|

市场调查报告书

商品编码

1698338

氢燃料电池汽车市场机会、成长动力、产业趋势分析及2025-2034年预测Hydrogen Fuel Cell Vehicle Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

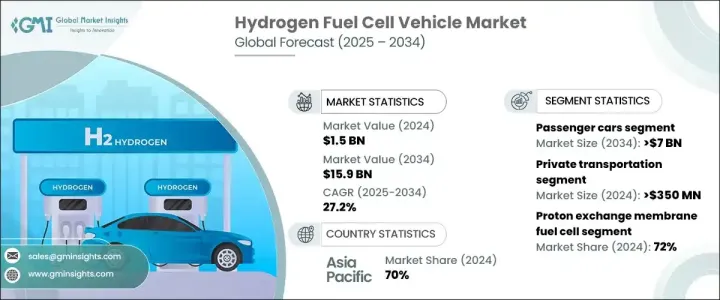

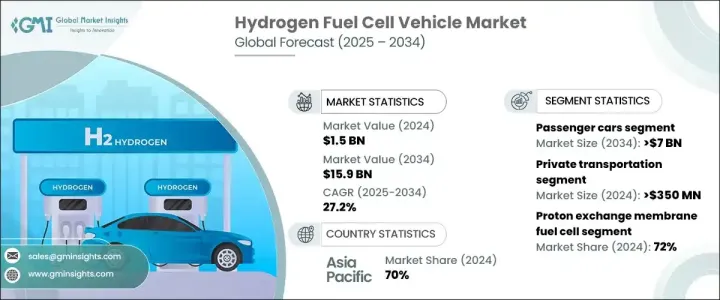

2024 年全球氢燃料电池汽车市场规模达到 15 亿美元,预计 2025 年至 2034 年间将以 27.2% 的强劲复合年增长率成长。清洁能源解决方案的需求激增,加上对氢燃料补给基础设施的投资不断增加,正在推动市场扩张。世界各国政府正投入大量资金建立广泛的加氢网络,确保其可及性并鼓励广泛采用氢动力汽车。在各国努力实现严格的排放目标并向永续的交通解决方案转型之际,这些努力至关重要。

随着全球汽车製造商将重点转向零排放汽车,氢燃料电池技术作为传统内燃机和电池电动车的可行替代品越来越受到关注。氢动力汽车结合了长续航力和快速加油时间,具有独特的优势,解决了电动车的关键问题,例如充电时间长。这项优势加上政府支持清洁能源计画的政策,正在激发消费者的兴趣并加快采用率。领先的汽车公司正在增加产量以满足不断增长的需求,一些製造商推出了新的氢燃料电池车型以满足市场需求。此外,燃料电池技术的不断进步使得氢动力交通更加经济高效,进一步巩固了其在未来交通运输中的地位。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 15亿美元 |

| 预测值 | 159亿美元 |

| 复合年增长率 | 27.2% |

氢燃料电池汽车市场按车辆类型细分,包括乘用车、商用车和专用车。 2024 年,乘用车市场占据主导地位,达到 50%,预计到 2034 年将创造 70 亿美元的市场价值。对零排放运输的日益追求迫使汽车製造商开发氢动力乘用车,将燃料电池技术与电池系统结合,以提高行驶里程和效率。消费者对氢动力汽车的偏好日益增长,因为它们能够长途行驶,而无需像电动车那样长时间充电。消费者情绪的转变正在推动汽车製造商投资氢技术,进一步促进市场成长。

就技术而言,市场分为质子交换膜 (PEM) 燃料电池、固体氧化物燃料电池、碱性燃料电池、磷酸燃料电池和其他类型。 2024年,PEM燃料电池凭藉其卓越的效率、轻量化的结构和快速的启动能力占据市场主导地位,占有72%的份额。这些特性使得PEM燃料电池成为氢动力汽车的首选。薄膜材料和燃料电池堆设计的不断进步正在推动性能的提高,同时降低生产成本,使该技术更容易被大规模采用。

亚太地区成为氢燃料电池汽车市场的领先地区,到 2024 年将占据 70% 的市场。这一增长得益于政府对氢燃料补给基础设施和大规模氢气生产计划的大量投资。该地区各国正积极将氢能纳入其长期能源战略,并提供大量财政激励措施以加速汽车普及。随着汽车製造商扩大生产以满足日益增长的需求,氢动力汽车的发展势头强劲,巩固了该地区在全球市场的主导地位。

目录

第一章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 原物料供应商

- 零件供应商

- 製造商

- 技术提供者

- 最终用途

- 供应商格局

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻和倡议

- 监管格局

- 价格趋势

- 成本細項分析

- 衝击力

- 成长动力

- 政府加强对氢燃料电池汽车的诱因与补贴力度

- 扩大加氢基础设施

- 增加绿色氢气生产的投资

- 零排放商业运输需求不断成长

- 产业陷阱与挑战

- 生产和加油成本高

- 加氢基础设施有限

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 轿车

- 掀背车

- SUV

- 商用车

- 轻型商用车(LCV)

- 重型商用车(HCV)

- 专用车辆

- 工业车辆

- 军用车辆

第六章:市场估计与预测:依技术分类,2021 - 2034 年

- 主要趋势

- 质子交换膜燃料电池(PEMFC)

- 固态氧化物燃料电池(SOFC)

- 碱性燃料电池

- 磷酸燃料电池

- 其他的

第七章:市场估计与预测:依范围,2021 - 2034 年

- 主要趋势

- 短距离(0-250英里)

- 中距离(251-500英里)

- 长距离(500 英里以上)

第八章:市场估计与预测:依功率范围,2021 年至 2034 年

- 主要趋势

- 小于150kW

- 150-250千瓦

- 250kW以上

第九章:市场估计与预测:按应用,2021 - 2034

- 主要趋势

- 私人交通

- 大众运输

- 工业的

- 军事与国防

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第 11 章:公司简介

- BMW

- FAW Group

- Ford

- General Motors

- Great Wall Motor

- Honda

- Hyundai

- Hyzon Motors

- Iveco Group

- MAN Energy Solutions

- Mercedes-Benz

- Nikola Corporation

- Porsche

- Renault

- Riversimple

- SAIC

- Stellantis

- Toyota

- Volkswagen

- Volvo

The Global Hydrogen Fuel Cell Vehicle Market reached USD 1.5 billion in 2024 and is projected to expand at a robust CAGR of 27.2% between 2025 and 2034. The surging demand for clean energy solutions, in line with increasing investments in hydrogen refueling infrastructure, is propelling market expansion. Governments worldwide are making substantial financial commitments to build an extensive hydrogen refueling network, ensuring accessibility and encouraging widespread adoption of hydrogen-powered vehicles. These efforts are crucial as nations strive to meet stringent emissions targets and transition toward sustainable transportation solutions.

As global automotive manufacturers shift focus toward zero-emission vehicles, hydrogen fuel cell technology is gaining traction as a viable alternative to conventional internal combustion engines and battery electric vehicles. Hydrogen-powered vehicles offer a unique advantage by combining long-range capabilities with rapid refueling times, addressing key concerns associated with battery electric vehicles, such as lengthy charging durations. This advantage, along with government policies supporting clean energy initiatives, is fueling consumer interest and accelerating adoption rates. Leading automotive companies are ramping up production to cater to the rising demand, with several manufacturers unveiling new hydrogen fuel cell models in response to market needs. Additionally, ongoing advancements in fuel cell technology are making hydrogen-powered mobility more cost-effective and efficient, further solidifying its position in the future of transportation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.5 Billion |

| Forecast Value | $15.9 Billion |

| CAGR | 27.2% |

The hydrogen fuel cell vehicle market is segmented by vehicle type, including passenger cars, commercial vehicles, and specialized vehicles. In 2024, the passenger car segment held a dominant 50% market share and is expected to generate USD 7 billion by 2034. The increasing push for zero-emission transportation is compelling automakers to develop hydrogen-powered passenger cars that integrate fuel cell technology with battery systems to enhance driving range and efficiency. Consumers are showing a growing preference for hydrogen vehicles due to their ability to travel long distances without the extended charging times associated with battery electric vehicles. This shift in consumer sentiment is driving automakers to invest in hydrogen technology, further boosting market growth.

In terms of technology, the market is categorized into proton exchange membrane (PEM) fuel cells, solid oxide fuel cells, alkaline fuel cells, phosphoric acid fuel cells, and other variants. In 2024, PEM fuel cells dominated the market, holding a 72% share due to their superior efficiency, lightweight structure, and rapid start-up capability. These characteristics make PEM fuel cells the preferred choice for hydrogen-powered vehicles. Continuous advancements in membrane materials and fuel cell stack design are driving performance improvements while reducing production costs, making the technology more accessible for mass adoption.

Asia Pacific emerged as the leading region in the hydrogen fuel cell vehicle market, capturing a significant 70% share in 2024. This growth is driven by extensive government investments in hydrogen refueling infrastructure and large-scale hydrogen production initiatives. Countries across the region are actively incorporating hydrogen into their long-term energy strategies, providing substantial financial incentives to accelerate vehicle adoption. As automakers scale up production to meet growing demand, hydrogen-powered mobility is gaining momentum, reinforcing the region's position as a dominant player in the global market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material suppliers

- 3.1.2 Component suppliers

- 3.1.3 Manufacturers

- 3.1.4 Technology providers

- 3.1.5 End Use

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Price trends

- 3.9 Cost breakdown analysis

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Rising government incentives and subsidies for adoption of hydrogen fuel cell vehicles

- 3.10.1.2 Expanding hydrogen refueling infrastructure

- 3.10.1.3 Increasing investments in green hydrogen production

- 3.10.1.4 Growing demand for zero-emission commercial transport

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High production and refueling costs

- 3.10.2.2 Limited hydrogen refueling infrastructure

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter’s analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Passenger cars

- 5.2.1 Sedans

- 5.2.2 Hatchbacks

- 5.2.3 SUVs

- 5.3 Commercial vehicles

- 5.3.1 Light Commercial Vehicles (LCV)

- 5.3.2 Heavy Commercial Vehicles (HCV)

- 5.4 Specialized Vehicles

- 5.4.1 Industrial vehicles

- 5.4.2 Military vehicles

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Proton Exchange Membrane Fuel Cells (PEMFCs)

- 6.3 Solid Oxide Fuel Cells (SOFCs)

- 6.4 Alkaline fuel cell

- 6.5 Phosphoric acid fuel cell

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Range, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Short range (0-250 Miles)

- 7.3 Medium range (251-500 Miles)

- 7.4 Long range (Above 500 Miles)

Chapter 8 Market Estimates & Forecast, By Power Range, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Less than 150kW

- 8.3 150-250kW

- 8.4 Above 250kW

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Private transportation

- 9.3 Public transportation

- 9.4 Industrial

- 9.5 Military & defense

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 BMW

- 11.2 FAW Group

- 11.3 Ford

- 11.4 General Motors

- 11.5 Great Wall Motor

- 11.6 Honda

- 11.7 Hyundai

- 11.8 Hyzon Motors

- 11.9 Iveco Group

- 11.10 MAN Energy Solutions

- 11.11 Mercedes-Benz

- 11.12 Nikola Corporation

- 11.13 Porsche

- 11.14 Renault

- 11.15 Riversimple

- 11.16 SAIC

- 11.17 Stellantis

- 11.18 Toyota

- 11.19 Volkswagen

- 11.20 Volvo