- 9.8 IPG Photonics Corporation

- 9.9 Jenoptik AG

- 9.10 Lasea S.A.

- 9.11 Laserline GmbH

- 9.12 Lumentum Holdings Inc.

- 9.13 Lumibird Group

- 9.14 Mitsubishi Electric Corporation

- 9.15 NKT Photonics A/S

- 9.16 Prima Industrie S.p.A.

- 9.17 Synrad, Inc.

- 9.18 Telesis Technologies, Inc.

- 9.19 Trumpf GmbH + Co. KG

- 9.20 Universal Laser Systems, Inc.