|

市场调查报告书

商品编码

1797853

中压电力电容器市场机会、成长动力、产业趋势分析及2025-2034年预测Medium Voltage Electric Capacitor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

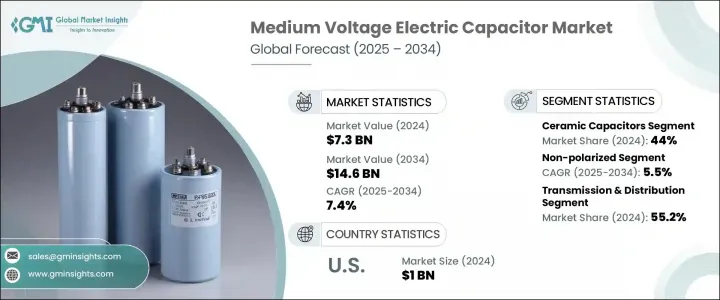

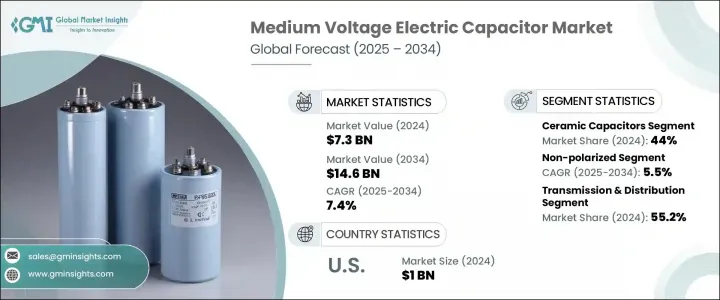

2024年,全球中压电力电容器市场规模达73亿美元,预计2034年将以7.4%的复合年增长率成长,达到146亿美元。公共和私营部门的持续投资,以及再生能源快速融入中压电网,共同推动了这一成长。然而,再生能源的间歇性带来了电压波动和不稳定等挑战。中压电容器透过提供无功功率支援、稳定电压等级和提高整体电能质量,有助于缓解这些问题。

随着老化电网亟待现代化改造,公用事业公司正大力投资升级基础设施,包括安装或更换电容器组。这些电容器有助于减少电力损耗,改善大面积电压调节,防止断电,同时提升服务品质。日益增长的电力需求,尤其是工业化和大型机械的推动,进一步刺激了市场发展。此外,随着能源效率标准和电网性能法规日益严格,公用事业公司面临最大限度降低输电损耗和优化营运的压力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 73亿美元 |

| 预测值 | 146亿美元 |

| 复合年增长率 | 7.4% |

陶瓷电容器在2024年的市占率为44%,预计到2034年将继续以5%的复合年增长率成长。这些电容器主要用于中压应用,例如高频滤波、抑制缓衝电路中的电压尖峰以及感测应用。它们能够以紧凑的形式管理高压,使其成为各种应用的首选,儘管它们不适用于高能量储存和连续功率处理。来自私营部门和公共部门的持续投资正在推动对陶瓷电容器的需求,从而推动其市场份额的不断增长。

预计到2034年,非极化电容器市场的复合年增长率将达到5.5%。这些电容器由于能够使用交流电,在公用电网、工业马达和智慧电网基础设施中不可或缺。全球电网现代化的兴起和再生能源的整合是非极化电容器市场成长的关键驱动力。其耐用性、耐高压性以及在多种应用中的多功能性巩固了其作为中压电力系统中可靠且必不可少的组件的地位。

美国中压电力电容器市场占74%的市场份额,2024年市场规模达10亿美元。受电网现代化项目、再生能源併网以及电动汽车基础设施建设的大规模投资推动,美国正经历显着的成长。技术进步和强大的国内製造能力巩固了美国在中压电力电容器市场的主导地位。此外,政府推广风能和太阳能的政策也进一步刺激了需求,因为电容器对于稳定电网免受再生能源波动的影响至关重要。

中压电力电容器市场的一些领先公司包括施耐德电气、西门子、日立能源有限公司、康奈尔杜比利埃、松下公司、基美公司和京瓷 AVX 组件公司等。在中压电力电容器市场营运的公司采用各种策略来加强其影响力。一个关键方法是不断创新电容器技术,特别是在提高性能、效率和耐用性方面。为了满足日益增长的需求,各公司也在扩大其产品组合,重点是采用适用于高频应用和工业用途的陶瓷和非极化电容器等材料。与公用事业、政府和其他基础设施参与者建立策略合作伙伴关係对于确保将电容器整合到电网现代化专案中也至关重要。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 科技趋势

- 智慧电网整合与数位化

- 高能量密度电容器创新

- 模组化多电平换流器应用

- 监管格局

- 产业衝击力

- 进出口贸易分析

- 价格趋势分析

- 按材质

- 按地理位置

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 策略倡议

- 竞争基准测试

- 战略仪表板

- 创新与技术格局

第五章:市场规模及预测:依资料,2021 - 2034 年

- 主要趋势

- 薄膜电容器

- 陶瓷电容器

- 电解电容器

- 其他的

第六章:市场规模及预测:依极化,2021 - 2034

- 主要趋势

- 偏振

- 非偏振

第七章:市场规模及预测:依最终用途,2021 - 2034

- 主要趋势

- 消费性电子产品

- 汽车

- 通讯与科技

- 输配电

- 其他的

第八章:市场规模及预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 奥地利

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第九章:公司简介

- Cornell Dubilier

- Circutor

- ELNA CO., LTD.

- Eaton Corporation

- Havells India Ltd.

- Hitachi Energy Ltd

- KEMET Corporation

- KYOCERA AVX Components Corporation

- Murata Manufacturing Co., Ltd.

- Panasonic Corporation

- SAMSUNG ELECTRO-MECHANICS

- Schneider Electric

- Siemens

- TAIYO YUDEN CO., LTD.

- TDK Corporation

- Vishay Intertechnology, Inc.

- UNITED CHEMI-CON

- WIMA GmbH & Co. KG

- Xuansn Capacitor

- ZONKAS ELECTRONIC CO., LTD

The Global Medium Voltage Electric Capacitor Market was valued at USD 7.3 billion in 2024 and is estimated to grow at a CAGR of 7.4% to reach USD 14.6 billion by 2034. This growth is fueled by continuous investments from both public and private sectors, along with the rapid expansion of renewable energy sources being integrated into the medium-voltage grid. However, the intermittent nature of renewable energy introduces challenges like voltage fluctuations and instability. Medium-voltage capacitors help mitigate these issues by providing reactive power support, stabilizing voltage levels, and improving overall power quality.

With aging power grids in need of modernization, utilities are investing heavily in upgrading infrastructure, including installing or replacing capacitor banks. These capacitors help reduce power losses, improve voltage regulation over vast areas, and prevent outages, all while enhancing service quality. The increasing electricity demand, particularly driven by industrialization and large-scale machinery, has further boosted the market. Additionally, as energy efficiency standards and grid performance regulations become more stringent, utilities are under pressure to minimize transmission losses and optimize their operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.3 Billion |

| Forecast Value | $14.6 Billion |

| CAGR | 7.4% |

Ceramic capacitors held a 44% share in 2024, and they are expected to continue growing at a CAGR of 5% through 2034. These capacitors are primarily used in medium-voltage applications for high-frequency filtering, suppressing voltage spikes in snubber circuits, and sensing applications. Their ability to manage high voltages in compact forms makes them a go-to choice for various applications, though they are not suitable for high-energy storage and continuous power handling. The ongoing investments from both private and public sectors are driving the demand for ceramic capacitors, contributing to their increasing share in the market.

The non-polarized segment is expected to grow at a CAGR of 5.5% through 2034. These capacitors are indispensable in utility grids, industrial motors, and smart grid infrastructure due to their ability to operate with alternating current. The rise in global grid modernization and the integration of renewable energy sources are key drivers for the growth of the non-polarized capacitor market. Their durability, high voltage tolerance, and versatility across multiple applications have solidified their position as a reliable and essential component in medium voltage electric systems.

U.S. Medium Voltage Electric Capacitor Market held 74% share and generated USD 1 billion in 2024. The country is witnessing significant growth driven by large-scale investments in grid modernization projects, renewable energy integration, and the development of electric vehicle infrastructure. Technological advancements and strong domestic manufacturing capabilities have solidified the U.S. as a dominant player in the medium voltage electric capacitor market. Additionally, government policies promoting wind and solar energy have further fueled demand, as capacitors are crucial for stabilizing the grid against the fluctuations caused by renewable energy sources.

Some of the leading companies in the Medium Voltage Electric Capacitor Market include Schneider Electric, Siemens, Hitachi Energy Ltd, Cornell Dubilier, Panasonic Corporation, KEMET Corporation, and KYOCERA AVX Components Corporation, among others. Companies operating in the medium voltage electric capacitor market employ a variety of strategies to strengthen their presence. One key approach is ongoing innovation in capacitor technology, particularly in terms of enhancing performance, efficiency, and durability. To cater to the growing demand, companies are also expanding their product portfolios, with a focus on incorporating materials like ceramic and non-polarized capacitors that are suitable for high-frequency applications and industrial uses. Strategic partnerships with utilities, governments, and other infrastructure players are also critical in ensuring the integration of capacitors into grid modernization projects.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.1.1 Business trends

- 2.1.2 Material trends

- 2.1.3 Polarization trends

- 2.1.4 End use trends

- 2.1.5 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Technology trend

- 3.2.1 Smart grid integration and digitalization

- 3.2.2 High-energy density capacitor innovation

- 3.2.3 Modular multilevel converter application

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.5 Import/export trade analysis

- 3.6 Price trend analysis

- 3.6.1 By material

- 3.6.2 By geography

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.8.1 Bargaining power of suppliers

- 3.8.2 Bargaining power of buyers

- 3.8.3 Threat of new entrants

- 3.8.4 Threat of substitutes

- 3.9 PESTEL analysis

- 3.9.1 Political factors

- 3.9.2 Economic factors

- 3.9.3 Social factors

- 3.9.4 Technological factors

- 3.9.5 Environmental factors

- 3.9.6 Legal factors

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiative

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Material, 2021 - 2034 (Thousand Units, USD Billion)

- 5.1 Key trends

- 5.2 Film capacitors

- 5.3 Ceramic capacitors

- 5.4 Electrolytic capacitors

- 5.5 Others

Chapter 6 Market Size and Forecast, By Polarization, 2021 - 2034 (Thousand Units, USD Billion)

- 6.1 Key trends

- 6.2 Polarized

- 6.3 Non-Polarized

Chapter 7 Market Size and Forecast, By End Use, 2021 - 2034 (Thousand Units, USD Billion)

- 7.1 Key trends

- 7.2 Consumer electronics

- 7.3 Automotive

- 7.4 Communications & technology

- 7.5 Transmission & distribution

- 7.6 Others

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (Thousand Units, USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Austria

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 India

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 Cornell Dubilier

- 9.2 Circutor

- 9.3 ELNA CO., LTD.

- 9.4 Eaton Corporation

- 9.5 Havells India Ltd.

- 9.6 Hitachi Energy Ltd

- 9.7 KEMET Corporation

- 9.8 KYOCERA AVX Components Corporation

- 9.9 Murata Manufacturing Co., Ltd.

- 9.10 Panasonic Corporation

- 9.11 SAMSUNG ELECTRO-MECHANICS

- 9.12 Schneider Electric

- 9.13 Siemens

- 9.14 TAIYO YUDEN CO., LTD.

- 9.15 TDK Corporation

- 9.16 Vishay Intertechnology, Inc.

- 9.17 UNITED CHEMI-CON

- 9.18 WIMA GmbH & Co. KG

- 9.19 Xuansn Capacitor

- 9.20 ZONKAS ELECTRONIC CO., LTD