|

市场调查报告书

商品编码

1698527

钠离子电池市场机会、成长动力、产业趋势分析及2025-2034年预测Sodium Ion Battery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

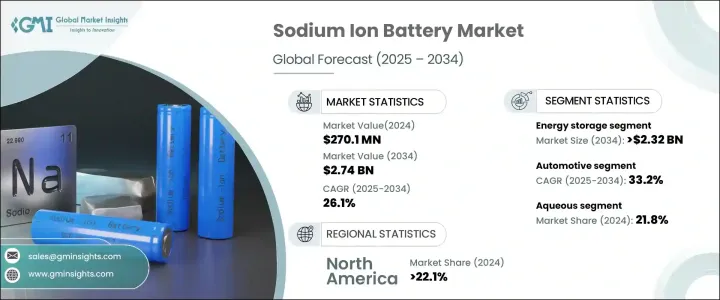

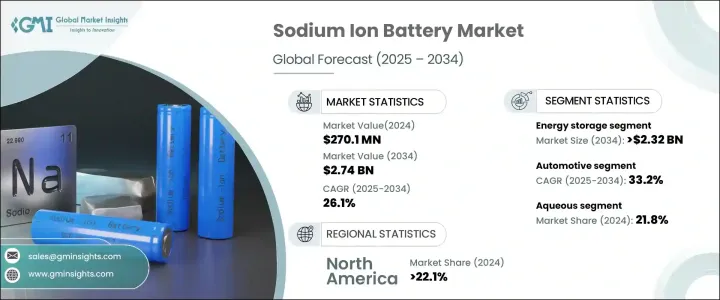

2024 年全球钠离子电池市场价值为 2.701 亿美元,预计在 2025 年至 2034 年期间将以 26.1% 的复合年增长率扩张,这得益于对经济高效且可持续的能源储存解决方案的需求不断增长。随着各行各业寻求增强供应链弹性的替代方案,钠离子技术因其依赖丰富的原料,减少了对稀缺和昂贵资源的依赖,成为可行的选择。人们对环保能源解决方案的日益重视进一步推动了这种转变,钠离子电池成为传统锂离子电池的低成本替代品。

钠离子电池的转变得益于其解决能源储存领域关键挑战的能力。再生能源的日益普及加剧了对大规模、经济实惠的能源储存解决方案的需求,使得钠离子技术成为首选。这些电池为汽车到电网等行业提供了可持续、高效且可扩展的选择。此外,与锂离子电池相比,它们的安全性有所提高,特别是在防止热失控方面,使其成为稳定性和可靠性至关重要的应用的理想解决方案。随着电网规模储能装置的扩大,钠离子电池因其降低火灾和爆炸风险(传统电池技术的主要问题)而变得越来越有吸引力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2.701亿美元 |

| 预测值 | 27.4亿美元 |

| 复合年增长率 | 26.1% |

在终端应用中,能源储存产业预计到 2034 年将创造 23.2 亿美元的收入。对于公用事业和大型再生能源专案而言,对经济高效且持久的储存解决方案的需求至关重要。随着世界各国政府推动能源转型政策,钠离子电池因其与太阳能和风能係统无缝整合的潜力而受到越来越大的关注。它们的经济性和安全性优势进一步增强了其大规模部署的吸引力,解决了与成本、供应链脆弱性和营运安全相关的关键产业挑战。汽车产业对钠离子技术的兴趣也日益浓厚,尤其是电动车(EV),因为製造商希望实现电池供应多样化,减少对锂基材料的依赖。

钠离子电池技术分为水系和非水系,其中水系在 2024 年的市占率为 21.8%。水系钠离子电池因其增强的安全性能而备受关注,可最大限度地减少火灾和爆炸危险。与传统的锂离子电池不同,它们即使在过度充电、短路和机械损坏等极端条件下也能保持稳定。这种稳定性,加上无需使用昂贵有机溶剂的成本效益,促使水性钠离子电池在广泛的储能係统中得到越来越广泛的应用。

2024 年,美国钠离子电池市场占全球市场的 22.1%,2023 年市场规模达 4,420 万美元。联邦政府支持储能发展的措施正在加速该领域的研发,促进钠离子电池技术的创新和商业化。不断扩大的可再生能源项目以及电网现代化建设进一步推动了对经济高效且安全的大规模储存解决方案的需求。随着国家继续投资永续能源基础设施,钠离子电池有望在塑造未来的能源储存方面发挥关键作用。

目录

第一章:方法论与范围

- 研究设计

- 基础估算与计算

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第二章:执行摘要

第三章:行业洞察

- 产业生态系统

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 战略仪表板

- 创新与永续发展格局

第五章:市场规模及预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 汽车

- 能源储存

- 其他的

第六章:市场规模及预测:依技术分类,2021 年至 2034 年

- 主要趋势

- 水性

- 非水性

第七章:市场规模及预测:依地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 法国

- 义大利

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 世界其他地区

第八章:公司简介

- Altris

- CATL

- China BAK Battery

- Farasis Energy

- Faradion Limited

- HiNa Battery Technology

- Li-FUN Technology

- Natron Energy

- Northvolt

- SVOLT

- Tiamat

The Global Sodium Ion Battery Market, valued at USD 270.1 million in 2024, is expected to expand at a CAGR of 26.1% between 2025 and 2034, driven by the increasing demand for cost-effective and sustainable energy storage solutions. As industries seek alternatives that enhance supply chain resilience, sodium-ion technology is emerging as a viable option due to its reliance on abundant raw materials, reducing dependence on scarce and expensive resources. This shift is further fueled by the growing emphasis on environmentally friendly energy solutions, with sodium-ion batteries presenting a low-cost alternative to traditional lithium-ion batteries.

The transition to sodium-ion batteries is being propelled by their ability to address critical challenges in the energy storage landscape. The rising adoption of renewable energy sources has intensified the need for large-scale, affordable energy storage solutions, making sodium-ion technology a preferred choice. These batteries offer a sustainable, efficient, and scalable option for industries ranging from automotive to power grids. Additionally, their improved safety profile over lithium-ion batteries, particularly in preventing thermal runaway, positions them as a compelling solution for applications where stability and reliability are paramount. As grid-scale energy storage installations expand, sodium-ion batteries are becoming increasingly attractive for reducing the risk of fire and explosion, a major concern in conventional battery technologies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $270.1 Million |

| Forecast Value | $2.74 Billion |

| CAGR | 26.1% |

Among end-use applications, the energy storage sector is poised to generate USD 2.32 billion by 2034. The need for cost-efficient and long-lasting storage solutions is critical for utilities and large-scale renewable energy projects. As governments worldwide push for energy transition policies, sodium-ion batteries are gaining traction due to their potential to integrate seamlessly with solar and wind power systems. Their affordability and safety advantages further enhance their appeal for large-scale deployment, addressing key industry challenges related to cost, supply chain vulnerabilities, and operational safety. The automotive industry is also showing growing interest in sodium-ion technology, particularly for electric vehicles (EVs), as manufacturers look to diversify their battery supply and reduce reliance on lithium-based materials.

Sodium-ion battery technology is categorized into aqueous and non-aqueous types, with the aqueous segment holding a 21.8% market share in 2024. Aqueous sodium-ion batteries are gaining attention due to their enhanced safety features, which minimize fire and explosion hazards. Unlike traditional lithium-ion batteries, they maintain stability even under extreme conditions, including overcharging, short circuits, and mechanical damage. This stability, combined with the cost benefits of eliminating expensive organic solvents, is contributing to the growing adoption of aqueous sodium-ion batteries for extensive energy storage systems.

The United States sodium-ion battery market accounted for 22.1% of the global market in 2024, generating USD 44.2 million in 2023. Federal initiatives supporting energy storage advancements are accelerating research and development in the sector, fostering innovation and commercialization of sodium-ion battery technology. Expanding renewable energy projects, along with grid modernization efforts, are further driving demand for cost-effective and safe large-scale storage solutions. As the country continues investing in sustainable energy infrastructure, sodium-ion batteries are expected to play a pivotal role in shaping the future of energy storage.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research Design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market Definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's Analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL Analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By End Use, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 Automotive

- 5.3 Energy Storage

- 5.4 Others

Chapter 6 Market Size and Forecast, By Technology, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 Aqueous

- 6.3 Non Aqueous

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 France

- 7.3.3 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 South Korea

- 7.4.4 India

- 7.5 Rest of World

Chapter 8 Company Profiles

- 8.1 Altris

- 8.2 CATL

- 8.3 China BAK Battery

- 8.4 Farasis Energy

- 8.5 Faradion Limited

- 8.6 HiNa Battery Technology

- 8.7 Li-FUN Technology

- 8.8 Natron Energy

- 8.9 Northvolt

- 8.10 SVOLT

- 8.11 Tiamat