|

市场调查报告书

商品编码

1846165

汽车方向盘:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Automotive Steering Wheel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

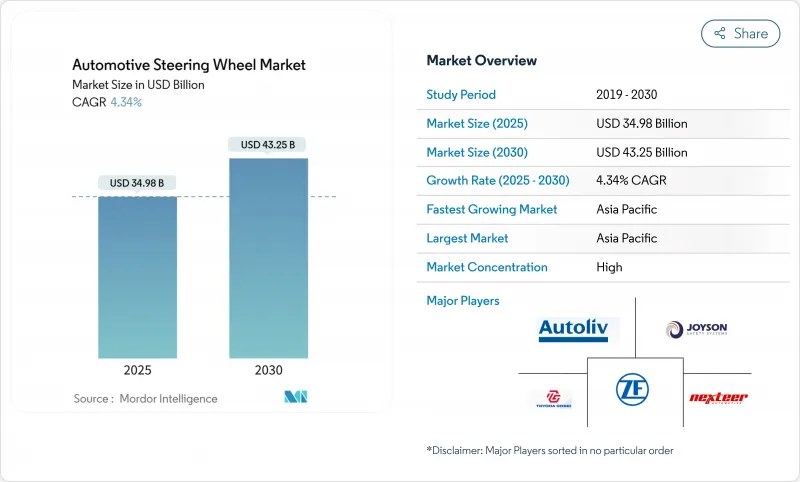

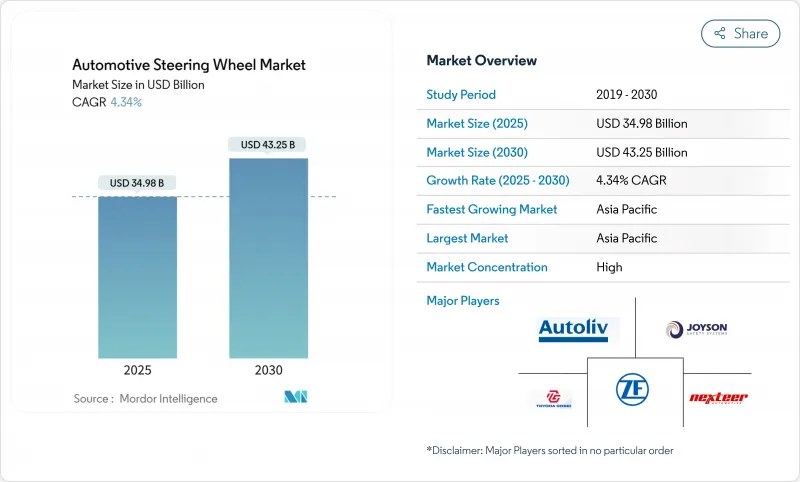

预计到 2025 年,汽车方向盘市场规模将达到 349.8 亿美元,到 2030 年将达到 432.5 亿美元,在预测期(2025-2030 年)内,复合年增长率将达到 4.34%。

电气化、L3+级自动驾驶汽车的发展以及不断扩大的安全法规(推动安全气囊整合和方向盘生物识别驾驶员监控)正在推动技术进步。虽然电动方向盘(EPS)仍然是销售的主要驱动力,但随着高阶电动车专案检验无转向柱驾驶座,线传(SbW)平台正在以最快的速度扩张。轻质金属和天然纤维复合材料在减轻重量的同时,也支持了汽车製造商的永续性目标。亚太地区由于中国电池电动车的蓬勃发展和半导体国产化而不断扩大生产份额,而北美和欧洲则推动了对具有触觉控制的高端介面的需求。市场竞争较为温和,传统领导企业奥托立夫、采埃孚和均胜正在向垂直整合转型。然而,软体定义汽车专家和晶片製造商正在转向控制和网路安全领域开闢閒置频段。

全球汽车方向盘市场趋势与洞察

线传平台采用率激增

继蔚来汽车于2025年推出采用采埃孚(ZF)无柱式悬吊架构的ET9之后,梅赛德斯-宾士将于2026年在其EQS车型上全面应用线控悬吊(SbW)。该技术取消了机械连桿,并透过可变传动比和软体调校的回馈,实现了城市道路的操控性和高速行驶的稳定性。采埃孚已赢得多家OEM厂商的合同,将支持SbW硬体在2030年前7.90%的复合年增长率。这项转变实现了软体定义的底盘控制,同时也对传统供应商提出了挑战,要求他们建构电子和网路安全能力。在中国市场的早期成功表明,监管机构对该架构的认证持开放态度,这将加速其在全球的普及应用。

强制将前座安全气囊整合到方向盘中

将于2024年7月生效的欧盟第二版通用安全法规(General Safety Regulation II)强制要求增强紧急煞车和疲劳驾驶警告功能,这将导致方向盘重新设计。在美国,国家公路交通安全管理局(NHTSA)正在其「驾驶员注意力不足过动症安全系统」(DADSS)计画下,研究利用嵌入轮圈的触觉感测器来检测驾驶员的疲劳状态。采埃孚LIFETEC正在设计顶部展开式安全气囊,兼顾美观和碰撞性能,以满足更严格的包装限制。监管趋同虽然增加了系统的复杂性和整合成本,但也实现了全球要求的标准化,从而为分阶段实施(Tier-On)策略创造了规模优势。

铝和镁价格波动剧烈

预计2024年至2025年间,铝镁现货价格波动幅度将超过20%,将挤压轻量化轮圈和辐条的利润空间。儘管供应商正透过签订长期供应协议和合金替代来规避风险,但成本上升仍将阻碍对成本敏感的细分市场采用这些产品。整车製造商将寻求回收原料来抵消价格波动,但二级铸造厂仍面临原料风险。

细分市场分析

到2024年,电动辅助转向(EPS)将占据汽车方向盘市场38.23%的份额,因为汽车製造商(OEM)为了提高效率和满足高级驾驶辅助系统(ADAS)的需求,正在将液压转向系统升级为电动辅助转向系统。传统的柱式转向系统在那些优先考虑低成本和机械结构简单的市场仍然占据主导地位。线控转向系统目前仍属于小众市场,但预计到2030年,随着高阶电动车和自动驾驶专案的推出,其复合年增长率将达到7.90%。

儘管EPS目前在方向盘市场占据主导地位,但SbW正在为电气化铺平道路。 ZF的ET9合约证明了可变传动比和软体定义的无液压油转向手感在商业性的可行性。在商用卡车领域,EPS装置展现出卓越的效率,能够提供高达8000牛顿米的扭矩,同时消费量液压泵。

次要因素影响供应商的市场定位。电动辅助转向系统 (EPS) 依靠整合式扭力感测器来驱动车道维持和自动停车功能,这提高了低成本厂商的准入门槛。线控无线 (SbW) 架构为伸缩式转向柱开闢了新的应用领域,从而实现了类似客厅的座舱设计理念。高频宽CAN-FD 或以乙太网路为基础网路域控制器的整合进一步模糊了底盘和资讯娱乐系统之间的界限,为软体整合商而非传统的转向柱专家提供了閒置频段。

到2024年,铝材将继续保持其在汽车方向盘市场的领先地位,市占率为37.45%。钢材在重型应用领域依然占据主导地位,因为在这些领域,耐用性比重量更为重要。镁合金轮圈占据了高性能轮圈的细分市场,但在加工成本和腐蚀成本方面面临挑战。受汽车製造商从摇篮到大门的二氧化碳减排目标的推动,以大麻和亚麻为主的天然纤维复合材料预计到2030年将以7.65%的复合年增长率增长。与碳纤维相比,Cupro ampliTex座椅背可减少49%的二氧化碳排放,展现了其在内装零件领域的扩充性。

在方向盘市场,铝製骨架上的生物复合材料蒙皮兼具结构完整性和触感永续性,具有显着优势。吸湿性要求采用先进的树脂体系,而生物纤维零件无法承受电动车喷漆生产线上常见的200°C高温烘烤循环。儘管如此,一项欧盟指令要求从2028年起,汽车内装必须包含25%的回收或生物基材料,无疑增强了对天然纤维的支持。

区域分析

亚太地区将在2024年以48.67%的市占率引领汽车方向盘市场,复合年增长率(CAGR)为6.80%,这主要得益于中国电动车的快速成长以及政策推动国内晶片生产。北京的目标是2025年达到25%的国产半导体含量,以保障方向盘整合感测器和电子控制单元(ECU)的供应。大规模生产和成本效益将推动触觉回馈等高阶功能快速普及到中阶车型。然而,稀土磁铁的出口限制正在扰乱汽车製造商(OEM)的生产计划,而铃木和福特工厂的暂时停产就是一个例证。

北美仍然是技术采用者而非成本领先者。美国基础设施立法强制要求安装驾驶员疲劳检测系统,这刺激了对配备感测器的车轮的需求。同时,加拿大和墨西哥的工厂正在扩大电动辅助转向系统(EPS)的生产,以支持底特律三大汽车製造商的电动车计画。耐世特在墨西哥新建的技术中心将在2026年前新增350个工作岗位,以利用近岸外包的趋势,并完善其柱式EPS和SbW(电子束驱动)检验。儘管运费较高,但围绕美国可能对墨西哥製造的组件征收关税的贸易政策不确定性,可能会导致采购重新转向亚洲。

欧洲正在努力平衡优质化与严格的安全法规要求。欧盟GSR II和Euro NCAP 2026对实体按键的要求推动了对整合式方向盘控制和握把感测器的需求。博世位于匈牙利的工厂目前为当地OEM厂商生产EPS转向齿条,并扩大产能以更贴近高端客户。在供应方面,德国Tierowner公司正透过TUV和KBA等权威机构推动SbW(电子转向系统)的检验,制定性能标桿,这些标桿将影响全球认证系统。

南美和中东及非洲等新兴地区在低基数的基础上实现了两位数的销量成长。印度零件製造商的目标是实现1000亿美元的出口额,其中方向盘总成被视为关税优惠的大宗货物。采埃孚Rane收购TRW Sun Steering Wheels后,将在古尔格拉姆和普纳增设工厂,从而加强印度本土安全气囊和感测器的生产。海湾国家正在加速推广电动车以实现车队脱碳,但基础设施的不足延缓了方向盘的大规模推广。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 线传平台采用率激增

- 强制将前座安全气囊整合到方向盘中

- 电动车製造商提倡轻量化

- 优质化和车载用户体验升级

- 关于车轮感知器监测行驶障碍物的立法

- L3+车辆对可折迭/无柱驾驶座的需求

- 市场限制

- 铝镁价格波动

- 全球Sbw认证和网路安全合规性延误

- 晶片级触觉/驱动感知模组短缺

- 无人驾驶计程车中操纵桿/语音人机介面的轮班风险

- 触觉/驱动感应模组晶片级短缺

- 价值/供应链分析

- 监管状况

- 技术展望

- 五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场规模与成长预测

- 依技术

- 传统柱式转向

- 电动辅助(EPS)

- 线控转向(SbW)

- 依材料类型

- 铝製轮圈

- 镁合金轮圈

- 钢圈

- 天然纤维复合材料轮辋

- 按车辆类型

- 搭乘用车

- 轻型商用车

- 大型商用车辆

- 公车和长途客车

- 按销售管道

- OEM配件

- 售后替换

- 依推进类型

- 内燃机

- 纯电动车

- 油电混合车

- 插电式混合动力汽车

- 燃料电池电动车

- 替代燃料

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 菲律宾

- 印尼

- 越南

- 澳洲

- 纽西兰

- 其他亚太地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 南非

- 埃及

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略倡议和伙伴关係

- 市占率分析

- 公司简介

- Autoliv Inc.

- ZF Friedrichshafen AG

- Joyson Safety Systems

- Toyoda Gosei Co., Ltd.

- Valeo SA

- Nexteer Automotive Group

- Tokai Rika Co., Ltd.

- Hyundai Mobis Co., Ltd.

- JTEKT Corporation

- NSK Ltd.

- Mando Corporation

- Robert Bosch GmbH

- Denso Corporation

- Continental AG

- Thyssenkrupp AG

第七章 市场机会与未来展望

The automotive steering wheel market stood at USD 34.98 billion in 2025 and is forecast to reach USD 43.25 billion by 2030, advancing at a 4.34% CAGR during the forecast period (2025-2030).

Growth is propelled by electrification, Level 3+ autonomous vehicle development, and expanding safety mandates pushing airbag integration and biometric driver-monitoring into the wheel. Electric Power Steering (EPS) remains the volume backbone, yet steer-by-wire (SbW) platforms are scaling fastest as premium EV programs validate column-less cockpits. Lightweight metals and natural-fiber composites limit mass while supporting OEM sustainability targets. Asia-Pacific commands production share thanks to China's battery-electric boom and semiconductor localisation, whereas North America and Europe pull demand for premium interfaces with haptic controls. Competitive intensity is moderate: legacy leaders Autoliv, ZF Friedrichshafen, and Joyson extend vertical integration. However, software-defined vehicle specialists and chipmakers are carving out white-space in steering control and cybersecurity stacks.

Global Automotive Steering Wheel Market Trends and Insights

Surging Adoption of Steer-By-Wire (SBW) Platforms

Mercedes-Benz will roll out full SbW on the 2026 EQS, following NIO's 2025 launch of the ET9 that features ZF's column-less architecture. The technology removes mechanical links, enabling variable ratios and software-tuned feedback for urban manoeuvrability and high-speed stability. ZF has secured multi-OEM contracts that underpin a 7.90% CAGR for SbW hardware through 2030. The shift allows software-defined chassis control while challenging traditional suppliers to build electronic and cybersecurity competencies. Early wins in China illustrate regulators' willingness to homologate the architecture, accelerating global uptake.

Mandatory Frontal-Airbag Integration in Steering Wheels

EU General Safety Regulation II, effective July 2024, compels enhanced emergency braking and drowsiness-warning functions that re-shape steering design. In the United States, NHTSA research into driver-impairment detection uses tactile sensors embedded in the rim under the DADSS program. ZF LIFETEC has engineered top-deployment airbags that blend aesthetics with crash performance, meeting stricter packaging limits. Convergence of mandates raises system complexity and integration cost but standardises global requirements, creating volume leverage for tier-ones.

Volatile Aluminum and Magnesium Prices

Spot prices for aluminium and magnesium have swung more than 20% in 2024-2025, squeezing margins on lightweight rims and spokes. Suppliers hedge through long-term supply contracts and alloy substitution, yet cost spikes deter adoption in cost-sensitive segments. OEMs explore recycled feedstock to offset volatility, but tier-two casting shops remain exposed to raw-material risk.

Other drivers and restraints analyzed in the detailed report include:

- Light-Weighting Push From EV OEMs

- Legislative Drive-Impairment Monitoring Via Wheel Sensors

- Global SbW Homologation and Cyber-Security Compliance Lag

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

EPS controlled 38.23% of the automotive steering wheel market in 2024 as OEMs upgraded hydraulic systems to electric assist for efficiency and ADAS readiness. Conventional column-steer persists in markets prioritising low cost and mechanical simplicity. Steer-by-wire remains niche but is forecast at 7.90% CAGR to 2030 thanks to premium EV launches and autonomous drive programs.

The EPS-heavy portion of the steering wheel market size supports today's electrification, while SbW prepares the ground for Level 3+ hands-free modes. ZF's ET9 contract showcases commercial viability, delivering a variable ratio and software-defined feel without hydraulic fluid. In commercial trucks, EPS units provide up to 8,000 Nm torque yet trim energy draw compared with hydraulic pumps, underlining the efficiency case.

Second-order effects shape supplier positioning. EPS units rely on integrated torque sensors that feed lane-keep and auto-park functions, raising entry barriers for low-cost players. SbW architectures create fresh real estate for retractable columns, enabling living-room cabin concepts. Integration of high-bandwidth CAN-FD or Ethernet-based domain controllers further blurs lines between chassis and infotainment domains, offering white-space for software integrators rather than classic column specialists.

Aluminium remained the leader with 37.45% of the automotive steering wheel market share in 2024, credited to 40% mass savings and endless recyclability. Steel endures for heavy-duty fleets where durability trumps weight. Magnesium rims serve high-performance niches but face processing and corrosion cost hurdles. Natural-fibre composites, notably hemp and flax, are set to grow 7.65% CAGR through 2030, propelled by automakers' cradle-to-gate CO2 targets. Cupra's ampliTex seatbacks cut 49% CO2 versus carbon fibre, signalling scalability for interior parts.

The steering wheel market benefits from bio-composite skins over aluminium skeletons, marrying structural integrity with tactile sustainability cues. Challenges persist: moisture absorption demands advanced resin systems, and bio-fibre parts cannot exceed 200 °C bake cycles common in EV paint lines. Nevertheless, European directives urging 25% recycled or bio-based content in interiors post-2028 strengthen the pull for natural fibres.

The Automotive Steering Wheel Market is Segmented by Technology (Conventional Column-Steer, and More), Material Type (Aluminum Rim, Magnesium Rim, and More), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Sales Channel (Original-Fitted and Aftermarket Replacement), Propulsion Type (Internal Combustion Engine, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific led the automotive steering wheel market with 48.67% share in 2024 and is growing at 6.80% CAGR on the strength of China's EV surge and policy-backed chip localisation. Beijing targets 25% local semiconductor content by 2025, anchoring supply for wheel-integrated sensors and ECUs. Large-scale production and cost efficiencies permit rapidly migrating premium features such as haptic feedback into mid-segment vehicles. However, export restrictions on rare-earth magnets have disrupted OEM production schedules, as seen in temporary shutdowns at Suzuki and Ford plants.

North America remains a technology adopter rather than a cost leader. US infrastructure legislation mandates driver-impairment detection, spurring demand for sensor-rich wheels, while Canadian and Mexican plants scale EPS output to serve Detroit Three EV programs. Nexteer's new technical centre in Mexico adds 350 roles by 2026 to hone column-type EPS and SbW validation, exploiting near-shoring trends. Trade-policy uncertainty around potential US tariffs on Mexican assemblies could shift sourcing back to Asia despite freight premiums.

Europe balances premiumisation with strict safety mandates. EU GSR II and Euro NCAP 2026 physical-button requirements anchor demand for integrated wheel controls and grip sensors. Bosch's Hungarian plant now produces EPS racks for regional OEMs, evidencing capacity expansion nearer to premium customers. On the supply side, German tier-ones push SbW validation through TUV and KBA authorities, setting performance benchmarks that ripple through global homologation.

Emerging regions - South America, the Middle East, and Africa - show double-digit unit growth off low bases. India's component makers pursue a USD 100 billion export ambition, with steering wheel assemblies viewed as tariff-friendly volume cargo. ZF Rane's acquisition of TRW Sun Steering Wheels adds Gurugram and Pune plants, enhancing domestic content for localised airbags and sensors. Gulf states accelerate EV adoption for fleet decarbonisation, yet infrastructure gaps delay large-scale SbW rollout.

- Autoliv Inc.

- ZF Friedrichshafen AG

- Joyson Safety Systems

- Toyoda Gosei Co., Ltd.

- Valeo SA

- Nexteer Automotive Group

- Tokai Rika Co., Ltd.

- Hyundai Mobis Co., Ltd.

- JTEKT Corporation

- NSK Ltd.

- Mando Corporation

- Robert Bosch GmbH

- Denso Corporation

- Continental AG

- Thyssenkrupp AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging Adoption of Steer-By-Wire (SBW) Platforms

- 4.2.2 Mandatory Frontal-Airbag Integration In Steering Wheels

- 4.2.3 Light-Weighting Push From EV OEMs

- 4.2.4 Premiumisation and In-Cabin UX Upgrades

- 4.2.5 Legislative Drive-Impairment Monitoring Via Wheel Sensors

- 4.2.6 Demand For Stowable/Column-Less Cockpits In L3+ Vehicles

- 4.3 Market Restraints

- 4.3.1 Volatile Aluminium and Magnesium Prices

- 4.3.2 Global Sbw Homologation and Cybersecurity Compliance Lag

- 4.3.3 Chip-Level Shortages For Haptic/Driver-Sense Modules

- 4.3.4 Share-Shift Risk From Joystick/Voice HMI In Robo-Taxis

- 4.3.5 Chip-Level Shortages For Haptic/Driver-Sense Modules

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By Technology

- 5.1.1 Conventional Column-Steer

- 5.1.2 Electric Power-Assist (EPS)

- 5.1.3 Steer-by-Wire (SbW)

- 5.2 By Material Type

- 5.2.1 Aluminium Rim

- 5.2.2 Magnesium Rim

- 5.2.3 Steel Rim

- 5.2.4 Natural-fibre Composite Rim

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Light Commercial Vehicles

- 5.3.3 Heavy Commercial Vehicles

- 5.3.4 Bus and Coahes

- 5.4 By Sales Channel

- 5.4.1 OEM Fitted

- 5.4.2 Aftermarket Replacement

- 5.5 By Propulsion Type

- 5.5.1 Internal-Combustion Engine

- 5.5.2 Battery-Electric Vehicle

- 5.5.3 Hybrid Electric Vehicle

- 5.5.4 Plug-In Hybrid Electric Vehicles

- 5.5.5 Fuel Cell Electric Vehicles

- 5.5.6 Alternative Fuels

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Philippines

- 5.6.4.6 Indonesia

- 5.6.4.7 Vietnam

- 5.6.4.8 Australia

- 5.6.4.9 New Zealand

- 5.6.4.10 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 Turkey

- 5.6.5.4 South Africa

- 5.6.5.5 Egypt

- 5.6.5.6 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves & Partnerships

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Autoliv Inc.

- 6.4.2 ZF Friedrichshafen AG

- 6.4.3 Joyson Safety Systems

- 6.4.4 Toyoda Gosei Co., Ltd.

- 6.4.5 Valeo SA

- 6.4.6 Nexteer Automotive Group

- 6.4.7 Tokai Rika Co., Ltd.

- 6.4.8 Hyundai Mobis Co., Ltd.

- 6.4.9 JTEKT Corporation

- 6.4.10 NSK Ltd.

- 6.4.11 Mando Corporation

- 6.4.12 Robert Bosch GmbH

- 6.4.13 Denso Corporation

- 6.4.14 Continental AG

- 6.4.15 Thyssenkrupp AG