|

市场调查报告书

商品编码

1699282

碳捕获与储存市场机会、成长动力、产业趋势分析及 2025-2034 年预测Carbon Capture and Storage Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

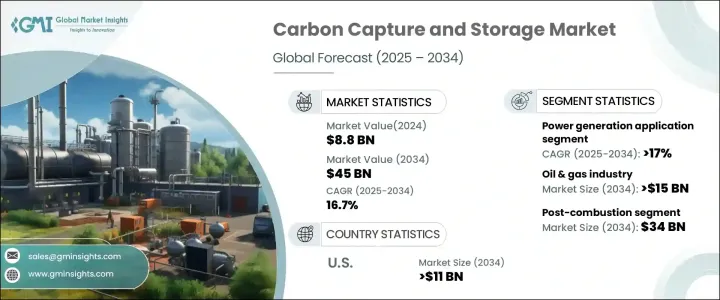

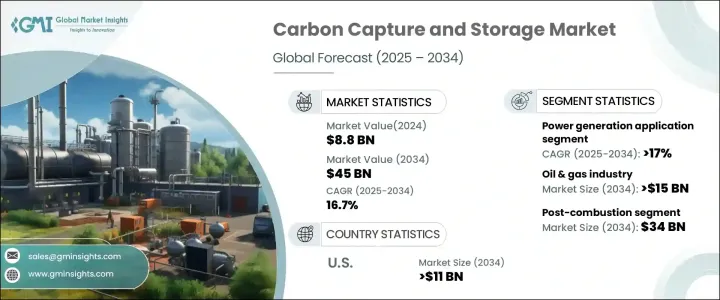

2024 年全球碳捕获与储存市场价值为 88 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 16.7%。抑制温室气体排放和实现脱碳目标的紧迫性日益增加,推动了对 CCS 技术的大量投资。世界各国政府正在实施严格的环境法规,迫使各行各业采用先进的碳捕获解决方案以满足合规标准并减少其碳足迹。人们对气候变迁的担忧日益加剧,加上工业的快速扩张和能源需求,进一步推动了对具有成本效益的排放控制技术的需求。

能源、化学和製造业领域的公司正在积极将 CCS 解决方案融入其营运中,以符合全球永续发展计画。人们对清洁能源转型的日益关注,加上碳捕获效率的提高,为市场扩张带来了新的机会。此外,不断增加的研究和开发活动正在促进下一代 CCS 技术的创新,从而提高可扩展性和操作可行性。随着各行各业努力在环境责任和经济成长之间取得平衡,CCS 正成为实现长期碳中和的关键解决方案。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 88亿美元 |

| 预测值 | 450亿美元 |

| 复合年增长率 | 16.7% |

根据技术,市场分为燃烧前、富氧燃烧和燃烧后。预计燃烧后捕获技术将实现大幅增长,预计到 2034 年其市场价值将达到 340 亿美元。该技术由于与现有工业设备的无缝整合而越来越受到关注,并有望在发电厂、炼油厂和製造工厂中大规模采用。随着排放控製成为优先事项,后燃烧系统正在不断发展,效率和成本效益不断提高,使其成为寻求可行碳减排策略的行业的一个有吸引力的选择。创新吸收剂和先进过滤技术的开发进一步提升了燃烧后技术的性能和应用,确保了市场的持续扩张。

在应用方面,市场涵盖发电、化学加工、石油和天然气等产业。 2024 年,发电领域占据了 36% 的份额,预计到 2034 年将以 17% 的复合年增长率成长。 CCS 基础设施的持续部署以促进氢气的生产、储存和分配是推动该领域需求的关键因素。随着全球能源消耗持续上升,各国政府和公用事业供应商都优先采用 CCS 来满足排放目标,同时又不影响能源产出。发电厂正在利用 CCS 解决方案改造传统能源系统,确保遵守严格的环境政策,同时维持营运效率。 CCS 与再生能源专案和碳负排放措施的整合进一步巩固了其在不断变化的能源格局中的作用。

美国市场在 2024 年创造了 33 亿美元的收入,预计到 2034 年将达到 110 亿美元。美国对减少碳排放和现代化能源基础设施的重视正在加速 CCS 投资。排放控制系统的技术进步,加上大规模 CCS 专案的大量资金,正在推动全国市场的成长。北美仍然是 CCS 扩张的关键地区,战略伙伴关係和政府激励措施在促进创新和部署方面发挥着至关重要的作用。随着各行各业都在努力追求更干净的生产方法,美国市场必将经历强劲成长,巩固其在全球 CCS 领域的领导地位。

目录

第一章:方法论与范围

- 市场范围和定义

- 市场估计和预测参数

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略展望

- 创新与永续发展格局

第五章:市场规模及预测:依技术分类,2021 年至 2034 年

- 主要趋势

- 预燃烧

- 后燃烧

- 富氧燃烧

第六章:市场规模及预测:依应用,2021 年至 2034 年

- 主要趋势

- 石油和天然气

- 化学加工

- 发电

- 其他的

第七章:市场规模及预测:依地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 丹麦

- 瑞典

- 亚太地区

- 中国

- 澳洲

- 韩国

- 世界其他地区

第八章:公司简介

- Air Products

- Aker Solutions

- Carbon Clean

- Chevron

- Dakota Gasification Company

- Equinor

- Exxon Mobil

- Fluor

- General Electric

- Halliburton

- Linde

- Mitsubishi Heavy Industries

- NRG Energy

- Shell Cansolv

- Siemens

- SLB

- Sulzer

- TotalEnergies

The Global Carbon Capture And Storage Market was valued at USD 8.8 billion in 2024 and is projected to grow at a CAGR of 16.7% between 2025 and 2034. The increasing urgency to curb greenhouse gas emissions and achieve decarbonization goals is driving significant investments in CCS technologies. Governments worldwide are implementing stringent environmental regulations, compelling industries to adopt advanced carbon capture solutions to meet compliance standards and mitigate their carbon footprint. Rising concerns over climate change, combined with the rapid industrial expansion and energy demands, are further propelling the need for cost-effective emission control technologies.

Companies across the energy, chemical, and manufacturing sectors are actively integrating CCS solutions into their operations to align with global sustainability initiatives. The growing focus on clean energy transition, coupled with advancements in carbon capture efficiency, is unlocking new opportunities for market expansion. Additionally, increasing research and development activities are fostering the innovation of next-generation CCS technologies that enhance scalability and operational feasibility. As industries strive to balance environmental responsibility with economic growth, CCS is emerging as a pivotal solution for achieving long-term carbon neutrality.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.8 Billion |

| Forecast Value | $45 Billion |

| CAGR | 16.7% |

The market is segmented based on technology into pre-combustion, oxy-fuel combustion, and post-combustion. Post-combustion capture technology is expected to witness substantial growth, with forecasts indicating it will reach USD 34 billion by 2034. This technology is gaining traction due to its seamless integration with existing industrial setups, enabling large-scale adoption across power plants, refineries, and manufacturing facilities. As emission control becomes a priority, post-combustion systems are evolving with enhanced efficiency and cost-effectiveness, making them an attractive option for industries seeking viable carbon reduction strategies. The development of innovative absorbents and advanced filtration techniques is further boosting the performance and adoption of post-combustion technology, ensuring consistent market expansion.

In terms of application, the market spans power generation, chemical processing, and oil & gas, among other industries. The power generation segment captured a 36% share in 2024 and is expected to grow at a CAGR of 17% through 2034. The increasing deployment of CCS infrastructure to facilitate hydrogen production, storage, and distribution is a crucial factor fueling demand within this sector. As global energy consumption continues to rise, governments and utility providers are prioritizing CCS adoption to meet emission targets without compromising energy output. Power plants are leveraging CCS solutions to retrofit conventional energy systems, ensuring compliance with strict environmental policies while maintaining operational efficiency. The integration of CCS in renewable energy projects and carbon-negative initiatives is further solidifying its role in the evolving energy landscape.

The U.S. market generated USD 3.3 billion in 2024 and is projected to reach USD 11 billion by 2034. The nation's emphasis on reducing carbon emissions and modernizing energy infrastructure is accelerating CCS investments. Technological advancements in emission control systems, coupled with substantial funding for large-scale CCS projects, are driving market growth across the country. North America remains a key region for CCS expansion, with strategic partnerships and government incentives playing a vital role in fostering innovation and deployment. As industries strive for cleaner production methods, the U.S. market is set to experience robust growth, reinforcing its leadership in the global CCS landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 – 2034 (MTPA, USD Billion)

- 5.1 Key trends

- 5.2 Pre combustion

- 5.3 Post combustion

- 5.4 Oxy-Fuel combustion

Chapter 6 Market Size and Forecast, By Application, 2021 – 2034 (MTPA, USD Billion)

- 6.1 Key trends

- 6.2 Oil and gas

- 6.3 Chemical processing

- 6.4 Power generation

- 6.5 Others

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (MTPA, USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 Denmark

- 7.3.4 Sweden

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 South Korea

- 7.5 Rest of World

Chapter 8 Company Profiles

- 8.1 Air Products

- 8.2 Aker Solutions

- 8.3 Carbon Clean

- 8.4 Chevron

- 8.5 Dakota Gasification Company

- 8.6 Equinor

- 8.7 Exxon Mobil

- 8.8 Fluor

- 8.9 General Electric

- 8.10 Halliburton

- 8.11 Linde

- 8.12 Mitsubishi Heavy Industries

- 8.13 NRG Energy

- 8.14 Shell Cansolv

- 8.15 Siemens

- 8.16 SLB

- 8.17 Sulzer

- 8.18 TotalEnergies