|

市场调查报告书

商品编码

1699237

海底电缆系统市场机会、成长动力、产业趋势分析及2025-2034年预测Submarine Cable Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

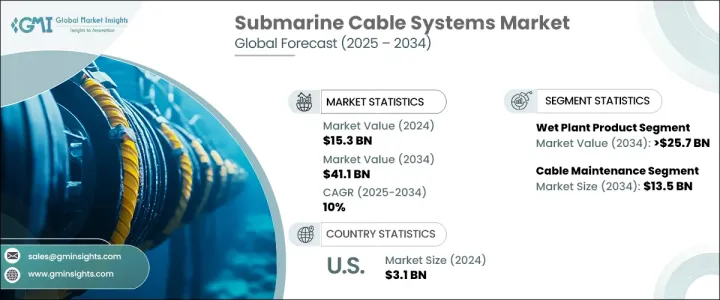

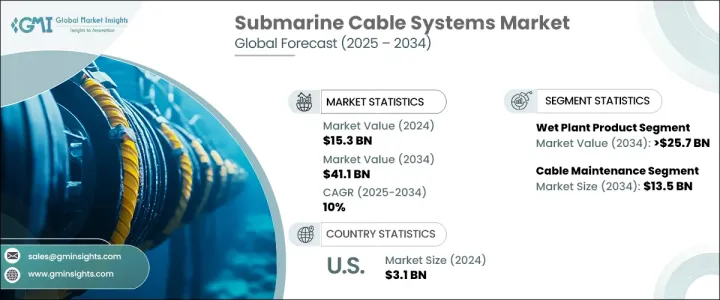

2024 年全球海底电缆系统市场价值为 153 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 10%。这一增长主要得益于工业化程度的提高以及新兴经济体对先进布线和电缆网路日益增长的需求。随着基础设施建设的加速,对强大的电力连接解决方案的需求不断增长,从而推动了对海底电缆系统的投资。

由于环境问题日益严重以及传统资源的枯竭,世界各国政府正积极将重点转向再生能源发电。互连项目数量的不断增加导致对海底电缆系统的需求不断增加,从而确保高效的能源传输。此外,频宽容量和光纤电缆耐用性的不断进步使得这些系统更加可靠和经济高效。产业参与者正在引入创新解决方案,例如高容量多光纤海底电缆,以提高资料传输效率。这些发展极大地促进了市场扩张,从而鼓励进一步的投资和技术改进。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 153亿美元 |

| 预测值 | 411亿美元 |

| 复合年增长率 | 10% |

随着全球对再生能源的日益重视,湿式植物产品领域的规模预计到 2034 年将超过 257 亿美元。随着再生能源的普及,对高效能水下传输网路的需求也日益增加。随着永续发展的大力推动,政府和企业正在增加对离岸风电场和能源电网互联的投资,这反过来又加强了对海底电缆的需求。

预计到 2034 年,电缆安装服务领域的复合年增长率将超过 8.5%。这一上升趋势归因于能源需求激增、工业扩张以及各个地区的快速城市化。随着工业现代化和城市发展,对无缝连接的需求正在推动对海底电缆部署的投资。高效的安装服务对于确保这些水下网路的可靠性和寿命起着至关重要的作用。

在美国,海底电缆系统市场一直稳定成长。 2022 年市值为 28 亿美元,2023 年为 29 亿美元,2024 年为 31 亿美元。城市化和工业化步伐的加快推动了对高性能海底电缆的需求,从而实现无缝资料和能源传输。对这些系统的日益依赖预示着未来的强劲扩张,巩固了该地区作为海底电缆基础设施关键市场的地位。

随着技术进步不断提高电缆性能和效率,海底电缆系统市场将在未来几年经历强劲成长。尖端光纤、增强的频宽能力和不断发展的能源传输要求的整合共同塑造了该行业的发展轨迹,使其成为全球基础设施发展的重要组成部分。

目录

第一章:方法论与范围

- 市场定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 战略仪表板

- 创新与永续发展格局

第五章:市场规模及预测:依组件划分,2021 年至 2034 年

- 主要趋势

- 干燥植物产品

- 湿植物产品

第六章:市场规模及预测:依产品类型 2021 – 2034

- 主要趋势

- 电缆安装服务

- 电缆维护和维修服务

- 升级服务

第七章:市场规模及预测:依部署情形 2021 年至 2034 年

- 主要趋势

- 浅水

- 深水

第 8 章:市场规模与预测:按应用 2021 年至 2034 年

- 主要趋势

- 海底电力电缆

- 海底通讯电缆

第九章:市场规模及预测:依最终用途划分 2021 – 2034

- 主要趋势

- 离岸风力发电

- 国家间和岛屿间连接

- 海上石油和天然气

第 10 章:市场规模与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第 11 章:公司简介

- Alcatel-Lucent Submarine Networks (ASN)

- Corning Incorporated

- Fujitsu Limited

- Global Marine Systems

- Gulf Bridge International (GBI)

- Hengtong Marine Cable Systems

- NEC Corporation

- Nexans

- Orange Marine

- Prysmian

- SEACOM

The Global Submarine Cable Systems Market was valued at USD 15.3 billion in 2024 and is expected to expand at a CAGR of 10% from 2025 to 2034. This growth is primarily driven by increasing industrialization and the rising demand for advanced wiring and cable networks in emerging economies. As infrastructure development accelerates, the need for robust electrical connectivity solutions continues to grow, fueling investments in submarine cable systems.

Governments worldwide are actively shifting their focus toward renewable energy generation due to rising environmental concerns and the depletion of conventional resources. The increasing number of interconnection projects is contributing to the rising demand for submarine cable systems, ensuring efficient energy transmission. Additionally, continuous advancements in bandwidth capacity and the durability of fiber optic cables are making these systems more reliable and cost-effective. Industry players are introducing innovative solutions, such as high-capacity multi-fiber submarine cables, to enhance data transmission efficiency. These developments are significantly boosting market expansion, thus encouraging further investments and technological improvements.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.3 Billion |

| Forecast Value | $41.1 Billion |

| CAGR | 10% |

The wet plant product segment is poised to exceed USD 25.7 billion by 2034, supported by the growing global emphasis on renewable energy. As renewable energy sources gain traction, the need for efficient underwater transmission networks is increasing. With a strong push toward sustainability, governments and enterprises are ramping up investments in offshore wind farms and energy grid interconnections, which in turn is strengthening the demand for submarine cables.

The cable installation services segment is expected to witness a CAGR of over 8.5% through 2034. This upward trend is attributed to surging energy demand, industrial expansion, and the rapid urbanization taking place across various regions. As industries modernize and cities grow, the need for seamless connectivity is propelling investments in submarine cable deployment. Efficient installation services play a crucial role in ensuring the reliability and longevity of these underwater networks.

In the United States, the submarine cable systems market has been experiencing steady growth. The market was valued at USD 2.8 billion in 2022, USD 2.9 billion in 2023, and USD 3.1 billion in 2024. The increasing pace of urbanization and industrialization is driving the demand for high-performance submarine cables, enabling seamless data and energy transmission. The growing reliance on these systems indicates strong future expansion, reinforcing the region's position as a key market for submarine cable infrastructure.

As technological advancements continue to refine cable performance and efficiency, the submarine cable systems market is set to experience robust growth in the coming years. The integration of cutting-edge fiber optics, enhanced bandwidth capabilities, and evolving energy transmission requirements are collectively shaping the industry's trajectory, making it a crucial component of global infrastructure development.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Component, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 Dry plant product

- 5.3 Wet plant product

Chapter 6 Market Size and Forecast, By Offering 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 Cable installation services

- 6.3 Cable maintenance and repair services

- 6.4 Upgradate services

Chapter 7 Market Size and Forecast, By Deployment 2021 – 2034 (USD Million)

- 7.1 Key trends

- 7.2 Shallow water

- 7.3 Deep water

Chapter 8 Market Size and Forecast, By Application 2021 – 2034 (USD Million)

- 8.1 Key trends

- 8.2 Submarine power cables

- 8.3 Submarine communication cables

Chapter 9 Market Size and Forecast, By End Use 2021 – 2034 (USD Million)

- 9.1 Key trends

- 9.2 Offshore wind power generation

- 9.3 Inter country & island connection

- 9.4 Offshore oil & gas

Chapter 10 Market Size and Forecast, By Region, 2021 – 2034 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Middle East & Africa

- 10.5.1 Saudi Arabia

- 10.5.2 UAE

- 10.5.3 South Africa

- 10.6 Latin America

- 10.6.1 Brazil

- 10.6.2 Argentina

Chapter 11 Company Profiles

- 11.1 Alcatel-Lucent Submarine Networks (ASN)

- 11.2 Corning Incorporated

- 11.3 Fujitsu Limited

- 11.4 Global Marine Systems

- 11.5 Gulf Bridge International (GBI)

- 11.6 Hengtong Marine Cable Systems

- 11.7 NEC Corporation

- 11.8 Nexans

- 11.9 Orange Marine

- 11.10 Prysmian

- 11.11 SEACOM