|

市场调查报告书

商品编码

1699399

资料中心电池市场机会、成长动力、产业趋势分析及2025-2034年预测Data Center Battery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

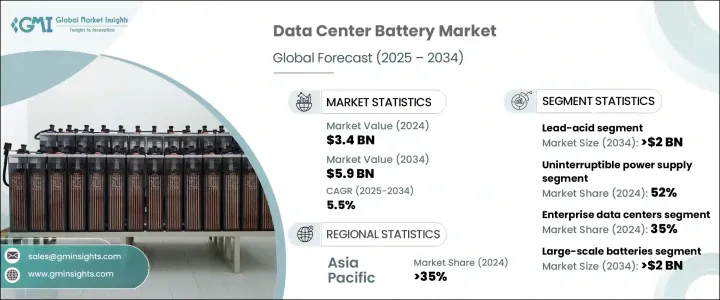

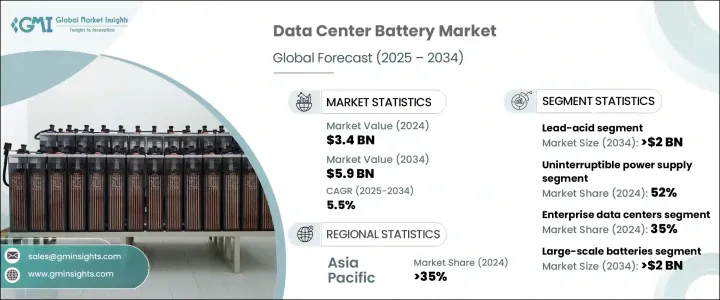

2024 年全球资料中心电池市场价值为 34 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 5.5%。对节能技术和永续解决方案的日益增长的需求正在重塑资料中心电源管理的格局。随着全球企业将永续发展放在首位,资料中心正在进行策略转变,转向节能电池解决方案,以最大限度地减少对环境的影响。再生能源的日益普及以及政府对碳排放的严格监管进一步推动了对先进电池技术的需求。

这个不断发展的市场中最重要的趋势之一是从传统铅酸电池转向锂离子电池的转变。该公司正在寻求高效能能源储存解决方案,以提供更长的使用寿命、更高的能量密度和更少的维护要求。锂离子电池因其能够提高能源效率、减少停机时间并支持永续发展目标而成为首选。此外,镍锌和其他创新电池化学等能源储存技术的进步正在透过提供更有效率、更可靠的解决方案进一步彻底改变市场。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 34亿美元 |

| 预测值 | 59亿美元 |

| 复合年增长率 | 5.5% |

资料中心电池市场根据电池类型进行分类,包括铅酸、锂离子、镍锌和其他技术。 2024年,铅酸电池占据40%的市场。儘管铅酸电池是一项较老的技术,但由于其价格低廉、可靠性高,仍被广泛使用。许多资料中心继续投资铅酸电池系统,因为它们的初始成本较低,并且在不间断电源 (UPS) 应用方面有着良好的业绩记录。此外,密封铅酸电池的进步最大限度地减少了维护需求,使其成为现有基础设施的实用解决方案。

市场也按应用细分,其中 UPS 细分市场在 2024 年将占据 52% 的份额。 UPS 系统对于资料中心至关重要,因为它们在停电期间提供即时备用电源,确保无缝运作并防止资料遗失。这些系统还可以保护敏感设备免受可能导致运作中断的电压波动和电涌的影响。锂离子电池因其更长的使用寿命、更快的充电能力和更高的能量密度,在 UPS 应用中越来越受欢迎。随着资料中心营运商寻求更具弹性和更高效的备用电源选择,向锂离子解决方案的转变正在加速。

受各行各业数位基础设施快速扩张的推动,亚太地区资料中心电池市场到 2024 年将占 35% 的份额。对云端运算、人工智慧和数据驱动技术的日益依赖,提高了该地区对稳定和永续电力解决方案的需求。亚太地区各国政府正在积极推动再生能源的应用,这导致对先进电池储存解决方案的投资增加。随着该地区资料中心的不断扩张,对高效能和环保的能源储存解决方案的需求仍将是市场的主要驱动力。

目录

第一章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 原物料供应商

- 零件供应商

- 製造商

- 技术提供者

- 服务提供者

- 经销商

- 最终用途

- 供应商格局

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻和倡议

- 监管格局

- 价格趋势

- 成本細項分析

- 衝击力

- 成长动力

- 电池技术不断进步

- 不间断电源(UPS)需求不断成长

- 资料中心功耗增加

- 全球资料中心建设不断增加

- 产业陷阱与挑战

- 初始资本成本高

- 与现有基础设施整合的复杂性

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按电池,2021 - 2034 年

- 主要趋势

- 铅酸电池

- 按施工

- 淹没

- 阀控铅酸蓄电池

- 年度股东大会

- 凝胶

- 按施工

- 锂离子

- 透过化学

- 利物浦足球俱乐部

- 低碳

- 长期演进

- 国家管理委员会

- 美国国家咖啡协会

- 改性活生物体

- 透过化学

- 镍锌

- 其他的

第六章:市场估计与预测:依电池容量,2021 - 2034 年

- 主要趋势

- 小型电池(100kWh以下)

- 中型电池(100 kWh - 1 MWh)

- 大型电池(1MWh以上)

第七章:市场估计与预测:按资料中心,2021 - 2034 年

- 主要趋势

- 企业资料中心

- 主机代管资料中心

- 超大规模资料中心

- 边缘资料中心

第八章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 不间断电源(UPS)

- 备用电源系统

- 储能係统(ESS)

- 削峰和负载平衡

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- Alpha Technologies

- C&D Technology

- Permanently closed

- Delta Electronics

- East Penn

- Energon

- EnerSys

- Exide Technologies

- FIAMM Energy Technology

- GS Yuasa

- Huawei Technologies

- Intercel

- Leoch

- LG Energy Solution

- MK BatteryUiPath

- Narada Power Source

- NorthStar Battery Company

- Power Sonic

- Saft Groupe

- Samsung SDI

The Global Data Center Battery Market was valued at USD 3.4 billion in 2024 and is expected to grow at a CAGR of 5.5% between 2025 and 2034. The increasing demand for energy-efficient technologies and sustainable solutions is reshaping the landscape of data center power management. As businesses worldwide prioritize sustainability, data centers are making strategic shifts toward energy-efficient battery solutions to minimize their environmental impact. The growing adoption of renewable energy sources and stringent government regulations on carbon emissions are further driving the demand for advanced battery technologies.

One of the most significant trends in this evolving market is the transition from traditional lead-acid batteries to lithium-ion batteries. Companies are seeking high-performance energy storage solutions that offer longer lifespans, higher energy density, and reduced maintenance requirements. Lithium-ion batteries are emerging as the preferred choice due to their ability to improve energy efficiency, reduce downtime, and support sustainability objectives. Additionally, advancements in energy storage technologies, such as nickel-zinc and other innovative battery chemistries, are further revolutionizing the market by providing more efficient and reliable solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.4 Billion |

| Forecast Value | $5.9 Billion |

| CAGR | 5.5% |

The data center battery market is categorized based on battery type, including lead-acid, lithium-ion, nickel-zinc, and other technologies. In 2024, lead-acid batteries accounted for 40% of the market share. Despite being an older technology, lead-acid batteries remain widely used due to their affordability and reliability. Many data centers continue to invest in lead-acid battery systems because of their lower initial costs and proven track record in uninterruptible power supply (UPS) applications. Additionally, sealed lead-acid battery advancements have minimized maintenance needs, making them a practical solution for existing infrastructure.

The market is also segmented by application, with the UPS segment holding a 52% share in 2024. UPS systems are critical for data centers as they provide immediate backup power during outages, ensuring seamless operations and preventing data loss. These systems also protect sensitive equipment from voltage fluctuations and power surges that can lead to operational disruptions. Lithium-ion batteries are gaining traction in UPS applications due to their extended lifespan, faster recharge capabilities, and higher energy density. This shift toward lithium-ion solutions is accelerating as data center operators seek more resilient and efficient backup power options.

Asia Pacific Data Center Battery Market held a 35% share in 2024, fueled by the rapid expansion of digital infrastructure across various industries. The increasing reliance on cloud computing, artificial intelligence, and data-driven technologies has heightened the need for stable and sustainable power solutions in the region. Governments in Asia Pacific are actively promoting renewable energy adoption, which has led to increased investments in advanced battery storage solutions. As data centers in this region continue to expand, the demand for high-performance and environmentally friendly energy storage solutions will remain a key market driver.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material suppliers

- 3.1.2 Component suppliers

- 3.1.3 Manufacturers

- 3.1.4 Technology providers

- 3.1.5 Service providers

- 3.1.6 Distributors

- 3.1.7 End use

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Price trends

- 3.9 Cost breakdown analysis

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Growing advancements in battery technology

- 3.10.1.2 Rising demand for Uninterrupted Power Supply (UPS)

- 3.10.1.3 Increase in data center power consumption

- 3.10.1.4 Rising construction of data centers across the globe

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High initial capital costs

- 3.10.2.2 Complexity in integration with existing infrastructure

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Battery, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Lead-acid

- 5.2.1 By construction

- 5.2.1.1 Flooded

- 5.2.1.2 VRLA

- 5.2.1.2.1 AGM

- 5.2.1.2.2 GEL

- 5.2.1 By construction

- 5.3 Lithium-ion

- 5.3.1 By chemistry

- 5.3.1.1 LFP

- 5.3.1.2 LCO

- 5.3.1.3 LTO

- 5.3.1.4 NMC

- 5.3.1.5 NCA

- 5.3.1.6 LMO

- 5.3.1 By chemistry

- 5.4 Nickel zinc

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Battery Capacity, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Small-scale batteries (Below 100 kWh)

- 6.3 Medium-scale batteries (100 kWh - 1 MWh)

- 6.4 Large-scale batteries (Above 1 MWh)

Chapter 7 Market Estimates & Forecast, By Data Center, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Enterprise data centers

- 7.3 Colocation data centers

- 7.4 Hyperscale data centers

- 7.5 Edge data centers

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Uninterruptible power supply (UPS)

- 8.3 Backup power systems

- 8.4 Energy storage systems (ESS)

- 8.5 Peak shaving and load balancing

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Alpha Technologies

- 10.2 C&D Technology

- 10.3 Permanently closed

- 10.4 Delta Electronics

- 10.5 East Penn

- 10.6 Energon

- 10.7 EnerSys

- 10.8 Exide Technologies

- 10.9 FIAMM Energy Technology

- 10.10 GS Yuasa

- 10.11 Huawei Technologies

- 10.12 Intercel

- 10.13 Leoch

- 10.14 LG Energy Solution

- 10.15 MK BatteryUiPath

- 10.16 Narada Power Source

- 10.17 NorthStar Battery Company

- 10.18 Power Sonic

- 10.19 Saft Groupe

- 10.20 Samsung SDI