|

市场调查报告书

商品编码

1684782

方向盘开关市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Steering Wheel Switches Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

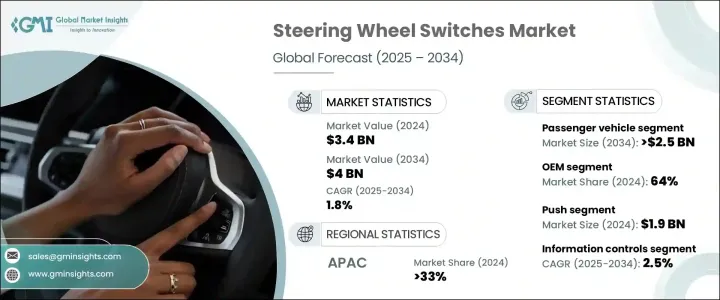

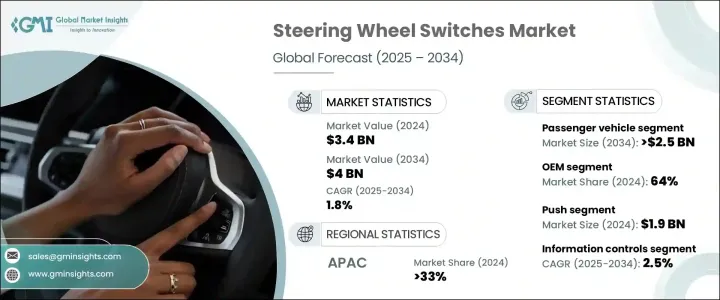

2024 年全球方向盘开关市场价值为 34 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 1.8%。道路安全仍然是全世界关注的主要问题,特别是在已开发地区,车辆事故会造成重大伤亡。消费者意识的增强,加上监管的影响和先进的购买力,导致对现代安全技术的需求日益增长。汽车製造商越来越多地将先进的驾驶辅助功能整合到车辆中,既提高了安全性,也扩大了市场。对驾驶员保护的日益重视推动了方向盘电子设备的采用,减少了干扰,并提高了整体驾驶效率。多功能方向盘控制装置越来越受欢迎,因为它们不仅提高了用户的便利性,而且符合行业趋势,尤其是电动车的快速普及。向无缝车载控制系统的转变进一步增强了市场前景。

2024 年,乘用车的市占率超过 60%,预计到 2034 年将超过 25 亿美元。轿车、掀背车和 SUV 对方向盘开关的需求很大,因为这些车辆继续占据全球销售主导地位。透过内建控制装置,驾驶者可以不受干扰地管理资讯娱乐、巡航控制和通讯系统,製造商正专注于整合更直观、更用户友好的介面。日常使用车辆的需求不断增加,尤其是在城市地区,进一步推动了对方向盘开关的需求。由于汽车製造商优先考虑驾驶员的便利性和效率,一体化控制解决方案正在成为现代乘用车的关键部件。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 34亿美元 |

| 预测值 | 40亿美元 |

| 复合年增长率 | 1.8% |

市场分为OEM和售后市场销售管道,其中OEM部门在 2024 年占据 64% 的份额。方向盘开关主要由原始设备製造商供应,以确保在生产过程中无缝整合到车辆中。随着这些开关成为大多数现代汽车的标准配置,汽车製造商正在延长生产週期以满足不断增长的需求。汽车装配线依靠供应商实现高效采购,製造商则投资自动化以简化生产。对新车的需求不断增加,特别是在高成长市场,正在推动对OEM方向盘开关的需求。

产品部分包括按钮开关和跷跷板开关,其中按钮部分在 2024 年创造 19 亿美元。按钮广泛用于资讯娱乐、音讯、巡航控制和通讯功能,提供直觉的使用者体验。它们的耐用性和成本效益使其成为汽车製造商的首选,支援多功能应用同时保持价格实惠。向简化的车载控制系统的转变,加上先进电子设备的集成,继续推动该领域的成长。

预计从 2025 年到 2034 年,资讯娱乐控制的复合年增长率将超过 2.5%。连网汽车技术的日益普及增加了对方向盘整合资讯娱乐功能的需求,以确保更安全、更方便的互动。免持存取导航、语音命令和其他功能可提高驾驶员安全性和使用者体验,使资讯娱乐控製成为现代车辆的重要组成部分。

2024 年亚太地区引领全球市场,占总份额的 33% 以上。随着汽车产量强劲增长以及对方向盘控制的需求不断增加,该地区继续推动市场扩张。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 供应商概况

- 原物料供应商

- 零件供应商

- 製造商

- 技术提供者

- 经销商

- 最终用户

- 利润率分析

- 供应商概况

- 技术与创新格局

- 专利分析

- 监管格局

- 价格趋势

- 衝击力

- 成长动力

- 全球汽车销售不断成长

- 道路安全意识增强

- 汽车零件产业兴起

- 汽车製造业稳定发展

- 汽车电子和自适应巡航控制技术的进步

- 产业陷阱与挑战

- 汽车触控萤幕显示器的应用日益广泛

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- SUV

- 商用车

- 轻型商用车 (LCV)

- 重型商用车 (HCV)

第 6 章:市场估计与预测:按销售管道,2021 - 2034 年

- 主要趋势

- OEM

- 售后市场

第 7 章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 推

- 跷跷板

第 8 章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 资讯娱乐控制

- 音讯控件

- 巡航控制

- 电话控制

- 其他的

第 9 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- ALPS

- Changjiang Automobile Electronic System

- COBO

- Continental

- Delphi

- Denso

- Dongguan

- Hyundai Motor

- Johnson Electric Holdings

- Kia Corporation

- Leopold Kostal

- LS Automotive Technologies

- Marquardt Group

- Nissan Motor

- Panasonic Corporation

- Preh

- TOKAI RIKA

- Toyota Motor

- Valeo

- ZF Friedrichshafen

The Global Steering Wheel Switches Market was valued at USD 3.4 billion in 2024 and is projected to grow at a CAGR of 1.8% between 2025 and 2034. Road safety remains a major concern worldwide, particularly in developed regions where vehicle accidents result in significant casualties. High consumer awareness, combined with regulatory influences and advanced purchasing power, has led to a growing demand for modern safety technologies. Automakers are increasingly integrating advanced driver-assist features into vehicles, enhancing both safety and market expansion. The rising emphasis on driver protection is fueling the adoption of steering wheel electronics, reducing distractions, and improving overall driving efficiency. Multi-functional steering wheel controls are gaining popularity as they enhance user convenience while aligning with industry trends, particularly the rapid acceptance of electric vehicles. The shift towards seamless in-car control systems further strengthens the market outlook.

Passenger vehicles held a market share of over 60% in 2024 and are expected to surpass USD 2.5 billion by 2034. Sedans, hatchbacks, and SUVs contribute significantly to the demand for steering wheel switches, as these vehicles continue to dominate global sales. With built-in controls allowing drivers to manage infotainment, cruise control, and communication systems without distractions, manufacturers are focusing on integrating more intuitive and user-friendly interfaces. The increasing demand for daily-use vehicles, especially in urban areas, is further driving the need for steering wheel-mounted switches. As automakers prioritize driver convenience and efficiency, all-in-one control solutions are becoming a key component in modern passenger cars.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.4 billion |

| Forecast Value | $4 billion |

| CAGR | 1.8% |

The market is divided into OEM and aftermarket sales channels, with the OEM segment holding a 64% share in 2024. Steering wheel switches are predominantly supplied by original equipment manufacturers, which ensures seamless integration into vehicles during production. As these switches become standard across most modern cars, automakers are expanding production cycles to meet rising demand. Automotive assembly lines rely on suppliers for efficient sourcing, with manufacturers investing in automation to streamline production. The increasing need for new vehicles, especially in high-growth markets, is boosting demand for OEM steering wheel switches.

The product segment includes push and see-saw switches, with the push button segment generating USD 1.9 billion in 2024. Push buttons are widely used for infotainment, audio, cruise control, and communication functions, providing an intuitive user experience. Their durability and cost-effectiveness make them a preferred choice for automakers, supporting multi-functional applications while maintaining affordability. The shift towards simplified in-car control systems, combined with the integration of advanced electronics, continues to drive segment growth.

Infotainment controls are expected to grow at a CAGR of over 2.5% from 2025 to 2034. The rising adoption of connected vehicle technologies has increased the demand for steering wheel-integrated infotainment features, ensuring safer and more convenient interactions. Hands-free access to navigation, voice commands, and other functions enhances both driver safety and user experience, making infotainment controls a crucial component in modern vehicles.

The Asia Pacific region led the global market in 2024, accounting for over 33% of the total share. With strong automotive production and increasing demand for steering wheel controls, the region continues to drive market expansion.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material suppliers

- 3.1.1.2 Component suppliers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 Distributors

- 3.1.1.6 End users

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Technology & innovation landscape

- 3.3 Patent analysis

- 3.4 Regulatory landscape

- 3.5 Price trend

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Growing sales of vehicles across the globe

- 3.6.1.2 Increased awareness about road safety

- 3.6.1.3 Emergence of automotive parts & components industry

- 3.6.1.4 Steadily developing automotive manufacturing sector

- 3.6.1.5 Advancements in automotive electronics & adaptive cruise control technology

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Increasing implementation of automotive touchscreen displays

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Passenger vehicles

- 5.2.1 Hatchback

- 5.2.2 Sedan

- 5.2.3 SUVs

- 5.3 Commercial vehicles

- 5.3.1 Light commercial vehicles (LCVs)

- 5.3.2 Heavy commercial vehicles (HCVs)

Chapter 6 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 OEM

- 6.3 Aftermarket

Chapter 7 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Push

- 7.3 See-saw

Chapter 8 Market Estimates & Forecast, By application, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Infotainment control

- 8.3 Audio controls

- 8.4 Cruise control

- 8.5 Phone control

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 ALPS

- 10.2 Changjiang Automobile Electronic System

- 10.3 COBO

- 10.4 Continental

- 10.5 Delphi

- 10.6 Denso

- 10.7 Dongguan

- 10.8 Hyundai Motor

- 10.9 Johnson Electric Holdings

- 10.10 Kia Corporation

- 10.11 Leopold Kostal

- 10.12 LS Automotive Technologies

- 10.13 Marquardt Group

- 10.14 Nissan Motor

- 10.15 Panasonic Corporation

- 10.16 Preh

- 10.17 TOKAI RIKA

- 10.18 Toyota Motor

- 10.19 Valeo

- 10.20 ZF Friedrichshafen