|

市场调查报告书

商品编码

1698268

电动商用车牵引马达市场机会、成长动力、产业趋势分析及2025-2034年预测Electric Commercial Vehicle Traction Motor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

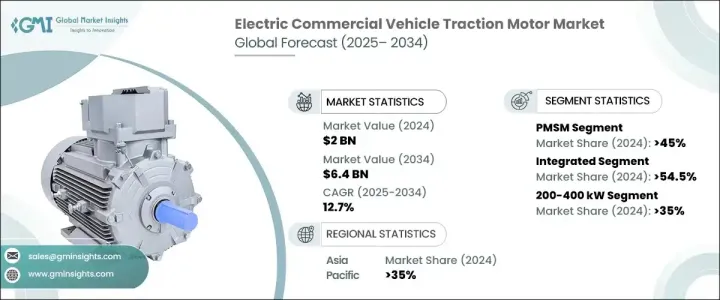

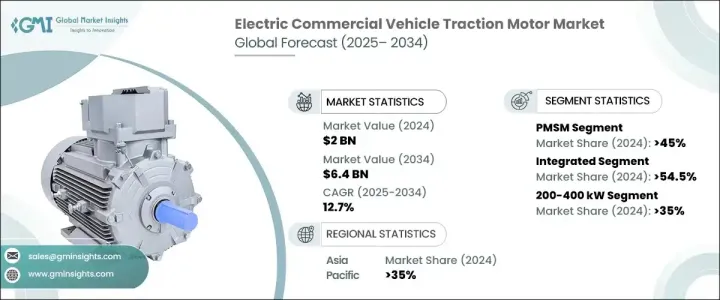

2024 年全球电动商用车牵引马达市场价值 20 亿美元,预计 2025 年至 2034 年的复合年增长率为 12.7%。在效率、耐用性和性能进步的推动下,该行业正在快速发展。新兴电机技术,包括永磁同步电机 (PMSM)、开关磁阻电机 (SRM) 和横向磁通电机,正在提高能量输出,同时最大限度地减少浪费。配备先进冷却系统的碳化硅 (SiC) 逆变器进一步优化了能源使用、延长了行驶里程并提高了整体性能。轻质材料和紧凑的设计提高了扭矩密度,使马达成为重型商用车的理想选择。同时,快速充电基础设施和电池效率的发展正在提高电动卡车和巴士在城市和长途应用中的实用性。充电站数量的增加大大减少了车队营运商的等待时间。

电动商用车牵引马达市场按马达类型、车轴结构、车辆类别和额定功率进行细分。 PMSM凭藉其高能源效率、紧凑的结构和卓越的功率输出,将在2024年占总收入的45%以上。这些电机具有出色的扭矩密度和再生製动,使其成为电动卡车和公共汽车的首选。在车轴架构的基础上,整合式电子车轴在 2024 年占据 54.5% 的收入份额,引领市场。这些系统将马达、逆变器和变速箱整合到一个单元中,从而减轻了重量,提高了能源效率,并优化了电动卡车和货车内的空间。中央驱动装置对于高扭矩和耐用性至关重要的重型应用来说仍然至关重要。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 20亿美元 |

| 预测值 | 64亿美元 |

| 复合年增长率 | 12.7% |

按车辆类别划分,受严格的排放法规和车队电气化程度不断提高的推动,中型和重型卡车将在 2024 年占据市场主导地位。这些卡车需要强大的高扭矩牵引电机,以在高负载下保持效率。先进的热管理和模组化马达设计进一步提高了可靠性并降低了整体拥有成本。随着采用率的提高,製造商正在开发可扩展的马达平台,以实现与各个商用电动车领域的无缝整合。

根据额定功率,200-400 kW 部分在 2024 年占据最大份额,贡献总收入的 35% 以上。该系列电机非常适合长途电动卡车和公共汽车,支援永续物流和货运。 100kW以下马达主要服务于小型电动厢型车和城市配送车,而100-200kW马达则广泛应用于轻型和中型卡车。 400 kW 以上的等级专门用于高性能应用,包括氢燃料电池汽车和电动采矿卡车。

2024年,亚太地区占据最大的市场份额,占全球产业的35%以上。中国成为主导者,预计到 2034 年将达到 18 亿美元,这得益于政策激励、技术进步以及其在电池和稀土材料生产方面的优势。

目录

第一章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 马达製造商

- 电池供应商

- 原始设备製造商

- 电力电子供应商

- 充电基础设施供应商

- 供应商格局

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻和倡议

- 新创企业融资分析

- 监管格局

- 衝击力

- 成长动力

- 电动商用车(ECVS)的普及率不断上升

- 严格的排放法规与永续发展目标

- 马达效率和技术的进步

- 充电基础设施的扩展和电池的进步

- 产业陷阱与挑战

- 车队营运商的初始成本高且投资回报率有限

- 供应炼和原料限制

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按汽车,2021 - 2034 年

- 主要趋势

- 交流感应电机

- 永磁同步马达(PMSM)

- 开关磁阻马达(SRM)

- 直流马达

第六章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 皮卡车

- 中型和重型卡车

- 货车

- 公车

第七章:市场估计与预测:依功率等级,2021 年至 2034 年

- 主要趋势

- 小于100千瓦

- 100-200千瓦

- 200-400千瓦

- 400度以上

第八章:市场估计与预测:按车桥架构,2021 - 2034 年

- 主要趋势

- 融合的

- 中央驱动单元

第九章:市场估计与预测:依传输方式,2021 - 2034 年

- 主要趋势

- 单速驱动

- 多速驱动

第十章:市场估计与预测:依设计,2021 - 2034 年

- 主要趋势

- 径向通量

- 轴向通量

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十二章:公司简介

- ABB

- Allison Transmission

- BorgWarner

- Bosch

- Continental

- Dana

- Danfoss Editron

- General Electric

- Hitachi Automotive

- Magna

- Mitsubishi Electric

- Nidec

- Siemens

- Skoda Transportation

- Toshiba

- Valeo

- Wabtec

- Wolong Electric

- Yaskawa Electric

- ZF

The Global Electric Commercial Vehicle Traction Motor Market was valued at USD 2 billion in 2024 and is projected to grow at a CAGR of 12.7% from 2025 to 2034. The industry is rapidly evolving, driven by advancements in efficiency, durability, and performance. Emerging motor technologies, including permanent magnet synchronous motors (PMSM), switched reluctance motors (SRM), and lateral flux motors, are enhancing energy output while minimizing waste. Silicon carbide (SiC) inverters with advanced cooling systems are further optimizing energy use, extending driving range, and improving overall performance. Lightweight materials and compact designs are increasing torque density, making motors ideal for heavy-duty commercial vehicles. Meanwhile, developments in fast-charging infrastructure and battery efficiency are improving the practicality of electric trucks and buses for both urban and long-haul applications. The increasing number of charging stations is significantly reducing wait times for fleet operators.

The electric commercial vehicle traction motor market is segmented by motor type, axle architecture, vehicle category, and power rating. PMSM accounted for over 45% of total revenue in 2024 due to its high energy efficiency, compact structure, and superior power output. These motors offer excellent torque density and regenerative braking, making them the preferred choice for electric trucks and buses. On the basis of axle architecture, integrated e-axles led the market with a 54.5% revenue share in 2024. These systems integrate motors, inverters, and transmissions into a single unit, reducing weight, increasing energy efficiency, and optimizing space within electric trucks and vans. Central drive units remain essential for heavy-duty applications where high torque and durability are critical.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2 Billion |

| Forecast Value | $6.4 Billion |

| CAGR | 12.7% |

By vehicle category, medium and heavy-duty trucks dominated the market in 2024, driven by strict emissions regulations and increasing fleet electrification. These trucks require powerful, high-torque traction motors that maintain efficiency under demanding loads. Advanced thermal management and modular motor designs are further improving reliability and reducing the total cost of ownership. As adoption grows, manufacturers are developing scalable motor platforms for seamless integration across various commercial EV segments.

Based on power rating, the 200-400 kW segment held the largest share in 2024, contributing over 35% of total revenue. Motors in this range are ideal for long-haul electric trucks and buses, supporting sustainable logistics and freight transport. Motors below 100 kW primarily serve compact electric vans and urban delivery vehicles, while 100-200 kW motors are widely used in light and medium-duty trucks. The above 400 kW category is reserved for high-performance applications, including hydrogen fuel cell-powered vehicles and electric mining trucks.

The Asia Pacific region held the largest share of the market in 2024, accounting for over 35% of the global industry. China emerged as the dominant player, projected to reach USD 1.8 billion by 2034, fueled by policy incentives, technological advancements, and its stronghold in battery and rare-earth material production.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Motor manufacturers

- 3.1.2 Battery suppliers

- 3.1.3 OEMs

- 3.1.4 Power electronics suppliers

- 3.1.5 Charging infrastructure providers

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Startup funding analysis

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising adoption of electric commercial vehicles (ECVS)

- 3.9.1.2 Stringent emission regulations & sustainability goals

- 3.9.1.3 Advancements in motor efficiency & technology

- 3.9.1.4 Expansion of charging infrastructure & battery advancements

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High initial cost & limited ROI for fleet operators

- 3.9.2.2 Supply chain & raw material constraints

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Motor, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 AC induction motors

- 5.3 Permanent magnet synchronous motors (PMSM)

- 5.4 Switched reluctance motors (SRM)

- 5.5 DC motors

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Pickups trucks

- 6.3 Medium and heavy-duty trucks

- 6.4 Vans

- 6.5 Buses

Chapter 7 Market Estimates & Forecast, By Power Rating, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Less than 100 kW

- 7.3 100-200 kW

- 7.4 200-400 kW

- 7.5 Above 400 kW

Chapter 8 Market Estimates & Forecast, By Axle Architecture, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Integrated

- 8.3 Central drive unit

Chapter 9 Market Estimates & Forecast, By Transmission, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Single-speed drive

- 9.3 Multi-speed drive

Chapter 10 Market Estimates & Forecast, By Design, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 Radial flux

- 10.3 Axial flux

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 South Africa

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 ABB

- 12.2 Allison Transmission

- 12.3 BorgWarner

- 12.4 Bosch

- 12.5 Continental

- 12.6 Dana

- 12.7 Danfoss Editron

- 12.8 General Electric

- 12.9 Hitachi Automotive

- 12.10 Magna

- 12.11 Mitsubishi Electric

- 12.12 Nidec

- 12.13 Siemens

- 12.14 Skoda Transportation

- 12.15 Toshiba

- 12.16 Valeo

- 12.17 Wabtec

- 12.18 Wolong Electric

- 12.19 Yaskawa Electric

- 12.20 ZF