|

市场调查报告书

商品编码

1708124

汽车燃油输送帮浦市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive Fuel Transfer Pumps Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

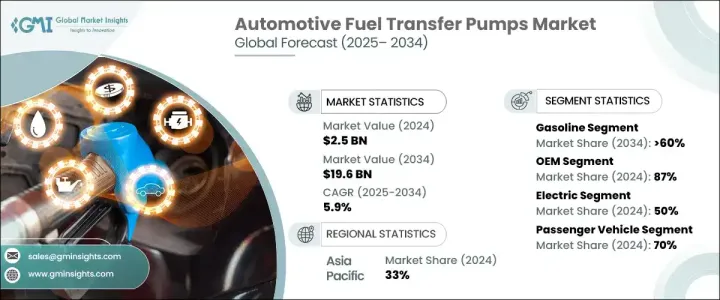

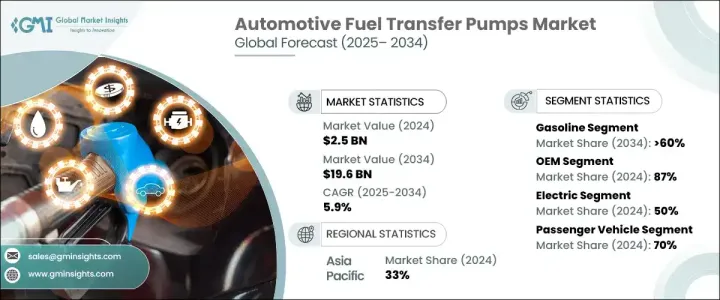

2024 年全球汽车燃油输送帮浦市场价值为 25 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 5.9%。受汽车产量成长和对节油解决方案的需求不断增加的推动,全球汽车产业不断扩张,推动市场向前发展。随着人们对高性能汽车的青睐日益增长,製造商正专注于提高引擎效率和耐用性的先进燃油输送泵技术。新兴经济体,尤其是亚洲和拉丁美洲的新兴经济体,由于城市化进程加快、可支配收入增加以及政府支持本地汽车製造的政策,汽车销售正在激增。由于汽车製造商强调车辆效率和法规遵循性,这直接促进了燃油输送泵的采用率不断提高。此外,全球范围内向严格的燃油效率标准转变,对优化燃料使用和减少排放的创新燃料转移解决方案产生了需求。

汽车燃油输送帮浦市场分为汽油和柴油两类。 2024 年,汽油市场占 60% 的份额,反映出其在乘用车领域的强劲地位。汽油动力汽车的广泛使用,加上燃油效率技术的进步,加强了该领域的主导地位。由于汽油引擎排放量较低且燃料价格实惠,在许多地区,尤其是在环境法规影响汽车偏好的市场,消费者继续青睐汽油引擎。旨在提高行驶里程和减少碳足迹的下一代汽油引擎的采用进一步推动了对高效燃油输送泵的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 25亿美元 |

| 预测值 | 196亿美元 |

| 复合年增长率 | 5.9% |

原始设备製造商 (OEM) 在汽车燃油输送泵市场中占据领先地位。汽车製造商依赖OEM组件,因为它们具有相容性、可靠性和卓越的性能。 OEM 和主要汽车品牌之间建立的关係确保了供应链的一致性,促进了长期合约并加强了OEM供应商的主导地位。对OEM製造的燃油输送泵的信任源于其能够满足严格的行业标准,从而确保现代车辆的最佳性能。

2024 年,亚太地区汽车燃油输送泵市场将占据 33% 的份额,主要汽车製造国的需求将激增。随着产量的增加推动市场扩张,汽车工业蓬勃发展的国家继续成为燃油输送泵的主要消费国。政府支持的促进国内汽车製造业的激励措施进一步加速了区域成长。亚太地区的基础设施发展正在提高汽车供应链效率,支援各个车辆领域对先进燃油输送泵的需求。

目录

第一章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 材料供应商

- 製造商

- 经销商

- 最终用途

- 利润率分析

- 供应商格局

- 技术与创新格局

- 专利分析

- 成本明细

- 价格趋势

- 监管格局

- 衝击力

- 成长动力

- 对轻量和人体工学座椅的需求不断增长

- 严格的安全和排放法规

- 电子商务和物流的成长

- 可持续材料的进步

- 产业陷阱与挑战

- 先进座椅技术成本高

- 供应链中断

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 机械的

- 电力

第六章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 商用车

- 轻型商用车(LCV)

- 中型商用车(MCV)

- 重型商用车(HCV)

第七章:市场估计与预测:按燃料,2021 - 2034 年

- 主要趋势

- 汽油

- 柴油引擎

第八章:市场估计与预测:依销售管道,2021 - 2034 年

- 主要趋势

- OEM

- 售后市场

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- Airtex Pumps

- Aisin Seiki

- Carter Fuel Systems

- Continental Automotive

- Cummins Fuel

- Delphi Technologies

- Denso Corporation

- Edelbrock Group

- GMB

- Hitachi Astemo

- Holley Performance Products

- Mitsubishi Electric

- Pierburg

- Robert Bosch

- Spectra Premium

- Stanadyne

- TI Fluid Systems

- UFI Filters

- VDO Automotive

- Walbro

The Global Automotive Fuel Transfer Pumps Market was valued at USD 2.5 billion in 2024 and is projected to grow at a CAGR of 5.9% between 2025 and 2034. The expanding global automotive industry, driven by rising vehicle production and increasing demand for fuel-efficient solutions, is propelling the market forward. With the growing preference for high-performance vehicles, manufacturers are focusing on advanced fuel transfer pump technologies that enhance engine efficiency and durability. Emerging economies, particularly in Asia and Latin America, are witnessing a surge in automobile sales due to rapid urbanization, rising disposable incomes, and government policies favoring local vehicle manufacturing. This has directly contributed to the increasing adoption of fuel transfer pumps as automakers emphasize vehicle efficiency and regulatory compliance. Additionally, the shift toward stringent fuel efficiency standards worldwide has created a demand for innovative fuel transfer solutions that optimize fuel usage and reduce emissions.

The automotive fuel transfer pumps market is segmented into gasoline and diesel fuel categories. The gasoline segment accounted for a 60% market share in 2024, reflecting its strong presence in the passenger vehicle sector. The widespread use of gasoline-powered cars, coupled with advancements in fuel efficiency technology, has strengthened the segment's dominance. Consumers continue to favor gasoline engines due to their lower emissions and affordable fuel prices in many regions, particularly in markets where environmental regulations influence vehicle preferences. The adoption of next-generation gasoline engines, designed for improved mileage and reduced carbon footprints, is further driving demand for efficient fuel transfer pumps.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.5 billion |

| Forecast Value | $19.6 billion |

| CAGR | 5.9% |

Original Equipment Manufacturers (OEMs) hold a leading position in the automotive fuel transfer pumps market. Automakers rely on OEM components due to their compatibility, reliability, and superior performance. Established relationships between OEMs and major automotive brands ensure a consistent supply chain, fostering long-term contracts and reinforcing the dominance of OEM suppliers. The trust in OEM-manufactured fuel transfer pumps stems from their ability to meet stringent industry standards, guaranteeing optimal performance in modern vehicles.

The Asia Pacific automotive fuel transfer pumps market commanded a 33% share in 2024, with demand surging in top vehicle manufacturing nations. Countries with robust automotive industries continue to be major consumers of fuel transfer pumps as increased production volumes drive market expansion. Government-backed incentives to promote domestic vehicle manufacturing further accelerate regional growth. Infrastructure developments across the Asia Pacific are enhancing automotive supply chain efficiency, supporting the demand for advanced fuel transfer pumps across various vehicle segments.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Material providers

- 3.1.1.2 Manufacturers

- 3.1.1.3 Distributors

- 3.1.1.4 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Technology & innovation landscape

- 3.3 Patent analysis

- 3.4 Cost breakdown

- 3.5 Price trend

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Rising demand for lightweight and ergonomic seating

- 3.7.1.2 Stringent safety and emission regulations

- 3.7.1.3 Growth in e-commerce and logistics

- 3.7.1.4 Advancements in sustainable materials

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High cost of advanced seating technologies

- 3.7.2.2 Supply chain disruptions

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Mechanical

- 5.3 Electrical

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger vehicles

- 6.3 Commercial vehicles

- 6.3.1 Light Commercial Vehicles (LCV)

- 6.3.2 Medium Commercial Vehicles (MCV)

- 6.3.3 Heavy Commercial Vehicles (HCV)

Chapter 7 Market Estimates & Forecast, By Fuel, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Gasoline

- 7.3 Diesel

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Airtex Pumps

- 10.2 Aisin Seiki

- 10.3 Carter Fuel Systems

- 10.4 Continental Automotive

- 10.5 Cummins Fuel

- 10.6 Delphi Technologies

- 10.7 Denso Corporation

- 10.8 Edelbrock Group

- 10.9 GMB

- 10.10 Hitachi Astemo

- 10.11 Holley Performance Products

- 10.12 Mitsubishi Electric

- 10.13 Pierburg

- 10.14 Robert Bosch

- 10.15 Spectra Premium

- 10.16 Stanadyne

- 10.17 TI Fluid Systems

- 10.18 UFI Filters

- 10.19 VDO Automotive

- 10.20 Walbro