|

市场调查报告书

商品编码

1687823

工业雷射-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Industrial Lasers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

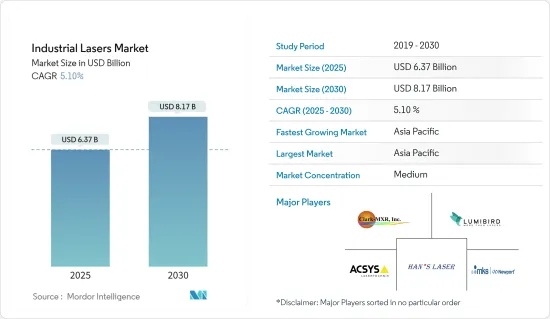

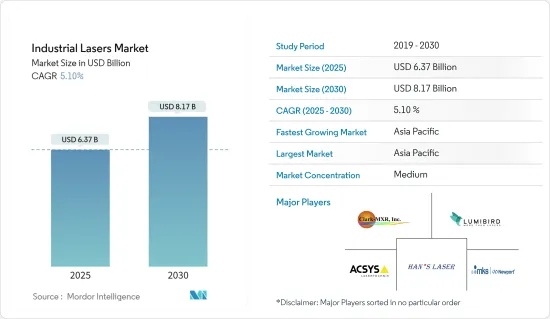

工业雷射市场规模预计在 2025 年为 63.7 亿美元,预计到 2030 年将达到 81.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.1%。

主要亮点

- 预计工业雷射市场在预测期内将出现强劲增长,这归因于多种因素,包括医疗和牙科应用、太空探索和工业应用对雷射的需求不断增长。材料加工是雷射在工业上的一项突出应用。光纤雷射器,其次是直接二极体雷射,是用于材料加工的主要雷射。

- 工业雷射用于各种生物医学设备,包括医学影像、雷射手术和动态治疗应用。二极体雷射通常用于多种软组织口腔外科手术,包括下颚骨切除术、孔源性纤维瘤、纤维瘤切除、脸部色素沉着治疗和血管病变治疗。二极体雷射器向细胞传递能量的能力可用于加热、焊接、凝固、蛋白质变性、干燥、汽化和碳化等任务。

- 随着供应商不断尝试为航太和国防工业引入新的解决方案,市场正在见证各种创新和伙伴关係。例如,2022 年 3 月,Ultisense 发布了配备先进光纤雷射技术的 25 公里测距模组 LRF 6042。 LRF 6042 是 AltiSense 高性能光纤雷射测距仪系列的最新产品,以 Vectronix 开发军用测距仪的经验为基础。紧凑型 LRF 6042 可测量 2.3 m x 2.3 m 目标上的最远 8 公里距离,射程可达 25 公里。与需要在脉衝之间进行充电和冷却的其他系统不同,LRF 6042 可以不间断地进行连续测量。重复率可达 10Hz。这对于长时间追踪(人员或车辆)来说是理想的。

- 在製造过程中采用雷射解决方案的公司必须遵守各种政府安全法规。此外,该设备比传统设备相对昂贵,因此在工业领域的应用面临挑战。

- 此外,通货膨胀对製造业影响重大,导致生产成本增加。这是由于多种因素造成的,包括原材料价格上涨、运输成本增加、人事费用以及人手不足。结果,製造商被迫提高价格以保持盈利,这最终可能会减少对其产品的需求。此外,通货膨胀还会导致製造商的合约限制、劳动力转移和投入问题。通货膨胀的上升可能会抑制所研究市场的成长。

工业雷射市场趋势

消费性电子产品大幅成长

- 在家用电子电器产业,雷射打标有助于产品识别和识别开关、插头、连接器、电容器外壳和包装等组件。电子元件中使用的电子连接器和阻燃塑胶可以使用紫外线雷射进行雷射标记,以实现可追溯性。 300W 及以上的雷射用于製造消费性电子元件的硬焊、金属板焊接和金属板切割应用。

- 家用电子电器中使用的现代晶片是使用光刻技术製造的,这是一种使用模板和雷射重复列印复杂晶片电路的高科技製程。

- 然而,不断扩大的 5G 网路和具有先进技术和功能的新产品的推出正在刺激智慧型手机、平板电脑和数位单眼相机的普及。智慧型手机市场的领先供应商不断推出具有新功能和改进相机品质的智慧型手机,从而创造了对工业雷射的需求。

- 根据爱立信预测,到2028年,西欧智慧型手机用户数可能达到4.59亿。截至2022年,西欧智慧型手机用户数约为4.4亿。

- 混合实境耳机市场的扩张正在推动市场研究。例如,2023 年 6 月,苹果发布了混合实境头戴装置 Vision Pro,配备 3D 相机,可协助使用者以 3D 方式拍摄太空照片和影片。

亚太地区:预计大幅成长

- 亚太地区是世界上最大的製造业经济体的所在地,包括中国、日本、韩国和台湾。汽车、电子、航太和医疗设备等领域製造业的持续扩张,对工业雷射的需求庞大,以支援各种加工、切割、焊接和标记应用。

- 亚太地区市场上有一些关键参与者,例如大族雷射科技产业集团。该地区以其在汽车和医疗行业的能力而闻名,预计这将推动该地区的市场成长。此外,预计亚太地区将见证市场最高的成长率,众多公司将在该地区进行投资以推动成长和发展。

- 印度等新兴国家扩大製造地和实现自力更生的努力将进一步推动市场成长。製造业已成为印度高成长产业之一。 「印度製造」计画使印度成为世界製造业中心,并获得了全球对印度经济的认可。根据印度商务基金会 (IBEF) 预测,到 2030 年,印度的商品出口将达到 1 兆美元,并有望成为全球主要製造业中心。

- 该地区的汽车工业正朝着电气化和小型化的方向发展,同时要求高刚性、设计灵活性和可製造性。蓝色雷射具有较高的光吸收效率,在汽车马达和电池的铜加工领域需求量很大。高生产率的加工需要高功率和高光束品质的雷射光源。

工业雷射市场概览

工业雷射市场处于半静态状态。市场上的主要供应商也在不断扩大地域范围,并越来越多地与生态系统参与者合作探索超快雷射的新应用。公司包括 ACSYS Lasertechnik Inc.、大族雷射科技产业集团、Clark-MXR Inc.、Newport Corporation(MKS Instruments Inc.)和 Lumibird SA。

- 2024 年 1 月 - ACSYS Lasertechnik GmbH(科恩韦斯特海姆)将在今年的「世界货币博览会」(2024 年 2 月 1 日至 4 日)上展示各种创新。在2号展厅D4展位,雷射技术领域的高精度标准和专用机器供应商展示了其在造币行业灵活、节省资源的涂层去除、雕刻和抛光方面的创新解决方案。

- 2023 年 11 月 - IPG Photonics Corporation 与电弧焊接 Mfg. LLC 宣布建立策略伙伴关係关係,旨在进一步推动手持式焊接应用的雷射解决方案。两家公司在开发针对客户挑战的特定解决方案方面都拥有独特的专业知识,我们将共同进一步发展并向市场推出易于学习和使用且具有无与伦比优势的产品。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- COVID-19 和其他宏观经济因素对市场的影响

第五章市场动态

- 市场驱动因素

- 比传统替代方案具有更高的精度和准确度

- 组件小型化

- 市场限制

- 雷射合规性

第六章市场区隔

- 按类型

- 光纤雷射

- 固体雷射

- CO2雷射

- 其他类型

- 按应用

- 断开

- 焊接

- 标记

- 钻孔

- 增材製造

- 其他用途

- 按最终用户产业

- 航太与国防

- 车

- 卫生保健

- 家电

- 半导体

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章竞争格局

- 公司简介

- ACSYS Lasertechnik Inc.

- Han's Laser Technology Industry Group Co. Ltd

- Clark-MXR Inc.

- Newport Corporation(MKS Instruments Inc.)

- Lumibird SA

- Coherent Inc.

- IPG Photonics

- Trumpf Group

- Lumentum Holdings Inc.

- Jenoptik AG

第八章投资分析

第九章 市场机会与未来趋势

The Industrial Lasers Market size is estimated at USD 6.37 billion in 2025, and is expected to reach USD 8.17 billion by 2030, at a CAGR of 5.1% during the forecast period (2025-2030).

Key Highlights

- The industrial lasers market is anticipated to witness robust growth during the forecast period owing to several factors, like rising demand for these lasers in medical and dental applications, space exploration, and industrial applications. Material processing is a prominent application for lasers in industries. Optical fiber lasers, followed by direct diode lasers, are majorly used for material processing.

- Industrial lasers are used in various biomedical instruments for medical imaging, laser surgery, and photodynamic therapy applications. They are commonly used in multiple soft tissue oral surgery, such as frenectomy, epulis fissuratum, fibroma removal, facial pigmentation treatment, and vascular lesion treatment. The diode laser's ability to transmit energy to cells can be used for tasks like warming, welding, coagulation, protein denaturation, drying, vaporization, and carbonization.

- The market is witnessing various innovations and partnerships as vendors are looking to launch new solutions regularly for the aerospace and defense industry. For instance, in March 2022, Ultisense launched the LRF 6042, a 25 km rangefinder module with advanced fiber laser technology. The LRF 6042 is the newest addition to the Ultisense portfolio of high-performance fiber laser rangefinders and builds on Vectronix's experience in developing military rangefinders. The compact LRF 6042 measures up to 8 km on 2.3 m X 2.3 m targets and boasts a maximum range performance of up to 25 km. Compared to other systems that have to charge and cool between pulses, the LRF 6042 measures continuously without interruption. It can achieve repetition rates of up to 10 Hz. This is ideal for tracking (e.g., people, vehicles) over an extended period.

- Enterprises adopting laser solutions as part of their manufacturing process are subject to various government safety regulations. In addition, the equipment is comparatively costlier than their conventional counterparts, thus challenging their adoption in the industrial space.

- Moreover, inflation significantly impacts manufacturing, leading to higher manufacturing costs. This can be due to various factors, such as higher prices for raw materials, increased shipping costs, and labor costs and shortages. As a result, manufacturers may be forced to raise their prices to maintain profitability, ultimately decreasing product demand. In addition, inflation can also lead to contract constraints, shifts in labor, and input issues for manufacturers. The rising inflation could restrain the growth of the market studied.

Industrial Lasers Market Trends

Consumer Electronics to Witness Major Growth

- In the consumer electronics industry, laser marking aids product recognition and identification of components like switches, plugs, connectors, capacitor housings, and packaging. Electronic connectors and flame-retardant plastics used for electronic components can be laser-marketed for traceability using UV lasers. Lasers above 300W are used in brazing, thin metal welding, and sheet metal cutting applications for manufacturing consumer electronic components.

- Modern chips used in consumer electronics are manufactured using photolithography, a hi-tech use of stencils and lasers, to print complex chip circuits in a repeatable way.

- However, the growing 5G network and the introduction of new products with advanced technologies and features fuel the adoption of smartphones, tablets, and DSLR cameras. Leading vendors in the smartphone market are continuously announcing new features and smartphones with better camera quality, which creates demand for industrial lasers.

- According to Ericsson, the number of smartphone subscriptions in Western Europe may reach 459 million by 2028. There were approximately 440 million smartphone subscriptions in Western Europe as of 2022.

- The expanding market for mixed reality headsets is aiding the market studied. For instance, in June 2023, Apple introduced Vision Pro, a mixed-reality headset with a 3D camera to help users capture spatial photos and videos in 3D.

Asia-Pacific Expected to Witness Major Growth

- Asia-Pacific is home to some of the world's largest manufacturing economies, including China, Japan, South Korea, and Taiwan. The ongoing expansion of manufacturing industries in sectors such as automotive, electronics, aerospace, and medical devices creates a significant demand for industrial lasers to support various machining, cutting, welding, and marking applications.

- The Asia-Pacific region houses some important players in the market, such as Han's Laser Technology Industry Group. The region is known for its capabilities in the automotive and medical industries, which are expected to drive the region's market growth. Also, various players have invested in driving their growth and development, as the Asia-Pacific region is expected to witness the highest growth rate in the market.

- Initiatives by emerging countries like India to expand their manufacturing footprint and become self-reliant further propel the market growth. Manufacturing emerged as one of India's high-growth sectors. The 'Make in India' program places India on the global map as a manufacturing hub and globally recognizes the Indian economy. According to IBEF, India can export goods worth USD 1 trillion by 2030 and is on the road to becoming a significant global manufacturing hub.

- The automotive industry in the region is moving toward electrification and miniaturization while requiring high rigidity, design flexibility, and productivity. Blue lasers with high optical absorption efficiency are in high demand in the field of copper fabrication for automotive motors and batteries. The highly productive processing requires a laser beam source with high output power and high beam quality.

Industrial Lasers Market Overview

The industrial lasers market is semi-consolidated as the significant vendors in the market are also expanding regionally and increasingly involved with ecosystem players, thus exploring new applications of ultrafast lasers. Some of the players include ACSYS Lasertechnik Inc., Han's Laser Technology Industry Group Co. Ltd, Clark-MXR Inc., Newport Corporation (MKS Instruments Inc.), and Lumibird SA.

- January 2024 - ACSYS Lasertechnik GmbH (Kornwestheim) presented various technological innovations at this year's "World Money Fair" from February 1-4, 2024. At Stand D4, Hall 2, the supplier of high-precision standards and special machines in the field of laser technology, presented innovative solutions for flexible, resource-saving de-coating, engraving, and polishing in the Mint industry, among other things.

- November 2023 - IPG Photonics Corporation and Miller Electric Mfg. LLC, a manufacturer of arc welding products, announced a strategic partnership with a goal to promote laser solutions for handheld welding applications further. Both companies bring unique expertise to develop specific solutions to address customer challenges, and together, they will further advance and bring to market products that are easy to learn and operate while offering unmatched benefits.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Enhanced Precision and Accuracy over Conventional Alternatives

- 5.1.2 Miniaturization of Component Parts

- 5.2 Market Restraints

- 5.2.1 Regulation Compliance Associated with Laser Usage

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Fiber Laser

- 6.1.2 Solid-state Laser

- 6.1.3 CO2 Laser

- 6.1.4 Other Types

- 6.2 By Application

- 6.2.1 Cutting

- 6.2.2 Welding

- 6.2.3 Marking

- 6.2.4 Drilling

- 6.2.5 Additive Manufacturing

- 6.2.6 Other Applications

- 6.3 By End-user Industry

- 6.3.1 Aerospace and Defense

- 6.3.2 Automotive

- 6.3.3 Healthcare

- 6.3.4 Consumer Electronics

- 6.3.5 Semiconductors

- 6.3.6 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ACSYS Lasertechnik Inc.

- 7.1.2 Han's Laser Technology Industry Group Co. Ltd

- 7.1.3 Clark-MXR Inc.

- 7.1.4 Newport Corporation (MKS Instruments Inc.)

- 7.1.5 Lumibird SA

- 7.1.6 Coherent Inc.

- 7.1.7 IPG Photonics

- 7.1.8 Trumpf Group

- 7.1.9 Lumentum Holdings Inc.

- 7.1.10 Jenoptik AG