|

市场调查报告书

商品编码

1708120

金属罐市场机会、成长动力、产业趋势分析及2025-2034年预测Metal Cans Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

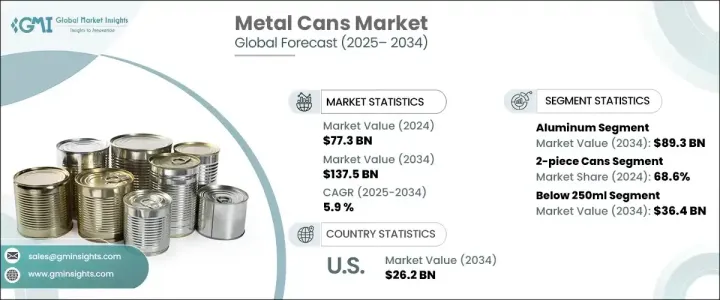

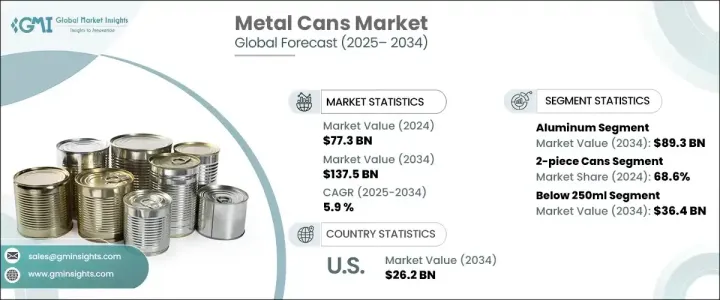

2024 年全球金属罐市场规模达到 773 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 5.9%。金属罐需求的不断增长受到多种关键因素的推动,包括精酿啤酒的日益普及、电子商务的扩张以及消费者对永续包装解决方案的日益倾向。各行各业的公司都在迅速转向金属罐,以满足对环保、高效和耐用包装日益增长的需求。随着永续发展成为重中之重,企业正致力于减少塑胶垃圾,金属罐因其可回收性、重量轻和增强的产品保存能力而成为一种有吸引力的替代品。

精酿啤酒产业在推动金属罐需求方面发挥着至关重要的作用。许多独立啤酒厂都采用铝罐,因为它们能有效地维持产品的新鲜度和品质。铝罐具有出色的防光和防氧性能,有助于保留风味并延长饮料的保质期。随着消费者偏好不断转向便利和永续的包装,对金属罐的需求正在加速成长,尤其是在饮料业。公司也利用金属罐提供的品牌机会,实现高品质的印刷和生动的设计,增强货架吸引力和消费者参与。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 773亿美元 |

| 预测值 | 1375亿美元 |

| 复合年增长率 | 5.9% |

市场主要分为两种材料类型:铝和钢。预计到 2034 年,铝罐的市值将达到 893 亿美元,其主导地位归功于其可回收性、重量轻以及对环境影响小。世界各国政府和环保组织正在实施更严格的法规来限制塑胶的使用,促使各行各业采用铝罐作为永续的替代品。各大品牌也纷纷改用铝包装,以彰显其永续发展的承诺,强化其具有环保意识的企业形象。随着越来越多的人积极寻找具有环保包装的产品,消费者偏好进一步支持了这种转变。

从产品类型来看,金属罐有两片式和三片式两种形式。 2024 年,两件式产品占了 68.6% 的市场份额,这主要归功于其成本效益、耐用性和较低的材料消耗。两片罐在食品和饮料行业中广受欢迎,尤其是碳酸饮料和即食食品,因为包装的完整性和易用性是关键因素。预计未来几年对轻质和高度可回收包装的需求将继续推动两片式金属罐的采用。

2024 年,北美金属罐市场占有 25% 的份额,永续发展倡议推动该地区实现显着成长。越来越多的饮料公司开始转向使用铝罐,以符合其企业永续发展目标并遵守不断变化的监管标准。推动环保替代品发展的不仅是环境问题,也是消费者期望的结果。随着政府推广绿色包装计画以及领先品牌优先减少塑胶垃圾,北美金属罐市场有望稳步扩张。随着企业对创新包装解决方案和回收计画的投资,金属罐将在塑造各行业永续包装的未来方面发挥关键作用。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 提高回收效率和循环经济整合

- 精酿啤酒销量成长

- 便携式食品和饮料的需求不断增长

- 电商平台的全球扩张

- 罐装非酒精饮料的激增

- 产业陷阱与挑战

- 金属开采对环境的影响

- 加强金属包装的监管审查

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按材料,2021 - 2034 年

- 主要趋势

- 铝

- 钢

第六章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 两片罐

- 三片罐

第七章:市场估计与预测:按关闭类型,2021 - 2034 年

- 主要趋势

- 易开盖(EOE)

- 剥离端(POE)

- 其他的

第八章:市场估计与预测:按产能,2021 - 2034 年

- 主要趋势

- 250毫升以下

- 250毫升-1升

- 1公升以上

第九章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 食物

- 水果和蔬菜

- 方便食品

- 宠物食品

- 肉类和海鲜

- 其他的

- 饮料

- 酒精饮料

- 碳酸软性饮料

- 运动和能量饮料

- 其他的

- 化妆品和个人护理

- 製药

- 其他的

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第 11 章:公司简介

- Ardagh Group

- Ball Corporation

- Canpack

- CCL Industries

- CPMC Holdings

- Crown Holdings

- DS Containers

- Envases Group

- Hindustan Tin Works

- Kian Joo Group

- Mauser Packaging

- P Wilkinson Containers

- Sapin

- Silgan Holdings

- Toyo Seikan

- Universal Can

- Visy

The Global Metal Cans Market reached USD 77.3 billion in 2024 and is projected to grow at a CAGR of 5.9% between 2025 and 2034. The increasing demand for metal cans is being fueled by several key factors, including the surging popularity of craft beer, the expansion of e-commerce, and a growing consumer inclination toward sustainable packaging solutions. Companies across industries are rapidly shifting to metal cans to meet the rising demand for eco-friendly, efficient, and durable packaging. With sustainability becoming a top priority, businesses are focusing on reducing plastic waste, making metal cans an attractive alternative due to their recyclability, lightweight nature, and enhanced product preservation capabilities.

The craft beer industry is playing a crucial role in boosting the demand for metal cans. Many independent breweries are embracing aluminum cans because they effectively maintain product freshness and quality. Aluminum cans offer superior protection against light and oxygen, which helps retain the flavor and extend the shelf life of beverages. As consumer preferences continue to shift toward convenient and sustainable packaging, the demand for metal cans is accelerating, particularly within the beverage sector. Companies are also capitalizing on the branding opportunities presented by metal cans, which allow for high-quality printing and vibrant designs, enhancing shelf appeal and consumer engagement.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $77.3 Billion |

| Forecast Value | $137.5 Billion |

| CAGR | 5.9% |

The market is primarily segmented into two material types: aluminum and steel. Aluminum cans are expected to reach USD 89.3 billion by 2034, with their dominance attributed to their recyclability, lightweight properties, and low environmental impact. Governments and environmental organizations worldwide are enforcing stricter regulations to curb plastic usage, prompting industries to adopt aluminum cans as a sustainable alternative. Brands are also making concerted efforts to highlight their sustainability commitments by switching to aluminum packaging, reinforcing their image as eco-conscious enterprises. This shift is further supported by consumer preferences, as a growing number of individuals actively seek out products with environmentally friendly packaging.

In terms of product type, metal cans are available in two-piece and three-piece formats. The two-piece segment held a 68.6% market share in 2024, largely due to its cost-effectiveness, durability, and lower material consumption. Two-piece cans are widely preferred in the food and beverage industry, especially for carbonated drinks and ready-to-eat meals, where packaging integrity and ease of use are critical factors. The demand for lightweight and highly recyclable packaging is expected to continue driving the adoption of two-piece metal cans in the coming years.

North America Metal Cans Market held a 25% share in 2024, with sustainability initiatives driving significant growth in the region. Beverage companies are increasingly transitioning to aluminum cans to align with their corporate sustainability goals and comply with evolving regulatory standards. The push for eco-friendly alternatives is not only being driven by environmental concerns but also by consumer expectations. With government programs promoting green packaging and leading brands prioritizing the reduction of plastic waste, the metal cans market in North America is poised for steady expansion. As businesses invest in innovative packaging solutions and recycling initiatives, metal cans are set to play a pivotal role in shaping the future of sustainable packaging across various industries.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Enhanced recycling efficiency and circular economy integration

- 3.2.1.2 Increasing sales of craft beer

- 3.2.1.3 Rising demand for on-the-go food and beverages

- 3.2.1.4 Global expansion of e-commerce platforms

- 3.2.1.5 Proliferation of non-alcoholic beverages in cans

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Environmental impact of mining for metal

- 3.2.2.2 Increased regulatory scrutiny on metal packaging

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Material, 2021 - 2034 (USD Bn & Units)

- 5.1 Key trends

- 5.2 Aluminum

- 5.3 Steel

Chapter 6 Market Estimates and Forecast, By Product, 2021 - 2034 (USD Bn & Units)

- 6.1 Key trends

- 6.2 2-piece cans

- 6.3 3-piece cans

Chapter 7 Market Estimates and Forecast, By Closure Type, 2021 - 2034 (USD Bn & Units)

- 7.1 Key trends

- 7.2 Easy-open end (EOE)

- 7.3 Peel-off end (POE)

- 7.4 Others

Chapter 8 Market Estimates and Forecast, By Capacity, 2021 - 2034 (USD Bn & Units)

- 8.1 Key trends

- 8.2 Below 250ml

- 8.3 250ml - 1 liter

- 8.4 Above 1 liter

Chapter 9 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Bn & Units)

- 9.1 Key trends

- 9.2 Food

- 9.2.1 Fruits & vegetables

- 9.2.2 Convenience foods

- 9.2.3 Pet foods

- 9.2.4 Meat & seafood

- 9.2.5 Others

- 9.3 Beverages

- 9.3.1 Alcoholic beverages

- 9.3.2 Carbonated soft drinks

- 9.3.3 Sports & energy drinks

- 9.3.4 Others

- 9.5 Cosmetics and personal care

- 9.6 Pharmaceuticals

- 9.7 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Bn & Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Ardagh Group

- 11.2 Ball Corporation

- 11.3 Canpack

- 11.4 CCL Industries

- 11.5 CPMC Holdings

- 11.6 Crown Holdings

- 11.7 DS Containers

- 11.8 Envases Group

- 11.9 Hindustan Tin Works

- 11.10 Kian Joo Group

- 11.11 Mauser Packaging

- 11.12 P Wilkinson Containers

- 11.13 Sapin

- 11.14 Silgan Holdings

- 11.15 Toyo Seikan

- 11.16 Universal Can

- 11.17 Visy