|

市场调查报告书

商品编码

1708139

重型自动驾驶汽车市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Heavy-Duty Autonomous Vehicle Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

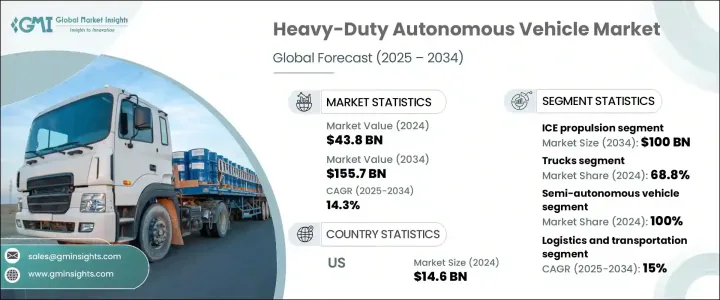

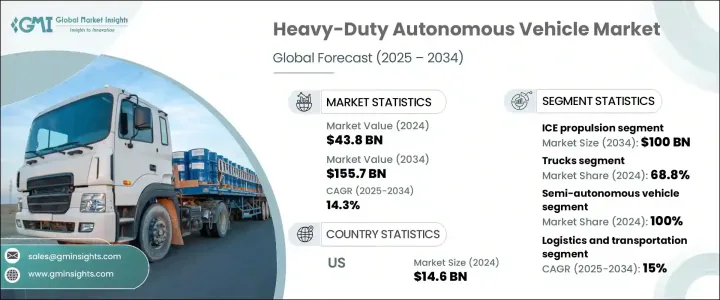

2024 年全球重型自动驾驶汽车市场规模达到 438 亿美元,预计 2025 年至 2034 年期间的复合年增长率将达到 14.3%。对增强安全功能的需求不断增长,加上自动驾驶技术的日益普及,正在推动该领域的大幅成长。自动驾驶重型车辆透过整合尖端感测器、人工智慧和即时资料分析来有效地导航道路,从而彻底改变了交通运输方式。这些先进的系统使车辆能够评估周围环境、做出即时决策并适应动态交通状况,从而显着降低事故风险。这种向自动化的转变不仅提高了道路安全性,而且还最大限度地减少了人为错误,从而减少了人员伤亡,并节省了医疗和财产损失的大量成本。

对永续性和营运效率的日益重视进一步加速了各行各业对重型自动驾驶汽车的采用。公司正在利用自动化来解决劳动力短缺问题、减少长期开支并优化车队管理。随着人工智慧决策和即时连接的进步,自动驾驶卡车和巴士正成为物流、采矿、建筑和公共交通不可或缺的一部分。世界各国政府正在推出法规和政策,以促进自动驾驶汽车测试和商业部署,确保其安全且无缝地融入现有的交通网络。此外,5G 连接、基于云端的监控和机器学习演算法的快速发展正在推动产业向前发展。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 438亿美元 |

| 预测值 | 1557亿美元 |

| 复合年增长率 | 14.3% |

市场根据推进类型进行细分,包括内燃机 (ICE)、电动和混合动力汽车。 2024 年,内燃机汽车占 60% 的市场份额,预计到 2034 年将创造 1,000 亿美元的市场价值。内燃机驱动的自动驾驶汽车由于其价格低廉和加油基础设施完善,仍然是早期研发的首选。与电动替代品相比,它们的续航里程更长,更适合长距离作业和具有挑战性的地形,有利于在不同环境中进行更广泛的测试和采用。

根据车辆类型,重型自动驾驶汽车市场分为卡车和巴士。 2024 年,卡车占据 68.8% 的主导份额,这得益于其在物流、采矿和製造等行业的广泛应用。自动驾驶卡车可以不间断地连续运行,从而优化燃料消耗并加快运输速度。随着企业优先考虑效率和降低成本,自动驾驶卡车的转变正在成为供应链发展的关键组成部分。公司越来越多地投资于自动驾驶卡车解决方案,以简化运输、提高生产力并缓解劳动力短缺。

2024 年,北美重型自动驾驶汽车市场产值达 146 亿美元。政府正在积极制定监管框架,以支持自动驾驶汽车测试和大规模部署。人们对道路安全和减少交通拥堵的日益关注推动了该地区对自动驾驶重型车辆的需求。随着自动驾驶技术的不断发展,北美正在成为一个关键市场,行业领导者正在投资下一代创新以重新定义运输和物流。

目录

第一章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 原物料供应商

- 组件提供者

- 製造商

- 技术提供者

- 配销通路分析

- 最终用途

- 利润率分析

- 供应商格局

- 技术与创新格局

- 专利分析

- 监管格局

- 成本細項分析

- 价格趋势

- 重要新闻和倡议

- 衝击力

- 成长动力

- 采矿和建筑业对自动化的需求不断增长

- 人工智慧和感测器技术的进步

- 监管推动更安全和永续的交通运输

- 政府对基础建设的投资不断增加

- 产业陷阱与挑战

- 初期投资成本高

- 监管和安全问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 卡车

- 7 类

- 第 8 类

- 公车

第六章:市场估计与预测:依自主级别,2021 年至 2034 年

- 主要趋势

- 半自动驾驶汽车

- 1级

- 2级

- 3级

- 自动驾驶汽车

- 4级

第七章:市场估计与预测:按推进方式,2021 - 2034 年

- 主要趋势

- 冰

- 电动车

- 油电混合车

第八章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 物流和运输

- 矿业

- 农业

- 建造

- 石油和天然气

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 法国

- 英国

- 西班牙

- 义大利

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- 2getthere

- Aurora

- Baidu

- Caterpillar

- Daimler Truck

- Embark Trucks

- FAW

- General Motors

- Kodiak Robotics

- Navya ARMA

- New Flyer

- Oxa Autonomy

- PACCAR

- Schaeffler AG

- Torc Robotics

- TRATON

- TuSimple

- Volvo

- ZF Friedrichshafen

- Zoox

The Global Heavy-duty Autonomous Vehicle Market reached USD 43.8 billion in 2024 and is projected to expand at a CAGR of 14.3% between 2025 and 2034. The rising demand for enhanced safety features, coupled with the increasing adoption of self-driving technology, is driving substantial growth in this sector. Autonomous heavy-duty vehicles are revolutionizing transportation by integrating cutting-edge sensors, artificial intelligence, and real-time data analysis to navigate roads efficiently. These advanced systems allow vehicles to assess their surroundings, make instant decisions, and adapt to dynamic traffic conditions, significantly reducing accident risks. This shift toward automation not only enhances road safety but also minimizes human error, leading to fewer fatalities and injuries and substantial cost savings on healthcare and property damage.

The growing emphasis on sustainability and operational efficiency is further accelerating the adoption of heavy-duty autonomous vehicles across industries. Companies are leveraging automation to address labor shortages, reduce long-term expenses, and optimize fleet management. With advancements in AI-driven decision-making and real-time connectivity, autonomous trucks and buses are becoming integral to logistics, mining, construction, and public transportation. Governments worldwide are introducing regulations and policies to facilitate autonomous vehicle testing and commercial deployment, ensuring safe and seamless integration into existing transportation networks. Additionally, rapid developments in 5G connectivity, cloud-based monitoring, and machine learning algorithms are propelling the industry forward.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $43.8 Billion |

| Forecast Value | $155.7 Billion |

| CAGR | 14.3% |

The market is segmented based on propulsion types, including internal combustion engine (ICE), electric, and hybrid vehicles. In 2024, the ICE segment dominated with a 60% market share and is expected to generate USD 100 billion by 2034. ICE-powered autonomous vehicles remain the preferred choice for early-stage research and development due to their affordability and well-established refueling infrastructure. Their extended range compared to electric alternatives makes them more suitable for long-distance operations and challenging terrains, facilitating broader testing and adoption across diverse environments.

By vehicle type, the heavy-duty autonomous vehicle market is categorized into trucks and buses. Trucks held a dominant share of 68.8% in 2024, driven by their widespread use in industries such as logistics, mining, and manufacturing. Autonomous trucks offer continuous operation without breaks, optimizing fuel consumption and expediting deliveries. As businesses prioritize efficiency and cost reduction, the shift toward self-driving trucks is becoming a critical component of supply chain evolution. Companies are increasingly investing in autonomous trucking solutions to streamline transportation, enhance productivity, and mitigate workforce shortages.

North America heavy-duty autonomous vehicle market generated USD 14.6 billion in 2024. Government initiatives are actively shaping regulatory frameworks to support autonomous vehicle testing and large-scale deployment. The growing focus on road safety and congestion reduction is propelling demand for self-driving heavy-duty vehicles in this region. As autonomous technology continues to evolve, North America is emerging as a key market, with industry leaders investing in next-generation innovations to redefine transportation and logistics.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material providers

- 3.1.1.2 Component providers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 Distribution channel analysis

- 3.1.1.6 End Use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Technology & innovation landscape

- 3.3 Patent analysis

- 3.4 Regulatory landscape

- 3.5 Cost breakdown analysis

- 3.6 Price trend

- 3.7 Key news & initiatives

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising demand for automation in mining and construction

- 3.8.1.2 Advancements in ai and sensor technologies

- 3.8.1.3 Regulatory push for safer and sustainable transport

- 3.8.1.4 Growing government investment in infrastructure development

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High initial investment costs

- 3.8.2.2 Regulatory and safety concerns

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Trucks

- 5.2.1 Class 7

- 5.2.2 Class 8

- 5.3 Buses

Chapter 6 Market Estimates & Forecast, By Level of Autonomy, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Semi-autonomous vehicle

- 6.2.1 Level 1

- 6.2.2 Level 2

- 6.2.3 Level 3

- 6.3 Autonomous vehicle

- 6.3.1 Level 4

Chapter 7 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 ICE

- 7.3 Electric vehicle

- 7.4 Hybrid vehicle

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Logistics and transportation

- 8.3 Mining

- 8.4 Agriculture

- 8.5 Construction

- 8.6 Oil & gas

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 France

- 9.3.3 U.K.

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 2getthere

- 10.2 Aurora

- 10.3 Baidu

- 10.4 Caterpillar

- 10.5 Daimler Truck

- 10.6 Embark Trucks

- 10.7 FAW

- 10.8 General Motors

- 10.9 Kodiak Robotics

- 10.10 Navya ARMA

- 10.11 New Flyer

- 10.12 Oxa Autonomy

- 10.13 PACCAR

- 10.14 Schaeffler AG

- 10.15 Torc Robotics

- 10.16 TRATON

- 10.17 TuSimple

- 10.18 Volvo

- 10.19 ZF Friedrichshafen

- 10.20 Zoox