|

市场调查报告书

商品编码

1788514

全球海底电缆系统市场(按电缆类型、组件、绝缘体和类型划分)- 预测至 2030 年Submarine Cable Systems Market by Cable Type (Communication Cable, Power Cable), Component (Dry Plant Product, Wet Plant Product), Insulation (Cross-linked Polyethylene, Oil-Impregnated Paper) and Type (Single Core, Multicore) - Global Forecast to 2030 |

||||||

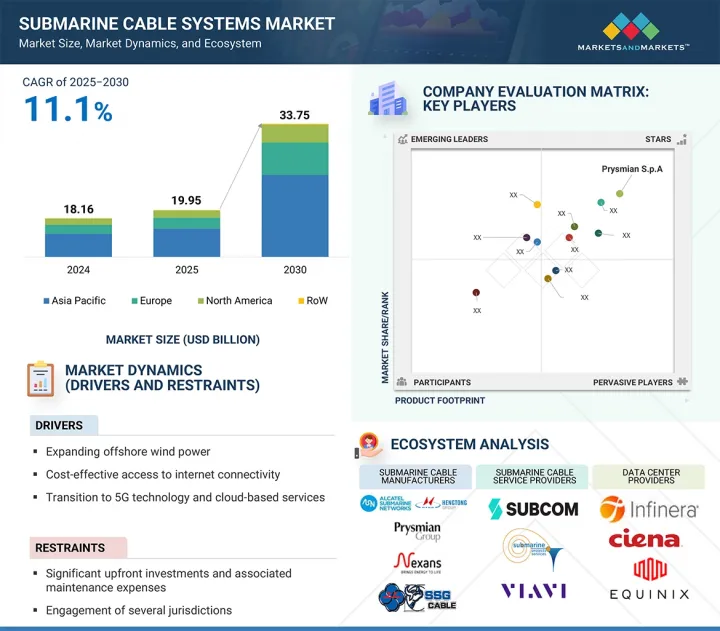

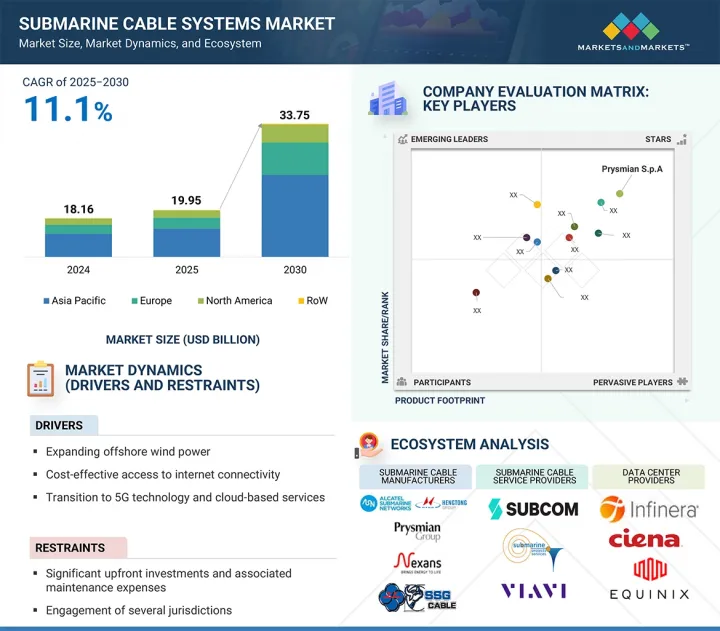

全球海底电缆系统市场预计将从 2025 年的 199.5 亿美元成长到 2030 年的 337.5 亿美元,复合年增长率为 11.1%。

5G 将使行动装置和物联网设备能够支援多个同时连接,并提高速度、延迟、可靠性和功耗。

| 调查范围 | |

|---|---|

| 调查年份 | 2021-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 单元 | 10亿美元 |

| 部分 | 电缆类型、组件、服务内容、类型、电压、绝缘、最终用途、地区 |

| 目标区域 | 北美、欧洲、亚太地区及其他地区 |

频谱竞标已接近尾声,支援 5G 的行动装置已陆续发布,全球网路部署也已开始。 5G 的发展主要集中在 B2C 市场,这主要得益于网路营运商降低营运成本的努力。影片和音讯串流服务等频宽频宽应用的资料需求不断增长,以及向云端服务和 5G 的持续转变,这些因素正在推动光纤互连的需求,从而推动海底电缆系统市场的成长。

“到 2024 年,干式设备产品领域将占据通讯电缆海底电缆系统市场的第二大份额。”

海底电缆系统市场对干式设备产品的需求,源自于海底电缆网路上岸后需要支援与效能最佳化。资料中心的快速扩张和宽频服务的普及需要强大的地面基础设施。

“2025年至2030年,安装和试运行部分将见证海底通讯电缆市场最高的复合年增长率。”

海底电缆的安装和试运行受多种因素驱动。首先,全球对高速可靠连接的需求日益增长,推动了对高效安装和试运行流程的需求,以便快速部署海底电缆网路。其次,安装技术的进步,例如遥控探勘(ROV) 和专用船舶,使得在恶劣的水下环境中能够更快、更准确地安装电缆,从而有助于缩短安装时间并降低成本。

“人们对海上基础设施的兴趣日益浓厚,使得亚太地区在 2024 年成为第二大海底电力电缆市场。”

根据全球风能理事会 (GWEC) 的预测,亚太地区预计将在未来十年主导海上风力发电扩张。中国积极推动可再生能源和海上基础设施建设,使其成为全球海底电力电缆市场的主导者。中国已设定目标,在未来五年内增加 64 吉瓦的离岸风电装置容量,以减少对石化燃料的依赖,实现碳中和。

本报告研究了全球海底电缆系统市场,提供了关键驱动因素和限制因素、竞争格局和未来趋势的资讯。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章 主要发现

- 海底电缆系统市场为企业带来诱人机会

- 海底电缆系统市场(依电缆类型)

- 海底通讯电缆市场(按组件)

- 海底电力电缆市场(依绝缘体)

- 欧洲海底电力电缆市场(按最终用途和国家划分)

- 各国海底电力电缆市场

第五章市场概述

- 介绍

- 市场动态

- 驱动程式

- 抑制因素

- 机会

- 任务

- 影响客户业务的趋势/中断

- 定价分析

- 海底电缆系统价格分布)(2024年)

- 海底通讯电缆平均售价趋势(2021-2024年)

- 主要企业提供的海底电缆系统价格分布(依电缆类型划分)(2024年)

- 各地区海底电力电缆平均售价趋势(2021-2024)

- 价值链分析

- 生态系分析

- 投资金筹措场景

- 技术分析

- 主要技术

- 互补技术

- 邻近技术

- 专利分析

- 贸易分析

- 进口情形(HS 编码 8544)

- 出口情形(HS 编码 8544)

- 大型会议和活动(2025-2026年)

- 案例研究

- 剑桥管理顾问公司、Pelagian 和 Baker Bots 为特克斯和凯科斯群岛提供高弹性、高容量光纤连接解决方案

- TRATOS 将提供海底电缆组件,以满足 ENI 墨西哥 AREA 1 开发计划的特定要求

- XTERA 和 GCS 合作铺设海底电缆,增强加拉巴哥群岛与厄瓜多尔之间的连结性

- 珊瑚海电缆系统(CS2)计划将加速巴布亚纽几内亚和所罗门群岛的网路连接

- N-SEA 利用 SINAY 的 METOCEAN ANALYTICS 进行天气风险管理,增强计划韧性

- 监管格局

- 监管机构、政府机构和其他组织

- 标准

- 波特五力分析

- 关键相关利益者和购买流程

- 采购过程中的关键相关利益者

- 采购标准

- 人工智慧/产生人工智慧对海底电缆系统市场的影响

- 介绍

- 人工智慧/生成式人工智慧对关键终端应用的影响

- 人工智慧/生成式人工智慧用例

- 海底电缆系统生态系统中人工智慧/生成式人工智慧的未来

- 2025年美国关税对海底电缆系统市场的影响

- 介绍

- 主要关税税率

- 价格影响分析

- 对国家的影响

- 对最终用途应用的影响

6. 海底电缆系统市场(依电缆类型)

- 介绍

- 通讯电缆

- 电源线

第七章 海底通讯电缆市场(依组件)

- 介绍

- 干燥植物产品

- 湿植物产品

第八章 海底通讯电缆市场(依服务提供)

- 介绍

- 安装及试运行

- 维护

- 系统升级

第九章 海底电力电缆市场(按类型)

- 介绍

- 单核

- 多核心

第 10 章 海底电力电缆市场(按电压)

- 介绍

- 中压

- 高压

第11章 海底电力电缆市场(依绝缘类型)

- 介绍

- 交联聚乙烯(XLPE)

- 油浸纸(OIP)

- 树脂转注纸(RIP)

- 树脂转注合成(RIS)

第 12 章。按最终用途分類的海底电力电缆市场

- 介绍

- 离岸风电场

- 跨国/岛屿连接

- 海上石油和天然气工厂

第十三章 海底电力电缆市场(按地区)

- 介绍

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 丹麦

- 荷兰

- 挪威

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 韩国

- 马来西亚

- 印尼

- 越南

- 其他亚太地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 安哥拉

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

第十四章 海底通讯电缆市场(按地区)

- 介绍

- 跨大西洋

- 跨太平洋

- 亚洲境内

- 美洲

- 欧亚大陆

- 欧洲、中东和非洲

第十五章竞争格局

- 概述

- 主要参与企业的策略/优势(2021-2025)

- 收益分析(2020-2024)

- 市场占有率分析(2024年)

- 公司估值及财务指标

- 比较产品

- 企业评估矩阵:主要企业(2024年)

- 公司评估矩阵:Start-Ups/中小企业(2024 年)

- 竞争场景

第十六章:公司简介

- 主要企业

- ALCATEL SUBMARINE NETWORKS

- PRYSMIAN SPA

- SUBCOM, LLC

- NEC CORPORATION

- NEXANS

- HENGTONG GROUP CO., LTD.

- ZTT

- NKT A/S

- SUMITOMO ELECTRIC INDUSTRIES LTD.

- LS CABLE & SYSTEM LTD.

- 其他公司

- CORNING INCORPORATED

- NINGBO ORIENT WIRES & CABLES CO. LTD.

- TAIHAN CABLE & SOLUTION CO., LTD.

- QINGDAO HANHE CABLE CO., LTD.

- FURUKAWA ELECTRIC CO., LTD.

- HEXATRONIC GROUP

- APAR INDUSTRIES LTD.

- TFKABLE

- AFL

- HELLENIC CABLES

- SHANGHAI QIFAN CABLE CO., LTD.

- SSGCABLE

- OCC CORPORATION

- FRIGATE ENGINEERING SERVICES PVT LTD

- TRATOS

第十七章 附录

At a CAGR of 11.1%, the global submarine cable system market is anticipated to grow from USD 19.95 billion in 2025 to USD 33.75 billion by 2030. 5G allows mobile handsets and Internet of Things (IoT) devices to accommodate multiple connections simultaneously while improving speed, latency, reliability, and power consumption.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Cable Type, Component, Service Offering, Type, Voltage, Insulation, End-use Application, and Region |

| Regions covered | North America, Europe, APAC, RoW |

The auctions for spectrum have nearly finished, 5G-ready handsets have been released, and network implementation has begun globally. Most 5G developments are focused on the business-to-consumer (B2C) market, owing to the efforts of network operators to reduce operational costs. With the growing demand for data fueled by bandwidth-intensive applications, such as video and audio streaming services, coupled with the continued shift toward cloud services and 5G, there is a growing need for fiber optic interconnectivity, which will drive the submarine cable systems market growth.

"Dry plant products segment captured second-largest share of submarine cable systems market for communication cables in 2024"

The dry plant products of submarine communication cables, comprising submarine line monitors (SLE), power feeding equipment (PFE), and submarine line terminal equipment (SLTE), cover the stage between beach manholes and cable landing stations. The demand for dry plant products in the submarine cable system market is driven by the need to support and optimize the performance of undersea cable networks once they reach the shore. The rapid expansion of data centers and the proliferation of broadband services require robust terrestrial infrastructure.

"Installation & commissioning segment to witness highest CAGR in market for submarine communication cables between 2025 and 2030"

Installation & commissioning are anticipated to witness the highest CAGR during the forecast period in the submarine communication cable market. Several key factors propel the installation and commissioning of submarine cables in the market. Firstly, the increasing global demand for high-speed and reliable connectivity drives the need for efficient installation and commissioning processes to deploy submarine cable networks swiftly. Secondly, advancements in installation technologies, such as remotely operated vehicles (ROVs) and specialized vessels, enable faster and more accurate cable laying in challenging underwater environments, contributing to reduced installation times and costs.

"Rising interest towards offshore infrastructure to position Asia Pacific as the second-largest submarine power cable market in 2024"

The submarine power cable market in Asia Pacific, which includes China, Japan, South Korea, Malaysia, Vietnam, Indonesia, and Rest of Asia Pacific, has been thoroughly assessed. According to projections from the Global Wind Energy Council (GWEC), the Asia Pacific is expected to dominate offshore wind energy expansion throughout this decade. China is emerging as a dominant player in the global submarine power cable market, driven by its aggressive push toward renewable energy and offshore infrastructure development. The country has set a target to add 64 GW of offshore wind power capacity within the next five years, aiming to reduce its dependence on fossil fuels and achieve carbon neutrality.

Breakdown of Primaries

Various executives from key organizations operating in the submarine cable systems market, including CEOs, marketing directors, and innovation and technology directors, were interviewed in-depth.

- By Company Type: Tier 1 - 40%, Tier 2 - 25%, and Tier 3 - 35%

- By Designation: Directors - 25%, C-level Executives - 45%, and Others - 30%

- By Region: North America - 55%, Europe - 10%, Asia Pacific - 25%, the Middle East & Africa - 5%, and South America - 10%

Note: Three tiers of companies have been defined based on their total revenue as of 2024: tier 3: revenue less than USD 500 million; tier 2: revenue between USD 500 million and USD 1 billion; and tier 1: revenue more than USD 1 billion. Other designations include sales managers, marketing managers, and product managers.

Major players profiled in this report are Alcatel Submarine Networks (France), Prysmian S.p.A (Italy), SubCom, LLC (US), NEC Corporation (Japan), Nexans (France), HENGTONG GROUP CO., LTD. (China), NKT A/S (Denmark), ZTT (China), LS Cable & System Ltd. (South Korea), Sumitomo Electric Industries, Ltd.(Japan), Corning Incorporated (US), Ningbo Orient Wires &Cables Co.,Ltd. (China), Taihan Cable & Solution Co., Ltd. (South Korea), Qingdao Hanhe Cable Co., Ltd. (China), Furukawa Electric Co., Ltd. (Japan), Hexatronic Group (Sweden), APAR Industries Ltd. (India), TFKable (Poland), AFL (US), Hellenic Cables (Greece), Shanghai Qifan Cable Co.,Ltd. (China), SSGCABLE (China), OCC Corporation (Japan), Tratos (UK), and Frigate Engineering Services Pvt Ltd (US). These leading companies possess a broad portfolio of products and establish a prominent presence in established and emerging markets.

The study provides a detailed competitive analysis of these key players in the submarine cable systems market, presenting their company profiles, most recent developments, and key market strategies.

Research Coverage

This report segments the submarine cable systems market based on cable type, component, service offering, type, end-use application, voltage, insulation, and region. The cable type segment includes communication cables and power cables. The component segment includes wet plant products and dry plant products.

The end-use application segment comprises offshore wind power generation plants, intercountry & island connections, and offshore oil & gas plants. The type segment includes single core and multicore. The service offerings segment covers the installation & commissioning, maintenance, and system upgrades. The voltage segment includes medium-voltage and High-voltage. The insulation segment includes cross-linked polyethylene, oil-impregnated paper, resin-impregnated paper, and resin-impregnated synthetics. The market for submarine power cable has been segmented into five regions-North America, Asia Pacific, Europe, the Middle East & Africa, and South America. The market for submarine communication cable has been segmented into five regions: Transatlantic, Transpacific, Intra-Asia, Americas, EMEA, and Europe-Asia.

Reasons to Buy the Report

The report will help the leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market and the subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the submarine cable systems market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

Key Benefits of Buying the Report

- Analysis of key drivers (Expanding offshore wind power, Cost-effective access to internet connectivity, Cost-effective access to internet connectivity, Transition to 5G technology and cloud-based services, Growing demand for internet connectivity across the Transpacific region, Rising need for electrical power supply on islands ), restraints (Significant upfront investments and associated maintenance expenses, Engagement of several jurisdictions), opportunities (Implementation of HVDC power transmission technology, Rising participation of OTT players), challenges (Shortage of commissioning, maintenance, and repair activities for vessels, Rise of alternative technologies) influencing the growth of the submarine cable systems market

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and product launches in the submarine cable systems market

- Market Development: Comprehensive information about lucrative markets, including the analysis of the submarine cable systems market across varied regions

- Market Diversification: Exhaustive information about new products/services, untapped geographies, recent developments, and investments in submarine cable systems

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, including Alcatel Submarine Networks (France), Prysmian S.p.A (Italy), SubCom, LLC (US), NEC Corporation (Japan), and Nexans (France).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 List of primary interview participants

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.1.3.4 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to derive market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to derive market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SUBMARINE CABLE SYSTEMS MARKET

- 4.2 SUBMARINE CABLE SYSTEMS MARKET, BY CABLE TYPE

- 4.3 SUBMARINE COMMUNICATION CABLES MARKET, BY COMPONENT

- 4.4 SUBMARINE POWER CABLES MARKET, BY INSULATION

- 4.5 SUBMARINE POWER CABLES MARKET IN EUROPE, BY END-USE APPLICATION AND COUNTRY

- 4.6 SUBMARINE POWER CABLES MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising need for reliable power transmission amid expanding offshore wind power capacity

- 5.2.1.2 Increasing bandwidth usage due to high access to affordable internet connectivity

- 5.2.1.3 Rapid transition toward 5G technology and cloud-based services

- 5.2.1.4 Mounting demand for high-speed internet connections across Transpacific region

- 5.2.1.5 Rising need for electrical power supply in islands

- 5.2.2 RESTRAINTS

- 5.2.2.1 Significant upfront investments and associated maintenance expenses

- 5.2.2.2 Requirement for permits for submarine cable installations

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Evolving HVDC power transmission technology

- 5.2.3.2 Increasing investment in submarine cable projects by over-the-top (OTT) players

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of commissioning, maintenance, and repair activities for vessels

- 5.2.4.2 Growing reliance on satellite internet technology

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 PRICING RANGE OF SUBMARINE CABLE SYSTEMS, BY CABLE TYPE, 2024

- 5.4.2 AVERAGE SELLING PRICE TREND OF SUBMARINE COMMUNICATION CABLES, 2021-2024

- 5.4.3 PRICING RANGE OF SUBMARINE CABLE SYSTEMS OFFERED BY KEY PLAYERS, BY CABLE TYPE, 2024

- 5.4.4 AVERAGE SELLING PRICING TREND OF SUBMARINE POWER CABLES, BY REGION, 2021-2024

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Wavelength division multiplexing

- 5.8.1.2 P-Laser cable technology

- 5.8.1.3 Open cables

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Subsea robotics

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Remote sensing and satellite communication

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO (HS CODE 8544)

- 5.10.2 EXPORT SCENARIO (HS CODE 8544)

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 CASE STUDY

- 5.12.1 CAMBRIDGE MANAGEMENT CONSULTING, PELAGIAN, AND BAKER BOTTS PROVIDE RESILIENT, HIGH-CAPACITY FIBER CONNECTIVITY SOLUTIONS IN TURKS & CAICOS ISLANDS

- 5.12.2 TRATOS SUPPLIES SUBMARINE CABLE COMPONENTS TO ADDRESS SPECIFIC REQUIREMENTS OF ENI'S MEXICO AREA 1 DEVELOPMENT PROJECT

- 5.12.3 XTERA AND GCS PARTNER TO DEPLOY SUBMARINE CABLES TO ENHANCE CONNECTIVITY BETWEEN GALAPAGOS ISLANDS AND ECUADOR

- 5.12.4 CORAL SEA CABLE SYSTEM (CS2) PROJECT ENABLES FASTER INTERNET CONNECTIVITY IN PAPUA NEW GUINEA AND SOLOMON ISLANDS

- 5.12.5 N-SEA BOOSTS PROJECT RESILIENCE USING SINAY'S METOCEAN ANALYTICS FOR WEATHER RISK MANAGEMENT

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 STANDARDS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.14.2 BARGAINING POWER OF SUPPLIERS

- 5.14.3 BARGAINING POWER OF BUYERS

- 5.14.4 THREAT OF SUBSTITUTES

- 5.14.5 THREAT OF NEW ENTRANTS

- 5.15 KEY STAKEHOLDERS AND BUYING PROCESS

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF AI/GEN AI ON SUBMARINE CABLE SYSTEMS MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 IMPACT OF AI/GEN AI ON KEY END-USE APPLICATIONS

- 5.16.2.1 Offshore wind power generation plants

- 5.16.2.2 Offshore oil & gas plants

- 5.16.3 AI/GEN AI USE CASES

- 5.16.4 FUTURE OF AI/GEN AI IN SUBMARINE CABLE SYSTEMS ECOSYSTEM

- 5.17 IMPACT OF 2025 US TARIFF ON SUBMARINE CABLE SYSTEMS MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRIES/REGIONS

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON END-USE APPLICATIONS

6 SUBMARINE CABLE SYSTEMS MARKET, BY CABLE TYPE

- 6.1 INTRODUCTION

- 6.2 COMMUNICATION CABLES

- 6.2.1 RISING ADOPTION OF CONNECTED DEVICES TO BOOST SEGMENTAL GROWTH

- 6.3 POWER CABLES

- 6.3.1 INCREASING OFFSHORE WIND FARM INSTALLATIONS TO ACCELERATE SEGMENTAL GROWTH

7 SUBMARINE COMMUNICATION CABLES MARKET, BY COMPONENT

- 7.1 INTRODUCTION

- 7.2 DRY PLANT PRODUCTS

- 7.2.1 GROWING DEMAND FOR ADVANCED TERRESTRIAL EQUIPMENT TO MANAGE DATA TRAFFIC AND ENSURE SEAMLESS CONNECTIVITY TO DRIVE MARKET

- 7.2.2 SUBMARINE LINE TERMINAL EQUIPMENT

- 7.2.3 SUBMARINE LINE MONITORS

- 7.2.4 POWER FEEDING EQUIPMENT

- 7.3 WET PLANT PRODUCTS

- 7.3.1 REPEATERS

- 7.3.1.1 Optimal amplification and resistance to water pressure to foster segmental growth

- 7.3.2 BRANCHING UNITS

- 7.3.2.1 Ability to handle cable breaks to contribute to segmental growth

- 7.3.3 CABLES

- 7.3.3.1 Use to address rising global connectivity demand to accelerate segmental growth

- 7.3.4 OTHER WET PLANT PRODUCTS

- 7.3.1 REPEATERS

8 SUBMARINE COMMUNICATION CABLES MARKET, BY SERVICE OFFERING

- 8.1 INTRODUCTION

- 8.2 INSTALLATION & COMMISSIONING

- 8.2.1 RISING GLOBAL DEMAND FOR FAST AND RELIABLE CONNECTIVITY TO BOLSTER SEGMENTAL GROWTH

- 8.3 MAINTENANCE

- 8.3.1 INCREASING SUBMARINE CABLE DAMAGE FROM HUMAN ACTIVITIES TO AUGMENT SEGMENTAL GROWTH

- 8.4 SYSTEM UPGRADE

- 8.4.1 ADOPTION OF COHERENT TRANSMISSION TECHNOLOGY TO OFFER GROWTH OPPORTUNITIES

9 SUBMARINE POWER CABLES MARKET, BY TYPE

- 9.1 INTRODUCTION

- 9.2 SINGLE CORE

- 9.2.1 EXPANDING USE IN OFFSHORE WIND FARMS AND REMOTE ISLANDS FOR POWER DISTRIBUTION TO FUEL SEGMENTAL GROWTH

- 9.3 MULTICORE

- 9.3.1 CAPABILITY OF LEAD SHEATHS TO PREVENT WATER INGRESS TO EXPEDITE SEGMENTAL GROWTH

10 SUBMARINE POWER CABLES MARKET, BY VOLTAGE

- 10.1 INTRODUCTION

- 10.2 MEDIUM-VOLTAGE

- 10.2.1 RISING NEED FOR CONNECTIONS BETWEEN GENERATORS ON WIND FARMS AND OFFSHORE OIL & GAS PLATFORMS TO DRIVE MARKET

- 10.3 HIGH-VOLTAGE

- 10.3.1 INCREASING OFFSHORE RENEWABLE POWER GENERATION TO ACCELERATE SEGMENTAL GROWTH

11 SUBMARINE POWER CABLES MARKET, BY INSULATION

- 11.1 INTRODUCTION

- 11.2 CROSS-LINKED POLYETHYLENE (XLPE)

- 11.2.1 CAPABILITY TO PROVIDE HIGH ELECTRICAL AND MECHANICAL STRENGTH TO BOOST SEGMENTAL GROWTH

- 11.3 OIL-IMPREGNATED PAPER (OIP)

- 11.3.1 INCREASING USE IN HIGH-VOLTAGE DC TRANSMISSION LINES TO CONTRIBUTE TO SEGMENTAL GROWTH

- 11.4 RESIN-IMPREGNATED PAPER (RIP)

- 11.4.1 CAPABILITY TO ENDURE HARSH ENVIRONMENTAL CONDITIONS TO AUGMENT SEGMENTAL GROWTH

- 11.5 RESIN-IMPREGNATED SYNTHETIC (RIS)

- 11.5.1 EXPLOSION-PROOF PROPERTIES TO ACCELERATE SEGMENTAL GROWTH

12 SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION

- 12.1 INTRODUCTION

- 12.2 OFFSHORE WIND POWER GENERATION PLANTS

- 12.2.1 GROWING NEED FOR LONG-DISTANCE POWER TRANSMISSION TO FUEL SEGMENTAL GROWTH

- 12.3 INTERCOUNTRY & ISLAND CONNECTION

- 12.3.1 RISING DEMAND FOR CLEAN AND RENEWABLE ENERGY TO DRIVE MARKET

- 12.4 OFFSHORE OIL & GAS PLANTS

- 12.4.1 INCREASING USE OF SATELLITE WELLS IN SUBSEA FIELD DEVELOPMENT TO BOOST SEGMENTAL GROWTH

13 SUBMARINE POWER CABLES MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 US

- 13.2.1.1 Rising government initiatives to promote offshore wind energy to accelerate market growth

- 13.2.2 CANADA

- 13.2.2.1 Growing emphasis on building clean economy through renewable energy technologies to drive market

- 13.2.3 MEXICO

- 13.2.3.1 Increasing offshore oil activities to contribute to market growth

- 13.2.1 US

- 13.3 EUROPE

- 13.3.1 UK

- 13.3.1.1 Growing emphasis on achieving net-zero emission targets to boost market growth

- 13.3.2 GERMANY

- 13.3.2.1 Government initiatives to support renewable energy adoption to fuel market growth

- 13.3.3 DENMARK

- 13.3.3.1 Increasing investment in offshore wind sector to accelerate market growth

- 13.3.4 NETHERLANDS

- 13.3.4.1 Growing reliance on sustainable energy sources to drive market

- 13.3.5 NORWAY

- 13.3.5.1 Increasing production of offshore oil and gas to bolster market growth

- 13.3.6 FRANCE

- 13.3.6.1 Growing construction of offshore wind farms to contribute to market growth

- 13.3.7 REST OF EUROPE

- 13.3.1 UK

- 13.4 ASIA PACIFIC

- 13.4.1 CHINA

- 13.4.1.1 Strong focus on reducing reliance on fossil fuels to augment market growth

- 13.4.2 JAPAN

- 13.4.2.1 Increasing installation of offshore wind capacity to foster market growth

- 13.4.3 SOUTH KOREA

- 13.4.3.1 Government-driven initiatives to promote renewable energy to fuel market growth

- 13.4.4 MALAYSIA

- 13.4.4.1 Escalating offshore oil production to contribute to market growth

- 13.4.5 INDONESIA

- 13.4.5.1 Rising implementation of favorable laws to promote carbon capture to accelerate market growth

- 13.4.6 VIETNAM

- 13.4.6.1 Strong commitment to achieving net-zero carbon emissions using renewable energy to expedite market growth

- 13.4.7 REST OF ASIA PACIFIC

- 13.4.1 CHINA

- 13.5 MIDDLE EAST & AFRICA

- 13.5.1 UAE

- 13.5.1.1 Increasing investment to accelerate oil and gas production to drive market

- 13.5.2 SAUDI ARABIA

- 13.5.2.1 Growing emphasis on offshore oil and gas exploration activities to boost market growth

- 13.5.3 ANGOLA

- 13.5.3.1 Increasing focus on offshore crude oil and natural gas production to accelerate market growth

- 13.5.4 REST OF MIDDLE EAST & AFRICA

- 13.5.1 UAE

- 13.6 SOUTH AMERICA

- 13.6.1 BRAZIL

- 13.6.1.1 Emergence as significant hub for wind energy to contribute to market growth

- 13.6.2 ARGENTINA

- 13.6.2.1 Rising implementation of legislation to support renewable energy initiatives to fuel market growth

- 13.6.3 REST OF SOUTH AMERICA

- 13.6.1 BRAZIL

14 SUBMARINE COMMUNICATION CABLES MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.2 TRANSATLANTIC

- 14.2.1 MOUNTING DEMAND FOR LOW-LATENCY COMMUNICATION TO CREATE MARKET GROWTH OPPORTUNITIES

- 14.3 TRANSPACIFIC

- 14.3.1 RISING INITIATIVES TO CONNECT MAJOR ECONOMIC AND DATA CENTER HUBS TO DRIVE MARKET

- 14.4 INTRA-ASIA

- 14.4.1 GROWING FOCUS ON ENHANCING DIGITAL CONNECTIVITY TO FUEL MARKET GROWTH

- 14.5 AMERICAS

- 14.5.1 FLOURISHING MOBILE DATA INDUSTRY TO CONTRIBUTE TO MARKET GROWTH

- 14.6 EURASIA

- 14.6.1 GROWING ADOPTION OF MOBILE AND CLOUD SERVICES TO BOLSTER MARKET GROWTH

- 14.7 EMEA

- 14.7.1 INCREASING EXECUTION OF SUBMARINE COMMUNICATION CABLE PROJECTS TO FOSTER MARKET GROWTH

15 COMPETITIVE LANDSCAPE

- 15.1 OVERVIEW

- 15.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 15.3 REVENUE ANALYSIS, 2020-2024

- 15.4 MARKET SHARE ANALYSIS, 2024

- 15.5 COMPANY VALUATION AND FINANCIAL METRICS

- 15.6 PRODUCT COMPARISON

- 15.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 15.7.1 STARS

- 15.7.2 EMERGING LEADERS

- 15.7.3 PERVASIVE PLAYERS

- 15.7.4 PARTICIPANTS

- 15.7.5 COMPANY FOOTPRINT: KEY PLAYERS IN SUBMARINE POWER CABLES MARKET, 2024

- 15.7.5.1 Company footprint

- 15.7.5.2 Region footprint

- 15.7.5.3 Type footprint

- 15.7.5.4 End-use application footprint

- 15.7.6 COMPANY FOOTPRINT: KEY PLAYERS IN SUBMARINE COMMUNICATION CABLES MARKET, 2024

- 15.7.6.1 Company footprint

- 15.7.6.2 Region footprint

- 15.7.6.3 Component footprint

- 15.7.6.4 Service offering footprint

- 15.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 15.8.1 PROGRESSIVE COMPANIES

- 15.8.2 RESPONSIVE COMPANIES

- 15.8.3 DYNAMIC COMPANIES

- 15.8.4 STARTING BLOCKS

- 15.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 15.8.5.1 Detailed list of key startups/SMEs

- 15.8.5.2 Competitive benchmarking of key startups/SMEs

- 15.9 COMPETITIVE SCENARIO

- 15.9.1 PRODUCT LAUNCHES

- 15.9.2 DEALS

- 15.9.3 EXPANSIONS

- 15.9.4 OTHER DEVELOPMENTS

16 COMPANY PROFILES

- 16.1 KEY PLAYERS

- 16.1.1 ALCATEL SUBMARINE NETWORKS

- 16.1.1.1 Business overview

- 16.1.1.2 Products/Solutions/Services offered

- 16.1.1.3 Recent developments

- 16.1.1.3.1 Deals

- 16.1.1.3.2 Expansions

- 16.1.1.3.3 Other developments

- 16.1.1.4 MnM view

- 16.1.1.4.1 Key strengths/Right to win

- 16.1.1.4.2 Strategic choices

- 16.1.1.4.3 Weaknesses/Competitive threats

- 16.1.2 PRYSMIAN S.P.A

- 16.1.2.1 Business overview

- 16.1.2.2 Products/Solutions/Services offered

- 16.1.2.3 Recent developments

- 16.1.2.3.1 Deals

- 16.1.2.3.2 Expansions

- 16.1.2.3.3 Other developments

- 16.1.2.4 MnM view

- 16.1.2.4.1 Key strengths/Right to win

- 16.1.2.4.2 Strategic choices

- 16.1.2.4.3 Weaknesses/Competitive threats

- 16.1.3 SUBCOM, LLC

- 16.1.3.1 Business overview

- 16.1.3.2 Products/Solutions/Services offered

- 16.1.3.3 Recent developments

- 16.1.3.3.1 Deals

- 16.1.3.3.2 Expansions

- 16.1.3.3.3 Other developments

- 16.1.3.4 MnM view

- 16.1.3.4.1 Key strengths/Right to win

- 16.1.3.4.2 Strategic choices

- 16.1.3.4.3 Weaknesses/Competitive threats

- 16.1.4 NEC CORPORATION

- 16.1.4.1 Business overview

- 16.1.4.2 Products/Solutions/Services offered

- 16.1.4.3 Recent developments

- 16.1.4.3.1 Product launches

- 16.1.4.3.2 Other developments

- 16.1.4.4 MnM view

- 16.1.4.4.1 Key strengths/Right to win

- 16.1.4.4.2 Strategic choices

- 16.1.4.4.3 Weaknesses/Competitive threats

- 16.1.5 NEXANS

- 16.1.5.1 Business overview

- 16.1.5.2 Products/Solutions/Services offered

- 16.1.5.3 Recent developments

- 16.1.5.3.1 Deals

- 16.1.5.3.2 Other developments

- 16.1.5.4 MnM view

- 16.1.5.4.1 Key strengths/Right to win

- 16.1.5.4.2 Strategic choices

- 16.1.5.4.3 Weaknesses/Competitive threats

- 16.1.6 HENGTONG GROUP CO., LTD.

- 16.1.6.1 Business overview

- 16.1.6.2 Products/Solutions/Services offered

- 16.1.6.3 Recent developments

- 16.1.6.3.1 Developments

- 16.1.7 ZTT

- 16.1.7.1 Business overview

- 16.1.7.2 Products/Solutions/Services offered

- 16.1.7.3 Recent developments

- 16.1.7.3.1 Developments

- 16.1.8 NKT A/S

- 16.1.8.1 Business overview

- 16.1.8.2 Products/Solutions/Services offered

- 16.1.8.3 Recent developments

- 16.1.8.3.1 Deals

- 16.1.8.3.2 Other developments

- 16.1.9 SUMITOMO ELECTRIC INDUSTRIES LTD.

- 16.1.9.1 Business overview

- 16.1.9.2 Products/Solutions/Services offered

- 16.1.9.3 Recent developments

- 16.1.9.3.1 Deals

- 16.1.9.3.2 Expansions

- 16.1.9.3.3 Other developments

- 16.1.10 LS CABLE & SYSTEM LTD.

- 16.1.10.1 Business overview

- 16.1.10.2 Products/Solutions/Services offered

- 16.1.10.3 Recent developments

- 16.1.10.3.1 Developments

- 16.1.1 ALCATEL SUBMARINE NETWORKS

- 16.2 OTHER PLAYERS

- 16.2.1 CORNING INCORPORATED

- 16.2.2 NINGBO ORIENT WIRES & CABLES CO. LTD.

- 16.2.3 TAIHAN CABLE & SOLUTION CO., LTD.

- 16.2.4 QINGDAO HANHE CABLE CO., LTD.

- 16.2.5 FURUKAWA ELECTRIC CO., LTD.

- 16.2.6 HEXATRONIC GROUP

- 16.2.7 APAR INDUSTRIES LTD.

- 16.2.8 TFKABLE

- 16.2.9 AFL

- 16.2.10 HELLENIC CABLES

- 16.2.11 SHANGHAI QIFAN CABLE CO.,LTD.

- 16.2.12 SSGCABLE

- 16.2.13 OCC CORPORATION

- 16.2.14 FRIGATE ENGINEERING SERVICES PVT LTD

- 16.2.15 TRATOS

17 APPENDIX

- 17.1 INSIGHTS FROM INDUSTRY EXPERTS

- 17.2 DISCUSSION GUIDE

- 17.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.4 CUSTOMIZATION OPTIONS

- 17.5 RELATED REPORTS

- 17.6 AUTHOR DETAILS

List of Tables

- TABLE 1 LIST OF KEY SECONDARY SOURCES

- TABLE 2 LIST OF PRIMARY INTERVIEW PARTICIPANTS

- TABLE 3 SUBMARINE CABLE SYSTEMS MARKET: RESEARCH ASSUMPTIONS

- TABLE 4 SUBMARINE CABLE SYSTEMS MARKET: RISK ANALYSIS

- TABLE 5 UPCOMING SUBMARINE POWER CABLE PROJECTS

- TABLE 6 UPCOMING SUBMARINE COMMUNICATION CABLE PROJECTS

- TABLE 7 PRICING RANGE OF SUBMARINE CABLE SYSTEMS, BY CABLE TYPE, 2024 (USD/KM)

- TABLE 8 AVERAGE SELLING PRICE TREND OF SUBMARINE COMMUNICATION CABLES, 2021-2024 (USD/KM)

- TABLE 9 PRICING RANGE OF SUBMARINE CABLE SYSTEMS OFFERED BY KEY PLAYERS, BY CABLE TYPE, 2024 (USD/KM)

- TABLE 10 AVERAGE SELLING PRICE TREND OF SUBMARINE POWER CABLES, BY REGION, 2021-2024 (USD/KM)

- TABLE 11 ROLE OF COMPANIES IN SUBMARINE CABLE SYSTEMS ECOSYSTEM

- TABLE 12 LIST OF MAJOR PATENTS, 2021-2024

- TABLE 13 IMPORT DATA FOR HS CODE 8544-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 14 EXPORT DATA FOR HS CODE 8544-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 15 LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 16 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 STANDARDS

- TABLE 21 IMPACT OF PORTER'S FIVE FORCES ANALYSIS

- TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE APPLICATION (%)

- TABLE 23 KEY BUYING CRITERIA, BY END-USE APPLICATION

- TABLE 24 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 25 KEY PRODUCT-RELATED TARIFF EFFECTIVE FOR SUBMARINE CABLE SYSTEMS

- TABLE 26 SUBMARINE CABLE SYSTEMS MARKET, BY CABLE TYPE, 2021-2024 (USD MILLION)

- TABLE 27 SUBMARINE CABLE SYSTEMS MARKET, BY CABLE TYPE, 2025-2030 (USD MILLION)

- TABLE 28 SUBMARINE CABLE SYSTEMS MARKET, 2021-2024 (KILOMETERS)

- TABLE 29 SUBMARINE CABLE SYSTEMS MARKET, 2025-2030 (KILOMETERS)

- TABLE 30 SUBMARINE COMMUNICATION CABLES MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 31 SUBMARINE COMMUNICATION CABLES MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 32 WET PLANT PRODUCTS: SUBMARINE COMMUNICATION CABLES MARKET, BY COMPONENT TYPE, 2021-2024 (USD MILLION)

- TABLE 33 WET PLANT PRODUCTS: SUBMARINE COMMUNICATION CABLES MARKET, BY COMPONENT TYPE, 2025-2030 (USD MILLION)

- TABLE 34 SUBMARINE COMMUNICATION CABLES MARKET, BY SERVICE OFFERING, 2021-2024 (USD MILLION)

- TABLE 35 SUBMARINE COMMUNICATION CABLES MARKET, BY SERVICE OFFERING, 2025-2030 (USD MILLION)

- TABLE 36 INSTALLATION & COMMISSIONING: SUBMARINE COMMUNICATION CABLES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 37 INSTALLATION & COMMISSIONING: SUBMARINE COMMUNICATION CABLES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 MAINTENANCE: SUBMARINE COMMUNICATION CABLES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 39 MAINTENANCE: SUBMARINE COMMUNICATION CABLES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 SYSTEM UPGRADE: SUBMARINE COMMUNICATION CABLES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 41 SYSTEM UPGRADE: SUBMARINE COMMUNICATION CABLES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 SUBMARINE POWER CABLES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 43 SUBMARINE POWER CABLES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 44 SINGLE CORE: SUBMARINE POWER CABLES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 45 SINGLE CORE: SUBMARINE POWER CABLES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 MULTICORE: SUBMARINE POWER CABLES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 47 MULTICORE: SUBMARINE POWER CABLES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 SUBMARINE POWER CABLES MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 49 SUBMARINE POWER CABLES MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 50 MEDIUM-VOLTAGE: SUBMARINE POWER CABLES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 51 MEDIUM-VOLTAGE: SUBMARINE POWER CABLES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 HIGH-VOLTAGE: SUBMARINE POWER CABLES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 53 HIGH-VOLTAGE: SUBMARINE POWER CABLES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 SUBMARINE POWER CABLES MARKET, BY INSULATION, 2021-2024 (USD MILLION)

- TABLE 55 SUBMARINE POWER CABLES MARKET, BY INSULATION, 2025-2030 (USD MILLION)

- TABLE 56 CROSS-LINKED POLYETHYLENE (XLPE): SUBMARINE POWER CABLES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 57 CROSS-LINKED POLYETHYLENE (XLPE): SUBMARINE POWER CABLES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 OIL-IMPREGNATED PAPER (OIP): SUBMARINE POWER CABLES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 59 OIL-IMPREGNATED PAPER (OIP): SUBMARINE POWER CABLES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 RESIN-IMPREGNATED PAPER (RIP): SUBMARINE POWER CABLES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 61 RESIN-IMPREGNATED PAPER (RIP): SUBMARINE POWER CABLES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 RESIN-IMPREGNATED SYNTHETIC (RIS): SUBMARINE POWER CABLES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 63 RESIN-IMPREGNATED SYNTHETIC (RIS): SUBMARINE POWER CABLES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 64 SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 65 SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 66 OFFSHORE WIND POWER GENERATION PLANTS: SUBMARINE POWER CABLES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 67 OFFSHORE WIND POWER GENERATION PLANTS: SUBMARINE POWER CABLES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 68 INTERCOUNTRY & ISLAND CONNECTIONS: SUBMARINE POWER CABLES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 69 INTERCOUNTRY & ISLAND CONNECTIONS: SUBMARINE POWER CABLES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 OFFSHORE OIL & GAS PLANTS: SUBMARINE POWER CABLES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 71 OFFSHORE OIL & GAS PLANTS: SUBMARINE POWER CABLES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 SUBMARINE POWER CABLES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 73 SUBMARINE POWER CABLES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 74 NORTH AMERICA: SUBMARINE POWER CABLES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 75 NORTH AMERICA: SUBMARINE POWER CABLES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 76 NORTH AMERICA: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 77 NORTH AMERICA: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 78 US: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 79 US: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 80 CANADA: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 81 CANADA: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 82 MEXICO: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 83 MEXICO: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 84 EUROPE: SUBMARINE POWER CABLES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 85 EUROPE: SUBMARINE POWER CABLES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 86 EUROPE: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 87 EUROPE: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 88 UK: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 89 UK: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 90 GERMANY: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 91 GERMANY: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 92 DENMARK: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 93 DENMARK: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 94 NETHERLANDS: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 95 NETHERLANDS: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 96 NORWAY: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 97 NORWAY: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 98 FRANCE: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 99 FRANCE: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 100 REST OF EUROPE: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 101 REST OF EUROPE: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 102 ASIA PACIFIC: SUBMARINE POWER CABLES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 103 ASIA PACIFIC: SUBMARINE POWER CABLES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 104 ASIA PACIFIC: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 105 ASIA PACIFIC: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 106 CHINA: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 107 CHINA: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 108 JAPAN: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 109 JAPAN: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 110 SOUTH KOREA: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 111 SOUTH KOREA: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 112 MALAYSIA: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 113 MALAYSIA: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 114 INDONESIA: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 115 INDONESIA: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 116 VIETNAM: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 117 VIETNAM: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 118 REST OF ASIA PACIFIC: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 119 REST OF ASIA PACIFIC: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 120 MIDDLE EAST & AFRICA: SUBMARINE POWER CABLES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 121 MIDDLE EAST & AFRICA: SUBMARINE POWER CABLES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 122 MIDDLE EAST & AFRICA: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 123 MIDDLE EAST & AFRICA: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 124 UAE: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 125 UAE: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 126 SAUDI ARABIA: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 127 SAUDI ARABIA: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 128 ANGOLA: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 129 ANGOLA: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 130 REST OF MIDDLE EAST & AFRICA: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 131 REST OF MIDDLE EAST & AFRICA: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 132 SOUTH AMERICA: SUBMARINE POWER CABLES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 133 SOUTH AMERICA: SUBMARINE POWER CABLES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 134 SOUTH AMERICA: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 135 SOUTH AMERICA: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 136 BRAZIL: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 137 BRAZIL: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 138 ARGENTINA: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 139 ARGENTINA: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 140 REST OF SOUTH AMERICA: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 141 REST OF SOUTH AMERICA: SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 142 SUBMARINE COMMUNICATION CABLES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 143 SUBMARINE COMMUNICATION CABLES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 144 TRANSATLANTIC: SUBMARINE COMMUNICATION CABLES MARKET, BY SERVICE OFFERING, 2021-2024 (USD MILLION)

- TABLE 145 TRANSATLANTIC: SUBMARINE COMMUNICATION CABLES MARKET, BY SERVICE OFFERING, 2025-2030 (USD MILLION)

- TABLE 146 TRANSPACIFIC: SUBMARINE COMMUNICATION CABLES MARKET, BY SERVICE OFFERING, 2021-2024 (USD MILLION)

- TABLE 147 TRANSPACIFIC: SUBMARINE COMMUNICATION CABLES MARKET, BY SERVICE OFFERING, 2025-2030 (USD MILLION)

- TABLE 148 INTRA-ASIA: SUBMARINE COMMUNICATION CABLES MARKET, BY SERVICE OFFERING, 2021-2024 (USD MILLION)

- TABLE 149 INTRA-ASIA: SUBMARINE COMMUNICATION CABLES MARKET, BY SERVICE OFFERING, 2025-2030 (USD MILLION)

- TABLE 150 AMERICAS: SUBMARINE COMMUNICATION CABLES MARKET, BY SERVICE OFFERING, 2021-2024 (USD MILLION)

- TABLE 151 AMERICAS: SUBMARINE COMMUNICATION CABLES MARKET, BY SERVICE OFFERING, 2025-2030 (USD MILLION)

- TABLE 152 EURASIA: SUBMARINE COMMUNICATION CABLES MARKET, BY SERVICE OFFERING, 2021-2024 (USD MILLION)

- TABLE 153 EURASIA: SUBMARINE COMMUNICATION CABLES MARKET, BY SERVICE OFFERING, 2025-2030 (USD MILLION)

- TABLE 154 EMEA: SUBMARINE COMMUNICATION CABLES MARKET, BY SERVICE OFFERING, 2021-2024 (USD MILLION)

- TABLE 155 EMEA: SUBMARINE COMMUNICATION CABLES MARKET, BY SERVICE OFFERING, 2025-2030 (USD MILLION)

- TABLE 156 SUBMARINE CABLE SYSTEMS MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2021-JUNE 2025

- TABLE 157 SUBMARINE COMMUNICATION CABLES MARKET: DEGREE OF COMPETITION, 2024

- TABLE 158 SUBMARINE POWER CABLES MARKET: DEGREE OF COMPETITION, 2024

- TABLE 159 SUBMARINE POWER CABLES MARKET: REGION FOOTPRINT

- TABLE 160 SUBMARINE POWER CABLES MARKET: TYPE FOOTPRINT

- TABLE 161 SUBMARINE POWER CABLES MARKET: END-USE APPLICATION FOOTPRINT

- TABLE 162 SUBMARINE COMMUNICATION CABLES MARKET: REGION FOOTPRINT

- TABLE 163 SUBMARINE COMMUNICATION CABLES MARKET: COMPONENT FOOTPRINT

- TABLE 164 SUBMARINE COMMUNICATION CABLES MARKET: SERVICE OFFERING FOOTPRINT

- TABLE 165 SUBMARINE CABLE SYSTEMS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 166 SUBMARINE CABLE SYSTEMS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 167 SUBMARINE CABLE SYSTEMS MARKET: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 168 SUBMARINE CABLE SYSTEMS MARKET: DEALS, JANUARY 2021-JUNE 2025

- TABLE 169 SUBMARINE CABLE SYSTEMS MARKET: EXPANSIONS, JANUARY 2021-JUNE 2025

- TABLE 170 SUBMARINE CABLE SYSTEMS MARKET: OTHER DEVELOPMENTS, JANUARY 2021-JUNE 2025

- TABLE 171 ALCATEL SUBMARINE NETWORKS: COMPANY OVERVIEW

- TABLE 172 ALCATEL SUBMARINE NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 173 ALCATEL SUBMARINE NETWORKS: DEALS

- TABLE 174 ALCATEL SUBMARINE NETWORKS: EXPANSIONS

- TABLE 175 ALCATEL SUBMARINE NETWORKS: OTHER DEVELOPMENTS

- TABLE 176 PRYSMIAN S.P.A: COMPANY OVERVIEW

- TABLE 177 PRYSMIAN S.P.A: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 178 PRYSMIAN S.P.A: DEALS

- TABLE 179 PRYSMIAN S.P.A: EXPANSIONS

- TABLE 180 PRYSMIAN S.P.A: OTHER DEVELOPMENTS

- TABLE 181 SUBCOM, LLC: COMPANY OVERVIEW

- TABLE 182 SUBCOM, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 183 SUBCOM, LLC: DEALS

- TABLE 184 SUBCOM, LLC: EXPANSIONS

- TABLE 185 SUBCOM, LLC: OTHER DEVELOPMENTS

- TABLE 186 NEC CORPORATION: COMPANY OVERVIEW

- TABLE 187 NEC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 NEC CORPORATION: PRODUCT LAUNCHES

- TABLE 189 NEC CORPORATION: OTHER DEVELOPMENTS

- TABLE 190 NEXANS: COMPANY OVERVIEW

- TABLE 191 NEXANS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 NEXANS: DEALS

- TABLE 193 NEXANS: OTHER DEVELOPMENTS

- TABLE 194 HENGTONG GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 195 HENGTONG GROUP CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 HENGTONG GROUP CO., LTD.: DEVELOPMENTS

- TABLE 197 ZTT: COMPANY OVERVIEW

- TABLE 198 ZTT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 ZTT: DEVELOPMENTS

- TABLE 200 NKT A/S: COMPANY OVERVIEW

- TABLE 201 NKT A/S: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 202 NKT A/S: DEALS

- TABLE 203 NKT A/S: OTHER DEVELOPMENTS

- TABLE 204 SUMITOMO ELECTRIC INDUSTRIES LTD.: COMPANY OVERVIEW

- TABLE 205 SUMITOMO ELECTRIC INDUSTRIES LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 SUMITOMO ELECTRIC INDUSTRIES LTD.: DEALS

- TABLE 207 SUMITOMO ELECTRIC INDUSTRIES LTD.: EXPANSIONS

- TABLE 208 SUMITOMO ELECTRIC INDUSTRIES LTD.: OTHER DEVELOPMENTS

- TABLE 209 LS CABLE & SYSTEM LTD.: COMPANY OVERVIEW

- TABLE 210 LS CABLE & SYSTEM LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 LS CABLE & SYSTEM LTD.: DEVELOPMENTS

List of Figures

- FIGURE 1 SUBMARINE CABLE SYSTEMS MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 SUBMARINE CABLE SYSTEMS MARKET: RESEARCH DESIGN

- FIGURE 3 SUBMARINE CABLE SYSTEMS MARKET: RESEARCH APPROACH

- FIGURE 4 KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 KEY DATA FROM PRIMARY SOURCES

- FIGURE 6 KEY INDUSTRY INSIGHTS

- FIGURE 7 BREAKDOWN OF PRIMARIES

- FIGURE 8 SUBMARINE CABLE SYSTEMS MARKET: BOTTOM-UP APPROACH

- FIGURE 9 SUBMARINE CABLE SYSTEMS MARKET: TOP-DOWN APPROACH

- FIGURE 10 SUBMARINE POWER CABLE SYSTEMS MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 11 SUBMARINE CABLE SYSTEMS MARKET: DATA TRIANGULATION

- FIGURE 12 SUBMARINE CABLE SYSTEMS MARKET SIZE, IN TERMS OF VALUE, 2021-2030

- FIGURE 13 POWER CABLES SEGMENT TO HOLD LARGER SHARE OF SUBMARINE CABLE SYSTEMS MARKET IN 2030

- FIGURE 14 INSTALLATION & COMMISSIONING SEGMENT TO DOMINATE SUBMARINE COMMUNICATION CABLES MARKET BETWEEN 2025 AND 2030

- FIGURE 15 OFFSHORE WIND POWER GENERATION PLANTS SEGMENT TO EXHIBIT HIGHEST CAGR IN SUBMARINE POWER CABLES MARKET FROM 2025 TO 2030

- FIGURE 16 HIGH-VOLTAGE SEGMENT TO CAPTURE LARGER SHARE OF SUBMARINE POWER CABLES MARKET IN 2025

- FIGURE 17 INTRA-ASIA TO RECORD HIGHEST CAGR IN SUBMARINE COMMUNICATION CABLES MARKET DURING FORECAST PERIOD

- FIGURE 18 EUROPE HELD LARGEST SHARE OF SUBMARINE POWER CABLES MARKET IN 2024

- FIGURE 19 INCREASING INVESTMENTS IN OFFSHORE WIND POWER PROJECTS TO DRIVE SUBMARINE POWER CABLE MARKET

- FIGURE 20 POWER CABLES SEGMENT TO DOMINATE SUBMARINE CABLE SYSTEMS MARKET BETWEEN 2025 AND 2030

- FIGURE 21 WET PLANT PRODUCTS SEGMENT TO HOLD LARGER SUBMARINE COMMUNICATION CABLES MARKET SHARE IN 2030

- FIGURE 22 OIL-IMPREGNATED PAPER (OIP) SEGMENT TO DOMINATE SUBMARINE POWER CABLES MARKET DURING FORECAST PERIOD

- FIGURE 23 OFFSHORE WIND POWER GENERATION PLANTS SEGMENT AND UK TO HOLD LARGEST SHARES OF EUROPEAN SUBMARINE POWER CABLES MARKET IN 2025

- FIGURE 24 US TO RECORD HIGHEST CAGR IN GLOBAL SUBMARINE POWER CABLES MARKET DURING FORECAST PERIOD

- FIGURE 25 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 26 IMPACT ANALYSIS: DRIVERS

- FIGURE 27 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 28 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 29 IMPACT ANALYSIS: CHALLENGES

- FIGURE 30 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 31 AVERAGE SELLING PRICE TREND OF SUBMARINE COMMUNICATION CABLES, 2021-2024

- FIGURE 32 AVERAGE SELLING PRICING TREND OF SUBMARINE POWER CABLES, BY REGION, 2021-2024

- FIGURE 33 VALUE CHAIN ANALYSIS

- FIGURE 34 SUBMARINE CABLE SYSTEMS ECOSYSTEM

- FIGURE 35 INVESTMENT AND FUNDING SCENARIO, 2021-2024

- FIGURE 36 PATENTS APPLIED AND GRANTED, 2015-2024

- FIGURE 37 IMPORT DATA FOR HS CODE 8544-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 38 EXPORT DATA FOR HS CODE 8544-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 39 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 40 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE APPLICATION

- FIGURE 41 KEY BUYING CRITERIA, BY END-USE APPLICATION

- FIGURE 42 AI/GEN AI USE CASES IN SUBMARINE CABLE SYSTEMS MARKET

- FIGURE 43 SUBMARINE CABLE SYSTEMS MARKET, BY CABLE TYPE

- FIGURE 44 POWER CABLES SEGMENT TO DOMINATE SUBMARINE CABLE SYSTEMS MARKET FROM 2025 TO 2030

- FIGURE 45 OFFSHORE WIND CAPACITY INSTALLATIONS, 2020-2023 (GW)

- FIGURE 46 SUBMARINE COMMUNICATION CABLES MARKET, BY COMPONENT

- FIGURE 47 WET PLANT PRODUCTS SEGMENT TO HOLD LARGER SHARE OF SUBMARINE COMMUNICATION CABLES MARKET IN 2025

- FIGURE 48 SUBMARINE COMMUNICATION CABLES MARKET, BY SERVICE OFFERING

- FIGURE 49 INSTALLATION & COMMISSIONING SEGMENT TO HOLD LARGEST SHARE OF SUBMARINE COMMUNICATION CABLES MARKET IN 2030

- FIGURE 50 SUBMARINE POWER CABLES MARKET, BY TYPE

- FIGURE 51 SINGLE CORE SEGMENT TO DOMINATE SUBMARINE POWER CABLES MARKET DURING FORECAST PERIOD

- FIGURE 52 SUBMARINE POWER CABLES MARKET, BY VOLTAGE

- FIGURE 53 HIGH-VOLTAGE SEGMENT TO REGISTER HIGHER CAGR IN SUBMARINE POWER CABLES MARKET DURING FORECAST PERIOD

- FIGURE 54 SUBMARINE POWER CABLES MARKET, BY INSULATION

- FIGURE 55 OIL-IMPREGNATED PAPER (OIP) SEGMENT TO CAPTURE LARGEST SHARE OF SUBMARINE POWER CABLES MARKET IN 2030

- FIGURE 56 SUBMARINE POWER CABLES MARKET, BY END-USE APPLICATION

- FIGURE 57 OFFSHORE WIND POWER GENERATION PLANTS SEGMENT TO RECORD HIGHEST CAGR IN SUBMARINE POWER CABLES MARKET DURING FORECAST PERIOD

- FIGURE 58 SUBMARINE POWER CABLES MARKET: REGIONAL SNAPSHOT

- FIGURE 59 NORTH AMERICA TO EXHIBIT HIGHEST CAGR IN SUBMARINE POWER CABLES MARKET FROM 2025 TO 2030

- FIGURE 60 EUROPE TO CLAIM LARGEST MARKET SHARE OF SUBMARINE POWER CABLES MARKET IN 2025

- FIGURE 61 NORTH AMERICA: SUBMARINE POWER CABLES MARKET SNAPSHOT

- FIGURE 62 EUROPE: SUBMARINE POWER CABLES MARKET SNAPSHOT

- FIGURE 63 ASIA PACIFIC: SUBMARINE POWER CABLES MARKET SNAPSHOT

- FIGURE 64 SUBMARINE COMMUNICATION CABLES MARKET, BY REGION

- FIGURE 65 TRANSATLANTIC TO HOLD LARGEST SHARE OF SUBMARINE COMMUNICATION CABLES MARKET IN 2025

- FIGURE 66 SUBMARINE CABLE SYSTEMS MARKET: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2020-2024

- FIGURE 67 MARKET SHARE ANALYSIS OF COMPANIES OFFERING SUBMARINE COMMUNICATION CABLES, 2024

- FIGURE 68 MARKET SHARE ANALYSIS OF COMPANIES OFFERING SUBMARINE POWER CABLES, 2024

- FIGURE 69 COMPANY VALUATION

- FIGURE 70 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 71 PRODUCT COMPARISON

- FIGURE 72 SUBMARINE CABLE SYSTEMS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 73 SUBMARINE POWER CABLES MARKET: COMPANY FOOTPRINT

- FIGURE 74 SUBMARINE COMMUNICATION CABLES MARKET: COMPANY FOOTPRINT

- FIGURE 75 SUBMARINE CABLE SYSTEMS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 76 PRYSMIAN S.P.A: COMPANY SNAPSHOT

- FIGURE 77 NEC CORPORATION: COMPANY SNAPSHOT

- FIGURE 78 NEXANS: COMPANY SNAPSHOT

- FIGURE 79 ZTT: COMPANY SNAPSHOT

- FIGURE 80 NKT A/S: COMPANY SNAPSHOT

- FIGURE 81 SUMITOMO ELECTRIC INDUSTRIES LTD.: COMPANY SNAPSHOT

- FIGURE 82 LS CABLE & SYSTEM LTD.: COMPANY SNAPSHOT