|

市场调查报告书

商品编码

1684861

汽车燃料电池市场机会、成长动力、产业趋势分析及 2024 - 2032 年预测Automotive Fuel Cell Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2024 - 2032 |

||||||

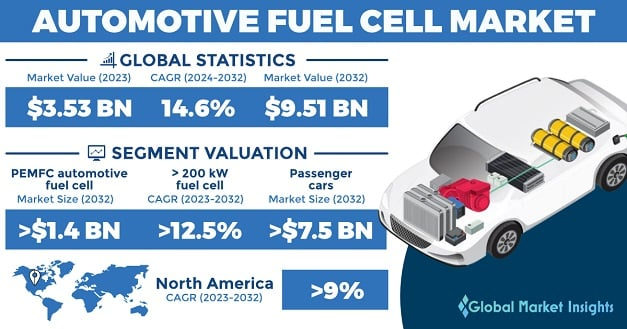

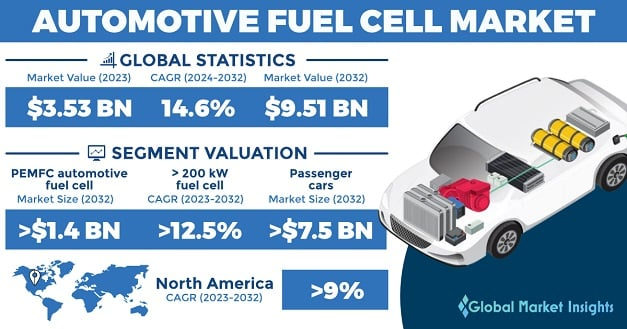

2023 年全球汽车燃料电池市场价值为 35.3 亿美元,预计 2024 年至 2032 年期间的复合年增长率为 14.6%。燃料电池是一种电化学装置,透过氢和氧的反应产生电能,为汽车、巴士和卡车等电动车提供动力。透过在阳极引入氢气并将空气中的氧气供应到阴极,该技术实现了零排放运输。向更清洁、更永续的行动解决方案的转变,加上政府、汽车製造商和能源部门的大量投资,继续推动市场扩张。对绿色交通解决方案的日益追求、氢基础设施的改善以及燃料电池技术的进步,正在加速各个汽车领域的产品应用。有利于燃料电池汽车的政策框架、财政激励措施和战略合作伙伴关係进一步促进了该行业的发展。

质子交换膜燃料电池 (PEMFC) 因其效率高、加油快、运作环保等特点,预计到 2032 年其市场规模将超过 14 亿美元。随着监管框架不断促进更清洁的能源解决方案,燃料电池在交通运输中的部署正在稳步增加。对技术进步和基础设施扩张的重视有望加强产品渗透率。汽车製造商、燃料电池开发商和能源供应商正在共同努力加强氢气供应网络,增强市场潜力。

| 市场范围 | |

|---|---|

| 起始年份 | 2023 |

| 预测年份 | 2024-2032 |

| 起始值 | 35.3亿美元 |

| 预测值 | 95.1亿美元 |

| 复合年增长率 | 14.6% |

到 2032 年,额定功率超过 200 kW 的燃料电池系统的复合年增长率将超过 12.5%。由于这些高容量系统能够支援长途运输并减少碳足迹,因此在重型卡车、巴士和工业车辆中的应用正日益受到青睐。商用车领域的大规模应用正在创造产业成长机会。提高燃料电池效率和降低营运成本的努力正在塑造竞争格局。政府补助、税收优惠和环境要求也在影响投资决策,鼓励车队营运商转向以氢为基础的交通工具。

随着消费者对零排放汽车的兴趣日益浓厚,以及出行解决方案日益多样化,预计到 2032 年,使用燃料电池技术的乘用车将创造超过 75 亿美元的市场价值。燃料电池汽车选择的不断扩大以及氢气补给网络的不断完善正在支持其广泛应用。消费者越来越倾向于永续交通,点对点汽车共享平台和先进的安全技术等创新正在加速燃料电池与汽车领域的整合。

预计到 2032 年,北美汽车燃料电池市场将以超过 9.0% 的复合年增长率扩张。政府的大力支持、对氢能解决方案的投资不断增加以及城市交通应用的不断扩大正在增强产业成长。工业流程和发电领域对氢作为能源载体的兴趣日益浓厚。旨在提高效率、寿命和成本效益的持续研究和开发工作预计将进一步推动整个地区的应用。

目录

第 1 章:方法论与范围

- 市场定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 未付费来源

第 2 章:执行摘要

第 3 章:汽车燃料电池产业洞察

- 产业生态系统分析

- 供应商矩阵

- 监管格局

- 产业衝击力

- 成长动力

- 燃料电池电动车的普及率不断提高

- 科技产品进步

- 氢能基础设施建设

- 产业陷阱与挑战

- 初期成本高

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第 4 章:竞争性基准化分析

- 创新与永续发展格局

- 2022 年竞争格局

- 战略仪表板

第 5 章:汽车燃料电池市场:按类型

- 主要类型趋势

- 质子交换膜燃料电池

- 平安金融中心与亚洲金融中心

- 其他的

第 6 章:汽车燃料电池市场:按功率输出

- 主要电力输出趋势

- < 100 千瓦

- 100 – 200 千瓦

- > 200 千瓦

第 7 章:汽车燃料电池市场:按应用

- 主要应用趋势

- 搭乘用车

- 商用车

- 其他的

第 8 章:汽车燃料电池市场:按地区

- 主要区域趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 奥地利

- 亚太地区

- 日本

- 韩国

- 中国

- 印度

- 菲律宾

- 越南

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

- 拉丁美洲

- 巴西

- 秘鲁

- 墨西哥

第九章:公司简介

- Acumentrics

- Altergy

- Ballard Power Systems

- FuelCell Energy, Inc

- Toshiba Energy Systems & Solutions Corporation

- Plug Power Inc.

- Cummins Inc.

- Panasonic Holdings Corporation

- Bloom Energy

- Convion Ltd

- Hyster-Yale Group, Inc.

- Advent Technologies

- BorgWarner Inc.

- Daimler Truck AG

- Ceres

- Hyundai Motor Company

- ITM Power PLC

- Nedstack Fuel Cell Technology BV

- NUVERA FUEL CELLS, LLC

- TW Horizon Fuel Cell Technologies

- Fuji Electric Co., Ltd

The Global Automotive Fuel Cell Market was valued at USD 3.53 billion in 2023 and is projected to expand at a CAGR of 14.6% between 2024 and 2032. Fuel cells serve as electrochemical devices that generate electricity through the reaction of hydrogen and oxygen, providing power for electric vehicles such as cars, buses, and trucks. With hydrogen introduced at the anode and oxygen from the air supplied to the cathode, the technology facilitates zero-emission transportation. A shift toward cleaner and more sustainable mobility solutions, combined with substantial investments from governments, automakers, and the energy sector, continues to drive market expansion. The growing push for green transportation solutions, improvements in hydrogen infrastructure, and advancements in fuel cell technology are accelerating product adoption across various vehicle segments. Policy frameworks favoring fuel cell vehicles, along with financial incentives and strategic partnerships, are further contributing to the industry's positive trajectory.

Proton Exchange Membrane Fuel Cells (PEMFCs) are expected to surpass USD 1.4 billion by 2032 due to their superior efficiency, rapid refueling, and environmentally friendly operation. As regulatory frameworks continue to promote cleaner energy solutions, fuel cell deployment in transportation is steadily increasing. The emphasis on technological advancements and infrastructure expansion is expected to strengthen product penetration. Automakers, fuel cell developers, and energy providers are working together to enhance hydrogen supply networks, reinforcing market potential.

| Market Scope | |

|---|---|

| Start Year | 2023 |

| Forecast Year | 2024-2032 |

| Start Value | $3.53 Billion |

| Forecast Value | $9.51 Billion |

| CAGR | 14.6% |

Fuel cell systems with power ratings above 200 kW are set to witness a CAGR of over 12.5% through 2032. The adoption of these higher-capacity systems in heavy-duty trucks, buses, and industrial vehicles is gaining traction due to their ability to support long-haul transport while reducing carbon footprints. Large-scale applications in the commercial vehicle sector are creating opportunities for industry growth. Efforts to enhance fuel cell efficiency and reduce operating costs are shaping the competitive landscape. Government grants, tax incentives, and environmental mandates are also influencing investment decisions, encouraging fleet operators to transition to hydrogen-based mobility.

Passenger cars using fuel cell technology are expected to generate over USD 7.5 billion by 2032, fueled by increased consumer interest in zero-emission vehicles and the availability of diverse mobility solutions. Expanding fuel cell vehicle options and improved hydrogen refueling networks are supporting widespread adoption. Consumers are increasingly inclined toward sustainable transportation, and innovations such as peer-to-peer car-sharing platforms and advanced safety technologies are accelerating the integration of fuel cells into the automotive sector.

North America automotive fuel cell market is forecasted to expand at a CAGR exceeding 9.0% through 2032. Robust government support, rising investments in hydrogen-based solutions, and expanding urban transit applications are strengthening industry growth. Interest in hydrogen as an energy carrier is surging across industrial processes and power generation. Ongoing research and development efforts aimed at enhancing efficiency, longevity, and cost-effectiveness are expected to further drive adoption across the region.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Unpaid sources

Chapter 2 Executive Summary

- 2.1 Automotive fuel cell industry 3600 synopsis, 2019 - 2032

- 2.1.1 Business trends

- 2.1.2 Type trends

- 2.1.3 Power output trends

- 2.1.4 Application trends

- 2.1.5 Regional trends

Chapter 3 Automotive Fuel Cell Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Vendor matrix

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Increasing adoption of FCEVs

- 3.3.1.2 Technological product advancements

- 3.3.1.3 Development of hydrogen Infrastructure

- 3.3.2 Industry pitfalls & challenges

- 3.3.2.1 Initial high cost

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Porter's Analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL Analysis

Chapter 4 Competitive Benchmarking

- 4.1 Innovation & sustainability landscape

- 4.2 Competitive landscape, 2022

- 4.2.1 Strategic dashboard

Chapter 5 Automotive Fuel Cell Market, By Type

- 5.1 Key type trends

- 5.2 PEMFC

- 5.3 PAFC & AFC

- 5.4 Others

Chapter 6 Automotive Fuel Cell Market, By Power Output

- 6.1 Key power output trends

- 6.2 < 100 kW

- 6.3 100 – 200 kW

- 6.4 > 200 kW

Chapter 7 Automotive Fuel Cell Market, By Application

- 7.1 Key application trends

- 7.2 Passenger cars

- 7.3 Commercial vehicles

- 7.4 Others

Chapter 8 Automotive Fuel Cell Market, By Region

- 8.1 Key regional trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Austria

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 South Korea

- 8.4.3 China

- 8.4.4 India

- 8.4.5 Philippines

- 8.4.6 Vietnam

- 8.5 Middle East & Africa

- 8.5.1 South Africa

- 8.5.2 Saudi Arabia

- 8.5.3 UAE

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Peru

- 8.6.3 Mexico

Chapter 9 Company Profiles

- 9.1 Acumentrics

- 9.2 Altergy

- 9.3 Ballard Power Systems

- 9.4 FuelCell Energy, Inc

- 9.5 Toshiba Energy Systems & Solutions Corporation

- 9.6 Plug Power Inc.

- 9.7 Cummins Inc.

- 9.8 Panasonic Holdings Corporation

- 9.9 Bloom Energy

- 9.10 Convion Ltd

- 9.11 Hyster-Yale Group, Inc.

- 9.12 Advent Technologies

- 9.13 BorgWarner Inc.

- 9.14 Daimler Truck AG

- 9.15 Ceres

- 9.16 Hyundai Motor Company

- 9.17 ITM Power PLC

- 9.18 Nedstack Fuel Cell Technology BV

- 9.19 NUVERA FUEL CELLS, LLC

- 9.20 TW Horizon Fuel Cell Technologies

- 9.21 Fuji Electric Co., Ltd