|

市场调查报告书

商品编码

1699407

压铸玩具市场机会、成长动力、产业趋势分析及 2025-2034 年预测Die-Cast Toys Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

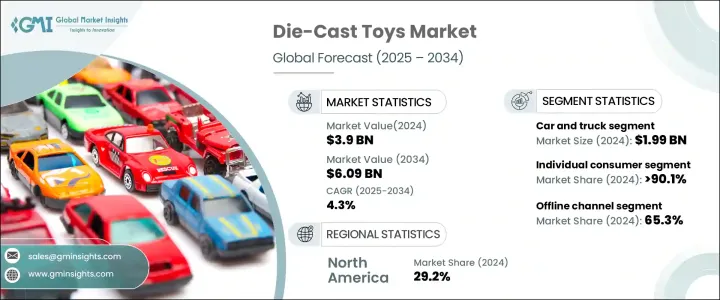

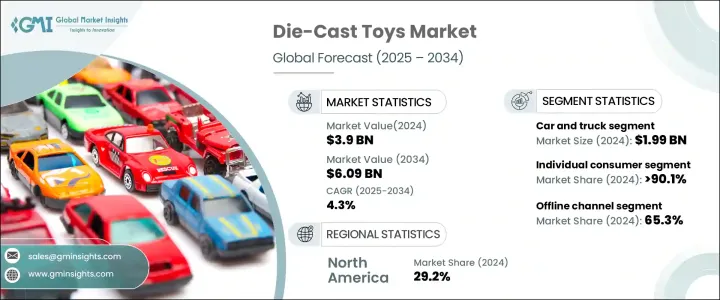

2024 年全球压铸玩具市场价值为 39 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 4.3%。受怀旧情绪、收藏热情以及年轻消费者日益增长的兴趣等共同推动,该市场正呈现强劲发展势头。随着收藏家和爱好者寻求高品质、精细的复製品,包括模型车、飞机和人偶在内的压铸玩具正在重新流行起来。製造商正在利用这一趋势,重新推出经典车型、推出限量版以及与娱乐特许经营商合作。

压铸玩具的情感吸引力是推动市场成长的主要因素之一。许多成年收藏家都被復古和重新发行的模型所吸引,因为它们能唤起他们的童年回忆。这导致復古风格玩具和特别版玩具的需求激增。作为回应,主要的压铸玩具品牌正在透过复杂的设计和限量生产来扩大其产品组合,以满足经验丰富的收藏家和新买家的需求。此外,可支配收入的增加以及电影、电视节目和电玩主题商品的日益普及进一步巩固了市场地位。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 39亿美元 |

| 预测值 | 60.9亿美元 |

| 复合年增长率 | 4.3% |

市场主要由终端用户细分,其中个人消费者在 2024 年占据 90.1% 的主导份额。这些消费者包括业余爱好者、儿童、汽车爱好者和收藏家,他们透过个人购买推动大部分销售。收藏家仍然是塑造市场趋势的关键力量,他们强烈偏爱精緻的限量版模型和復古设计。他们的需求影响着新产品的推出,甚至决定了旧款车型的重新推出,使他们成为製造商的关键目标受众。

压铸玩具的通路分为线上和线下销售,其中线下销售占据主导地位,到2024年将占65.3%的份额。实体店,包括玩具店和百货公司,仍然是许多买家的首选购物目的地,尤其是收藏家,他们重视在购买前检查工艺和细节的机会。店内展示和在人流量大的区域进行策略性的产品摆放进一步刺激了衝动性购买,尤其是在父母和孩子中。虽然由于便利性和更广泛的选择,网路销售正在稳步增长,但实体店在培养客户参与度和品牌忠诚度方面仍然至关重要。

2024 年,北美占据压铸玩具市场的 29.2% 份额,产值达 11.8 亿美元。该地区拥有一群忠实的收藏家和爱好者,他们积极寻求独特、高品质的车型。市场领导者透过扩大产品线、与汽车製造商建立合作伙伴关係以及与娱乐特许经营商合作不断创新。这些合作提高了品牌知名度并吸引了更广泛的消费者群体。因此,市场不断发展,品牌专注于精准度、工艺和独特性,以在日益激烈的竞争中保持领先地位。

目录

第一章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究与验证

- 主要来源

- 资料探勘来源

- 市场定义

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 定价分析

- 技术与创新格局

- 重要新闻和倡议

- 监管格局

- 製造商

- 经销商

- 零售商

- 对部队的影响

- 成长动力

- 收藏品日益流行

- 怀旧与復古潮流

- 品牌合作与授权

- 产业陷阱与挑战

- 原料成本上涨

- 人们对数位和互动玩具的偏好日益增长

- 成长动力

- 成长潜力分析

- 消费者购买行为

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按产品类型,2021 - 2034 年(十亿美元)

- 主要趋势

- 汽车和卡车

- 运动的

- 极佳的

- 路

- 皮卡车

- 卡车

- 其他(老式卡车、工程卡车等)

- 摩托车和自行车

- 运动自行车

- 直升机自行车

- 越野摩托车

- 巡洋舰自行车

- 飞机

- 商用飞机

- 军用机

- 直升机

- 火车

- 机车

- 搭乘用车

- 货车

第六章:市场估计与预测:依资料,2021 年至 2034 年

- 主要趋势

- 金属

- 铝

- 塑胶

- 橡皮

第七章:市场估计与预测:依电源分类,2021 年至 2034 年

- 主要趋势

- 电池电量

- 风力

第八章:市场估计与预测:以价格,2021 年至 2034 年

- 主要趋势

- 低的

- 中等的

- 高的

第九章:市场估计与预测:依规模,2021 年至 2034 年

- 主要趋势

- 1:8-1:18

- 1:24-1:1:43

- 1:43-1:76

- 1:87-3'

第 10 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 个人消费者

- 教育机构

第 11 章:市场估计与预测:按控制方法,2021 年至 2034 年(十亿美元)

- 主要趋势

- 手动的

- 偏僻的

- 互动的

第 12 章:市场估计与预测:按配销通路,2021 年至 2034 年(十亿美元)

- 主要趋势

- 网路零售

- 电子商务网站

- 公司网站

- 线下零售

- 玩具店

- 百货公司

- 专卖店

第 13 章:市场估计与预测:按地区,2021 年至 2034 年(十亿美元)

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第 14 章:公司简介

- Bburago

- Brekina Modelle

- Diecast Models Wholesale

- Dinky Toys

- Greenlight Collectibles

- Hasbro, Inc.

- Hot Wheels

- Jada Toys, Inc.

- LEGO Group

- Maisto International, Inc.

- Matchbox

- Mattel, Inc.

- Tomica (TOMY Company, Ltd.)

- Welly Diecast

- Yat Ming

The Global Die-Cast Toys Market was valued at USD 3.9 billion in 2024 and is projected to grow at a CAGR of 4.3% between 2025 and 2034. The market is witnessing strong momentum, fueled by a combination of nostalgia, collector enthusiasm, and increasing interest from younger consumers. Die-cast toys, including model cars, aircraft, and action figures, are seeing a resurgence as collectors and enthusiasts seek high-quality, detailed replicas. Manufacturers are capitalizing on this trend by reintroducing classic models, launching limited-edition releases, and collaborating with entertainment franchises.

The emotional appeal of die-cast toys is one of the primary factors driving market growth. Many adult collectors are drawn to vintage and reissued models that evoke memories of their childhood. This has led to a surge in demand for retro-styled toys and special edition releases. In response, major die-cast toy brands are expanding their portfolios with intricate designs and limited-production runs to cater to both seasoned collectors and new buyers. Additionally, rising disposable incomes and the increasing popularity of themed merchandise from movies, TV shows, and video games have further strengthened the market's position.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.9 Billion |

| Forecast Value | $6.09 Billion |

| CAGR | 4.3% |

The market is primarily segmented by end-users, with individual consumers accounting for a dominant 90.1% share in 2024. These consumers include hobbyists, children, car enthusiasts, and collectors who drive the majority of sales through personal purchases. Collectors remain a crucial force in shaping market trends, with a strong preference for detailed, limited-edition models and vintage designs. Their demand influences new product launches and even dictates the reintroduction of older models, making them a key target audience for manufacturers.

Distribution channels for die-cast toys are divided into online and offline sales, with offline sales leading the segment, holding a 65.3% share in 2024. Physical stores, including toy shops and department stores, continue to be the preferred shopping destinations for many buyers, particularly collectors who value the opportunity to inspect craftsmanship and detailing before making a purchase. In-store displays and strategic product placements in high-traffic areas further boost impulse purchases, particularly among parents and children. While online sales are steadily increasing due to convenience and a wider selection, brick-and-mortar stores remain critical in fostering customer engagement and brand loyalty.

North America accounted for a significant 29.2% share of the Die-Cast Toy Market in 2024, generating USD 1.18 billion. The region has a well-established base of collectors and enthusiasts who actively seek exclusive and high-quality models. Market leaders are continuously innovating by expanding their product lines, forging partnerships with automobile manufacturers, and collaborating with entertainment franchises. These collaborations enhance brand visibility and attract a broader consumer base. As a result, the market continues to evolve, with brands focusing on precision, craftsmanship, and exclusivity to stay ahead in an increasingly competitive landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.3 Pricing analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Manufacturers

- 3.8 Distributors

- 3.9 Retailers

- 3.10 Impact on forces

- 3.10.1 Growth drivers

- 3.10.1.1 Increasing popularity of collectibles

- 3.10.1.2 Nostalgia and retro trends

- 3.10.1.3 Brand collaborations and licensing

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Rising cost of raw materials

- 3.10.2.2 Growing preference for digital and interactive toys

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Consumer buying behavior

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 ($Bn) (Thousand Units)

- 5.1 Key trends

- 5.2 Cars & trucks

- 5.2.1 Sports

- 5.2.2 Super

- 5.2.3 Road

- 5.2.4 Pickup trucks

- 5.2.5 Lorries

- 5.2.6 Other (Vintage, construction trucks etc.)

- 5.3 Motorcycles & bikes

- 5.3.1 Sports bikes

- 5.3.2 Chopper bikes

- 5.3.3 Dirt bikes

- 5.3.4 Cruiser Bikes

- 5.4 Airplanes

- 5.4.1 Commercial jets

- 5.4.2 Military aircraft

- 5.4.3 Helicopters

- 5.5 Trains

- 5.5.1 Locomotives

- 5.5.2 Passenger cars

- 5.5.3 Freight cars

Chapter 6 Market Estimates & Forecast, By Material, 2021 – 2034, (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Metal

- 6.3 Aluminum

- 6.4 Plastic

- 6.5 Rubber

Chapter 7 Market Estimates & Forecast, By Power Source, 2021 – 2034, (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Battery power

- 7.3 Wind power

Chapter 8 Market Estimates & Forecast, By Price, 2021 – 2034, (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High

Chapter 9 Market Estimates & Forecast, By Scale, 2021 – 2034, (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 1:8-1:18

- 9.3 1:24-1: 1:43

- 9.4 1:43- 1:76

- 9.5 1:87- 3'

Chapter 10 Market Estimates & Forecast, By End Use, 2021 – 2034, (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 Individual consumers

- 10.3 Educational institutions

Chapter 11 Market Estimates & Forecast, By Control Method, 2021 - 2034 ($Bn) (Thousand Units)

- 11.1 Key trends

- 11.2 Manual

- 11.3 Remote

- 11.4 Interactive

Chapter 12 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn) (Thousand Units)

- 12.1 Key trends

- 12.2 Online Retail

- 12.2.1 E-commerce websites

- 12.2.2 Company website

- 12.3 Offline Retail

- 12.3.1 Toy stores

- 12.3.2 Department stores

- 12.3.3 Specialty stores

Chapter 13 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn) (Thousand Units)

- 13.1 Key trends

- 13.2 North America

- 13.2.1 U.S.

- 13.2.2 Canada

- 13.3 Europe

- 13.3.1 UK

- 13.3.2 Germany

- 13.3.3 France

- 13.3.4 Italy

- 13.3.5 Spain

- 13.3.6 Russia

- 13.3.7 Nordics

- 13.4 Asia Pacific

- 13.4.1 China

- 13.4.2 India

- 13.4.3 Japan

- 13.4.4 Australia

- 13.4.5 South Korea

- 13.4.6 Southeast Asia

- 13.5 Latin America

- 13.5.1 Brazil

- 13.5.2 Mexico

- 13.5.3 Argentina

- 13.6 MEA

- 13.6.1 UAE

- 13.6.2 South Africa

- 13.6.3 Saudi Arabia

Chapter 14 Company Profiles

- 14.1 Bburago

- 14.2 Brekina Modelle

- 14.3 Diecast Models Wholesale

- 14.4 Dinky Toys

- 14.5 Greenlight Collectibles

- 14.6 Hasbro, Inc.

- 14.7 Hot Wheels

- 14.8 Jada Toys, Inc.

- 14.9 LEGO Group

- 14.10 Maisto International, Inc.

- 14.11 Matchbox

- 14.12 Mattel, Inc.

- 14.13 Tomica (TOMY Company, Ltd.)

- 14.14 Welly Diecast

- 14.15 Yat Ming