|

市场调查报告书

商品编码

1698518

餐包配送服务市场机会、成长动力、产业趋势分析及 2025-2034 年预测Meal Kit Delivery Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

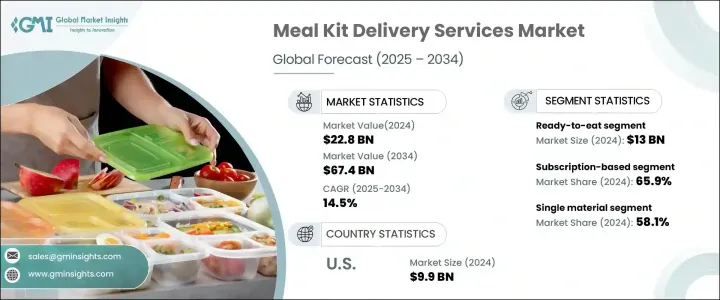

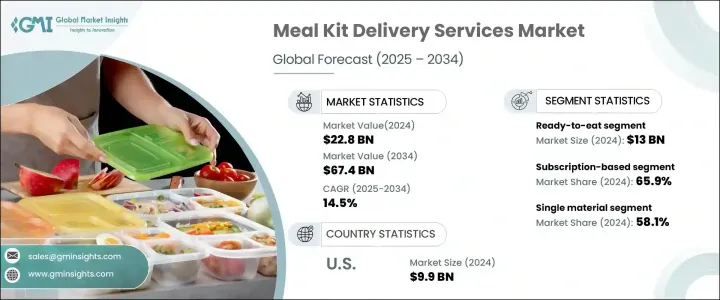

2024 年全球餐包配送服务市场价值为 228 亿美元,预估 2025 年至 2034 年期间的复合年增长率为 14.5%。对方便、份量控制和营养均衡的膳食的需求不断增长是推动这一增长的关键因素。随着现代生活节奏越来越快,消费者正在积极寻求既美味又健康的无忧食品解决方案。餐包在便利性和营养性之间实现了理想的平衡,吸引了从忙碌的专业人士到注重健康的家庭等广泛的消费者。此外,人们对健康饮食习惯和饮食偏好的认识不断提高,鼓励更多的人探索符合他们的健身目标和生活方式选择的饮食套件选择。全球美食、植物性饮食选择和防过敏替代品的种类不断增加,进一步扩大了这些服务的吸引力,为市场成长做出了重大贡献。

餐包服务主要分为两类:即食和即食。即食食品在 2024 年占据了市场主导地位,创造了 130 亿美元的产值,预计将保持强劲势头,从 2025 年到 2034 年的复合年增长率为 14.3%。由于时间限制,人们对方便食品的倾向日益增长,使得即食餐包成为注重易于准备的消费者的首选。随着冷冻和预煮食品越来越受欢迎,越来越多的人选择现成的食物而不是传统的家常菜。随着全球可支配所得水准的提高,消费者更愿意投资于节省时间同时又能提供高品质口味和营养的预製食品。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 228亿美元 |

| 预测值 | 674亿美元 |

| 复合年增长率 | 14.5% |

餐包配送市场的营运格局主要分为订阅模式和按需模式。订阅服务凭藉其用户友好的介面和个人化的选项,在 2024 年占据了 65.9% 的市场份额。这些计划提供了灵活性,可以根据需要选择膳食偏好、修改份量或跳过送餐,以满足消费者的不同需求。先进的人工智慧个人化工具透过分析先前的食物选择并推荐符合个人饮食要求的餐点,进一步增强了客户体验。餐包领域技术的不断进步正在帮助品牌增强客户忠诚度和满意度。

在美国,受消费者偏好转变的推动,餐包配送市场规模到 2024 年将达到 99 亿美元。远距工作的日益普及提高了人们对便捷餐饮解决方案的兴趣,促进了产业的持续成长。此外,日益增长的环境问题促使公司采用环保包装解决方案并实施减少食物浪费的策略。对永续性的重视正在成为市场中的关键差异化因素,影响着购买决策和品牌认知。同时,亚太地区预计在预测期内经历最快的成长,因为中国和印度等国家的消费者越来越愿意投资于提供便利和多样性的预煮餐解决方案。多个地区的需求激增凸显了餐包服务的全球吸引力及其重塑家庭餐饮未来的潜力。

目录

第一章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

- 初步研究和验证

- 主要来源

- 资料探勘来源

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 增加均衡且分量控制的膳食供应

- 对客製化食品的需求不断增长

- 由于方便,餐包的采用率不断上升

- 提高消费者对即食食品的倾向

- 产业陷阱与挑战

- 客户获取成本高

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按食品类型,2021 年至 2034 年

- 主要趋势

- 即食

- 即食

第六章:市场估计与预测:依交付模式,2021 年至 2034 年

- 主要趋势

- 基于订阅

- 一经请求

第七章:市场估计与预测:按服务,2021 年至 2034 年

- 主要趋势

- 单身的

- 多种的

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Albertsons Companies

- Blue Apron

- Daily Harvest

- Factor75

- Fresh n' Lean

- Gobble

- HelloFresh

- Marley Spoon

- Mindful Chef

- Purple Carrot

- Quicklly

- Snap Kitchen

- Sun Basket

- The Kroger

- Trifecta Nutrition

The Global Meal Kit Delivery Services Market was valued at USD 22.8 billion in 2024 and is projected to grow at a CAGR of 14.5% between 2025 and 2034. The growing demand for convenient, portion-controlled, and nutritionally balanced meals is a key factor fueling this growth. As modern lifestyles become increasingly fast-paced, consumers are actively seeking hassle-free food solutions that offer both taste and health benefits. Meal kits provide an ideal balance between convenience and nutrition, appealing to a wide range of consumers-from busy professionals to health-conscious families. Moreover, rising awareness of healthy eating habits and dietary preferences is encouraging more individuals to explore meal kit options that align with their fitness goals and lifestyle choices. The expanding variety of global cuisines, plant-based meal options, and allergy-conscious alternatives further widens the appeal of these services, contributing significantly to market growth.

Meal kit services fall into two main categories: ready-to-cook and ready-to-eat. The ready-to-eat segment dominated the market in 2024, generating USD 13 billion, and is expected to maintain strong momentum, growing at a CAGR of 14.3% from 2025 to 2034. The growing inclination toward convenience foods, driven by time constraints, has made ready-to-eat meal kits a preferred choice for consumers who prioritize ease of preparation. With the increasing popularity of frozen and pre-cooked meals, more individuals are opting for ready-made solutions over traditional home-cooked options. As disposable income levels rise globally, consumers are more willing to invest in prepared meals that save time while delivering high-quality taste and nutrition.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $22.8 Billion |

| Forecast Value | $67.4 Billion |

| CAGR | 14.5% |

The operational landscape of the meal kit delivery market is primarily divided between subscription-based and on-demand models. Subscription services accounted for 65.9% of the market share in 2024, owing to their user-friendly interfaces and personalized options. These plans offer the flexibility to choose meal preferences, modify portion sizes, or skip deliveries as needed, catering to the diverse needs of consumers. Advanced AI-driven personalization tools have further enhanced the customer experience by analyzing previous food choices and recommending meals that align with individual dietary requirements. The continuous advancement of technology in the meal kit space is helping brands strengthen customer loyalty and satisfaction.

In the United States, the meal kit delivery market was valued at USD 9.9 billion in 2024, driven by shifting consumer preferences. The increasing popularity of remote work has heightened interest in convenient meal solutions, fostering sustained industry growth. Furthermore, rising environmental concerns have prompted companies to adopt eco-friendly packaging solutions and implement strategies to minimize food waste. The emphasis on sustainability is becoming a crucial differentiator in the market, influencing purchasing decisions and brand perception. Meanwhile, the Asia Pacific region is poised to experience the fastest growth during the forecast period, as consumers in countries such as China and India show an increasing willingness to invest in pre-cooked meal solutions that offer convenience and variety. This surge in demand across multiple regions highlights the global appeal of meal kit services and their potential to reshape the future of home dining.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing offering of balanced and portion-controlled meals

- 3.6.1.2 Rising demand for customizable food options

- 3.6.1.3 Increasing adoption of meal kits due to their convenience

- 3.6.1.4 Rise consumer inclination towards ready to cook food

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High customer acquisition costs

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Food Type, 2021 – 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Ready-to-cook

- 5.3 Ready-to-eat

Chapter 6 Market Estimates and Forecast, By Delivery Model, 2021 – 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Subscription-based

- 6.3 On-demand

Chapter 7 Market Estimates and Forecast, By Serving, 2021 – 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Single

- 7.3 Multiple

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Albertsons Companies

- 9.2 Blue Apron

- 9.3 Daily Harvest

- 9.4 Factor75

- 9.5 Fresh n' Lean

- 9.6 Gobble

- 9.7 HelloFresh

- 9.8 Marley Spoon

- 9.9 Mindful Chef

- 9.10 Purple Carrot

- 9.11 Quicklly

- 9.12 Snap Kitchen

- 9.13 Sun Basket

- 9.14 The Kroger

- 9.15 Trifecta Nutrition