|

市场调查报告书

商品编码

1762535

Fc和糖基工程抗体市场:产业趋势及全球预测 - 依修饰类型、治疗类型、治疗领域、给药途径和重点地区Fc and Glycoengineered Antibodies Market : Industry Trends and Global Forecasts - Distribution by Type of Engineering, Type of Therapy, Therapeutic Area, Route of Administration and Key Geographical Regions |

||||||

Fc 和糖基工程抗体市场:概览

今年全球 Fc 和糖基工程抗体市场规模达 388亿美元。预计在预测期内(~2035年),市场将以良好的年复合成长率成长。

市场区隔根据以下参数划分市场规模与机会分析:

修饰类型

- Fc修饰抗体

- 糖基修饰抗体

治疗类型

- 单药治疗

- 合併治疗

- 双方

治疗领域

- 自体免疫疾病

- 皮肤病

- 肿瘤疾病

- 罕见疾病

- 其他

给药途径

- 静脉注射

- 皮下注射

- 肌肉注射

主要地区

- 北美

- 欧洲

- 亚太地区

- 世界其他地区

Fc与醣基工程抗体市场:成长与趋势

随着近 100 种单株抗体获批以及超过 550 种分子进入临床研发管线,基于抗体的药物干预已成为生物製药行业成长最快的领域之一。此外,在抗体治疗行业,透过修饰片段结晶(Fc)区开发的人工抗体在过去几年中引起了人们的浓厚兴趣。糖基工程抗体、蛋白质工程以及抗体 Fc 融合蛋白中的同型嵌合等修饰已证明可以增强各种效应功能,例如抗体依赖性细胞毒性作用(ADCC)、补体依赖性细胞毒作用(CDC)、抗体依赖性细胞吞噬作用(ADCP)活性和分子半衰期。此外,多种Fc工程技术可以抑制某些通路中的效应功能,并积极研究用于开发抗癌抗体。

该领域的持续研究已带来两种突破性药物:Gazyva(用于治疗慢性淋巴细胞白血病)和POTELEGIO(用于治疗Sezary症候群)。此外,Margenza、MONJUVI和SKYRIZI等多种Fc工程抗体产品也在过去几年中获得了批准。最近,一种名为Epcoritamab的Fc工程抗体获准用于治疗瀰漫性大B细胞淋巴瘤。此外,还有多种药物研发中,并由各种规模的製药公司进行研究。由于令人鼓舞的临床结果和持续的技术发展,Fc 工程抗体市场预计将在未来十年以惊人的速度发展。

Fc与糖基工程抗体市场:关键洞察

本报告深入探讨了 Fc 和糖基工程抗体市场的现状,并识别了该行业的潜在成长机会。报告的主要调查结果包括:

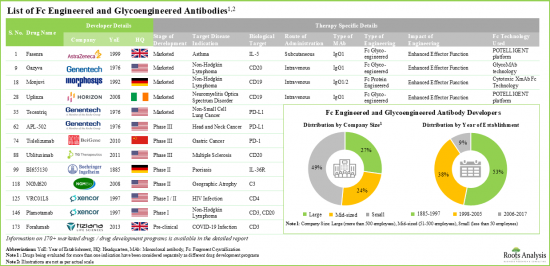

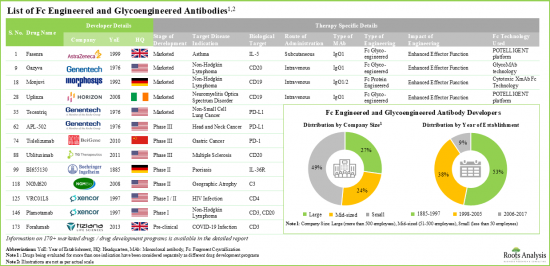

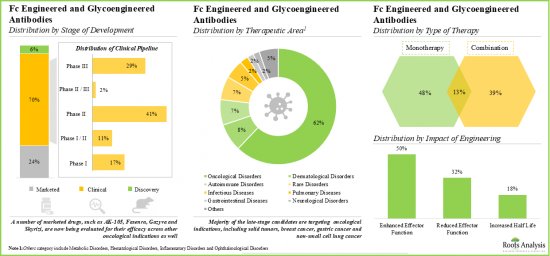

- Fc 抗体研发管线包括 40 多种已上市药物和 131个药物研发计画,主要由中型和大型公司开发。

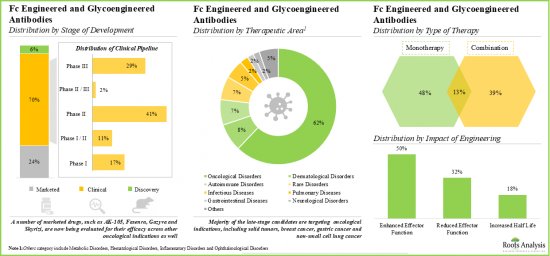

- 大多数(62%)针对肿瘤疾病的干预措施处于临床研发阶段,其中大多数(81%)抗体是 Fc 工程抗体。

- 过去几年,Fc 和糖工程抗体领域已获得近 150 项资助,其中 NIAID 成为获得资助最多的机构。

- 随着时间的推移,围绕 Fc 和糖工程抗体的智慧财产权以惊人的速度成长,业内和非业内参与者都提交了专利申请。

- 在不同地区招募/入组了近 50万名受试者,参与了已註册的Fc 和糖工程抗体评估临床试验。

- 自2016年以来,已与各行业和非行业参与者签署了70多项协议,以进一步加强其与医药合约製造相关的製造组合。

- 在前景光明的开发管线的推动下,Fc和糖基工程抗体市场预计将在未来几年稳步成长。

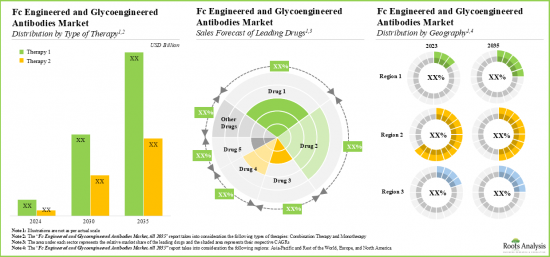

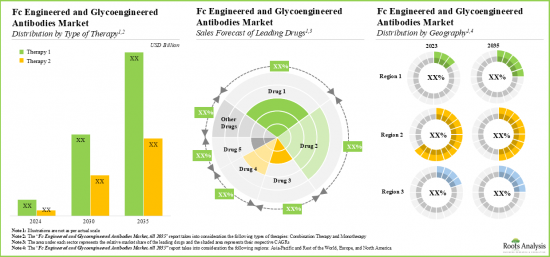

- 就已上市和后期药物的销售收入而言,预计未来全球各类疗法的机会将更加多元化。

Fc 和醣工程抗体市场:主要细分市场

Fc 工程抗体市场占据 Fc 和糖工程抗体市场的最大占有率

根据 Fc 修饰类型,市场可细分为 Fc 工程抗体和糖工程抗体。目前,Fc 工程抗体在全球 Fc 和糖工程抗体市场中占据最大占有率。由于 Fc 工程抗体能够增强效应功能并提高疗效,预计未来几年这一趋势将持续。

依治疗类型,市场可细分为单一药物治疗、合併治疗、两者兼具。目前,单药治疗在全球 Fc/糖工程抗体市场中占最大占有率,这得益于单药治疗的诸多优势,例如更便捷的监管途径、更少的潜在药物交互作用以及更高的成本效益。

依治疗领域划分,市场分为自体免疫疾病、皮肤病、肿瘤疾病、罕见疾病和其他疾病。目前,肿瘤疾病领域在全球Fc/糖基工程化抗体市场中占有最大占有率。然而,预计在预测期内,自体免疫疾病领域的市场将以更高的年复合成长率成长。

依给药途径划分,市场分为静脉给药途径、皮下给药途径及肌肉注射途径。目前,全球Fc/糖基工程化抗体市场以静脉给药为主。这是因为静脉给药可以使抗体分布到全身,进而提高疗效和生物利用度。

依主要地区划分,市场分为北美、欧洲、亚太地区及世界其他地区。目前,北美在全球Fc抗体和糖基化抗体市场占据主导地位,占据最大的收入占有率。此外,未来几年亚太市场可望实现更高的年复合成长率。

Fc 和糖基工程抗体市场参与者范例

- AbbVie

- Akesobio

- Alexion Pharmaceuticals

- Amgen

- AstraZeneca

- Boehringer Ingelheim

- Genentech

- MacroGenics

- MorphoSys

- Kyowa Kirin

- Xencor

目录

第1章 引言

第2章 研究方法

第3章 经济及其他专案特定考量

- 章节概述

- 市场动态

第4章 执行摘要

- 章节概述

第5章 引言

- 章节概述

- 抗体结构

- 抗体发展历史时间线

- 抗体亚型

- 抗体作用机制

- Fc 区与效应子功能

- 未来展望

第6章 市场格局

- 章节概述

- Fc 工程与糖基工程抗体:整体研发线

- Fc 工程与糖基工程抗体:整体研发格局

第7章 公司简介

- 章节概述

- 领先Fc和糖基工程抗体药物开发商的详细简介

- AbbVie

- Alexion Pharmaceuticals

- AstraZeneca

- Genentech

- MacroGenics

- Kyowa Kirin

- 其他公司简介

- Akeso Biopharma

- Amgen

- Boehringer Ingelheim

- MorphoSys

- Xemcor

第8章 临床试验分析

- 章节概述

- 范围与研究方法

- Fc和糖基工程抗体:临床试验分析

第9章 合作伙伴关係与合作

- 章节概述

- 合作模式

- Fc 修饰与糖基化改造抗体:合作关係与合作

第10章 资助分析

- 章节概述

- 研究范围与研究方法

- Fc 修饰与糖基化改造抗体:资助分析

第11章 专利分析

- 章节概述

- 研究范围与研究方法

- Fc 修饰与糖基化改造抗体:专利分析

第12章 全球 Fc 修饰与糖基化改造抗体市场

- 章节概述

- 关键假设与研究方法

- 全球Fc修饰及糖基化抗体市场,历史趋势(2019年至今)及未来预测(至2035年)

- 主要市场细分

第13章 依修饰类型划分的Fc修饰与糖基化抗体市场

- 章节概述

- 关键假设与研究方法

- 依修饰类型划分的Fc修饰和糖基化抗体市场

- 资料三角测量与验证

第14章 依治疗类型划分的Fc修饰与糖基化抗体市场

- 章节概述

- 关键假设与研究方法

- 依治疗类型划分的Fc修饰和糖基化抗体市场类型

- 资料三角剖分与验证

第15章 Fc修饰与糖基工程化抗体市场(依治疗领域划分)

- 章节概述

- 关键假设与研究方法

- Fc修饰和糖基工程化抗体市场(依治疗领域划分)

- 资料三角剖分与验证

第16章 Fc修饰和糖基化抗体市场(依给药途径)

- 章节概述

- 关键假设与研究方法

- Fc修饰和糖基化抗体市场(依给药途径)

- 资料三角剖分与验证

第17章 Fc修饰和糖基化抗体市场(依主要地区)

- 章节概述

- 关键假设与研究方法

- Fc修饰和糖基化抗体市场(依主要地区)

- 资料三角剖分与验证

第18章 Fc修饰及糖基化抗体市场及药品销售预测

- 章节概述

- 关键假设与研究方法

- 已上市的Fc修饰和糖基工程抗体市场:销售预测

- III期Fc修饰与糖基工程抗体市场:销售预测

- 资料三角测量与验证

第19章 结论

第20章 附录1:表格资料

第21章 附录2:公司与组织清单

FC AND GLYCOENGINEERED ANTIBODIES MARKET: OVERVIEW

As per Roots Analysis, the global Fc and glycoengineered antibodies market is valued at USD 38.8 billion in the current year and is expected to grow at a lucrative CAGR during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Engineering

- Fc Engineered Antibodies

- Glycoengineered Antibodies

Type of Therapy

- Monotherapy

- Combination Therapy

- Both

Therapeutic Area

- Autoimmune Disorders

- Dermatological Disorders

- Oncological Disorders

- Rare Diseases

- Other Disorders

Route of Administration

- Intravenous Route

- Subcutaneous Route

- Intramuscular Route

Key Geographical Regions

- North America

- Europe

- Asia-Pacific

- Rest of the World

FC AND GLYCOENGINEERED ANTIBODIES MARKET: GROWTH AND TRENDS

With close to 100 approved monoclonal antibodies, and over 550 molecules in the clinical pipeline, antibody based pharmacological interventions have become one of the fastest growing segments of the biopharmaceutical industry. Further, within the antibody therapeutics industry, engineered antibodies, developed by modifying the fragment crystallizable (Fc) region, have garnered significant interest over the past few years. The modifications, such as glycoengineered antibodies, protein engineering or isotype chimerism in the Fc fusion protein of an antibody have shown to augment the various effector functions, such as antibody-dependent cellular cytotoxicity (ADCC), complement-dependent cytotoxicity (CDC), antibody-dependent cellular phagocytosis (ADCP) activity and / or the half-life of the molecule. Moreover, several Fc engineering technologies enable the suppression of the effector functions in certain pathways and are being actively explored for development of anti-cancer antibodies.

The consistent research efforts in this domain have resulted into the emergence of two groundbreaking drugs, namely Gazyva (for Chronic Lymphocytic Leukemia) and POTELEGIO (for Sezary syndrome). Further, several other Fc engineered antibody products, including Margenza, MONJUVI and SKYRIZI have also received approval in the past few years. More recently, Fc engineered antibody, named Epcoritamab, received approval for the treatment of diffuse large B-cell lymphoma. Further, there are several drugs in the development pipeline, which are being investigated by various small and established pharmaceutical companies. With the promising clinical results coupled with ongoing technological developments, the market for Fc engineered antibodies is likely to evolve at a commendable pace over the next decade.

FC AND GLYCOENGINEERED ANTIBODIES MARKET: KEY INSIGHTS

The report delves into the current state of the Fc and glycoengineered antibodies market and identifies potential growth opportunities within industry. Some key findings from the report include:

- Fc engineered antibodies pipeline features more than 40 marketed drugs, and 131 drug development programs intended for the treatment of various diseases; these are primarily developed by mid and large-sized players.

- Majority (62%) of the interventions targeting oncological disorders are in clinical phase of development; of these, most (81%) of the antibodies are Fc engineered.

- Close to 150 grants have been awarded in the past few years in the domain of Fc engineered and glycoengineered antibodies; NIAID emerged as the top funding institute for these grants.

- Over time, the intellectual property related to Fc engineered and glycoengineered antibodies has grown at a commendable pace, with patents being filed by both industry and non-industry players.

- Close to half a million patients have been recruited / enrolled in clinical trials registered for the evaluation of Fc engineered and glycoengineered antibodies, across different geographies.

- Since 2016, more than 70 agreements have been inked by various industry and non-industry players, in order to further enhance their manufacturing portfolio related to pharmaceutical contract manufacturing.

- Driven by the promising development pipeline, the market for Fc engineered and glycoengineered antibodies is likely to grow at a steady pace in the coming years.

- In terms of revenues from the sales of marketed and late-stage therapies, the future opportunity is anticipated to be well dispersed across different types of therapy across the globe.

FC AND GLYCOENGINEERED ANTIBODIES MARKET: KEY SEGMENTS

Fc Engineered Antibodies Segment holds the Largest Share of the Fc and Glycoengineered Antibodies Market

Based on the type of Fc engineering, the market is segmented into Fc engineered antibodies and glycoengineered antibodies. At present, the Fc engineered antibodies segment holds the maximum share of the global Fc and glycoengineered antibodies market. This trend is likely to remain the same in the coming years owing to the fact that Fc engineering enhances effector functions, improving the therapeutic efficacy of the modality.

By Type of Therapy, Monotherapy Segment Accounts for the Largest Share of the Global Fc and Glycoengineered Antibodies Market

Based on the type of therapy, the market is segmented into monotherapy, combination therapy and both. Currently, the monotherapy segment captures the highest proportion of the global Fc and glycoengineered antibodies market owing to the several benefits associated with monotherapy, such as easy regulatory pathways, reduced potential drug interactions and cost effectiveness.

By Therapeutic Area, Autoimmune Disorders is the Fastest Growing Segment of the Global Fc and Glycoengineered Antibodies Market

Based on the therapeutic area, the market is segmented into autoimmune disorders, dermatological disorders, oncological disorders, rare diseases and other disorders. At present, the oncological disorders segment holds the maximum share of the global Fc and glycoengineered antibodies market. However, the market for autoimmune disorders segment is expected to grow at a higher CAGR during the forecasted period.

The Intravenous Route Segment Account for the Largest Share of the Global Fc and Glycoengineered Antibodies Market

Based on the route of administration, the market is segmented into intravenous route, subcutaneous route and intramuscular route of administration. Currently, the global Fc and glycoengineered antibodies market is dominated by the Fc and glycoengineered antibodies for intravenous route of administration. This is due to the fact that intravenous route provides complete systemic distribution of antibodies facilitating enhanced therapeutic efficacy and bioavailability.

North America Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia-Pacific and Rest of the World. Currently, North America dominates the global Fc and glycoengineered antibodies market and accounts for the largest revenue share. Further, the market Asia-Pacific is likely to grow at a higher CAGR in the coming future.

Example Players in the Fc and Glycoengineered Antibodies Market

- AbbVie

- Akesobio

- Alexion Pharmaceuticals

- Amgen

- AstraZeneca

- Boehringer Ingelheim

- Genentech

- MacroGenics

- MorphoSys

- Kyowa Kirin

- Xencor

FC AND GLYCOENGINEERED ANTIBODIES MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the global Fc and glycoengineered antibodies market, focusing on key market segments, including [A] type of engineering, [B] type of therapy, [C] therapeutic area, [D] route of administration and [E] key geographical regions.

- Market Landscape: A comprehensive evaluation of Fc and glycoengineered antibodies, based on several relevant parameters, such as [A] phase of development, [B] type of engineering, [C] impact of engineering, [D] biological target, [E] type of therapy, [F] target disease indication, [G] therapeutic area, [H] route of administration and [I] popular Fc engineering technologies.

- Company Profiles: In-depth profiles of key players that are currently involved in the development of Fc engineered antibodies, focusing on [A] overview of the company, [B] financial information (if available) [C] drug portfolio and [D] recent developments and an informed future outlook.

- Clinical Trial Analysis: An insightful analysis of clinical trials related to Fc and glycoengineered antibodies, based on several parameters, such as [A] trial registration year, [B] trial status, [C] trial phase, [D] enrolled patient population, [E] type of sponsor, [F] most active industry players (in terms of number of trials conducted), [F] study design, [G] target indication and [H] key geographical regions.

- Partnerships and Collaborations: An insightful analysis of the deals inked by stakeholders in this domain, based on several parameters, such as [A] year of partnership, [B] type of partnership, [C] type of engineering, [D] therapeutic area, [E] most active players (in terms of the number of partnerships signed) and [F] regional distribution of the companies involved in these agreements.

- Grants Analysis: A comprehensive assessment of grants that have been awarded to research institutes for projects related to Fc and glycoengineered antibodies, based on various relevant parameters, such as [A] year of grant award, [B] amount awarded, [C] funding institute center, [D] support period, [E] type of grant application, [F] purpose of grant award, [G] activity code, [H] study section involved, [I] most popular NIH departments, [J] prominent program officers and [K] popular recipient organizations.

- Patent Analysis: An in-depth analysis of patents filed / granted till date related to Fc and glycoengineering antibodies, based on various relevant parameters, such as [A] type of patent, [B] publication year, [C] application year, [D] type of applicant, [E] geographical location, [E] CPC symbols, [F] most active players and [G] patent valuation analysis.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2 RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Project Methodology

- 2.4. Forecast Methodology

- 2.5. Robust Quality Control

- 2.6. Key Considerations

- 2.6.1. Demographics

- 2.6.2. Economic Factors

- 2.6.3. Government Regulations

- 2.6.4. Supply Chain

- 2.6.5. COVID Impact / Related Factors

- 2.6.6. Market Access

- 2.6.7. Healthcare Policies

- 2.6.8. Industry Consolidation

- 2.7. Key Market Segmentations

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Chapter Overview

- 3.2. Market Dynamics

- 3.2.1. Time Period

- 3.2.1.1. Historical Trends

- 3.2.1.2. Current and Forecasted Estimates

- 3.2.2. Currency Coverage

- 3.2.2.1. Major Currencies Affecting the Market

- 3.2.2.2. Impact of Currency Fluctuations on the Industry

- 3.2.2.3. Foreign Exchange Impact

- 3.2.2.4. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 3.2.2.5. Strategies for Mitigating Foreign Exchange Risk

- 3.2.3. Recession

- 3.2.3.1. Historical Analysis of Past Recessions and Lessons Learnt

- 3.2.3.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 3.2.4. Inflation

- 3.2.4.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 3.2.4.2. Potential Impact of Inflation on the Market Evolution

- 3.2.1. Time Period

4. EXECUTIVE SUMMARY

- 4.1. Chapter Overview

5. INTRODUCTION

- 5.1. Chapter Overview

- 5.2. Structure of Antibodies

- 5.3. Historical Timeline of Antibody Development

- 5.4. Antibody Isotypes

- 5.5. Mechanism of Action of Antibodies

- 5.6. Fc Region and Effector Functions

- 5.6.1. Types of Fc Receptors

- 5.6.2. Engineering of the Fc Region

- 5.6.2.1. Glycoengineering

- 5.6.2.2. Protein Engineering

- 5.6.2.3. Isotype Chimerism

- 5.7. Future Perspective

6. MARKET LANDSCAPE

- 6.1. Chapter Overview

- 6.2. Fc Engineered and Glycoengineered Antibodies: Overall Pipeline

- 6.2.1. Analysis by Stage of Development

- 6.2.2. Analysis by Type of Antibody

- 6.2.3. Analysis by Type of Engineering

- 6.2.4. Analysis by Impact of Engineering

- 6.2.5. Analysis by Biological Target

- 6.2.6. Analysis by Type of Therapy

- 6.2.7. Analysis by Target Disease Indication

- 6.2.8. Analysis by Therapeutic Area

- 6.2.9. Analysis by Route of Administration

- 6.2.10. Popular Fc Engineering Technologies: Analysis by Number of Marketed Drugs and Development Programs

- 6.3. Fc Engineered and Glycoengineered Antibodies: Overall Developer Landscape

- 6.3.1. Analysis by Year of Establishment

- 6.3.2. Analysis by Company Size

- 6.3.3. Analysis by Location of Headquarters

- 6.3.4. Leading Developers: Analysis by Number of Drugs

7. COMPANY PROFILES

- 7.1. Chapter Overview

- 7.2. Detailed Company Profiles of Leading Fc Engineered and Glycoengineered Antibody Drug Developers

- 7.2.1. AbbVie

- 7.2.1.1. Company Overview

- 7.2.1.2. Financial Information

- 7.2.1.3. Drug Portfolio

- 7.2.1.3.1. Drug Profile: Skyrizi

- 7.2.1.4. Recent Developments and Future Outlook

- 7.2.2. Alexion Pharmaceuticals

- 7.2.2.1. Company Overview

- 7.2.2.2. Drug Portfolio

- 7.2.2.2.1. Drug Profile: Soliris

- 7.2.2.2.2. Drug Profile: Ultomiris

- 7.2.2.3. Recent Developments and Future Outlook

- 7.2.3. AstraZeneca

- 7.2.3.1. Company Overview

- 7.2.3.2. Financial Information

- 7.2.3.3. Drug Portfolio

- 7.2.3.3.1. Drug Profile: Beyfortus

- 7.2.3.3.2. Drug Profile: Imfinzi

- 7.2.3.3.3. Drug Profile: Fasenra

- 7.2.3.3.4. Drug Profile: Saphnelo

- 7.2.3.4. Recent Developments and Future Outlook

- 7.2.4. Genentech

- 7.2.4.1. Company Overview

- 7.2.4.2. Financial Information

- 7.2.4.3. Drug Portfolio

- 7.2.4.3.1. Drug Profile: Gazyva

- 7.2.4.3.2. Drug Profile: Ocrevus

- 7.2.4.3.3. Drug Profile: Tecentriq

- 7.2.4.4. Recent Developments and Future Outlook

- 7.2.5. MacroGenics

- 7.2.5.1. Company Overview

- 7.2.5.2. Financial Information

- 7.2.5.3. Drug Portfolio

- 7.2.5.3.1. Drug Profile: Margenza

- 7.2.5.3.2. Drug Profile: MGA-271

- 7.2.5.4. Recent Developments and Future Outlook

- 7.2.6. Kyowa Kirin

- 7.2.6.1. Company Overview

- 7.2.6.2. Financial Information

- 7.2.6.3. Drug Portfolio

- 7.2.6.3.1. Drug Profile: POTELIGEO

- 7.2.6.4. Recent Developments and Future Outlook

- 7.2.1. AbbVie

- 7.3. Short Company Profiles of Leading Fc Engineered and Glycoengineered Antibody Drug Developers

- 7.3.1. Akeso Biopharma

- 7.3.1.1. Company Overview

- 7.3.1.2. Drug Portfolio

- 7.3.1.2.1. Drug Profile: Penpulimab

- 7.3.2. Amgen

- 7.3.2.1. Company Overview

- 7.3.2.2. Drug Portfolio

- 7.3.2.2.1. Drug Profile: Bemarituzuman

- 7.3.2.2.2. Drug Profile: STEAP1 XmAb Antibody

- 7.3.2.2.3. Drug Profile: FPA157

- 7.3.3. Boehringer Ingelheim

- 7.3.3.1. Company Overview

- 7.3.3.2. Drug Portfolio

- 7.3.3.2.2. Drug Profile: Spesolimab

- 7.3.4. MorphoSys

- 7.3.4.1. Company Overview

- 7.3.4.2. Drug Portfolio

- 7.3.4.2.1. Drug Portfolio: Tafasitamab

- 7.3.5. Xemcor

- 7.3.5.1. Company Overview

- 7.3.5.2. Drug Portfolio

- 7.3.5.2.1. Drug Portfolio: Tidutamab

- 7.3.5.2.2. Drug Portfolio: XmAb22841

- 7.3.5.2.3. Drug Portfolio: XmAb23104

- 7.3.5.2.4. Drug Portfolio: Plamotamab

- 7.3.5.2.5. Drug Portfolio: Vibecotamab

- 7.3.5.2.6. Drug Portfolio: RO7310729

- 7.3.5.2.7. Drug Portfolio: XmAb20717

- 7.3.5.2.8. Drug Portfolio: XmAb819

- 7.3.5.2.9. Drug Portfolio: XmAb27564

- 7.3.5.2.10. Drug Portfolio: VRC01LS

- 7.3.1. Akeso Biopharma

8. CLINICAL TRIAL ANALYSIS

- 8.1. Chapter Overview

- 8.2. Scope and Methodology

- 8.3. Fc Engineered and Glycoengineered Antibodies: Clinical Trial Analysis

- 8.3.1. Analysis by Trial Registration Year

- 8.3.2. Analysis of Number of Patients Enrolled by Trial Registration Year

- 8.3.3. Analysis by Trial Phase

- 8.3.4. Analysis of Number of Patients Enrolled by Trial Phase

- 8.3.5. Analysis by Trial Registration Year and Trial Phase

- 8.3.6. Analysis by Trial Status

- 8.3.7. Analysis by Patient Gender

- 8.3.8. Analysis by Target Indication

- 8.3.9. Analysis by Study Design

- 8.3.9.1. Analysis by Type of Trial Masking

- 8.3.9.2. Analysis by Type of Intervention Model

- 8.3.9.3. Analysis by Type of Trial Purpose

- 8.3.9.4. Analysis by Design Allocation

- 8.3.10. Most Active Sponsor / Collaborator: Analysis by Number of Registered Trials

- 8.3.10.1. Analysis by Leading Industry Players

- 8.3.10.2. Analysis by Leading Non-Industry Players

- 8.3.11. Analysis by Geography

- 8.3.11.1. Analysis of Clinical Trials by Trial Status and Geography

- 8.3.11.2. Analysis of Patients Enrolled by Trial Status and Geography

9. PARTNERSHIPS AND COLLABORATIONS

- 9.1. Chapter Overview

- 9.2. Partnership Models

- 9.3. Fc Engineered and Glycoengineered Antibodies: Partnerships and Collaborations

- 9.3.1. Analysis by Year of Partnership

- 9.3.2. Analysis by Type of Partnership

- 9.3.3. Analysis by Year and Type of Partnership

- 9.3.4. Analysis by Type of Engineering

- 9.3.5. Analysis by Therapeutic Area

- 9.3.6. Most Active Players: Analysis by Number of Partnerships

- 9.3.7. Analysis by Geography

- 9.3.7.1. Intracontinental and Intercontinental Agreements

- 9.3.7.2. Local and International Agreements

10. GRANT ANALYSIS

- 10.1. Chapter Overview

- 10.2. Scope and Methodology

- 10.3. Fc Engineered and Glycoengineered Antibodies: Grant Analysis

- 10.3.1. Analysis by Year of Grant Award

- 10.3.2. Analysis by Amount Awarded

- 10.3.3. Analysis by Funding Institute Center

- 10.3.4. Analysis by Support Period

- 10.3.5. Analysis by Funding Institute Center and Support Period

- 10.3.6. Analysis by Type of Grant Application

- 10.3.7. Analysis by Purpose of Grant Award

- 10.3.8. Analysis by Activity Code

- 10.3.9. Analysis by Study Section Involved

- 10.3.10. Most Popular NIH Departments: Analysis by Number of Grants

- 10.3.10.1. Prominent Program Officers: Analysis By Number of Grants

- 10.3.10.2. Popular Recipient Organizations: Analysis by Number of Grants

- 10.3.10.3. Popular Recipient Organizations: Analysis by Grant Amount

- 10.3.11. Popular Recipient Organizations: Distribution by States in the US

11. PATENT ANALYSIS

- 11.1. Chapter Overview

- 11.2. Scope and Methodology

- 11.3. Fc Engineered and Glycoengineered Antibodies: Patent Analysis

- 11.3.1. Analysis by Patent Publication Year

- 11.3.2. Analysis by Patent Application Year

- 11.3.3. Analysis by Granted Patents and Patent Applications, Since 2019

- 11.3.4. Analysis by Patent Jurisdiction

- 11.3.5. Analysis by CPC Symbols

- 11.3.6. Analysis by Type of Applicant

- 11.3.7. Leading Industry Players: Analysis by Number of Patents

- 11.3.8. Leading Non-Industry Players: Analysis by Number of Patents

- 11.3.9. Leading Patent Assignees: Analysis by Number of Patents

- 11.3.10. Patent Benchmarking Analysis

- 11.3.10.1. Analysis by Patent Characteristics

- 11.3.11. Patent Valuation

- 11.3.12. Leading Patents by Number of Citations

12. GLOBAL Fc ENGINEERED AND GLYCOENGINEERED ANTIBODIES MARKET

- 12.1. Chapter Overview

- 12.2. Key Assumptions and Methodology

- 12.3. Global Fc Engineered and Glycoengineered Antibodies Market, Historical Trends (Since 2019) and Future Estimates (Till 2035)

- 12.3.1. Scenario Analysis

- 12.3.1.1. Conservative Scenario

- 12.3.1.2. Optimistic Scenario

- 12.3.1. Scenario Analysis

- 12.4. Key Market Segmentations

13. Fc ENGINEERED AND GLYCOENGINEERED ANTIBODIES MARKET, BY TYPE OF ENGINEERING

- 13.1. Chapter Overview

- 13.2. Key Assumptions and Methodology

- 13.3. Fc Engineered and Glycoengineered Antibodies Market: Distribution by Type of Engineering

- 13.3.1. Fc Engineered Antibodies Market, Till 2035

- 13.3.2. Glycoengineered Antibodies Market, Till 2035

- 13.4. Data Triangulation and Validation

14. Fc ENGINEERED AND GLYCOENGINEERED ANTIBODIES MARKET, BY TYPE OF THERAPY

- 14.1. Chapter Overview

- 14.2. Key Assumptions and Methodology

- 14.3. Fc Engineered and Glycoengineered Antibodies Market: Distribution by Type of Therapy

- 14.3.1. Fc Engineered and Glycoengineered Market for Monotherapy, Till 2035

- 14.3.2. Fc Engineered and Glycoengineered Market for Combination Therapy, Till 2035

- 14.3.3. Fc Engineered and Glycoengineered Market for Both, Till 2035

- 14.4. Data Triangulation and Validation

15. Fc ENGINEERED AND GLYCOENGINEERED ANTIBODIES MARKET, BY THERAPEUTIC AREA

- 15.1. Chapter Overview

- 15.2. Key Assumptions and Methodology

- 15.3. Fc Engineered and Glycoengineered Antibodies Market: Distribution by Therapeutic Area

- 15.3.1. Fc Engineered and Glycoengineered Market for Oncological Disorders, Till 2035

- 15.3.2. Fc Engineered and Glycoengineered Market for Dermatological Disorders, Till 2035

- 15.3.3. Fc Engineered and Glycoengineered Market for Autoimmune Disorders, Till 2035

- 15.3.4. Fc Engineered and Glycoengineered Market for Rare Disorders, Till 2035

- 15.3.5. Fc Engineered and Glycoengineered Market for Other Disorders, Till 2035

- 15.4. Data Triangulation and Validation

16. Fc ENGINEERED AND GLYCOENGINEERED ANTIBODIES MARKET, BY ROUTE OF ADMINISTRATION

- 16.1. Chapter Overview

- 16.2. Key Assumptions and Methodology

- 16.3. Fc Engineered and Glycoengineered Antibodies Market: Distribution by Route of Administration

- 16.3.1. Fc Engineered and Glycoengineered Market for Intravenous Route, Till 2035

- 16.3.2. Fc Engineered and Glycoengineered Market for Subcutaneous Route, Till 2035

- 16.3.3. Fc Engineered and Glycoengineered Market for Intramuscular Route, Till 2035

- 16.4. Data Triangulation and Validation

17. Fc ENGINEERED AND GLYCOENGINEERED ANTIBODIES MARKET, BY KEY GEOGRAPHICAL REGIONS

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Fc Engineered and Glycoengineered Antibodies Market: Distribution by Key Geographical Regions

- 17.3.1. Fc Engineered and Glycoengineered Market in North America, Till 2035

- 17.3.2. Fc Engineered and Glycoengineered Market in Europe, Till 2035

- 17.3.3. Fc Engineered and Glycoengineered Market in Asia-Pacific, Till 2035

- 17.3.4. Fc Engineered and Glycoengineered Market in Rest of the World, Till 2035

- 17.4. Data Triangulation and Validation

18. Fc ENGINEEREDAND GLYCOENGINEERED ANTIBODIES MARKET, SALES FORECAST OF DRUGS

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Commercialized Fc Engineered and Glycoengineered Antibodies Market: Sales Forecast

- 18.3.1. AK-105 Sales Forecast

- 18.3.2. BeyfortusTM Sales Forecast

- 18.3.3. Briumvi(R) Sales Forecast

- 18.3.4. Fasenra(R) Sales Forecast

- 18.3.5. Gazyva(R) Sales Forecast

- 18.3.6. Imfinzi(R) Sales Forecast

- 18.3.7. Margenza Sales Forecast

- 18.3.8. Monjuvi(R) Sales Forecast

- 18.3.9. Ocrevus(R) Sales Forecast

- 18.3.10. POTELIGEO(R) Sales Forecast

- 18.3.11. Saphnelo(R) Sales Forecast

- 18.3.12. Skyrizi(R) Sales Forecast

- 18.3.13. Soliris(R) Sales Forecast

- 18.3.14. Tecentriq(R) Sales Forecast

- 18.3.15. Tislelizumab Sales Forecast

- 18.3.16. Tzield(R) Sales Forecast

- 18.3.17. Ultomiris(R) Sales Forecast

- 18.3.18. Uplizna(R) Sales Forecast

- 18.4. Phase III Fc Engineered and Glycoengineered Antibodies Market: Sales Forecast

- 18.4.1. Clazakizumab Sales Forecast

- 18.4.2. FPA144 Sales Forecast

- 18.4.3. Skyrizi Sales Forecast

- 18.4.4. TQ-B2450 Sales Forecast

- 18.4.5. Visterra Sales Forecast

- 18.5. Data Triangulation and Validation

19. CONCLUDING REMARKS

- 19.1. Chapter Overview

20 APPENDIX I: TABULATED DATA

21 APPENDIX II: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 1.1. Fc and Glycoengineered Antibodies Market: Report Attribute / Market Segment

- Table 5.1. Features of Different Isotypes of Antibodies

- Table 5.2. Features of Engineered Fc Regions

- Table 6.1. Fc Engineered and Glycoengineered Antibodies: Overall Pipeline

- Table 6.2. Fc Engineered and Glycoengineered Antibodies: Information on Type of Engineering, Impact of Engineering and Fc Engineering Technology

- Table 6.3. Fc Engineered and Glycoengineered Antibodies: List of Developers

- Table 7.1. Fc Engineered and Glycoengineered Antibodies: List of Drug Developers Profiled

- Table 7.2. AbbVie: Company Snapshot

- Table 7.3. Drug Profile: Skyrizi

- Table 7.4. AbbVie: Recent Developments and Future Outlook

- Table 7.5. Alexion Pharmaceuticals: Company Snapshot

- Table 7.6. Drug Profile: Soliris

- Table 7.7. Drug Profile: Ultomiris

- Table 7.8. AstraZeneca: Company Snapshot

- Table 7.9. Drug Profile: Beyfortus

- Table 7.10. Drug Profile: Imfinzi

- Table 7.11. Drug Profile: Fasenra

- Table 7.12. Drug Profile: Saphnelo

- Table 7.13. AstraZeneca: Recent Developments and Future Outlook

- Table 7.14. Genentech: Company Snapshot

- Table 7.15. Drug Profile: Gazyva

- Table 7.16. Drug Profile: Ocrevus

- Table 7.17. Drug Profile: Tecentriq

- Table 7.18. Genentech: Recent Developments and Future Outlook

- Table 7.19. MacroGenics: Company Snapshot

- Table 7.20. Drug Profile: Margenza

- Table 7.21. Drug Profile: MGA-271

- Table 7.22. MacroGenics: Recent Developments and Future Outlook

- Table 7.23. Kyowa Kirin: Company Snapshot

- Table 7.24. Drug Profile: POTELIGEO

- Table 7.25. Kyowa Kirin: Recent Developments and Future Outlook

- Table 7.26. Akeso Biopharma: Company Snapshot

- Table 7.27. Drug Profile: Penpulimab

- Table 7.28. Amgen: Company Snapshot

- Table 7.29. Drug Profile: Bmarituzumab

- Table 7.30. Drug Profile: XmAb Antibody

- Table 7.31. Drug Profile: FPA157

- Table 7.32. Boehringer Ingelheim: Company Snapshot

- Table 7.33. Drug Profile: Spesolimab

- Table 7.34. MorphoSys: Company Snapshot

- Table 7.35. Drug Profile: Tafasitamab

- Table 7.36. Xencor: Company Snapshot

- Table 7.37. Drug Profile: Tidutamab

- Table 7.38. Drug Profile: XmAb22841

- Table 7.39. Drug Profile: XmAb23104

- Table 7.40. Drug Profile: Plamotamab

- Table 7.41. Drug Profile: Vibecotamab

- Table 7.42. Drug Profile: RO7310729

- Table 7.43. Drug Profile: XmAb20717

- Table 7.44. Drug Profile: XmAb819

- Table 7.45. Drug Profile: XmAb27564

- Table 7.46. Drug Profile: VRC01LS

- Table 9.1. Fc Engineered and Glycoengineered Antibodies: List of Partnerships and Collaborations, Since 2016

- Table 9.2. Partnerships and Collaborations: Information on Type of Engineering and Therapeutic Area

- Table 11.1. Patent Analysis: Top CPC Sections

- Table 11.2. Patent Analysis: Top CPC Symbols

- Table 11.3. Patent Analysis: Top CPC Codes

- Table 11.4. Patent Analysis: Summary of Benchmarking Analysis

- Table 11.5. Patent Analysis: Categorization based on Weighted Valuation Scores

- Table 11.6. Patent Portfolio: List of Leading Patents (by Highest Relative Valuation)

- Table 11.7. Patent Portfolio: List of Leading Patents (by Number of Citations)

- Table 21.1. Fc Engineered and Glycoengineered Antibodies: Distribution by Stage of Development

- Table 21.2. Fc Engineered and Glycoengineered Antibodies: Distribution by Type of Antibody

- Table 21.3. Fc Engineered and Glycoengineered Antibodies: Distribution by Type of Engineering

- Table 21.4. Fc Engineered and Glycoengineered Antibodies: Distribution by Impact of Engineering

- Table 21.5. Fc Engineered and Glycoengineered Antibodies: Distribution by Biological Target

- Table 21.6. Fc Engineered and Glycoengineered Antibodies: Distribution by Type of Therapy

- Table 21.7. Fc Engineered and Glycoengineered Antibodies: Distribution by Target Disease Indication

- Table 21.8. Fc Engineered and Glycoengineered Antibodies: Distribution by Therapeutic Area

- Table 21.9. Fc Engineered and Glycoengineered Antibodies: Distribution by Route of Administration

- Table 21.10. Popular Fc Engineering Technologies: Distribution by Number of Development Programs

- Table 21.11. Fc Engineered and Glycoengineered Antibodies: Distribution by Year of Establishment

- Table 21.12. Fc Engineered and Glycoengineered Antibodies: Distribution by Company Size

- Table 21.13. Fc Engineered and Glycoengineered Antibodies: Distribution by Location of Headquarters

- Table 21.14. AbbVie: Annual Revenues, Since FY 2019 (USD Billion)

- Table 21.15. AstraZeneca: Annual Revenues, Since FY 2019 (USD Billion)

- Table 21.16. Roche (Parent Company of Genentech): Annual Revenues, Since FY 2019 (CHF Billion)

- Table 21.17. MacroGenics: Annual Revenues, Since FY 2019 (USD Million)

- Table 21.18. Kyowa Kirin: Annual Revenues, Since FY 2019 (YEN Billion)

- Table 21.19. Clinical Trial Analysis: Cumulative Year-wise Trend, Since Pre-2015

- Table 21.20. Clinical Trial Analysis: Year-wise Trend of Patients Enrolled by Trial Registration Year, Since Pre-2015

- Table 21.21. Clinical Trial Analysis: Distribution by Trial Phase

- Table 21.22. Clinical Trial Analysis: Distribution of Number of Patients Enrolled by Trial Phase

- Table 21.23. Clinical Trial Analysis: Distribution by Trial Registration Year and Trial Phase, Since Pre-2015

- Table 21.24. Clinical Trial Analysis: Distribution by Trial Status

- Table 21.25. Clinical Trial Analysis: Distribution by Patient Gender

- Table 21.26. Clinical Trial Analysis: Distribution by Target Indication

- Table 21.27. Clinical Trial Analysis: Distribution by Type of Trial Masking

- Table 21.28. Clinical Trial Analysis: Distribution by Type of Intervention Model

- Table 21.29. Clinical Trial Analysis: Distribution by Trial Purpose

- Table 21.30. Clinical Trial Analysis: Distribution by Design Allocation

- Table 21.31. Leading Industry Players: Distribution by Number of Registered Trials

- Table 21.32. Leading Non-Industry Players: Distribution by Number of Registered Trials

- Table 21.33. Clinical Trial Analysis: Distribution of Clinical Trials by Trial Status and Geography

- Table 21.34. Clinical Trial Analysis: Distribution of Patients Enrolled by Trial Status and Geography

- Table 21.35. Partnerships and Collaborations: Cumulative Year-wise Trend, Since 2016

- Table 21.36. Partnerships and Collaborations: Distribution by Type of Partnership

- Table 21.37. Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Table 21.38. Partnerships and Collaborations: Distribution by Type of Engineering

- Table 21.39. Partnerships and Collaborations: Distribution by Therapeutic Area

- Table 21.40. Most Active Players: Distribution by Number of Partnerships

- Table 21.41. Partnerships and Collaborations: Intracontinental and Intercontinental Agreements

- Table 21.42. Partnerships and Collaborations: Local and International Agreements

- Table 21.43. Grant Analysis: Cumulative Year-wise Trend, Since 2019

- Table 21.44. Grants Analysis: Cumulative Year-wise Trend of Grants by Amount Awarded (USD Million)

- Table 21.45. Grants Analysis: Distribution by Funding Institute Center

- Table 21.46. Grants Analysis: Distribution by Support Period

- Table 21.47. Grants Analysis: Distribution by Funding Institute Center and Support Period

- Table 21.48. Grants Analysis: Distribution by Type of Grant Application

- Table 21.49. Grants Analysis: Distribution by Purpose of Grant Award

- Table 21.50. Grants Analysis: Distribution by Activity Code

- Table 21.51. Grants Analysis: Distribution by Study Section Involved

- Table 21.52. Most Popular Departments: Distribution by Number of Grants

- Table 21.53. Prominent Program Officers: Distribution by Number of Grants

- Table 21.54. Popular Recipient Organizations: Distribution by Number of Grants

- Table 21.55. Popular Recipient Organizations: Distribution by Grant Amount (USD Million)

- Table 21.56. Popular Recipient Organizations: Distribution by States in the US

- Table 21.57. Patent Analysis: Distribution by Type of Patent

- Table 21.58. Patent Analysis: Cumulative Distribution by Patent Publication Year, Since 2019

- Table 21.59. Patent Analysis: Distribution by Patent Application Year, Since 2019

- Table 21.60. Patent Analysis: Year-wise Distribution of Granted Patents and Patent Applications, Since 2019

- Table 21.61. Patent Analysis: Distribution by Patent Jurisdiction

- Table 21.62. Patent Analysis: Cumulative Year-wise Distribution by Type of Applicant

- Table 21.63. Leading Industry Players: Distribution by Number of Patents

- Table 21.64. Leading Non-Industry Players: Distribution by Number of Patents

- Table 21.65. Leading Individual Assignees: Distribution by Number of Patents

- Table 21.66. Patent Analysis: Distribution by Patent Age

- Table 21.67. Fc Engineered and Glycoengineered Antibodies: Patent Valuation

- Table 21.68. Global Fc Engineered and Glycoengineered Antibodies Market, Historical Trends (Since 2019) and Future Estimates (Till 2035) (USD Billion)

- Table 21.69. Global Fc Engineered and Glycoengineered Antibodies Market, Till 2035: Conservative Scenario (USD Billion)

- Table 21.70. Global Fc Engineered and Glycoengineered Antibodies Market, Till 2035: Optimistic Scenario (USD Billion)

- Table 21.71. Fc Engineered and Glycoengineered Antibodies Market: Distribution by Type of Engineering (USD Billion)

- Table 21.72. Fc Engineered and Glycoengineered Antibodies Market for Fc Engineered Antibodies, Till 2035 (USD Billion)

- Table 21.73. Fc Engineered and Glycoengineered Antibodies Market for Glycoengineered Antibodies, Till 2035 (USD Billion)

- Table 21.74. Fc Engineered and Glycoengineered Antibodies Market: Distribution by Type of Therapy (USD Billion)

- Table 21.75. Fc Engineered and Glycoengineered Antibodies Market for Monotherapy, Till 2035 (USD Billion)

- Table 21.76. Fc Engineered and Glycoengineered Antibodies Market for Combination Therapy, Till 2035 (USD Billion)

- Table 21.77. Fc Engineered and Glycoengineered Antibodies Market for Both, Till 2035 (USD Billion)

- Table 21.78. Fc Engineered and Glycoengineered Antibodies Market: Distribution by Therapeutic Area (USD Billion)

- Table 21.79. Fc Engineered and Glycoengineered Antibodies Market for Oncological Disorders, Till 2035 (USD Billion)

- Table 21.80. Fc Engineered and Glycoengineered Antibodies Market for Dermatological Disorders, Till 2035 (USD Billion)

- Table 21.81. Fc Engineered and Glycoengineered Antibodies Market for Autoimmune Disorders, Till 2035 (USD Billion)

- Table 21.82. Fc Engineered and Glycoengineered Antibodies Market for Rare Disorders, Till 2035 (USD Billion)

- Table 21.83. Fc Engineered and Glycoengineered Antibodies Market for Other Disorders, Till 2035 (USD Billion)

- Table 21.84. Fc Engineered and Glycoengineered Antibodies Market: Distribution by Route of Administration (USD Billion)

- Table 21.85. Fc Engineered and Glycoengineered Antibodies Market for Intravenous Route, Till 2035 (USD Billion)

- Table 21.86. Fc Engineered and Glycoengineered Antibodies Market for Subcutaneous Route, Till 2035 (USD Billion)

- Table 21.87. Fc Engineered and Glycoengineered Antibodies Market for Intramuscular Route, Till 2035 (USD Billion)

- Table 21.88. Fc Engineered and Glycoengineered Antibodies Market: Distribution by Key Geographical Regions (USD Billion)

- Table 21.89. Fc Engineered and Glycoengineered Antibodies Market in North America, Till 2035 (USD Billion)

- Table 21.90. Fc Engineered and Glycoengineered Antibodies Market in Europe, Till 2035 (USD Billion)

- Table 21.91. Fc Engineered and Glycoengineered Antibodies Market in Asia-Pacific, Till 2035 (USD Billion)

- Table 21.92. Fc Engineered and Glycoengineered Antibodies Market in Rest of the World, Till 2035 (USD Billion)

- Table 21.93. Commercialized Fc Engineered and Glycoengineered Antibodies Market: AK-105 Sales Forecast, Till 2035 (USD Billion)

- Table 21.94. Commercialized Fc Engineered and Glycoengineered Antibodies Market: BeyfortusTM Sales Forecast, Till 2035 (USD Billion)

- Table 21.95. Commercialized Fc Engineered and Glycoengineered Antibodies Market: Briumvi(R) Sales Forecast, Till 2035 (USD Billion)

- Table 21.96. Commercialized Fc Engineered and Glycoengineered Antibodies Market: Fasenra(R) Sales Forecast, Till 2035 (USD Billion)

- Table 21.97. Commercialized Fc Engineered and Glycoengineered Antibodies Market: Gazyva(R) Sales Forecast, Till 2035 (USD Billion)

- Table 21.98. Commercialized Fc Engineered and Glycoengineered Antibodies Market: Imfinzi(R) Sales Forecast, Till 2035 (USD Billion)

- Table 21.99. Commercialized Fc Engineered and Glycoengineered Antibodies Market: Margenza Sales Forecast, Till 2035 (USD Billion)

- Table 21.100. Commercialized Fc Engineered and Glycoengineered Antibodies Market: Monjuvi(R) Sales Forecast, Till 2035 (USD Billion)

- Table 21.101. Commercialized Fc Engineered and Glycoengineered Antibodies Market: Ocrevus(R) Sales Forecast, Till 2035 (USD Billion)

- Table 21.102. Commercialized Fc Engineered and Glycoengineered Antibodies Market: POTELIGEO(R) Sales Forecast, Till 2035 (USD Billion)

- Table 21.103. Commercialized Fc Engineered and Glycoengineered Antibodies Market: Saphnelo(R) Sales Forecast, Till 2035 (USD Billion)

- Table 21.104. Commercialized Fc Engineered and Glycoengineered Antibodies Market: Skyrizi(R) Sales Forecast, Till 2035 (USD Billion)

- Table 21.105. Commercialized Fc Engineered and Glycoengineered Antibodies Market: Soliris(R) Sales Forecast, Till 2035 (USD Billion)

- Table 21.106. Commercialized Fc Engineered and Glycoengineered Antibodies Market: Tecentriq(R) Sales Forecast, Till 2035 (USD Billion)

- Table 21.107. Commercialized Fc Engineered and Glycoengineered Antibodies Market: Tislelizumab Sales Forecast, Till 2035 (USD Billion)

- Table 21.108. Commercialized Fc Engineered and Glycoengineered Antibodies Market: Tzield(R) Sales Forecast, Till 2035 (USD Billion)

- Table 21.109. Commercialized Fc Engineered and Glycoengineered Antibodies Market: Ultomiris(R) Sales Forecast, Till 2035 (USD Billion)

- Table 21.110. Commercialized Fc Engineered and Glycoengineered Antibodies Market: Uplizna(R) Sales Forecast, Till 2035 (USD Billion)

- Table 21.111. Phase III Fc Engineered and Glycoengineered Antibodies Market: Clazakizumab Sales Forecast, Till 2035 (USD Billion)

- Table 21.112. Phase III Fc Engineered and Glycoengineered Antibodies Market: FPA144 Sales Forecast, Till 2035 (USD Billion)

- Table 21.113. Phase III Fc Engineered and Glycoengineered Antibodies Market: Skyrizi Sales Forecast, Till 2035 (USD Billion)

- Table 21.114. Phase III Fc Engineered and Glycoengineered Antibodies Market: TQ-B2450 Sales Forecast, Till 2035 (USD Billion)

- Table 21.115. Phase III Fc Engineered and Glycoengineered Antibodies Market: VIS649 Sales Forecast, Till 2035 (USD Billion)

List of Figures

- Figure 2.1 Research Methodology: Project Methodology

- Figure 2.2 Research Methodology: Forecast Methodology

- Figure 2.3 Research Methodology: Robust Quality Control

- Figure 2.4 Research Methodology: Key Market Segmentation

- Figure 3.1. Lessons Learnt from Past Recessions

- Figure 4.1. Executive Summary: Overall Market Landscape

- Figure 4.2. Executive Summary: Clinical Trial Analysis

- Figure 4.3. Executive Summary: Partnerships and Collaborations

- Figure 4.4. Executive Summary: Grant Analysis

- Figure 4.5. Executive Summary: Patent Analysis

- Figure 4.6. Executive Summary: Market Sizing and Opportunity Analysis

- Figure 5.1. Structure of an Antibody

- Figure 5.2. Historical Timeline of Antibody Development

- Figure 5.3. Main Functions of Antibodies

- Figure 6.1. Fc Engineered and Glycoengineered Antibodies: Distribution by Stage of Development

- Figure 6.2. Fc Engineered and Glycoengineered Antibodies: Distribution by Type of Antibody

- Figure 6.3. Fc Engineered and Glycoengineered Antibodies: Distribution by Type of Engineering

- Figure 6.4. Fc Engineered and Glycoengineered Antibodies: Distribution by Impact of Engineering

- Figure 6.5. Fc Engineered and Glycoengineered Antibodies: Distribution by Biological Target

- Figure 6.6. Fc Engineered and Glycoengineered Antibodies: Distribution by Type of Therapy

- Figure 6.7. Fc Engineered and Glycoengineered Antibodies: Distribution by Target Disease Indication

- Figure 6.8. Fc Engineered and Glycoengineered Antibodies: Distribution by Therapeutic Area

- Figure 6.9. Fc Engineered and Glycoengineered Antibodies: Distribution by Route of Administration

- Figure 6.10. Popular Fc Engineered Technologies: Distribution by Number of Marketed Drugs Development Programs

- Figure 6.11. Fc Engineered and Glycoengineered Antibodies: Distribution by Year of Establishment

- Figure 6.12. Fc Engineered and Glycoengineered Antibodies: Distribution by Company Size

- Figure 6.13. Fc Engineered and Glycoengineered Antibodies: Distribution by Location of Headquarters

- Figure 6.14. World Map Representation: Analysis by Geography

- Figure 6.15. Leading Developers: Distribution by Number of Drugs

- Figure 7.1. AbbVie: Annual Revenues, Since FY 2019 (USD Billion)

- Figure 7.2. AstraZeneca: Annual Revenues, Since FY 2019 (USD Billion)

- Figure 7.3. Roche (Parent Company of Genentech): Annual Revenues, Since FY 2019 (CHF Billion)

- Figure 7.4. MacroGenics: Annual Revenues, Since FY 2019 (USD Million)

- Figure 7.5. Kyowa Kirin: Annual Revenues, Since FY 2019 (YEN Billion)

- Figure 8.1. Clinical Trial Analysis: Cumulative Year-wise Trend, Since Pre-2015

- Figure 8.2. Clinical Trial Analysis: Year-wise Trend of Patients Enrolled by Trial Registration Year, Since Pre-2015

- Figure 8.3. Clinical Trial Analysis: Distribution by Trial Phase

- Figure 8.4. Clinical Trial Analysis: Distribution of Number of Patients Enrolled by Trial Phase

- Figure 8.5. Clinical Trial Analysis: Distribution by Trial Registration Year and Trial Phase, Since Pre-2015

- Figure 8.6. Clinical Trial Analysis: Distribution by Trial Status

- Figure 8.7. Clinical Trial Analysis: Distribution by Patient Gender

- Figure 8.8. Clinical Trial Analysis: Distribution by Target Indication

- Figure 8.9. Clinical Trial Analysis: Distribution by Type of Trial Masking

- Figure 8.10. Clinical Trial Analysis: Distribution by Type of Intervention Model

- Figure 8.11. Clinical Trial Analysis: Distribution by Trial Purpose

- Figure 8.12. Clinical Trial Analysis: Distribution by Design Allocation

- Figure 8.13. Leading Industry Players: Distribution by Number of Registered Trials

- Figure 8.14. Leading Non-Industry Players: Distribution by Number of Registered Trials

- Figure 8.15. Clinical Trial Analysis: Distribution of Clinical Trials by Trial Status and Geography

- Figure 8.16. Clinical Trial Analysis: Distribution of Patients Enrolled by Trial Status and Geography

- Figure 9.1. Partnerships and Collaborations: Cumulative Year-wise Trend, Since 2016

- Figure 9.2. Partnerships and Collaborations: Distribution by Type of Partnership

- Figure 9.3. Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Figure 9.4. Partnerships and Collaborations: Distribution by Type of Engineering

- Figure 9.5. Partnerships and Collaborations: Distribution by Therapeutic Area

- Figure 9.6. Most Active Players: Distribution by Number of Partnerships

- Figure 9.7. Partnerships and Collaborations: Intracontinental and Intercontinental Agreements

- Figure 9.8. Partnerships and Collaborations: Local and International Agreements

- Figure 10.1. Grant Analysis: Cumulative Year-wise Trend, Since 2019

- Figure 10.2. Grants Analysis: Cumulative Year-wise Trend of Grants by Amount Awarded (USD Million)

- Figure 10.3. Grants Analysis: Distribution by Funding Institute Center

- Figure 10.4. Grants Analysis: Distribution by Support Period

- Figure 10.5. Grants Analysis: Distribution by Funding Institute Center and Support Period

- Figure 10.6. Grants Analysis: Distribution by Type of Grant Application

- Figure 10.7. Grants Analysis: Distribution by Purpose of Grant Award

- Figure 10.8. Grants Analysis: Distribution by Activity Code

- Figure 10.9. Grants Analysis: Distribution by Study Section Involved

- Figure 10.10. Most Popular Departments: Distribution by Number of Grants

- Figure 10.11. Prominent Program Officers: Distribution by Number of Grants

- Figure 10.12. Popular Recipient Organizations: Distribution by Number of Grants

- Figure 10.13. Popular Recipient Organizations: Distribution by Grant Amount (USD Million)

- Figure 10.14. Popular Recipient Organizations: Distribution by States in the US

- Figure 11.1. Patent Analysis: Distribution by Type of Patent

- Figure 11.2. Patent Analysis: Cumulative Distribution by Patent Publication Year, Since 2019

- Figure 11.3. Patent Analysis: Distribution by Patent Application Year, Since Pre-2019

- Figure 11.4. Patent Analysis: Year-wise Distribution of Granted Patents and Patent Applications, Since 2019

- Figure 11.5. Patent Analysis: Distribution by Patent Jurisdiction

- Figure 11.6. Patent Analysis: Distribution by CPC Symbols

- Figure 11.7. Patent Analysis: Cumulative Year-wise Distribution by Type of Applicant

- Figure 11.8. Leading Industry Players: Distribution by Number of Patents

- Figure 11.9. Leading Non-Industry Players: Distribution by Number of Patents

- Figure 11.10. Leading Individual Assignees: Distribution by Number of Patents

- Figure 11.11. Patent Benchmarking Analysis: Distribution of Patent Characteristics (CPC Codes) by Leading Industry Players

- Figure 11.12. Patent Benchmarking Distribution of Leading Industry Players by Patent Characteristics (CPC Codes)

- Figure 11.13. Patent Analysis: Distribution by Patent Age

- Figure 11.14. Fc Engineered and Glycoengineered Antibodies: Patent Valuation

- Figure 12.1. Global Fc Engineered and Glycoengineered Antibodies Market, Historical Trends (Since 2019) and Future Estimates (Till 2035) (USD Billion)

- Figure 12.2. Global Fc Engineered and Glycoengineered Antibodies Market, Till 2035: Conservative Scenario (USD Billion)

- Figure 12.3. Global Fc Engineered and Glycoengineered Antibodies Market, Till 2035: Optimistic Scenario (USD Billion)

- Figure 13.1. Fc Engineered and Glycoengineered Antibodies Market: Distribution by Type of Engineering

- Figure 13.2. Fc Engineered and Glycoengineered Antibodies Market for Fc Engineered Antibodies, Till 2035 (USD Billion)

- Figure 13.3. Fc Engineered and Glycoengineered Antibodies Market for Glycoengineered Antibodies, Till 2035 (USD Billion)

- Figure 14.1. Fc Engineered and Glycoengineered Antibodies Market: Distribution by Type of Therapy

- Figure 14.2. Fc Engineered and Glycoengineered Antibodies Market for Monotherapy, Till 2035 (USD Billion)

- Figure 14.3. Fc Engineered and Glycoengineered Antibodies Market for Combination Therapy, Till 2035 (USD Billion)

- Figure 14.4. Fc Engineered and Glycoengineered Antibodies Market for Both, Till 2035 (USD Billion)

- Figure 15.1. Fc Engineered and Glycoengineered Antibodies Market: Distribution by Therapeutic Area

- Figure 15.2. Fc Engineered and Glycoengineered Antibodies Market for Oncological Disorders, Till 2035 (USD Billion)

- Figure 15.3. Fc Engineered and Glycoengineered Antibodies Market for Dermatological Disorders, Till 2035 (USD Billion)

- Figure 15.4. Fc Engineered and Glycoengineered Antibodies Market for Autoimmune Disorders, Till 2035 (USD Billion)

- Figure 15.5. Fc Engineered and Glycoengineered Antibodies Market for Rare Disorders, Till 2035 (USD Billion)

- Figure 15.6. Fc Engineered and Glycoengineered Antibodies Market for Other Disorders, Till 2035 (USD Billion)

- Figure 16.1. Fc Engineered and Glycoengineered Antibodies Market: Distribution by Route of Administration

- Figure 16.2. Fc Engineered and Glycoengineered Antibodies Market for Intravenous Route, Till 2035 (USD Billion)

- Figure 16.3. Fc Engineered and Glycoengineered Antibodies Market for Subcutaneous Route, Till 2035 (USD Billion)

- Figure 16.4. Fc Engineered and Glycoengineered Antibodies Market for Intramuscular Route, Till 2035 (USD Billion)

- Figure 17.1. Fc Engineered and Glycoengineered Antibodies Market: Distribution by Key Geographical Regions

- Figure 17.2. Fc Engineered and Glycoengineered Antibodies Market in North America, Till 2035 (USD Billion)

- Figure 17.3. Fc Engineered and Glycoengineered Antibodies Market in Europe, Till 2035 (USD Billion)

- Figure 17.4. Fc Engineered and Glycoengineered Antibodies Market in Asia-Pacific, Till 2035 (USD Billion)

- Figure 17.5. Fc Engineered and Glycoengineered Antibodies Market in Rest of the World, Till 2035 (USD Billion)

- Figure 18.1. Commercialized Fc Engineered and Glycoengineered Antibodies Market: AK-105 Sales Forecast, Till 2035 (USD Billion)

- Figure 18.2. Commercialized Fc Engineered and Glycoengineered Antibodies Market: BeyfortusTM Sales Forecast, Till 2035 (USD Billion)

- Figure 18.3. Commercialized Fc Engineered and Glycoengineered Antibodies Market: Briumvi(R) Sales Forecast, Till 2035 (USD Billion)

- Figure 18.4. Commercialized Fc Engineered and Glycoengineered Antibodies Market: Fasenra(R) Sales Forecast, Till 2035 (USD Billion)

- Figure 18.5. Commercialized Fc Engineered and Glycoengineered Antibodies Market: Gazyva(R) Sales Forecast, Till 2035 (USD Billion)

- Figure 18.6. Commercialized Fc Engineered and Glycoengineered Antibodies Market: Imfinzi(R) Sales Forecast, Till 2035 (USD Billion)

- Figure 18.7. Commercialized Fc Engineered and Glycoengineered Antibodies Market: Margenza Sales Forecast, Till 2035 (USD Billion)

- Figure 18.8. Commercialized Fc Engineered and Glycoengineered Antibodies Market: Monjuvi(R) Sales Forecast, Till 2035 (USD Billion)

- Figure 18.9. Commercialized Fc Engineered and Glycoengineered Antibodies Market: Ocrevus(R) Sales Forecast, Till 2035 (USD Billion)

- Figure 18.10. Commercialized Fc Engineered and Glycoengineered Antibodies Market: POTELIGEO(R) Sales Forecast, Till 2035 (USD Billion)

- Figure 18.11. Commercialized Fc Engineered and Glycoengineered Antibodies Market: Saphnelo(R) Sales Forecast, Till 2035 (USD Billion)

- Figure 18.12. Commercialized Fc Engineered and Glycoengineered Antibodies Market: Skyrizi(R) Sales Forecast, Till 2035 (USD Billion)

- Figure 18.13. Commercialized Fc Engineered and Glycoengineered Antibodies Market: Soliris(R) Sales Forecast, Till 2035 (USD Billion)

- Figure 18.14. Commercialized Fc Engineered and Glycoengineered Antibodies Market: Tecentriq(R) Sales Forecast, Till 2035 (USD Billion)

- Figure 18.15. Commercialized Fc Engineered and Glycoengineered Antibodies Market: Tislelizumab Sales Forecast, Till 2035 (USD Billion)

- Figure 18.16. Commercialized Fc Engineered and Glycoengineered Antibodies Market: Tzield(R) Sales Forecast, Till 2035 (USD Billion)

- Figure 18.17. Commercialized Fc Engineered and Glycoengineered Antibodies Market: Ultomiris(R) Sales Forecast, Till 2035 (USD Billion)

- Figure 18.18. Commercialized Fc Engineered and Glycoengineered Antibodies Market: Uplizna(R) Sales Forecast, Till 2035 (USD Billion)

- Figure 18.19. Phase III Fc Engineered and Glycoengineered Antibodies Market: Clazakizumab Sales Forecast, Till 2035 (USD Billion)

- Figure 18.20. Phase III Fc Engineered and Glycoengineered Antibodies Market: FPA144 Sales Forecast, Till 2035 (USD Billion)

- Figure 18.21. Phase III Fc Engineered and Glycoengineered Antibodies Market: Skyrizi Sales Forecast, Till 2035 (USD Billion)

- Figure 18.22. Phase III Fc Engineered and Glycoengineered Antibodies Market: TQ-B2450 Sales Forecast, Till 2035 (USD Billion)

- Figure 18.23. Phase III Fc Engineered and Glycoengineered Antibodies Market: VIS649 Sales Forecast, Till 2035 (USD Billion)

- Figure 19.1. Concluding Remarks: Fc Engineered and Glycoengineered Antibodies: Overall Market Landscape

- Figure 19.2. Concluding Remarks: Fc Engineered and Glycoengineered Antibodies: Clinical Trial Analysis

- Figure 19.3. Concluding Remarks: Fc Engineered and Glycoengineered Antibodies: Partnerships and Collaborations

- Figure 19.4. Concluding Remarks: Fc Engineered and Glycoengineered Antibodies: Grant Analysis

- Figure 19.5. Concluding Remarks: Fc Engineered and Glycoengineered Antibodies: Patent Analysis

- Figure 19.6. Concluding Remarks: Fc Engineered and Glycoengineered Antibodies: Market Sizing and Opportunity Analysis (I/II)

- Figure 19.7. Concluding Remarks: Fc Engineered and Glycoengineered Antibodies: Market Sizing and Opportunity Analysis (II/II)