|

市场调查报告书

商品编码

1685120

非极化电容器市场机会、成长动力、产业趋势分析与预测 2025 - 2034Non-Polarized Electric Capacitor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

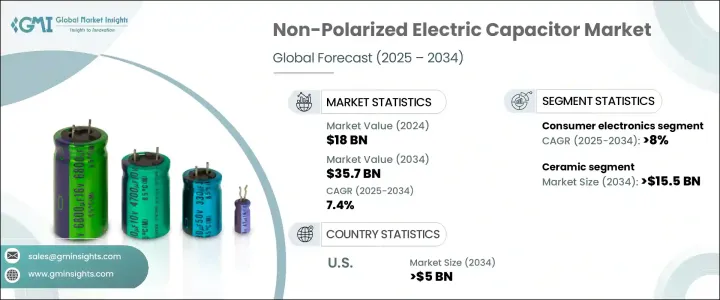

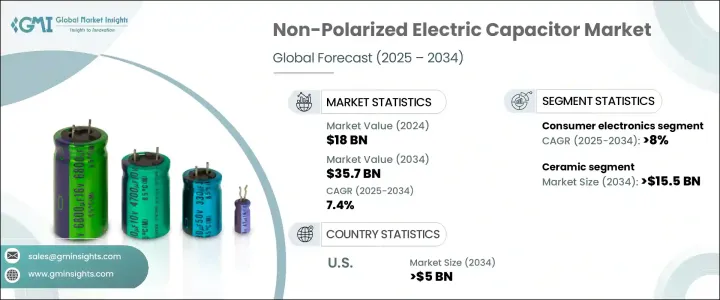

2024 年全球非极化电力电容器市场价值为 180 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 7.4%。随着电容器技术的进步不断改变储能解决方案,这些组件在广泛的电子和电气应用中仍然不可或缺。高容量电容器的需求不断增加,特别是在发展中地区,凸显了它们在现代技术中的重要性。智慧型设备、电动车和再生能源系统的普及加剧了对高效能、可靠和耐用电容器的需求。

电容器是许多应用中不可或缺的一部分,从电源稳定到杂讯过滤和讯号去耦。微处理器和小型化电路的技术突破正在加速采用能够承受高频和高温环境的电容器。随着产业注重永续性和能源效率,製造商正在投资性能更好、寿命更长、可靠性更高的下一代电容器。消费性电子产品、自动化系统和高速资料传输网路的需求激增进一步推动了市场扩张,使得非极化电容器成为商业和工业领域的重要组成部分。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 180亿美元 |

| 预测值 | 357亿美元 |

| 复合年增长率 | 7.4% |

陶瓷非极化电容器市场预计将在 2034 年创造 155 亿美元的市场规模,这得益于其卓越的稳定性、低电感和成本效益。这些电容器提供广泛的电容范围,通常在 1nF 和 30µF 之间,非常适合高频和高温应用。由于其使用寿命长、可靠性高,在汽车、电信和工业应用中广泛使用。随着业界对更高效、更紧凑的电子元件的需求,陶瓷电容器继续成为工程师和製造商的首选,确保市场稳步扩大。

就终端使用产业而言,到 2034 年,消费性电子产业预计将以 8% 的复合年增长率成长,这反映了智慧型手机、可携式运算设备和汽车电子产品对电容器的需求不断增长。 5G网路、人工智慧和先进驾驶辅助系统(ADAS)的兴起提升了电容器在高速资料处理和能源管理中的作用。随着製造商优先考虑创新以提高电容器的效率、耐用性和减小尺寸,消费性电子领域仍然是市场成长的主要驱动力。对于具有更高热稳定性和更大电容的紧凑、轻型电容器的需求正在塑造这个快节奏产业中电子元件的未来。

受消费性电子、汽车和再生能源领域的强劲需求推动,美国非极化电容器市场预计到 2034 年将创收 50 亿美元。向电动车和智慧型设备的转变加剧了在极端条件下高效运行的电容器的需求。产业领导者正在大力投资产品小型化、更高电容和增强热阻,以满足下一代应用不断变化的需求。随着技术的进步,专为提高效率和耐用性而设计的电容器将在推动未来的电子和储能解决方案方面发挥关键作用,确保未来十年的市场持续成长。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 市场估计和预测参数

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 战略展望

- 创新与永续发展格局

第 5 章:市场规模及预测:依资料,2021 – 2034 年

- 主要趋势

- 薄膜电容器

- 陶瓷电容器

- 电解电容器

- 其他的

第 6 章:市场规模与预测:依最终用途,2021 – 2034 年

- 主要趋势

- 消费性电子产品

- 汽车

- 通讯与科技

- 输配电

- 其他的

第 7 章:市场规模及预测:按地区,2021 – 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 奥地利

- 义大利

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

- 智利

第八章:公司简介

- ABB

- Cornell Dubilier

- Elna

- Havells India

- Kemet

- Kyocera AVX Components

- Murata Manufacturing

- Panasonic

- Samsung Electro-Mechanics

- Schneider Electric

- Siemens

- Taiyo Yuden

- TDK

- Vishay Intertechnology

- Wima

- Xuansn Capacitor

The Global Non-Polarized Electric Capacitor Market, valued at USD 18 billion in 2024, is set to experience a CAGR of 7.4% between 2025 and 2034. As advances in capacitor technology continue to transform energy storage solutions, these components remain indispensable across a wide array of electronic and electrical applications. The increasing demand for high-capacitance capacitors, particularly in developing regions, underscores their importance in modern technology. The proliferation of smart devices, electric vehicles, and renewable energy systems has intensified the need for efficient, reliable, and durable capacitors.

Capacitors are integral to numerous applications, from power supply stabilization to noise filtering and signal decoupling. Technological breakthroughs in microprocessors and miniaturized circuits are accelerating the adoption of capacitors that can withstand high-frequency and high-temperature environments. As industries focus on sustainability and energy efficiency, manufacturers are investing in next-generation capacitors with improved performance, longer lifespans, and enhanced reliability. The surge in demand for consumer electronics, automation systems, and high-speed data transmission networks further fuels market expansion, making non-polarized electric capacitors an essential component in both commercial and industrial sectors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $18 Billion |

| Forecast Value | $35.7 Billion |

| CAGR | 7.4% |

The ceramic non-polarized electric capacitor segment is poised to generate USD 15.5 billion by 2034, driven by its superior stability, low inductance, and cost-effectiveness. These capacitors offer a broad capacitance range, typically between 1nF and 30µF, making them ideal for high-frequency and high-temperature applications. Their long lifespan and exceptional reliability have led to widespread adoption in automotive, telecommunications, and industrial applications. As industries demand more efficient and compact electronic components, ceramic capacitors continue to be a preferred choice for engineers and manufacturers, ensuring steady market expansion.

In terms of end-use industries, the consumer electronics sector is expected to grow at a CAGR of 8% through 2034, reflecting the ever-increasing need for capacitors in smartphones, portable computing devices, and automotive electronics. The rise of 5G networks, artificial intelligence, and advanced driver assistance systems (ADAS) has elevated the role of capacitors in high-speed data processing and energy management. With manufacturers prioritizing innovations to enhance capacitor efficiency, durability, and size reduction, the consumer electronics segment remains a major driver of market growth. The demand for compact, lightweight capacitors with improved thermal stability and higher capacitance is shaping the future of electronic components in this fast-paced industry.

The U.S. non-polarized electric capacitor market is projected to generate USD 5 billion by 2034, fueled by strong demand across consumer electronics, automotive, and renewable energy sectors. The transition toward electric vehicles and smart devices has heightened the need for capacitors that operate efficiently under extreme conditions. Industry leaders are investing heavily in product miniaturization, higher capacitance, and enhanced thermal resistance to meet the evolving demands of next-generation applications. As technology advances, capacitors designed for improved efficiency and durability will play a crucial role in powering the future of electronic and energy storage solutions, ensuring sustained market growth over the coming decade.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Material, 2021 – 2034 ('000 Units, USD Billion)

- 5.1 Key trends

- 5.2 Film capacitors

- 5.3 Ceramic capacitors

- 5.4 Electrolytic capacitors

- 5.5 Others

Chapter 6 Market Size and Forecast, By End Use, 2021 – 2034 ('000 Units, USD Billion)

- 6.1 Key trends

- 6.2 Consumer electronics

- 6.3 Automotive

- 6.4 Communications & technology

- 6.5 Transmission & distribution

- 6.6 Others

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 ('000 Units, USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Austria

- 7.3.5 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

- 7.6.3 Chile

Chapter 8 Company Profiles

- 8.1 ABB

- 8.2 Cornell Dubilier

- 8.3 Elna

- 8.4 Havells India

- 8.5 Kemet

- 8.6 Kyocera AVX Components

- 8.7 Murata Manufacturing

- 8.8 Panasonic

- 8.9 Samsung Electro-Mechanics

- 8.10 Schneider Electric

- 8.11 Siemens

- 8.12 Taiyo Yuden

- 8.13 TDK

- 8.14 Vishay Intertechnology

- 8.15 Wima

- 8.16 Xuansn Capacitor