|

市场调查报告书

商品编码

1698308

灾难性抗磷脂症候群市场机会、成长动力、产业趋势分析及 2025-2034 年预测Catastrophic Antiphospholipid Syndrome Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

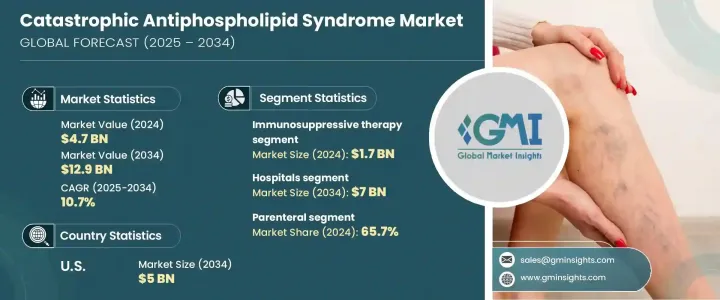

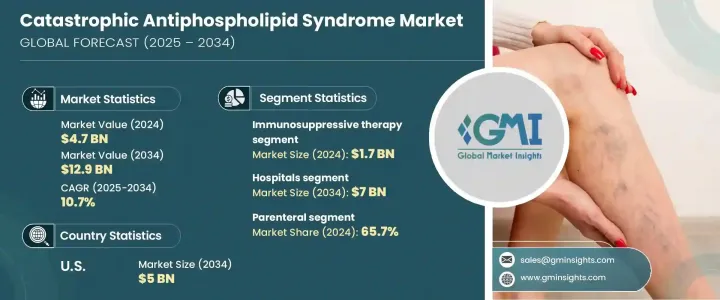

2024 年全球灾难性抗磷脂症候群市场价值为 47 亿美元,预计 2025 年至 2034 年的复合年增长率为 10.7%。市场发展的驱动力在于自体免疫疾病盛行率的上升以及人们对 CAPS(一种危及生命的抗磷脂症候群 (APS) 变异体)认识的不断提高。诊断技术的进步正在增强早期疾病的检测能力,增加对有效治疗的需求。政府和私部门的研究经费正在进一步加速新疗法的发展。

CAPS,也称为阿什森综合征,是一种严重的自体免疫疾病,其特征是影响多个器官的快速血栓事件。由于这种疾病的复杂性,治疗方法多种多样,通常包括抗凝血、皮质类固醇、血浆置换和其他免疫抑制疗法。市场按治疗类型、给药途径和最终用途设置进行细分。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 47亿美元 |

| 预测值 | 129亿美元 |

| 复合年增长率 | 10.7% |

在治疗方法中,免疫抑制疗法仍占主导地位,2022 年的价值为 14 亿美元,预计 2024 年将达到 17 亿美元。这些药物通常与抗凝血剂和皮质类固醇联合使用,对于改善患者的预后至关重要。越来越多的临床证据支持免疫抑制疗法的有效性,从而增强了市场需求。此外,美国 FDA 和 EMA 等监管机构对孤儿药的指定正在促进免疫抑制治疗的采用,包括环磷酰胺、利妥昔单抗和皮质类固醇。

市场根据给药途径进一步分类,其中肠外治疗占据主导地位,到 2024 年将占据 65.7% 的市场份额。预计在预测期内,该细分市场的复合年增长率将达到 10.6%。 CAPS 的严重性需要立即进行医疗干预,而肠外给药由于其快速的治疗效果而成为首选。透过肠外给药方式使用利妥昔单抗和依库珠单抗等生物疗法的现像日益增多,进一步加强了市场的成长。输液帮浦和预充式註射器等药物输送系统的创新正在提高治疗效果并扩大应用。

就最终用途而言,医院是最大的部分,预计到 2034 年将达到 70 亿美元,复合年增长率为 10.5%。医院配备了先进的诊断和治疗设备,使其成为 CAPS 管理的主要中心。医疗保健支出的增加和医院基础设施的改善正在推动这一领域的成长。此外,医院经常与製药公司和研究机构合作,促进临床试验,为患者提供先进的治疗方法。医院中专业风湿病专家的不断增加进一步促进了市场的扩大。

光是美国市场在 2024 年就创造了 19 亿美元的收入,预计到 2034 年将达到 50 亿美元。该国自体免疫疾病病例的不断增加推动了对更好治疗方案的需求。研究投入的增加和现代诊断系统的采用正在加速市场扩大。医疗保健专业人员对华法林和肝素等抗凝血剂的使用日益增多也支持了市场的成长。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 自体免疫疾病盛行率不断上升

- 诊断和治疗技术的进步

- 灾难性抗磷脂症候群(CAPS)的认识不断提高

- 医疗支出增加

- 产业陷阱与挑战

- 治疗费用高

- 专科治疗有限

- 成长动力

- 成长潜力分析

- 监管格局

- 未来市场趋势

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依治疗方式,2021 年至 2034 年

- 主要趋势

- 抗凝血剂

- 免疫抑制治疗

- 血浆置换疗法

- 静脉注射免疫球蛋白(IVIG)

- 其他治疗

第六章:市场估计与预测:依管理路线,2021 年至 2034 年

- 主要趋势

- 口服

- 肠外

第七章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 专科诊所

- 门诊手术中心

- 其他最终用途

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Abbott Laboratories

- AbbVie

- Boehringer Ingelheim International

- Bristol Myers Squibb Company

- Cadrenal Therapeutics

- Eli Lily and Company

- F. Hoffmann-La Roche

- Johnson & Johnson Services

- Merck

- Novartis

- Pfizer

- Sanofi

The Global Catastrophic Antiphospholipid Syndrome Market was valued at USD 4.7 billion in 2024 and is expected to grow at a CAGR of 10.7% from 2025 to 2034. The market is driven by the rising prevalence of autoimmune disorders and growing awareness of CAPS, a life-threatening variant of antiphospholipid syndrome (APS). Technological advancements in diagnostics are enhancing early disease detection, increasing demand for effective treatments. Government and private sector research funding are further accelerating the development of novel therapies.

CAPS, also known as Asherson's syndrome, is a severe autoimmune disorder characterized by rapid thrombotic events affecting multiple organs. Due to the complexity of this condition, treatment approaches vary and typically include anticoagulation, corticosteroids, plasma exchange, and other immunosuppressive therapies. The market is segmented by treatment type, route of administration, and end-use settings.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.7 Billion |

| Forecast Value | $12.9 Billion |

| CAGR | 10.7% |

Among treatments, immunosuppressive therapy remains the dominant segment, valued at USD 1.4 billion in 2022 and projected to reach USD 1.7 billion in 2024. These drugs, often combined with anticoagulants and corticosteroids, are vital for improving patient outcomes. Increasing clinical evidence supporting the efficacy of immunosuppressive therapy is bolstering market demand. Additionally, orphan drug designations by regulatory bodies such as the U.S. FDA and EMA are promoting the adoption of immunosuppressive treatments, including cyclophosphamide, rituximab, and corticosteroids.

The market is further categorized based on the route of administration, with parenteral treatments leading, accounting for 65.7% of the market share in 2024. This segment is expected to grow at a CAGR of 10.6% through the forecast period. The severity of CAPS necessitates immediate medical intervention, making parenteral administration the preferred choice due to its rapid therapeutic effects. The rising use of biologic therapies such as rituximab and eculizumab via parenteral delivery is further strengthening market growth. Innovations in drug delivery systems, including infusion pumps and prefilled syringes, are enhancing treatment efficacy and expanding adoption.

In terms of end-use, hospitals represent the largest segment, projected to reach USD 7 billion by 2034, growing at a CAGR of 10.5%. Hospitals are equipped with advanced diagnostic and treatment facilities, making them the primary centers for CAPS management. Rising healthcare expenditures and improved hospital infrastructure are driving this segment's growth. Additionally, hospitals frequently collaborate with pharmaceutical companies and research organizations to facilitate clinical trials, bringing advanced therapies to patients. The increasing presence of specialized rheumatologists in hospital settings is further contributing to the expanding market.

The U.S. market alone generated USD 1.9 billion in 2024 and is expected to reach USD 5 billion by 2034. The growing number of autoimmune disease cases in the country is fueling demand for better treatment options. Increased investment in research and the adoption of modern diagnostic systems are accelerating market expansion. The rising use of anticoagulants such as warfarin and heparin among healthcare professionals is also supporting market growth.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of autoimmune disorders

- 3.2.1.2 Technological advancements in diagnostics and therapeutics

- 3.2.1.3 Rising awareness of catastrophic antiphospholipid syndrome (CAPS)

- 3.2.1.4 Increasing healthcare expenditure

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High treatment costs

- 3.2.2.2 Limited availability of specialized treatment

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Future market trends

- 3.6 Porter’s analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Treatment, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Anticoagulants

- 5.3 Immunosuppressive therapy

- 5.4 Plasma exchange therapy

- 5.5 Intravenous immunoglobulin (IVIG)

- 5.6 Other treatments

Chapter 6 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Oral

- 6.3 Parenteral

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Specialty clinics

- 7.4 Ambulatory surgical centers

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 AbbVie

- 9.3 Boehringer Ingelheim International

- 9.4 Bristol Myers Squibb Company

- 9.5 Cadrenal Therapeutics

- 9.6 Eli Lily and Company

- 9.7 F. Hoffmann-La Roche

- 9.8 Johnson & Johnson Services

- 9.9 Merck

- 9.10 Novartis

- 9.11 Pfizer

- 9.12 Sanofi