|

市场调查报告书

商品编码

1699329

海上风能市场机会、成长动力、产业趋势分析及2025-2034年预测Offshore Wind Energy Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

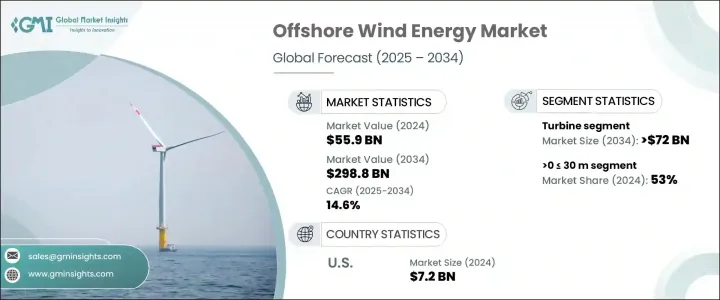

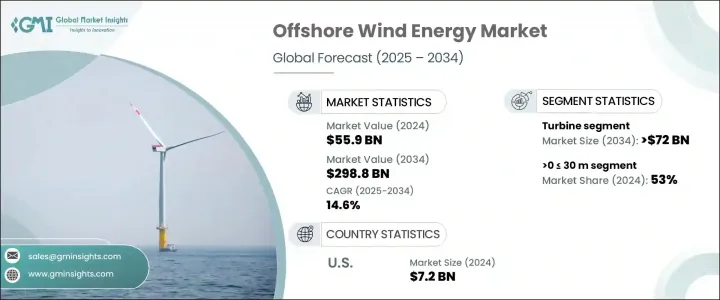

2024 年全球离岸风能市场规模达到 559 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 14.6%。快速的工业化、激增的电力需求以及抑制碳排放的迫切需要,使海上风能成为全球再生能源格局的重要组成部分。世界各国政府正在实施积极的政策和激励措施来加速清洁能源投资,包括固定关税、特定技术配额和竞争性拍卖。这些措施正在推动产业扩张,强化离岸风电作为永续能源生产主要解决方案的作用。

涡轮机技术的进步、电网基础设施的改善以及安装成本的下降进一步推动了市场发展势头。更大、更有效率的风力涡轮机,加上更长的叶片和更高的塔架,正在优化能量的捕获和产生。这些创新不仅提高了营运效率,也降低了平准化能源成本 (LCOE),使得离岸风电与传统化石燃料的竞争力越来越强。对输电基础设施的投资,包括高压直流(HVDC)系统和混合变电站,正在提高能源分配效率。随着各国政府加大实现净零碳目标的力度,离岸风电产业将在全球能源转型中发挥关键作用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 559亿美元 |

| 预测值 | 2988亿美元 |

| 复合年增长率 | 14.6% |

涡轮机部分仍然是离岸风能应用的关键驱动力,预计到 2034 年估值将达到 720 亿美元。对再生能源解决方案的不懈推动正在加速能够产生更大电力输出的大容量风力涡轮机的开发。具有扩大的转子直径和优化的空气动力学设计的海上设施正在最大限度地捕获风能,特别是在风速更稳定的高海拔地区。随着整个产业致力于降低每兆瓦时发电成本,正在进行的研究和开发计划有望进一步提高效率。随着离岸风电场规模和容量不断扩大,涡轮机技术将继续处于市场扩张的前沿。

离岸风电项目依深度分为>0<= 30 公尺、>30<= 50 公尺、>50 公尺三类。浅水部分覆盖水深 >0<= 30 米,由于成本优势和安装程序简化,到 2024 年将占 53% 的市场份额。浅水区风电场所需的基础工程较不复杂,因此可以加快部署速度并减少资本支出。透过混合变电站整合交流 (AC) 和直流 (DC) 输电系统,简化了能源分配,进一步提高了营运效率。考虑到财务和物流方面的优势,开发商优先考虑在浅水地区建造离岸风电项目,以确保未来几年市场持续扩张。

2024年美国离岸风能市场规模将达72亿美元,北美将占全球离岸风能市场的16%。该地区的成长轨迹受到支持性监管框架、对离岸风电基础设施的大量投资以及对脱碳日益增长的承诺的推动。随着技术创新推动效率提高和成本降低,离岸风电正在成为可行且可扩展的能源解决方案。随着计画审批的增加和基础设施的持续发展,北美将在未来十年成为全球离岸风能领域的关键参与者。

目录

第一章:方法论与范围

- 市场定义

- 基础估算与计算

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略仪表板

- 创新与永续发展格局

第五章:市场规模及预测:依组件划分,2021 年至 2034 年

- 主要趋势

- 涡轮

- 等级

- ≤2兆瓦

- >2≤5兆瓦

- >5≤8兆瓦

- >8≤10兆瓦

- >10≤12兆瓦

- > 12 兆瓦

- 安装

- 漂浮的

- 轴

- 水平的

- 上风

- 顺风

- 垂直的

- 水平的

- 成分

- 刀片

- 塔楼

- 其他的

- 轴

- 固定的

- 轴

- 水平的

- 上风

- 顺风

- 垂直的

- 水平的

- 成分

- 刀片

- 塔楼

- 其他的

- 轴

- 漂浮的

- 等级

- 支撑结构

- 下部结构(钢)

- 基础

- 单桩

- 夹克

- 其他的

- 电力基础设施

- 电线电缆

- 变电站

- 其他的

- 其他的

第六章:市场规模及预测:依深度,2021 年至 2034 年

- 主要趋势

- > 0 至 ≤ 30 米

- > 30 至 ≤ 50 米

- > 50米

第七章:市场规模及预测:依地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 西班牙

- 英国

- 法国

- 义大利

- 瑞典

- 波兰

- 丹麦

- 葡萄牙

- 荷兰

- 爱尔兰

- 比利时

- 亚太地区

- 中国

- 印度

- 澳洲

- 日本

- 韩国

- 越南

- 菲律宾

- 台湾

- 世界其他地区

第八章:公司简介

- Enessere

- Furukawa Electric

- General Electric

- Global Energy (Group) Limited

- Goldwind

- IMPSA

- LS Cable & System

- Nexans

- Nordex SE

- Prysmian Group

- Siemens Gamesa Renewable Energy

- Sumitomo Electric Industries

- Southwire Company

- Suzlon Energy Limited

- Vestas

- WEG

The Global Offshore Wind Energy Market reached USD 55.9 billion in 2024 and is projected to expand at a CAGR of 14.6% between 2025 and 2034. Rapid industrialization, surging electricity demand, and the pressing need to curb carbon emissions have positioned offshore wind energy as a critical component of the global renewable energy landscape. Governments worldwide are implementing aggressive policies and incentives to accelerate clean energy investments, including fixed tariffs, technology-specific quotas, and competitive auctions. These measures are driving industry expansion, reinforcing the role of offshore wind as a primary solution for sustainable energy generation.

Advancements in turbine technology, improvements in grid infrastructure, and declining installation costs are further fueling market momentum. Larger and more efficient wind turbines, enhanced by longer blades and taller towers, are optimizing energy capture and generation. These innovations not only improve operational efficiency but also reduce the levelized cost of energy (LCOE), making offshore wind increasingly competitive with traditional fossil fuels. Investments in transmission infrastructure, including high-voltage direct current (HVDC) systems and hybrid substations, are enhancing energy distribution efficiency. As governments ramp up their commitment to achieving net-zero carbon goals, the offshore wind sector is set to play a pivotal role in global energy transformation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $55.9 Billion |

| Forecast Value | $298.8 Billion |

| CAGR | 14.6% |

The turbine segment remains a key driver of offshore wind energy adoption, with projections indicating a valuation of USD 72 billion by 2034. The relentless push for renewable energy solutions is accelerating the development of high-capacity wind turbines capable of generating greater power output. Offshore installations with extended rotor diameters and optimized aerodynamic designs are maximizing wind capture, especially at higher altitudes where wind speeds are more consistent. With an industry-wide focus on reducing costs per megawatt-hour of electricity generated, ongoing research and development initiatives are expected to unlock further efficiency gains. As offshore wind farms continue to scale up in size and capacity, turbine technology will remain at the forefront of market expansion.

Offshore wind projects are classified based on depth into three categories: >0 <= 30 m, >30 <= 50 m, and >50 m. The shallow-water segment, covering depths of >0 <= 30 m, accounted for a 53% market share in 2024, driven by cost advantages and simplified installation procedures. Wind farms in shallow waters require less complex foundation engineering, enabling faster deployment and reduced capital expenditure. The integration of alternating current (AC) and direct current (DC) transmission systems through hybrid substations is streamlining energy distribution, further enhancing operational efficiencies. Given the financial and logistical benefits, developers are prioritizing shallow-water locations for offshore wind projects, ensuring sustained market expansion in the coming years.

The US offshore wind energy market reached USD 7.2 billion in 2024, with North America capturing a 16% share of the global industry. The region's growth trajectory is fueled by supportive regulatory frameworks, significant investments in offshore wind infrastructure, and a growing commitment to decarbonization. As technological innovations drive efficiency improvements and cost reductions, offshore wind is emerging as a viable and scalable energy solution. With increasing project approvals and ongoing infrastructure development, North America is set to become a key player in the global offshore wind energy sector over the next decade.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Component, 2021 – 2034 (MW & USD Million)

- 5.1 Key trends

- 5.2 Turbine

- 5.2.1 Rating

- 5.2.1.1 ≤ 2 MW

- 5.2.1.2 >2≤ 5 MW

- 5.2.1.3 >5≤ 8 MW

- 5.2.1.4 >8≤10 MW

- 5.2.1.5 >10≤ 12 MW

- 5.2.1.6 > 12 MW

- 5.2.2 Installation

- 5.2.2.1 Floating

- 5.2.2.1.1 Axis

- 5.2.2.1.1.1 Horizontal

- 5.2.2.1.1.1.1 Up wind

- 5.2.2.1.1.1.2 Down wind

- 5.2.2.1.1.2 Vertical

- 5.2.2.1.1.1 Horizontal

- 5.2.2.1.2 Component

- 5.2.2.1.2.1 Blades

- 5.2.2.1.2.2 Towers

- 5.2.2.1.2.3 Others

- 5.2.2.1.1 Axis

- 5.2.2.2 Fixed

- 5.2.2.2.1 Axis

- 5.2.2.2.1.1 Horizontal

- 5.2.2.2.1.1.1 Up wind

- 5.2.2.2.1.1.2 Down wind

- 5.2.2.2.1.2 Vertical

- 5.2.2.2.1.1 Horizontal

- 5.2.2.2.2 Component

- 5.2.2.2.2.1 Blades

- 5.2.2.2.2.2 Towers

- 5.2.2.2.2.3 Others

- 5.2.2.2.1 Axis

- 5.2.2.1 Floating

- 5.2.1 Rating

- 5.3 Support Structure

- 5.3.1 Substructure (Steel)

- 5.3.2 Foundation

- 5.3.2.1 Monopile

- 5.3.2.2 Jacket

- 5.3.3 Others

- 5.4 Electrical Infrastructure

- 5.4.1.1 Wires & cables

- 5.4.1.2 Substation

- 5.4.1.3 Others

- 5.5 Others

Chapter 6 Market Size and Forecast, By Depth, 2021 – 2034 (MW & USD Million)

- 6.1 Key trends

- 6.2 > 0 to ≤ 30 m

- 6.3 > 30 to ≤ 50 m

- 6.4 > 50 m

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (MW & USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 Spain

- 7.3.3 UK

- 7.3.4 France

- 7.3.5 Italy

- 7.3.6 Sweden

- 7.3.7 Poland

- 7.3.8 Denmark

- 7.3.9 Portugal

- 7.3.10 Netherlands

- 7.3.11 Ireland

- 7.3.12 Belgium

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Australia

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.4.6 Vietnam

- 7.4.7 Philippines

- 7.4.8 Taiwan

- 7.5 Rest of World

Chapter 8 Company Profiles

- 8.1 Enessere

- 8.2 Furukawa Electric

- 8.3 General Electric

- 8.4 Global Energy (Group) Limited

- 8.5 Goldwind

- 8.6 IMPSA

- 8.7 LS Cable & System

- 8.8 Nexans

- 8.9 Nordex SE

- 8.10 Prysmian Group

- 8.11 Siemens Gamesa Renewable Energy

- 8.12 Sumitomo Electric Industries

- 8.13 Southwire Company

- 8.14 Suzlon Energy Limited

- 8.15 Vestas

- 8.16 WEG