|

市场调查报告书

商品编码

1699324

建筑便携式逆变发电机市场机会、成长动力、产业趋势分析及 2025-2034 年预测Construction Portable Inverter Generator Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

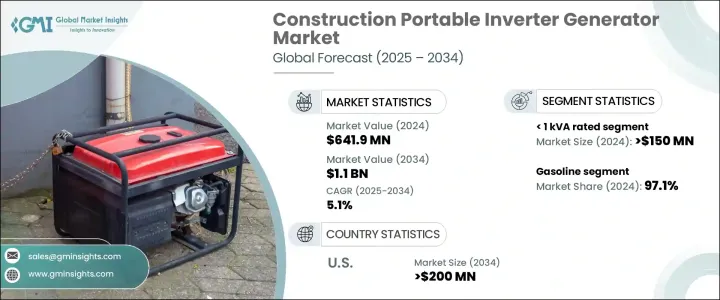

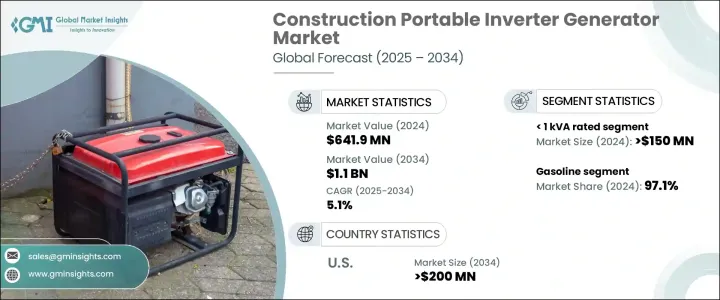

2024 年全球建筑便携式逆变发电机市场规模达到 6.419 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 5.1%,这得益于建筑工地对高效可靠电力解决方案的需求不断增长。建筑活动的激增,加上对便携式和多功能电源的需求,正在推动市场扩张。随着工业和住宅领域寻求增强电源的移动性和灵活性,逆变器发电机的采用持续加速。

这些发电机具有多种优点,包括提高燃油效率、减少排放和更安静的运作。其紧凑轻巧的设计使其非常适合建筑应用,易于运输和部署。城市化和基础设施建设的快速发展进一步促进了工作场所对不间断电源的需求不断增长。政府和私人开发商正在大力投资大型基础设施项目,增加了便携式逆变发电机的需求。此外,节能技术和排放控制措施的进步正在鼓励世界范围内采用这些发电机。随着碳排放法规的收紧,製造商正专注于生产符合环保标准的低碳、节能车型。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 6.419亿美元 |

| 预测值 | 11亿美元 |

| 复合年增长率 | 5.1% |

按额定功率细分,市场包括 1 kVA、> 1 kVA - 2 kVA、> 2 kVA - 3 kVA、> 3 kVA - 4 kVA 和 > 4 kVA 类别。对于更小、更节能的解决方案的需求持续成长,特别是在家庭装修、小型建筑工程和室内装修项目中。仅 1 kVA 市场在 2024 年就创造了 1.5 亿美元的收入,人们越来越倾向于选择能够提供可靠电力且噪音较小的发电机。这些装置的紧凑尺寸和增强的燃油效率使其成为小规模应用的实用选择。

按动力源划分,市场包括汽油、柴油和其他替代能源。 2024 年,汽油驱动的便携式逆变发电机占据了 97.1% 的市场份额,占据了整个产业的主导地位。它们在中小型建筑项目中广泛应用,加上其便于携带且能够为多种工具供电,推动了巨大的需求。由于成本效益和能源效率的提高,发展中地区的部署正在增加。随着燃料消耗和排放控制的不断创新,製造商正致力于提高汽油动力车型的性能,以满足不断变化的行业需求。

2024 年美国建筑便携式逆变发电机市场价值为 1.076 亿美元,预计到 2034 年将达到 2 亿美元。技术进步、法规遵循以及对可靠电力解决方案日益增长的需求等因素正在加速市场成长。飓风和野火等自然灾害发生的频率不断上升,也增加了对这些发电机的需求,以确保紧急情况下不间断的电力供应。随着市场不断发展,主要参与者优先考虑产品创新,以满足对节能且经济高效的便携式电源解决方案日益增长的需求。

目录

第一章:方法论与范围

- 市场范围和定义

- 市场估计和预测参数

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略展望

- 创新与永续发展格局

第五章:市场规模及预测:依功率等级,2021-2034

- 主要趋势

- < 1 千伏安

- > 1千伏安 - 2千伏安

- > 2千伏安 - 3千伏安

- > 3千伏安 - 4千伏安

- > 4千伏安

第六章:市场规模及预测:按电源,2021-2034

- 主要趋势

- 汽油

- 柴油引擎

- 其他的

第七章:市场规模及预测:依地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 俄罗斯

- 英国

- 德国

- 法国

- 西班牙

- 奥地利

- 义大利

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 印尼

- 马来西亚

- 泰国

- 越南

- 菲律宾

- 新加坡

- 中东

- 沙乌地阿拉伯

- 阿联酋

- 卡达

- 土耳其

- 伊朗

- 阿曼

- 非洲

- 埃及

- 奈及利亚

- 阿尔及利亚

- 南非

- 莫三比克

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 智利

第八章:公司简介

- A-iPower

- Atlas Copco

- Briggs & Stratton

- Caterpillar

- Champion Power Equipment

- Cummins

- Deere & Company

- DuroMax Power Equipment

- Generac Power Systems

- Ha-Ko Industries

- HIMOINSA

- Honda Motor

- Kirloskar

- Kohler

- Wacker Neuson SE

- WEN Products

- Westinghouse Electric Corporation

- Yamaha Motor

The Global Construction Portable Inverter Generator Market reached USD 641.9 million in 2024 and is projected to grow at a CAGR of 5.1% between 2025 and 2034., driven by increasing demand for efficient and reliable power solutions across construction sites. The surge in construction activities, coupled with the need for portable and versatile power sources, is fueling market expansion. As industries and residential sectors seek enhanced mobility and flexibility in power supply, the adoption of inverter generators continues to accelerate.

These generators offer multiple advantages, including improved fuel efficiency, reduced emissions, and quieter operation. Their compact and lightweight design makes them highly suitable for construction applications, allowing easy transportation and deployment. The rapid pace of urbanization and infrastructure development is further contributing to the rising demand for uninterrupted power supply at job sites. Governments and private developers are investing heavily in large-scale infrastructure projects, increasing the necessity for portable inverter generators. Additionally, advancements in energy-efficient technologies and emission control measures are encouraging the adoption of these generators worldwide. As regulations on carbon emissions tighten, manufacturers are focusing on producing low-carbon, energy-efficient models that comply with environmental standards.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $641.9 Million |

| Forecast Value | $1.1 Billion |

| CAGR | 5.1% |

Segmented by power rating, the market consists of 1 kVA, > 1 kVA - 2 kVA, > 2 kVA - 3 kVA, > 3 kVA - 4 kVA, and > 4 kVA categories. The demand for smaller, more energy-efficient solutions continues to grow, particularly in home renovations, minor construction work, and interior finishing projects. The 1 kVA segment alone generated USD 150 million in 2024, with increasing preference for generators that offer dependable power with minimal noise. The compact size and enhanced fuel efficiency of these units make them a practical choice for small-scale applications.

By power source, the market includes gasoline, diesel, and other alternatives. Gasoline-powered portable inverter generators dominated the industry with a 97.1% market share in 2024. Their widespread adoption in small to medium-sized construction projects, combined with their ease of portability and ability to power multiple tools, has driven significant demand. Developing regions are seeing an uptick in deployment due to cost-effectiveness and energy efficiency. With ongoing innovations in fuel consumption and emission control, manufacturers are focusing on enhancing the performance of gasoline-powered models to meet evolving industry needs.

The U.S. construction portable inverter generator market was valued at USD 107.6 million in 2024 and is expected to generate USD 200 million by 2034. Factors such as technological advancements, regulatory compliance, and the increasing need for reliable power solutions are accelerating market growth. The rising frequency of natural disasters, including hurricanes and wildfires, is also amplifying demand for these generators, ensuring uninterrupted power supply in emergency situations. As the market continues to evolve, key players are prioritizing product innovation to address the growing need for energy-efficient and cost-effective portable power solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Power Rating, 2021-2034 (USD Million & '000 Units)

- 5.1 Key trends

- 5.2 < 1 kVA

- 5.3 > 1 kVA - 2 kVA

- 5.4 > 2 kVA - 3 kVA

- 5.5 > 3 kVA - 4 kVA

- 5.6 > 4 kVA

Chapter 6 Market Size and Forecast, By Power Source, 2021-2034 (USD Million & '000 Units)

- 6.1 Key trends

- 6.2 Gasoline

- 6.3 Diesel

- 6.4 Others

Chapter 7 Market Size and Forecast, By Region, 2021-2034 (USD Million & '000 Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Russia

- 7.3.2 UK

- 7.3.3 Germany

- 7.3.4 France

- 7.3.5 Spain

- 7.3.6 Austria

- 7.3.7 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.4.6 Indonesia

- 7.4.7 Malaysia

- 7.4.8 Thailand

- 7.4.9 Vietnam

- 7.4.10 Philippines

- 7.4.11 Singapore

- 7.5 Middle East

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Qatar

- 7.5.4 Turkey

- 7.5.5 Iran

- 7.5.6 Oman

- 7.6 Africa

- 7.6.1 Egypt

- 7.6.2 Nigeria

- 7.6.3 Algeria

- 7.6.4 South Africa

- 7.6.5 Mozambique

- 7.7 Latin America

- 7.7.1 Brazil

- 7.7.2 Mexico

- 7.7.3 Argentina

- 7.7.4 Chile

Chapter 8 Company Profiles

- 8.1 A-iPower

- 8.2 Atlas Copco

- 8.3 Briggs & Stratton

- 8.4 Caterpillar

- 8.5 Champion Power Equipment

- 8.6 Cummins

- 8.7 Deere & Company

- 8.8 DuroMax Power Equipment

- 8.9 Generac Power Systems

- 8.10 Ha-Ko Industries

- 8.11 HIMOINSA

- 8.12 Honda Motor

- 8.13 Kirloskar

- 8.14 Kohler

- 8.15 Wacker Neuson SE

- 8.16 WEN Products

- 8.17 Westinghouse Electric Corporation

- 8.18 Yamaha Motor