|

市场调查报告书

商品编码

1699387

航空衍生燃气涡轮机市场机会、成长动力、产业趋势分析及 2025-2034 年预测Aeroderivative Gas Turbine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

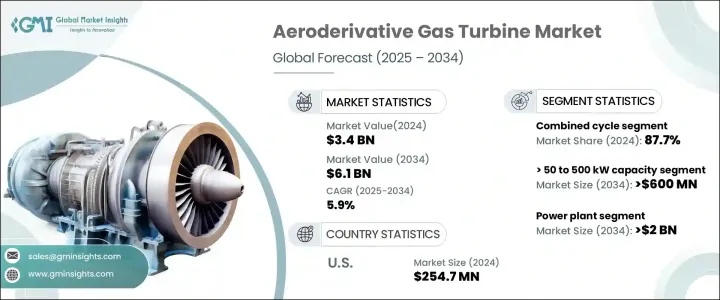

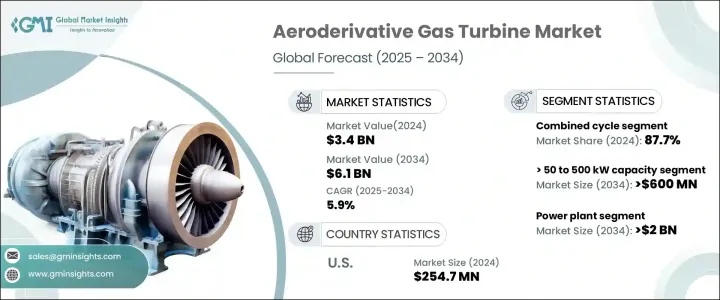

2024 年全球航空衍生型燃气涡轮机市场规模达到 34 亿美元,预计到 2034 年将达到 61 亿美元,2025 年至 2034 年期间的复合年增长率为 5.9%。对能源效率标准的日益重视以及整合再生能源的转变正在推动这些燃气涡轮机的采用。天然气分销和开采的大量投资,加上全球能源消耗的不断增长,正在促进市场的成长。此外,微电网基础设施的扩张以及对降低大型火力发电厂资本成本的日益偏好预计将推动对这些涡轮机的需求。它们能够在尖峰负载和备用电源情况下高效运行,并且具有较高的燃料灵活性和较短的启动时间,因此非常适合电网电力和独立电力系统。

数位孪生技术、人工智慧预测性维护以及涡轮机与再生能源的无缝整合等技术进步正在提高这些系统的性能和运行效率。人们对能源安全、成本效益和永续性的日益重视,为这些产品的普及创造了有利的商业环境。航空衍生型燃气涡轮机具有快速启动和可靠发电的能力,可提供多功能且可靠的能源解决方案,在竞争激烈且快速变化的市场中具有吸引力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 34亿美元 |

| 预测值 | 61亿美元 |

| 复合年增长率 | 5.9% |

市场按容量细分为<= 50 kW、> 50 至 500 kW、> 500 kW 至 1 MW、> 1 至 30 MW、> 30 至 70 MW 和 > 70 MW。预计到 2034 年,50 千瓦容量部分的复合年增长率将超过 6%。由于对分散式能源系统的需求不断增加,该部分在偏远地区和工业应用中越来越受欢迎,以确保电网连接有限地区的稳定电力供应。

根据技术,市场分为开式循环系统和联合循环系统。受各产业对分散式发电日益关注的推动,开式循环部分将在 2024 年占总收入的 12.3% 以上。涡轮机技术的不断进步旨在提高燃油效率并遵守严格的排放标准,进一步加强了这一领域。同时,受益于全球向清洁能源替代品的转变以及摆脱燃煤发电厂的趋势,联合循环领域将在 2024 年占据市场主导地位,占有 87.7% 的份额。

根据应用,市场细分为石油和天然气、发电厂、加工厂、航空、海洋和其他领域。预计到 2034 年,发电厂部分的规模将超过 20 亿美元,这得益于人们越来越多地转向清洁能源解决方案,以及将燃气涡轮机纳入再生能源系统以提高电网稳定性。由于快速的工业扩张和严格的能源效率要求推动了强大发电系统的采用,预计到 2034 年,石油和天然气行业的复合年增长率将超过 5.5%。

美国航空衍生型燃气涡轮机市值在 2022 年为 2.679 亿美元,2023 年为 2.381 亿美元,2024 年为 2.547 亿美元。从传统发电厂向燃气涡轮机技术的转变正在推动产品采用,而对减少碳足迹和满足严格环境标准的高度关注进一步推动了对这些高效涡轮机的需求。预计到 2034 年,北美市场的复合年增长率将超过 6%,这得益于不断增长的工业活动和持续的技术创新,这些创新将提高营运效率并满足对可靠电力解决方案日益增长的需求。

目录

第一章:方法论与范围

- 市场范围和定义

- 市场估计和预测参数

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 战略展望

- 创新与永续发展格局

第五章:市场规模及预测:依产能,2021 年至 2034 年

- 主要趋势

- ≤ 50 千瓦

- > 50至500千瓦

- > 500 千瓦至 1 兆瓦

- > 1至30兆瓦

- > 30至70兆瓦

- > 70 兆瓦

第六章:市场规模及预测:依技术分类,2021 年至 2034 年

- 主要趋势

- 开放式循环

- 复合循环

第七章:市场规模及预测:依应用,2021 年至 2034 年

- 主要趋势

- 发电厂

- 石油和天然气

- 加工厂

- 航空

- 海洋

- 其他的

第八章:市场规模及预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 德国

- 俄罗斯

- 义大利

- 荷兰

- 丹麦

- 波兰

- 瑞典

- 亚太地区

- 中国

- 澳洲

- 日本

- 韩国

- 印尼

- 泰国

- 马来西亚

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 卡达

- 阿曼

- 埃及

- 土耳其

- 伊拉克

- 南非

- 阿尔及利亚

- 拉丁美洲

- 巴西

- 阿根廷

- 智利

第九章:公司简介

- Ansaldo Energia

- Baker Hughes Company

- Capstone Green Energy

- Collins Aerospace

- Destinus Energy

- Doosan Enerbility

- General Electric

- Harbin Electric

- Honeywell International

- IHI Corporation

- Kawasaki Heavy Industries

- MAN Energy Solutions

- Mitsubishi Heavy Industries

- Nanjing Turbine & Electric Machinery

- Pratt & Whitney

- Rolls-Royce

- Safran

- Siemens Energy

- Vericor

- Wartsila

The Global Aeroderivative Gas Turbine Market reached USD 3.4 billion in 2024 and is projected to reach USD 6.1 billion by 2034, reflecting a CAGR of 5.9% between 2025 and 2034. Increasing emphasis on energy efficiency standards and the shift toward integrating renewable energy sources are driving the adoption of these turbines. Extensive investments in natural gas distribution and extraction, coupled with rising global energy consumption, are contributing to market growth. Additionally, the expansion of microgrid infrastructure and the growing preference for reducing capital costs of large-scale thermal power plants are expected to fuel demand for these turbines. Their ability to operate efficiently during peak load and backup power scenarios, along with their high fuel flexibility and low startup times, makes them highly suitable for both grid power and independent power systems.

Technological advancements such as digital twin technology, AI-powered predictive maintenance, and the seamless integration of turbines with renewable energy sources are enhancing the performance and operational efficiency of these systems. The growing emphasis on energy security, cost-efficiency, and sustainability is creating a favorable business environment for the increased penetration of these products. With their ability to deliver quick startups and reliable power generation, aeroderivative gas turbines offer a versatile and dependable energy solution, making them appealing in competitive and rapidly changing markets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.4 Billion |

| Forecast Value | $6.1 Billion |

| CAGR | 5.9% |

The market is segmented by capacity into <= 50 kW, > 50 to 500 kW, > 500 kW to 1 MW, > 1 to 30 MW, > 30 to 70 MW, and > 70 MW. The 50 kW capacity segment is expected to witness a CAGR of over 6% through 2034. This segment is gaining traction in remote areas and industrial applications due to the increasing need for decentralized energy systems, ensuring stable power supply in areas with limited grid connectivity.

By technology, the market is divided into open cycle and combined cycle systems. The open cycle segment accounted for over 12.3% of total revenue in 2024, driven by the rising focus on decentralized power generation across industries. Ongoing advancements in turbine technology aimed at improving fuel efficiency and adhering to stringent emission norms are further strengthening this segment. Meanwhile, the combined cycle segment dominated the market with an 87.7% share in 2024, benefiting from the global shift toward cleaner energy alternatives and the transition away from coal-fired power plants.

Based on application, the market is segmented into oil and gas, power plants, process plants, aviation, marine, and other sectors. The power plant segment is projected to surpass USD 2 billion by 2034, driven by the increasing shift toward cleaner energy solutions and the incorporation of gas turbines into renewable energy systems to improve grid stability. The oil and gas sector is expected to grow at a CAGR of over 5.5% through 2034, as rapid industrial expansion and stringent energy efficiency requirements are driving the adoption of robust power generation systems.

The US aeroderivative gas turbine market was valued at USD 267.9 million in 2022, USD 238.1 million in 2023, and USD 254.7 million in 2024. The shift from traditional power plants to gas turbine technology is boosting product adoption, while a heightened focus on reducing carbon footprints and meeting strict environmental standards is further driving demand for these high-efficiency turbines. The North American market is anticipated to grow at a CAGR of over 6% through 2034, supported by increasing industrial activities and continuous technological innovations that enhance operational efficiency and meet the growing demand for reliable power solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's Analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL Analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Capacity, 2021 – 2034 (MW & USD Million)

- 5.1 Key trends

- 5.2 ≤ 50 kW

- 5.3 > 50 to 500 kW

- 5.4 > 500 kW to 1 MW

- 5.5 > 1 to 30 MW

- 5.6 > 30 to 70 MW

- 5.7 > 70 MW

Chapter 6 Market Size and Forecast, By Technology, 2021 – 2034 (MW & USD Million)

- 6.1 Key trends

- 6.2 Open cycle

- 6.3 Combined cycle

Chapter 7 Market Size and Forecast, By Application, 2021 – 2034 (MW & USD Million)

- 7.1 Key trends

- 7.2 Power plants

- 7.3 Oil & gas

- 7.4 Process plants

- 7.5 Aviation

- 7.6 Marine

- 7.7 Others

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (MW & USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 France

- 8.3.3 Germany

- 8.3.4 Russia

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.3.7 Denmark

- 8.3.8 Poland

- 8.3.9 Sweden

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Indonesia

- 8.4.6 Thailand

- 8.4.7 Malaysia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Qatar

- 8.5.4 Oman

- 8.5.5 Egypt

- 8.5.6 Turkey

- 8.5.7 Iraq

- 8.5.8 South Africa

- 8.5.9 Algeria

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

- 8.6.3 Chile

Chapter 9 Company Profiles

- 9.1 Ansaldo Energia

- 9.2 Baker Hughes Company

- 9.3 Capstone Green Energy

- 9.4 Collins Aerospace

- 9.5 Destinus Energy

- 9.6 Doosan Enerbility

- 9.7 General Electric

- 9.8 Harbin Electric

- 9.9 Honeywell International

- 9.10 IHI Corporation

- 9.11 Kawasaki Heavy Industries

- 9.12 MAN Energy Solutions

- 9.13 Mitsubishi Heavy Industries

- 9.14 Nanjing Turbine & Electric Machinery

- 9.15 Pratt & Whitney

- 9.16 Rolls-Royce

- 9.17 Safran

- 9.18 Siemens Energy

- 9.19 Vericor

- 9.20 Wartsila