|

市场调查报告书

商品编码

1755337

极化电容器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Polarized Electric Capacitor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

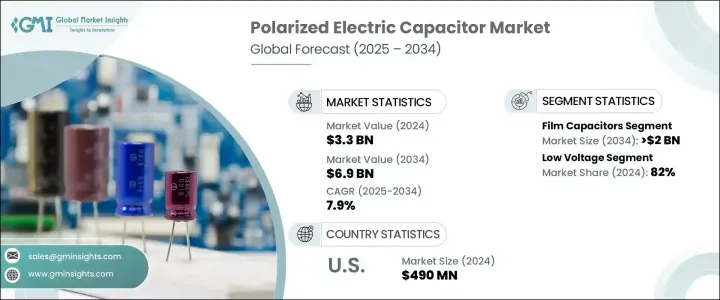

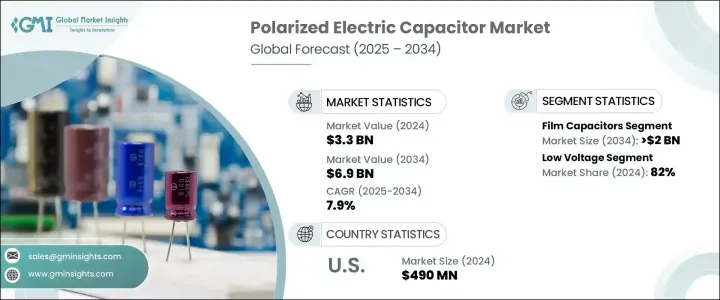

2024年,全球极化电容器市场规模达33亿美元,预计到2034年将以7.9%的复合年增长率成长,达到69亿美元,这得益于电动车 (EV)、再生能源系统和智慧连网设备的日益普及。由于这些产业对更可靠、能量密度更高、储能体积比更有效率的电容器的需求,市场规模持续扩张。电子设备技术的快速进步,使得极化电容器在储能、电压调节和讯号滤波方面发挥至关重要的作用,也增加了对这些元件的需求。

随着微型化和永续性趋势的日益突出,对更大容量、更小尺寸电容器的需求激增。电容器技术也取得了进步,其热稳定性更高、使用寿命更长,并且采用了环保材料。这使得它们在汽车等行业中得到了更广泛的应用,尤其是在电动车和混合动力车 (HEV) 领域,电容器在这些领域中对于功率调节和储能至关重要。此外,工业自动化以及对高性能电容器的需求也推动了市场的发展。物联网 (IoT) 在工业环境中的兴起,使得设备在功率负载波动和极端温度的环境中运行,这推动了对电容器的需求,这些电容器需要能够承受此类条件并确保可靠的性能。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 33亿美元 |

| 预测值 | 69亿美元 |

| 复合年增长率 | 7.9% |

预计到2034年,薄膜电容器市场规模将达到20亿美元,这得益于再生能源、汽车、消费性电子和工业自动化等产业的旺盛需求。薄膜电容器以其卓越的电气性能(例如高绝缘电阻以及在广泛温度和频率范围内的稳定性)而闻名,在现代电子产品中至关重要。

预计低压电容器将占据市场主导地位,市占率达82%,到2034年成长率为8%。对紧凑高效设计中储能、稳压和滤波的需求日益增长,进一步推动了该领域的扩张。同时,随着风能、太阳能等再生能源系统以及电网现代化改造,各种功率调节应用中都需要电容器进行功率因数校正和电压平滑处理,对中压电容器的需求也不断增长。

受自动化、智慧製造和机器人技术进步的推动,美国极化电容器市场在2024年的价值达到4.9亿美元。这些技术进步需要能够在严苛环境下运作并承受高电气应力的耐用电容器。这些电容器对于工业应用至关重要,包括马达驱动器、可程式逻辑控制器 (PLC) 和工厂中的电源转换器。

全球极化电容器产业的主要参与者包括:KEMET 公司、Murata Manufacturing、TDK Corporation、Panasonic Corporation、Vishay Intertechnology、西门子、ABB、Cornell Dubilier、施耐德电气、WIMA GmbH、SAMSUNG ELECTRO-MECHANICS、KYOCERA AVX、HaveEN、Ijuan、HaveEN、Ijuan、X、HaveEN、Ajuan、HaveEN、Ijuan、X、HaveEN、Ajuan、Hacers、TAX、uanX、HaveEN、Ijuan、Huan、TAX.极化电容器产业的公司专注于创新、技术改进和扩大产品供应。製造商正在投资开发具有增强热稳定性和更长使用寿命的电容器,以满足高性能应用的需求。公司采用环保材料以顺应永续发展趋势,这是消费者和监管机构的要求。许多参与者也在改进其生产技术,以实现更紧凑、更有效率的电容器设计,从而允许整合到更小的设备中而不会牺牲性能。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率

- 战略仪表板

- 策略倡议

- 竞争基准测试

- 创新与技术格局

第五章:市场规模与预测:依资料,2021-2034 年

- 主要趋势

- 薄膜电容器

- 陶瓷电容器

- 电解电容器

- 其他的

第六章:市场规模及预测:按电压,2021 - 2034

- 主要趋势

- 低的

- 中等的

- 高的

第七章:市场规模及预测:依最终用途,2021-2034

- 主要趋势

- 消费性电子产品

- 汽车

- 通讯与科技

- 输配电

- 其他的

第八章:市场规模及预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 德国

- 义大利

- 奥地利

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第九章:公司简介

- ABB

- Cornell Dubilier

- ELNA

- Havells

- KEMET Corporation

- KYOCERA AVX

- Murata Manufacturing

- Panasonic Corporation

- SAMSUNG ELECTRO-MECHANICS

- Schneider Electric

- Siemens

- TAIYO YUDEN

- TDK Corporation

- Vishay Intertechnology

- WIMA GmbH

- Xuansn Capacitor

The Global Polarized Electric Capacitor Market was valued at USD 3.3 billion in 2024 and is estimated to grow at a CAGR of 7.9% to reach USD 6.9 billion by 2034, driven by the rising adoption of electric vehicles (EVs), renewable energy systems, and smart connected devices. As these sectors demand more reliable capacitors with higher energy density and efficient energy storage-to-volume ratios, the market continues to expand. The rapid technological advancements in electronic devices, where polarized capacitors play a crucial role in energy storage, voltage regulation, and signal filtering, have increased demand for these components.

The need for capacitors with larger capacities in smaller form factors has surged as the trend toward miniaturization and sustainability becomes more prominent. Capacitor technology has also advanced to offer improved thermal stability, longer operational lifespans, and environmentally friendly materials. This has led to their wider application in industries like automotive, particularly in EVs and hybrid electric vehicles (HEVs), where capacitors are essential for power conditioning and energy storage. Moreover, industrial automation, alongside the demand for high-performance capacitors, is contributing to the market's momentum. The rise of the Internet of Things (IoT) in industrial settings, where devices operate in environments with fluctuating power loads and extreme temperatures, is driving the need for capacitors to withstand such conditions while ensuring reliable performance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.3 Billion |

| Forecast Value | $6.9 Billion |

| CAGR | 7.9% |

The film capacitor segment is expected to generate USD 2 billion by 2034, driven by high demand across industries like renewable energy, automotive, consumer electronics, and industrial automation. Known for their exceptional electrical properties such as high insulation resistance and stability over a wide range of temperatures and frequencies, film capacitors are vital in modern electronics.

The low voltage segment is anticipated to dominate the market, with a share of 82% and a growth rate of 8% through 2034. The increasing need for energy storage, voltage stabilization, and filtering in compact, efficient designs is further fueling this segment's expansion. In parallel, the demand for medium voltage capacitors is rising as renewable energy systems such as wind and solar power and grid modernization require capacitors for power factor correction and voltage smoothing in various power conditioning applications.

United States Polarized Electric Capacitor Market was valued at USD 490 million in 2024 driven by technological advancements in automation, smart manufacturing, and robotics, which require durable capacitors capable of operating in challenging environments and withstanding high electrical stress. These capacitors are crucial for industrial applications, including motor drives, programmable logic controllers (PLCs), and power converters in industrial plants.

Key players in the Global Polarized Electric Capacitor Industry include: KEMET Corporation, Murata Manufacturing, TDK Corporation, Panasonic Corporation, Vishay Intertechnology, Siemens, ABB, Cornell Dubilier, Schneider Electric, WIMA GmbH, SAMSUNG ELECTRO-MECHANICS, KYOCERA AVX, Havells, TAIYO YUDEN, ELNA, Xuansn Capacitor. Companies in the polarized electric capacitor industry focus on innovation, technological improvements, and expanding their product offerings. Manufacturers are investing in developing capacitors with enhanced thermal stability and longer operational lifespans to meet the needs of high-performance applications. Companies incorporate environmentally friendly materials to align with sustainability trends, which is demanded by consumers and regulatory bodies. Many players are also advancing their production techniques to achieve more compact and efficient capacitor designs, allowing integration into smaller devices without sacrificing performance.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share

- 4.3 Strategic dashboard

- 4.4 Strategic initiative

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Material, 2021 - 2034, (USD Million, '000 Units)

- 5.1 Key trends

- 5.2 Film capacitors

- 5.3 Ceramic capacitor

- 5.4 Electrolytic capacitor

- 5.5 Others

Chapter 6 Market Size and Forecast, By Voltage, 2021 - 2034, (USD Million, '000 Units)

- 6.1 Key trends

- 6.2 Low

- 6.3 Medium

- 6.4 High

Chapter 7 Market Size and Forecast, By End Use, 2021 - 2034, (USD Million, '000 Units)

- 7.1 Key trends

- 7.2 Consumer electronics

- 7.3 Automotive

- 7.4 Communications & technology

- 7.5 Transmission & distribution

- 7.6 Others

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034, (USD Million, '000 Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 France

- 8.3.3 Germany

- 8.3.4 Italy

- 8.3.5 Austria

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 Cornell Dubilier

- 9.3 ELNA

- 9.4 Havells

- 9.5 KEMET Corporation

- 9.6 KYOCERA AVX

- 9.7 Murata Manufacturing

- 9.8 Panasonic Corporation

- 9.9 SAMSUNG ELECTRO-MECHANICS

- 9.10 Schneider Electric

- 9.11 Siemens

- 9.12 TAIYO YUDEN

- 9.13 TDK Corporation

- 9.14 Vishay Intertechnology

- 9.15 WIMA GmbH

- 9.16 Xuansn Capacitor