|

市场调查报告书

商品编码

1685053

精准农业市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Precision Farming Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

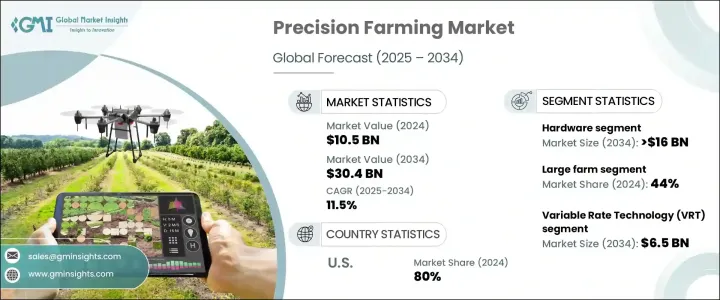

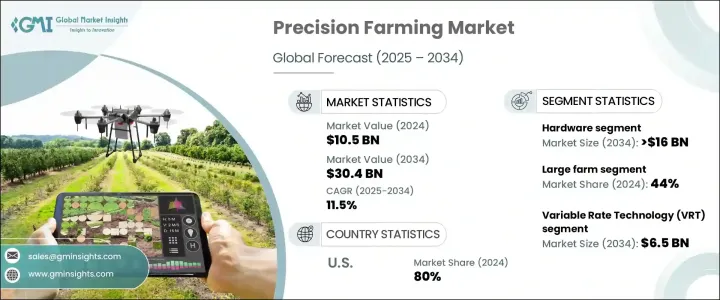

2024 年全球精准农业市场价值为 105 亿美元,预估 2025 年至 2034 年期间复合年增长率为 11.5%。人口快速增长和粮食需求不断增加是推动这一扩张的主要驱动力。随着全球人口每年增加约 8,300 万,对永续农业实践的需求变得更加迫切。精准农业利用先进技术来优化作物产量,已成为解决这项挑战的关键解决方案。

世界各国政府在推动精准农业的应用方面发挥着至关重要的作用。透过提供补贴、补助和政策激励,他们旨在提高农业生产力,同时最大限度地减少对环境的影响。精准农业融合了物联网、人工智慧、无人机和资料分析等技术,以提高效率并减少资源消耗。这些创新帮助农民提高生产力,降低营运成本,实施生态友善实践,确保长期可持续的粮食生产。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 105亿美元 |

| 预测值 | 304亿美元 |

| 复合年增长率 | 11.5% |

市场根据组件进行细分,硬体在 2024 年处于领先地位,占有超过 55% 的市场份额。到 2034 年,该部分的规模预计将超过 160 亿美元。农业经营中 GPS、感测器和自动化设备的日益广泛应用推动了这一成长。土壤感测器、气象站和 GPS 接收器等硬体工具使农民能够监测条件、优化灌溉并自动执行种植和收穫等关键任务。自动化进一步提高了效率,机器人系统可以执行传统上手动处理的任务。

以农场规模计算,大型农场在 2024 年占据了约 44% 的市场。他们投资先进技术以提高生产力和效率的能力促成了这种主导地位。 GPS 导航拖拉机、无人机和智慧灌溉系统可以实现精确的作物监测和资源管理。随着大型农场寻求优化运营,对精准农业解决方案的需求持续上升。

从技术角度来看,变数速率技术 (VRT) 是一个主导领域,预计到 2034 年将创造 65 亿美元的产值。该技术允许农民根据具体的田间条件客製化肥料、种子和农药的使用。透过利用感测器、GPS 和先进软体的资料,VRT 可确保最佳输入分配,减少浪费并最大限度地提高产量。对成本效益和永续农业的日益重视正在加速其应用,农业机构的支持不断增加使得这些系统更容易获得。

在应用方面,产量监测将在 2024 年以 25% 的份额引领市场。该系统帮助农民即时追踪作物生长情况,从而根据数据做出决策,提高生产力。感测器技术和资料分析的进步提供了对产量模式和土壤条件的精确洞察,从而改善了长期农场管理。随着粮食需求的增加,精准农业解决方案对于优化农业产量变得至关重要。

北美引领全球市场,美国在 2024 年占据 80% 的份额。先进农业技术的广泛采用、政府补贴和强大的基础设施支持精准农业的扩张。对无人机、感测器和资料分析的日益依赖不断改变农业经营方式,使农业更有效率、更有利可图。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 硬体提供者

- 软体供应商

- 服务提供者

- 技术提供者

- 最终客户

- 供应商概况

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻及倡议

- 监管格局

- 精准农业的演变

- 使用案例

- 衝击力

- 成长动力

- 对永续农业实践的需求日益增长

- 全球人口不断成长,对粮食产量的需求也随之增加

- 增加对农业技术的投资

- 政府支持数位农业技术的措施和补贴

- 产业陷阱与挑战

- 缺乏操作先进精准农业设备的熟练劳动力

- 农村地区高速网路存取有限

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 硬体

- 感应器

- 自动转向系统

- 无人机、无人驾驶飞机和摄影机

- 行动装置

- GPS 和 GNSS

- 其他的

- 软体

- 农场管理软体(FMS)

- 数据分析与巨量资料解决方案

- 地理资讯系统 (GIS) 软体

- 基于云端的软体解决方案

- 人工智慧和机器学习软体

- 服务

- 专业服务

- 託管服务

第六章:市场估计与预测:依技术,2021 - 2034 年

- 主要趋势

- 高精度定位系统

- 地理测绘

- 遥感

- 综合电子通讯

- 可变速率技术 (VRT)

第 7 章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 天气监测

- 产量监测

- 字段映射

- 灌溉管理

- 废弃物管理

- 财务管理

- 其他的

第 8 章:市场估计与预测:按农场规模,2021 - 2034 年

- 主要趋势

- 小农场

- 中型农场

- 大型农场

第 9 章:市场估计与预测:按地区,2021 - 2034 年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- AG Leader

- AGCO

- Agribotix

- AgSense

- AgSmarts

- Boumatic

- CNH

- CropMetrics

- CropX

- Delaval

- Dickey-John

- Farmers Edge

- GEA Group

- John Deere

- Monsanto

- Precision Planting

- Raven

- Topcon

- Trimble

- Yara

The Global Precision Farming Market was valued at USD 10.5 billion in 2024 and is projected to grow at an 11.5% CAGR from 2025 to 2034. Rapid population growth and the increasing demand for food are key drivers behind this expansion. With the global population rising by approximately 83 million annually, the need for sustainable agricultural practices has become more urgent. Precision farming, which leverages advanced technologies to optimize crop yields, has emerged as a critical solution to this challenge.

Governments worldwide are playing a crucial role in promoting the adoption of precision agriculture. By offering subsidies, grants, and policy incentives, they aim to boost agricultural productivity while minimizing environmental impact. Precision farming integrates technologies such as IoT, AI, drones, and data analytics to improve efficiency and reduce resource consumption. These innovations help farmers enhance productivity, cut operational costs, and implement eco-friendly practices, ensuring sustainable food production in the long run.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.5 billion |

| Forecast Value | $30.4 billion |

| CAGR | 11.5% |

The market is segmented based on components, with hardware leading in 2024, holding over 55% market share. By 2034, the segment is anticipated to surpass USD 16 billion. The increasing adoption of GPS, sensors, and automated equipment in farming operations is driving this growth. Hardware tools such as soil sensors, weather stations, and GPS receivers enable farmers to monitor conditions, optimize irrigation, and automate critical tasks like planting and harvesting. Automation further enhances efficiency, with robotic systems performing tasks traditionally handled manually.

By farm size, large farms accounted for approximately 44% of the market share in 2024. Their ability to invest in advanced technology for improved productivity and efficiency contributes to this dominance. GPS-guided tractors, drones, and smart irrigation systems allow for precise crop monitoring and resource management. As large-scale farms seek to optimize operations, demand for precision farming solutions continues to rise.

Technology-wise, variable rate technology (VRT) is a dominant segment, expected to generate USD 6.5 billion by 2034. This technology allows farmers to tailor the application of fertilizers, seeds, and pesticides based on specific field conditions. By leveraging data from sensors, GPS, and advanced software, VRT ensures optimal input distribution, reducing waste while maximizing yield. The growing emphasis on cost efficiency and sustainable farming is accelerating adoption, with increased support from agricultural institutions making these systems more accessible.

In terms of applications, yield monitoring led the market in 2024 with a 25% share. This system helps farmers track crop performance in real time, enabling data-driven decisions to enhance productivity. Advancements in sensor technology and data analytics provide precise insights into yield patterns and soil conditions, improving long-term farm management. With increasing food demand, precision farming solutions are becoming essential for optimizing agricultural output.

North America leads the global market, with the US holding an 80% share in 2024. The widespread adoption of advanced agricultural technologies, government subsidies, and strong infrastructure support precision farming expansion. Increased reliance on drones, sensors, and data analytics continues to transform farming operations, making agriculture more efficient and profitable.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Hardware providers

- 3.1.2 Software providers

- 3.1.3 Service providers

- 3.1.4 Technology providers

- 3.1.5 End customers

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Evolution of precision farming

- 3.9 Use cases

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 The growing need for sustainable farming practices

- 3.10.1.2 The rising global population and the corresponding demand for higher food production

- 3.10.1.3 Increased investment in agricultural technologies

- 3.10.1.4 Government initiatives and subsidies supporting digital farming technologies

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 The lack of skilled labor to operate advanced precision farming equipment

- 3.10.2.2 Limited access to high-speed internet in rural areas

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter’s analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Sensor

- 5.2.2 Automated steering system

- 5.2.3 Drone, UAV, and camera

- 5.2.4 Mobile device

- 5.2.5 GPS and GNSS

- 5.2.6 Others

- 5.3 Software

- 5.3.1 Farm Management Software (FMS)

- 5.3.2 Data analytics and big data solution

- 5.3.3 Geographic information system (GIS) software

- 5.3.4 Cloud-based software solution

- 5.3.5 Artificial intelligence and machine learning software

- 5.4 Services

- 5.4.1 Professional services

- 5.4.2 Managed services

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 High precision positioning system

- 6.3 Geo mapping

- 6.4 Remote sensing

- 6.5 Integrated electronic communication

- 6.6 Variable Rate Technology (VRT)

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Weather monitoring

- 7.3 Yield monitoring

- 7.4 Field mapping

- 7.5 Irrigation management

- 7.6 Waste management

- 7.7 Financial management

- 7.8 Others

Chapter 8 Market Estimates & Forecast, By Farm Size, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Small farm

- 8.3 Medium farm

- 8.4 Large farm

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 North America

- 9.1.1 U.S.

- 9.1.2 Canada

- 9.2 Europe

- 9.2.1 UK

- 9.2.2 Germany

- 9.2.3 France

- 9.2.4 Italy

- 9.2.5 Spain

- 9.2.6 Russia

- 9.2.7 Nordics

- 9.3 Asia Pacific

- 9.3.1 China

- 9.3.2 India

- 9.3.3 Japan

- 9.3.4 Australia

- 9.3.5 South Korea

- 9.3.6 Southeast Asia

- 9.4 Latin America

- 9.4.1 Brazil

- 9.4.2 Mexico

- 9.4.3 Argentina

- 9.5 MEA

- 9.5.1 UAE

- 9.5.2 South Africa

- 9.5.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 AG Leader

- 10.2 AGCO

- 10.3 Agribotix

- 10.4 AgSense

- 10.5 AgSmarts

- 10.6 Boumatic

- 10.7 CNH

- 10.8 CropMetrics

- 10.9 CropX

- 10.10 Delaval

- 10.11 Dickey-John

- 10.12 Farmers Edge

- 10.13 GEA Group

- 10.14 John Deere

- 10.15 Monsanto

- 10.16 Precision Planting

- 10.17 Raven

- 10.18 Topcon

- 10.19 Trimble

- 10.20 Yara