|

市场调查报告书

商品编码

1782146

高压电力电容器市场机会、成长动力、产业趋势分析及2025-2034年预测High Voltage Electric Capacitor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

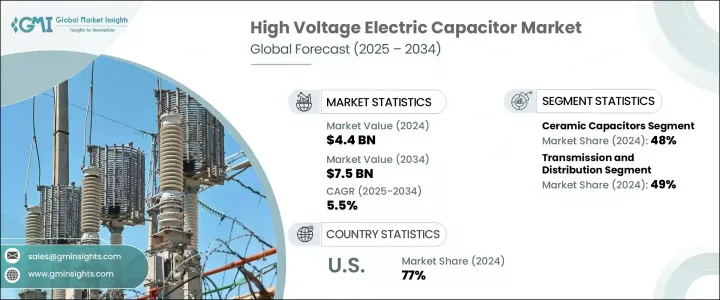

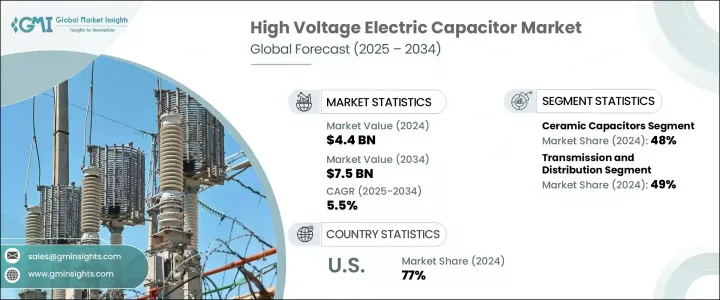

2024年,全球高压电力电容器市场规模达44亿美元,预计2034年将以5.5%的复合年增长率成长,达到75亿美元。由于电力传输、配电系统、储能和功率因数校正等广泛领域对这些元件的依赖日益加深,该市场在全球范围内蓬勃发展。高压电容器已成为确保电压稳定调节、提高电网效率和最大限度降低传输损耗不可或缺的零件。随着电网越来越多地整合太阳能、风能和水力等再生能源,对先进电容器解决方案的需求也日益增长。这些装置具有高耐用性、耐热性和耐压性能,使其成为在105°C以上严苛商业和工业环境中运作的理想选择。

製造商也注重紧凑型设计,以便在空间受限和极端运行条件下提供卓越的效率。这些创新旨在在不影响性能的情况下减少电气系统的整体占地面积,从而提高系统架构和布局的灵活性。紧凑型高压电容器尤其适用于模组化电网组件、移动变电站、海上平台以及其他空间和热管理至关重要的高需求环境。透过优化尺寸与电容的比率,企业正在使工程师和公用事业供应商更容易将这些解决方案整合到先进的电力电子和再生能源装置中。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 44亿美元 |

| 预测值 | 75亿美元 |

| 复合年增长率 | 5.5% |

至2034年,薄膜电容器市场规模将达21亿美元,复合年增长率为5.4%。薄膜电容器的广泛应用得益于其长使用寿命、高热稳定性和低电感,使其在能源电子设备的滤波、功率校正和突波吸收方面具有极高的可靠性。随着能源转型趋势的持续,薄膜电容器正成为清洁能源系统中功率流管理的关键元件,尤其是在用于太阳能和风能併网的逆变器和转换器中。

输配电领域在2024年占据49%的份额,预计到2034年将以5.2%的复合年增长率成长。随着人们越来越关注电网效率和长距离电力传输的稳定性,高性能电容器的需求量也越来越大。这些元件在确保大型输电基础设施的电压稳定性方面发挥着至关重要的作用,尤其是在发展中地区和国家,这些地区和国家正在扩展特高压(UHV)和超高压(EHV)系统,以支援日益增长的电力需求和广阔的地域范围。

2024年,美国高压电力电容器市场占77%的市场份额,产值达6.5亿美元。市场成长主要源自于持续推动老化电网的现代化改造和清洁能源的整合。美国各地的公用事业公司正在大力投资强大的电容器技术,以管理无功功率、提高电压一致性,并增强电网对波动性能源负载的弹性。

活跃于该市场的主要公司包括基美 (Kemet)、村田 (Murata)、松下 (Panasonic)、ABB 和康奈尔杜比利埃 (Cornell Dubilier)。为了提升市场地位,高压电容器产业的公司正专注于产品创新、策略合作伙伴关係和地理扩张。公司专注于开发具有更高耐高温性、更高能量密度和更长使用寿命的先进电容器技术,以支援再生能源併网和智慧电网现代化应用。各公司还在研发方面投入资金,以生产节省空间的高性能产品,满足工业和公用事业领域不断变化的客户需求。建立区域製造部门和服务中心可以缩短交货时间并提供在地化支援。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 策略仪表板

- 策略倡议

- 竞争基准测试

- 创新与技术格局

第五章:市场规模与预测:依资料,2021-2034 年

- 主要趋势

- 薄膜电容器

- 陶瓷电容器

- 电解电容器

- 其他的

第六章:市场规模及预测:依最终用途,2021-2034

- 主要趋势

- 消费性电子产品

- 汽车

- 通讯与科技

- 输配电

- 其他的

第七章:市场规模及预测:依地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 德国

- 义大利

- 奥地利

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 卡达

- 科威特

- 拉丁美洲

- 巴西

- 阿根廷

- 智利

第八章:公司简介

- ABB

- Cornell Dubilier

- Elna

- Havells

- Kemet

- Kyocera AVX

- Murata Manufacturing

- Panasonic

- Samsung Electro-Mechanics

- Schneider Electric

- Siemens

- Taiyo Yuden

- TDK

- Vishay Intertechnology

The Global High Voltage Electric Capacitor Market was valued at USD 4.4 billion in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 7.5 billion by 2034. This market is gaining traction worldwide due to the growing reliance on these components for a wide range of uses, including power transmission, distribution systems, energy storage, and power factor correction. High-voltage capacitors have become indispensable for ensuring consistent voltage regulation, enhancing grid efficiency, and minimizing transmission losses. As power networks increasingly integrate renewable sources like solar, wind, and hydro, demand for advanced capacitor solutions is accelerating. These devices offer high durability, heat resistance, and elevated voltage performance, making them ideal for demanding commercial and industrial environments operating beyond 105°C.

Manufacturers are also focusing on compact designs that deliver superior efficiency in space-constrained and extreme operational conditions. These innovations aim to reduce the overall footprint of electrical systems without compromising performance, allowing for greater flexibility in system architecture and layout. Compact high voltage capacitors are particularly beneficial in modular grid components, mobile substations, offshore platforms, and other high-demand settings where space and thermal management are critical. By optimizing size-to-capacitance ratios, companies are making it easier for engineers and utility providers to integrate these solutions into advanced power electronics and renewable installations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.4 Billion |

| Forecast Value | $7.5 Billion |

| CAGR | 5.5% |

The film capacitors segment will reach USD 2.1 billion by 2034, growing at a 5.4% CAGR. Their widespread use is attributed to their long service life, strong thermal stability, and low inductance, making them highly reliable for filtering, power correction, and surge absorption in energy electronics. As energy transition trends continue, film capacitors are becoming a critical component in managing power flow in clean energy systems, especially within inverters and converters for solar and wind grid integration.

The transmission and distribution segment held a 49% share in 2024 and is forecast to grow at a CAGR of 5.2% through 2034. With the growing focus on grid efficiency and consistent power delivery over long distances, high-performance capacitors are in high demand. These components play a vital role in ensuring voltage stability across vast transmission infrastructures, especially in developing regions and nations expanding ultra-high voltage (UHV) and extra-high voltage (EHV) systems to support increasing electricity needs and wide territorial spans.

U.S. High Voltage Electric Capacitor Market held 77% share in 2024, generating USD 650 million. Growth is primarily driven by ongoing efforts to modernize the aging electric grid and increase the integration of cleaner energy sources. Utilities across the U.S. are investing heavily in robust capacitor technologies to manage reactive power, improve voltage consistency, and enhance grid resilience in response to fluctuating energy loads.

Key companies active in the market include Kemet, Murata, Panasonic, ABB, and Cornell Dubilier. To enhance their market positioning, companies in the high voltage electric capacitor sector are focusing on product innovation, strategic partnerships, and geographic expansion. Emphasis is being placed on developing advanced capacitor technologies with higher temperature resistance, better energy density, and longer service life to support applications in renewable integration and smart grid modernization. Firms are also investing in R&D to manufacture space-efficient, high-performance products that meet evolving customer demands in industrial and utility sectors. Establishing regional manufacturing units and service centers allows for reduced delivery times and localized support.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategy dashboard

- 4.4 Strategic initiative

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Material, 2021 - 2034, ('000 Units and USD Billion)

- 5.1 Key trends

- 5.2 Film capacitors

- 5.3 Ceramic capacitors

- 5.4 Electrolytic capacitors

- 5.5 Others

Chapter 6 Market Size and Forecast, By End Use, 2021 - 2034, ('000 Units and USD Billion)

- 6.1 Key trends

- 6.2 Consumer electronics

- 6.3 Automotive

- 6.4 Communication & technology

- 6.5 Transmission & distribution

- 6.6 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034, ('000 Units and USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 France

- 7.3.3 Germany

- 7.3.4 Italy

- 7.3.5 Austria

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Qatar

- 7.5.4 Kuwait

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

- 7.6.3 Chile

Chapter 8 Company Profiles

- 8.1 ABB

- 8.2 Cornell Dubilier

- 8.3 Elna

- 8.4 Havells

- 8.5 Kemet

- 8.6 Kyocera AVX

- 8.7 Murata Manufacturing

- 8.8 Panasonic

- 8.9 Samsung Electro-Mechanics

- 8.10 Schneider Electric

- 8.11 Siemens

- 8.12 Taiyo Yuden

- 8.13 TDK

- 8.14 Vishay Intertechnology