|

市场调查报告书

商品编码

1693684

海底电缆系统-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Submarine Cable Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

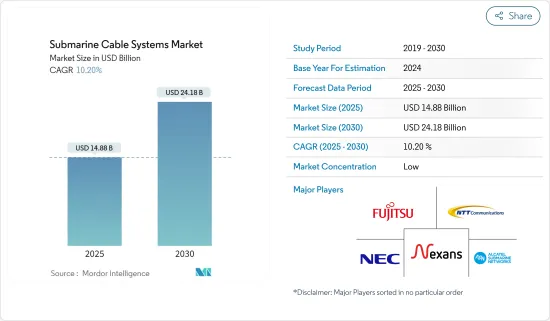

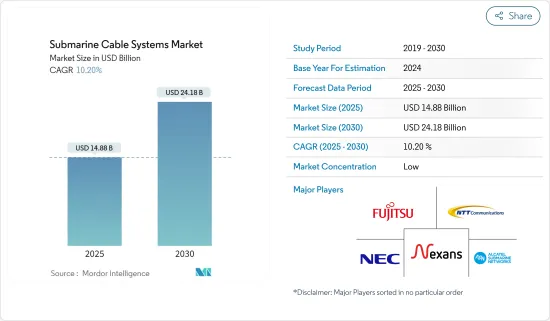

预计 2025 年海底电缆系统市场规模为 148.8 亿美元,到 2030 年将达到 241.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 10.2%。

关键亮点

- 海底电缆系统通常利用光纤电缆传输资料和电力。这些系统铺设在海床上,连接各个位置的海缆登陆站 (CLS),向广阔的海洋区域传输通讯和电力讯号。海底电缆系统为世界各国提供可靠、安全、高容量的通讯链路。

- 推动海底电缆系统市场成长的主要因素之一是高速网路基础设施投资的增加。此外,全球数据产生和传输的持续扩张预计将显着推动市场成长。因此,预计在整个预测期内将有大量网路骨干业者投资海底电缆系统市场。

- 随着网路存取在新兴国家的扩大,下一阶段的网路改进可能会集中在全球新兴市场。因此,包括政府机构在内的许多公司都认为海底电缆分配系统市场前景看好。此外,行动宽频的快速普及也为该产业的发展做出了巨大贡献。

- 此外,由于可支配收入增加、5G 的推出以及通讯基础设施的进步等各种因素,全球对智慧型手机的需求正在上升。据爱立信称,预计全球智慧型手机用户数量将在 2021 年达到 62.6 亿,到 2027 年将达到 76.9 亿。预计这些趋势将继续推动市场发展。

- 海底电缆对全球经济和通讯至关重要,其运作环境日益受到地缘政治、物理和网路威胁,包括民族国家破坏和间谍活动。据官方资讯来源称,海底通讯电缆正在成为网路威胁的目标,这可能会对全球网路造成严重破坏,进一步影响研究市场的成长。

海底电缆系统市场趋势

干燥植物产品推动市场成长

- 干式设备构成了陆上海底电缆网段,从海滩上的沙井延伸到电缆登陆站。其中包括供电设备(PFE)、海底电缆终端设备、网路管理系统和陆地电缆段。

- 随着客户对宽频服务的需求和网路效能的提高,全球通讯流量正在迅速扩大。例如,根据国际电信联盟的预测,到2023年,亚太地区固定宽频用户将达到约8.48亿,较2022年增加约5,000万。因此,对海底通讯系统的需求正在稳步增长,不仅包括新建电缆系统的需求,还包括现有电缆系统的容量扩展的需求。为了满足日益增长的需求,一些公司正在开发利用光学技术的海底线路终端设备 (SLTE)。

- 例如,Google-Equaiano 海底电缆的圣赫勒拿岛支线将于 2023 年 10 月开通,透过高速海底光缆将岛屿连接到网路。到2023年6月,电缆海底终端设备的安装和整合完成,当地陆地光纤网路的建设工作也已开始。

- 陆地电缆段将海底电缆终端与电缆登陆站的供电设备和其他系统连接起来。网路管理系统作为统一的平台,管理海底电缆系统中的所有设备,并在日常维护和运营期间监督湿设备、供电设备(PFE)、开放电缆接入设备(OCAE)和网路运作。

- 干燥植物产品通常设计用于承受恶劣的沿海环境条件,例如强风、盐雾和极端温度。干式设备故障会导致整个海底电缆系统停止服务,因此其设计优先考虑高可靠性。

跨太平洋航线占很大市场占有率

- 在跨太平洋地区,第一条跨太平洋海底电缆系统TPC-1(跨太平洋1号电缆)于1960年代投入使用。这是一条小型海底同轴电缆,拥有 128 条电路,连接日本、关岛、夏威夷,并经由夏威夷连接美国当地。此后,多条跨太平洋海底电缆系统不断建成,大大扩大了该地区的容量。

- 海底电缆承载着全球97%以上的网路流量,反映出我们日常业务对网路的依赖日益加深。网路将世界各地的人们连接起来的能力导致国际流量不断增加。亚太地区约占全球网路流量的一半,推动了对海底通讯电缆的需求。该地区某些国家缺乏海底通讯,刺激了对跨太平洋更快互联网服务的需求,促使世界银行和亚洲开发银行等组织为新的海底通讯系统提供资金。

- 2022年7月,日本电信电话株式会社、三井物产株式会社、PC Landing株式会社、JA三井租赁株式会社宣布成立新公司Seiren Juno Network(以下简称“Seiren”),建设和运营连接日本和美国的最广泛的跨太平洋海底电缆系统JUNO。

- 此外,2022年8月,NEC株式会社宣布Selenium Juno Networks株式会社被选定为JUNO光缆系统的建设公司,该光缆系统是一条连接美国加利福尼亚州与日本千叶县和三重县的跨太平洋海底光缆。该电缆长度超过10,000公里,预计于2024年完工。

- 日本、澳洲等地区主要国家都将海底电缆系统视为经济成长的关键,纷纷增加对海底电缆网路的投资,创造了市场机会。例如,2023年7月,日本政府宣布计画增加数位基础设施发展基金,以扩大连接日本与世界其他地区的海底电缆网路。

海底电缆系统市场概况

海底电缆系统市场由多家主要企业,包括 NTT 通讯公司、耐吉森公司、富士通有限公司、NEC 公司和阿尔卡特海底网路公司。这些公司正在采取合资、长期伙伴关係和併购等策略性倡议,以提高收益成长并扩大其全球影响力。

2023年10月,NEC宣布印尼Patara-2海底电缆网路竣工开通。该网路由印尼最大的数位通讯供应商 PT Telkom Indonesia 拥有,标誌着印尼各岛屿数位化进程迈出了关键一步。

同样,谷歌有限责任公司也在同月宣布了其南太平洋连接计划。该计划包括引入两条新的跨太平洋海底电缆(Honomoana 和 Tabua)。这些电缆旨在显着提高跨太平洋数位连接的可靠性和弹性。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 买家的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 产业价值链分析

- 宏观趋势如何影响产业

第五章市场动态

- 市场驱动因素

- 内容供应商对网路频宽的需求不断增加

- 增加新兴地区的海底电缆连接

- 增加对离岸风力发电的投资

- 市场限制

- 资料隐私和在地化倡议

- 地缘政治紧张局势限制了计划

第六章市场区隔

- 按类型

- 干燥植物产品

- 湿植物产品

- 依所有权类型

- 多所有权系统

- 单一所有权制度

- 多边开发银行

- 按地区

- 跨太平洋

- 跨大西洋

- 美国-拉丁美洲

- 亚洲境内

- 欧洲-亚洲

- 欧洲-撒哈拉以南非洲

第七章竞争格局

- 公司简介

- Alcatel Submarine Networks

- NEC Corporation

- Nexans SA

- Fujitsu Ltd

- NTT Communications Corporation

- Google LLC

- SubCom LLC

- Sumitomo Electronics Industries Ltd

- JDR Cable Systems LLC

- PT Communication Cable System Indonesia Tbk

第八章投资分析

第九章:未来市场展望

The Submarine Cable Systems Market size is estimated at USD 14.88 billion in 2025, and is expected to reach USD 24.18 billion by 2030, at a CAGR of 10.2% during the forecast period (2025-2030).

Key Highlights

- Submarine cable systems typically utilize optical fiber cables for transmitting both data and power. These systems are laid on the seabed, connecting cable landing stations (CLS) at different locations to carry telecommunication and power signals across vast expanses of the ocean. Submarine cabling systems offer highly reliable, secure, and high-capacity telecommunication links between countries worldwide.

- One primary factor driving the growth of the submarine cabling system market is the increased investment in high-speed internet infrastructure. Additionally, the continuous expansion in data generation and transmission globally is anticipated to significantly boost market growth. Consequently, numerous internet backbone operators are expected to invest in the submarine cabling system market throughout the forecast period.

- As Internet access expands in developing countries, the next phase of network improvement may focus on emerging markets worldwide. Consequently, many businesses, including government entities, perceive the submarine cabling system market as a lucrative prospect. Moreover, the rapid increase in mobile broadband adoption significantly contributes to industry growth.

- Furthermore, the global demand for smartphones has been on the rise due to various factors, including increasing disposable income, the introduction of 5G, and telecom infrastructure advancements. Ericsson reports that the global number of smartphone subscribers was 6.26 billion in 2021, predicted to reach 7.69 billion in 2027. These trends are expected to remain key drivers of the studied market's growth.

- Submarine cables, crucial to the global economy and telecommunications, operate in an environment increasingly exposed to geopolitical, physical, and cyber threats, including nation-state sabotage and spying. According to official sources, submarine communication cables are a growing target for cyber-threat actors, with incidents capable of causing substantial global internet disruption, further impacting the studied market's growth.

Submarine Cable Systems Market Trends

Dry Plant Products to Drive the Market's Growth

- The dry plant comprises the subsea cable network segment on land, extending from the beach manhole to the cable landing station. This encompasses power feeding equipment (PFE), submarine line terminal equipment, network management systems, and land cable segments.

- Global telecommunications traffic is rapidly expanding in response to customer demands for broadband services and enhanced network performance. For instance, according to ITU, the By 2023, there were approximately 848 million fixed broadband subscriptions in the Asia-Pacific area, showing a growth of almost 50 million compared to 2022. Consequently, the demand for submarine telecommunication systems is steadily increasing, not only for constructing new cable systems but also for augmenting the capacity of existing ones. Several companies are developing Submarine Line Terminal Equipment (SLTE) utilizing optical technologies to meet this rising demand.

- For instance, in October 2023, the Saint Helena branch of the Google Equiano cable was activated, representing the island's inaugural connection to the internet through high-speed subsea fiber optic cables. By June 2023, the installation and integration of the cable's Submarine Line Terminal Equipment had concluded, prompting the commencement of work on the local terrestrial fiber optic network.

- The land cable segments link the submarine line terminals to the power-feeding equipment and other systems at the cable landing station. The Network Management System serves as the unified platform managing all equipment in the submarine cable system, overseeing the wet plant, Power Feeding Equipment (PFE), Open Cable Access Equipment (OCAE), and network operations during routine maintenance and operation.

- Dry plant products are typically engineered to withstand harsh coastal environmental conditions, including high winds, salt spray, and extreme temperatures. Their design prioritizes high reliability, as any disruption to the dry plant can result in a service outage for the entire submarine cable system.

Trans-Pacific to Hold a Significant Market Share

- In the transpacific region, the first Trans-Pacific submarine cable system (TPC-1 (Trans-Pacific Cable 1)) operated during the 1960s. It was a submarine coaxial cable that began with a modest 128-phone line capacity, linking Japan, Guam, Hawaii, and the mainland United States via Hawaii. Since then, numerous transpacific submarine cable systems have continuously been constructed, significantly expanding the region's capacity.

- Submarine cables handle over 97% of global Internet traffic, reflecting the widespread reliance on the Internet for daily tasks. The Internet's capability to connect people globally has led to a continuous rise in international traffic. The Asia Pacific region contributes approximately half of the world's internet traffic, driving the demand for submarine communication cables. The lack of these systems in certain countries within this region has spurred the need for faster internet services in the Transpacific region, prompting funding from organizations like the World Bank and the Asia Development Bank for new cable systems.

- In July 2022, NTT Ltd Japan Corporation, Mitsui & Co. Ltd, PC Landing Corp., and JA Mitsui Leasing, Ltd. announced the formation of a new company, Seren Juno Network Co., Ltd. ("Seren"), established to construct and operate "JUNO," the most extensive trans-Pacific submarine cable system linking Japan and the United States.

- Moreover, in August 2022, NEC Corporation revealed that Seren Juno Network had selected them to build the trans-Pacific subsea fiber-optic cable, the "JUNO Cable System," connecting California in the United States with Chiba and Mie prefectures in Japan. This cable, spanning over 10,000 km, is projected to be completed by 2024.

- Key countries in the region, including Japan and Australia, among others, consider submarine cabling systems vital for their economic growth and are intensifying their investments in submarine cable networks, creating opportunities in the studied market. For instance, in July 2023, the Japanese government unveiled plans to augment the Digital Infrastructure Development Fund to expand the submarine cable networks linking Japan with the rest of the world.

Submarine Cable Systems Market Overview

The submarine cable systems market features various key players, including NTT Communications Corporation, Nexans SA, Fujitsu Ltd, NEC Corporation, and Alcatel Submarine Networks. These companies engage in collaborative ventures, long-term partnerships, and strategic initiatives like mergers and acquisitions to bolster revenue growth and expand their global presence.

In October 2023, NEC Corporation marked the completion and activation of the Patara-2 submarine cable network in Indonesia. This network, owned by PT Telkom Indonesia, the country's largest digital telecommunications provider, stands as a pivotal step in advancing digitization efforts across Indonesia's diverse islands.

Similarly, Google LLC revealed plans for the South Pacific Connect initiative during the same month. This initiative entails the implementation of two new transpacific subsea cables-Honomoana and Tabua. These cables aim to significantly enhance the reliability and resilience of digital connectivity across the Pacific region.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Macro-trends on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Internet Bandwidth from Content Providers

- 5.1.2 Increasing Submarine Cable Connectivity in Emerging Regions

- 5.1.3 Growing Investments in Offshore Wind Farms

- 5.2 Market Restraints

- 5.2.1 Data Privacy and Localization Initiatives

- 5.2.2 Geopolitical Tensions Limiting Projects

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Dry Plant Products

- 6.1.2 Wet Plant Products

- 6.2 By Ownership Type

- 6.2.1 Multiple Ownership System

- 6.2.2 Single Ownership System

- 6.2.3 Multilateral Development Banks

- 6.3 By Geography

- 6.3.1 Trans - Pacific

- 6.3.2 Trans - Atlantic

- 6.3.3 US - Latin America

- 6.3.4 Intra Asia

- 6.3.5 Europe - Asia

- 6.3.6 Europe - Sub-Saharan Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Alcatel Submarine Networks

- 7.1.2 NEC Corporation

- 7.1.3 Nexans SA

- 7.1.4 Fujitsu Ltd

- 7.1.5 NTT Communications Corporation

- 7.1.6 Google LLC

- 7.1.7 SubCom LLC

- 7.1.8 Sumitomo Electronics Industries Ltd

- 7.1.9 JDR Cable Systems LLC

- 7.1.10 PT Communication Cable System Indonesia Tbk