|

市场调查报告书

商品编码

1698541

发电燃气涡轮机市场机会、成长动力、产业趋势分析及 2025-2034 年预测Power Generation Gas Turbine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

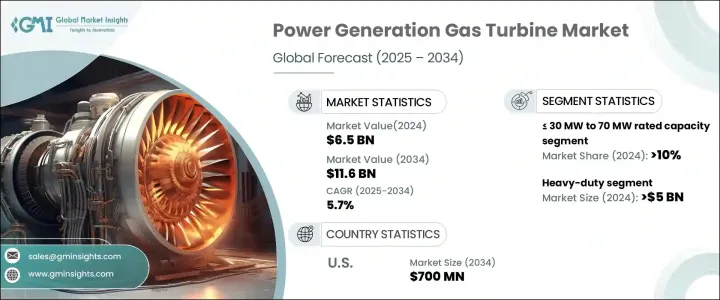

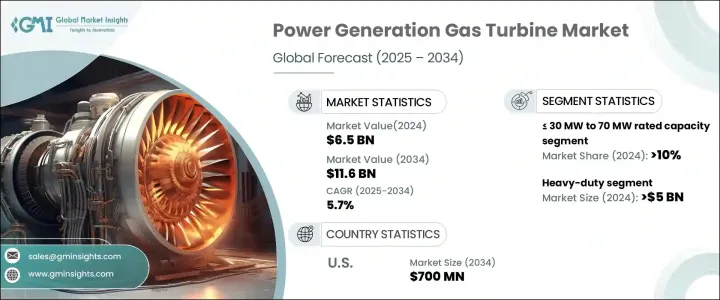

2024 年全球发电燃气涡轮机市场价值为 65 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 5.7%。向更清洁能源的转变以及对高效和永续发电解决方案日益增长的需求正在推动行业成长。消费者意识的增强,加上减少碳排放的严格规定,正在促进发电领域对燃气涡轮机的需求。由于燃气涡轮机在平衡电网可靠性和再生能源整合方面发挥关键作用,从燃煤发电厂向天然气替代能源的转变正在加速。随着燃气涡轮发电份额的不断增加,市场在快速城市化、工业扩张和人口增长的推动下不断发展。由于老化发电厂需要现代化改造,先进的燃气涡轮技术对于满足全球能源需求变得至关重要。

燃气涡轮机因其效率高、反应时间快,仍是发电的首选。这些系统将燃料的化学能转换为机械能,然后再转换为电能。再生能源的整合、涡轮机设计的进步以及氢混合涡轮机的日益普及正在增强市场前景。分散式电力系统的扩张,特别是在离网和偏远地区的扩张,正在推动中小型燃气涡轮机的需求。对实现净零排放的日益关注进一步推动了正在开发使用替代燃料的下一代涡轮机的采用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 65亿美元 |

| 预测值 | 116亿美元 |

| 复合年增长率 | 5.7% |

根据容量,市场分为涡轮机容量范围从<= 30 MW 到 70 MW、> 70 MW 到 200 MW 和> 200 MW。 2024 年,功率在 <= 30 MW 至 70 MW 范围内的系统将占据超过 10% 的市场份额,因其效率高、成本效益高以及在联合循环和气化厂中的广泛应用而受到青睐。涡轮机部件(包括翼型和涂层)的不断发展正在提高其运行性能和可靠性。

根据设计,该产业分为航空衍生型燃气涡轮机和重型燃气涡轮机。 2024 年,重型引擎市场的份额将达到 50 亿美元,这得益于联合循环燃气涡轮机 (CCGT) 电厂的广泛使用以及补充再生能源的能力。航空衍生产品领域预计在 2024 年价值 10 亿美元,由于其在电网接入受限地区的效率而越来越受到关注。资料中心的成长及其庞大的电力需求也刺激了对航空衍生涡轮机的需求。

市场进一步细分为开式循环和联合循环系统。联合循环涡轮机在 2024 年的市场规模将超过 50 亿美元,而开式循环涡轮机预计到 2034 年的复合年增长率将达到 5%。开式循环涡轮机因其启动快、功能多样、冷却要求低而受到青睐。受工业成长、能源效率要求以及政府减排政策的推动,到 2034 年,联合循环领域的复合年增长率预计将超过 5.5%。

受氢燃烧技术和低碳能源投资增加的推动,美国市场规模预计到 2034 年将超过 7 亿美元。受益于丰富的天然气供应和开采技术的进步,预计到 2034 年,北美燃气涡轮机产业的复合年增长率将达到 5.5%。联合循环发电厂的持续发展和燃气涡轮机效率的提高将在推动产业扩张方面发挥重要作用。

目录

第一章:方法论与范围

- 市场范围和定义

- 市场估计和预测参数

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略展望

- 创新与永续发展格局

第五章:市场规模及预测:依产能,2021 年至 2034 年

- 主要趋势

- ≤30MW至70MW

- > 70 兆瓦至 200 兆瓦

- > 200 兆瓦

第六章:市场规模及预测:依产品,2021 年至 2034 年

- 主要趋势

- 航改型

- 重负

第七章:市场规模及预测:依技术分类,2021 年至 2034 年

- 主要趋势

- 开放式循环

- 复合循环

第八章:市场规模及预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 德国

- 俄罗斯

- 义大利

- 荷兰

- 芬兰

- 希腊

- 丹麦

- 罗马尼亚

- 波兰

- 瑞典

- 亚太地区

- 中国

- 澳洲

- 日本

- 韩国

- 印尼

- 泰国

- 马来西亚

- 孟加拉

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 卡达

- 科威特

- 阿曼

- 埃及

- 土耳其

- 巴林

- 伊拉克

- 约旦

- 黎巴嫩

- 南非

- 奈及利亚

- 阿尔及利亚

- 肯亚

- 迦纳

- 拉丁美洲

- 巴西

- 阿根廷

- 秘鲁

- 智利

第九章:公司简介

- Ansaldo Energia

- Bharat Heavy Electricals Limited (BHEL)

- Flex Energy Solutions

- GE Vernova

- Harbin Electric

- JSC United Engine

- Kawasaki Heavy Industries

- MAN Energy Solutions

- Mitsubishi Heavy Industries

- Opra Turbines

- Rolls Royce

- Siemens

- Solar Turbines

- TotalEnergies

- Wartsila

- Zorya-Mashproekt

The Global Power Generation Gas Turbine Market, valued at USD 6.5 billion in 2024, is projected to expand at a CAGR of 5.7% from 2025 to 2034. The transition toward cleaner energy sources and the rising need for efficient and sustainable power generation solutions are driving industry growth. Increasing consumer awareness, combined with stringent regulations to reduce carbon emissions, is fostering demand for gas turbines in power generation. The shift from coal-fired power plants to natural gas-based alternatives is accelerating adoption, as gas turbines play a key role in balancing grid reliability and renewable energy integration. With an increasing share of electricity generation coming from gas turbines, the market continues to evolve, supported by rapid urbanization, industrial expansion, and population growth. As aging power plants require modernization, advanced gas turbine technologies are becoming essential in meeting the global energy demand.

Gas turbines remain a preferred choice in power generation due to their efficiency and rapid response time. These systems convert the chemical energy of fuel into mechanical energy, which is then transformed into electricity. The integration of renewable energy sources, advancements in turbine designs, and the growing deployment of hydrogen-blend turbines are enhancing market prospects. The expansion of distributed power systems, especially in off-grid and remote locations, is driving demand for small and medium-sized gas turbines. Increased focus on achieving net-zero emissions is further boosting the adoption of next-generation turbines, which are being developed to operate on alternative fuels.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.5 Billion |

| Forecast Value | $11.6 Billion |

| CAGR | 5.7% |

The market is categorized based on capacity into turbines ranging from <= 30 MW to 70 MW, > 70 MW to 200 MW, and > 200 MW. Systems within the <= 30 MW to 70 MW range accounted for over 10% of the market in 2024, favored for their efficiency, cost-effectiveness, and widespread application in combined cycle and gasification plants. The continuous evolution of turbine components, including airfoils and coatings, is enhancing operational performance and reliability.

By design, the industry is divided into aeroderivative and heavy-duty gas turbines. The heavy-duty segment held a USD 5 billion share in 2024, driven by extensive use in combined cycle gas turbine (CCGT) plants and the ability to complement renewable energy. The aeroderivative segment, valued at USD 1 billion in 2024, is gaining traction due to its efficiency in regions with limited grid access. The growth of data centers, with their substantial power requirements, is also fueling demand for aeroderivative turbines.

The market further differentiates into open cycle and combined cycle systems. While combined cycle turbines accounted for over USD 5 billion in 2024, open cycle turbines are expected to grow at a CAGR of 5% through 2034. Open cycle turbines are favored for their quick startup, versatility, and lower cooling requirements. The combined cycle segment is projected to witness a CAGR of over 5.5% through 2034, driven by industrial growth, energy efficiency mandates, and government policies aimed at reducing emissions.

The U.S. market is expected to surpass USD 700 million by 2034, supported by increased investment in hydrogen combustion technologies and low-carbon energy sources. North America's gas turbine industry is projected to expand at a CAGR of 5.5% through 2034, benefiting from an abundant natural gas supply and advancements in extraction technologies. The continued development of combined cycle power plants and improvements in gas turbine efficiency will play a significant role in driving the industry's expansion.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Capacity, 2021 – 2034 (MW & USD Million)

- 5.1 Key trends

- 5.2 ≤ 30 MW to 70 MW

- 5.3 > 70 MW to 200 MW

- 5.4 > 200 MW

Chapter 6 Market Size and Forecast, By Product, 2021 – 2034 (MW & USD Million)

- 6.1 Key trends

- 6.2 Aero-derivative

- 6.3 Heavy duty

Chapter 7 Market Size and Forecast, By Technology, 2021 – 2034 (MW & USD Million)

- 7.1 Key trends

- 7.2 Open cycle

- 7.3 Combined cycle

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (MW & USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 France

- 8.3.3 Germany

- 8.3.4 Russia

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.3.7 Finland

- 8.3.8 Greece

- 8.3.9 Denmark

- 8.3.10 Romania

- 8.3.11 Poland

- 8.3.12 Sweden

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Indonesia

- 8.4.6 Thailand

- 8.4.7 Malaysia

- 8.4.8 Bangladesh

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Qatar

- 8.5.4 Kuwait

- 8.5.5 Oman

- 8.5.6 Egypt

- 8.5.7 Turkey

- 8.5.8 Bahrain

- 8.5.9 Iraq

- 8.5.10 Jordan

- 8.5.11 Lebanon

- 8.5.12 South Africa

- 8.5.13 Nigeria

- 8.5.14 Algeria

- 8.5.15 Kenya

- 8.5.16 Ghana

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

- 8.6.3 Peru

- 8.6.4 Chile

Chapter 9 Company Profiles

- 9.1 Ansaldo Energia

- 9.2 Bharat Heavy Electricals Limited (BHEL)

- 9.3 Flex Energy Solutions

- 9.4 GE Vernova

- 9.5 Harbin Electric

- 9.6 JSC United Engine

- 9.7 Kawasaki Heavy Industries

- 9.8 MAN Energy Solutions

- 9.9 Mitsubishi Heavy Industries

- 9.10 Opra Turbines

- 9.11 Rolls Royce

- 9.12 Siemens

- 9.13 Solar Turbines

- 9.14 TotalEnergies

- 9.15 Wartsila

- 9.16 Zorya-Mashproekt