|

市场调查报告书

商品编码

1716573

汽车市场人工智慧机会、成长动力、产业趋势分析及 2025 - 2034 年预测AI in Automotive Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

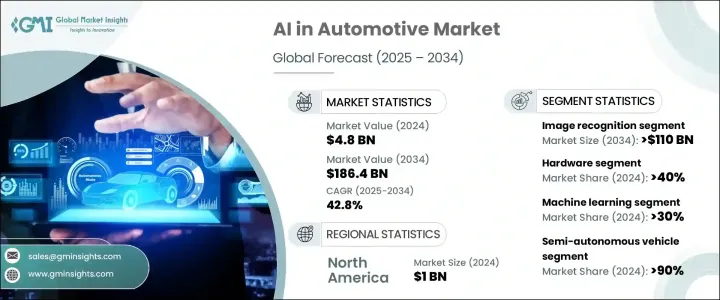

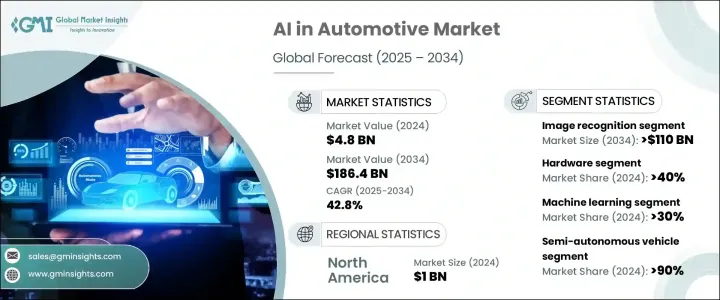

2024 年全球汽车人工智慧市场价值为 48 亿美元,预计 2025 年至 2034 年间复合年增长率将达到惊人的 42.8%。随着人工智慧技术继续重新定义移动出行的未来,这种指数级增长反映了对智慧汽车解决方案日益增长的需求。人工智慧与车辆的融合正在改变汽车的运作方式,提升乘客的安全性和驾驶体验。领先的汽车製造商和科技公司正在大力投资人工智慧驱动系统,特别是自动驾驶汽车和下一代高级驾驶辅助系统 (ADAS)。

人工智慧在增强车辆智慧、态势感知和即时决策方面的作用正在推动汽车产业走向更安全、更互联、更自主的未来。从交通管理和防撞到预测性维护和个人化车内体验,人工智慧正在成为现代车辆架构的核心组成部分。汽车製造商也利用人工智慧提供预测导航、语音辨识和行为分析功能,提高驾驶和乘客的便利性。随着消费者对更安全、更智慧的行动解决方案的需求不断增长,人工智慧将成为汽车领域不可或缺的一部分,并在未来十年进一步加速市场成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 48亿美元 |

| 预测值 | 1864亿美元 |

| 复合年增长率 | 42.8% |

人工智慧应用的激增很大程度上是由 ADAS 和自动驾驶解决方案等技术的日益实施所推动的。人工智慧透过与先进感测器、高解析度摄影机、雷达和光达系统的无缝集成,显着提高了车辆安全性和整体驾驶体验。车道维持辅助、自适应巡航控制、自动紧急煞车和行人侦测等功能均由人工智慧演算法提供支持,使车辆能够分析周围环境并做出即时驾驶决策,从而减少事故并提高道路安全。

市场主要根据资料探勘和影像辨识等流程进行细分,其中影像辨识占据主导地位。由于该领域在实现自动驾驶汽车和 ADAS 功能方面发挥关键作用,预计到 2034 年该领域的产值将超过 1,100 亿美元。影像辨识技术使人工智慧系统能够处理和解释即时环境资料,精确识别行人、交通标誌、车辆和车道标记。感知和理解动态路况的能力使影像辨识成为自动驾驶发展的基石。

从组件来看,汽车人工智慧市场分为硬体、软体和服务,其中硬体在 2024 年将占 40% 的份额。汽车製造商正在大力投资先进的硬件,以支援人工智慧汽车的运算需求。人工智慧晶片、GPU、感测器和光达系统等专用组件对于处理大量资料流进行即时处理至关重要,可实现自动驾驶、影像侦测、感测器融合和基于深度学习的分析等无缝人工智慧功能。

由于美国强大的技术基础设施和快速的人工智慧应用,美国汽车市场的人工智慧占据了显着的 33% 的份额,并在 2024 年创造了 10 亿美元的产值。主要汽车製造商和科技巨头在开发基于人工智慧的自动驾驶技术和先进安全系统方面处于领先地位,美国牢牢占据着塑造全球人工智慧汽车格局的关键地位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 技术提供者

- OEM製造商

- 经销商

- 最终用途

- 利润率分析

- 供应商格局

- 技术与创新格局

- 专利分析

- 监管格局

- 衝击力

- 成长动力

- 高级驾驶辅助系统 (ADAS) 和自动驾驶汽车

- 增强车辆安全性和防撞功能

- 预测性维护和车队管理

- 人工智慧车载资讯娱乐和语音助手

- 产业陷阱与挑战

- 实施成本高且整合复杂

- 资料隐私和网路安全问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 硬体

- 软体

- 服务

第六章:市场估计与预测:依技术分类,2021 - 2034 年

- 主要趋势

- 电脑视觉

- 情境感知

- 深度学习

- 机器学习

- 自然语言处理(NLP)

第七章:市场估计与预测:按工艺,2021 - 2034 年

- 主要趋势

- 资料探勘

- 影像辨识

第八章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 半自动驾驶汽车

- 完全自动驾驶汽车

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- Alphabet

- Audi

- Bayerische Motoren Werke (BMW)

- Daimler

- Didi Chuxing

- Ford Motor

- General Motors

- Harman International Industries

- Honda Motor

- Intel

- International Business Machines (IBM)

- Microsoft

- NVIDIA

- Qualcomm

- Tesla

- Toyota Motor

- Uber Technologies

- Volvo Car

- Waymo

- Xilinx

The Global AI In Automotive Market was valued at USD 4.8 billion in 2024 and is projected to witness a staggering CAGR of 42.8% between 2025 and 2034. This exponential growth reflects the rising demand for intelligent automotive solutions as AI technologies continue to redefine the future of mobility. The integration of AI into vehicles is transforming the way cars operate, elevating both the safety and driving experience of passengers. Leading automakers and technology companies are heavily investing in AI-driven systems, particularly for autonomous vehicles and next-generation Advanced Driver Assistance Systems (ADAS).

AI's role in enhancing vehicle intelligence, situational awareness, and real-time decision-making is pushing the automotive sector toward a future where cars are safer, more connected, and increasingly autonomous. From traffic management and collision avoidance to predictive maintenance and personalized in-car experiences, AI is becoming a central component of modern vehicle architecture. Automakers are also capitalizing on AI to offer predictive navigation, voice recognition, and behavior analysis features, enhancing both driver and passenger convenience. With growing consumer demand for safer and smarter mobility solutions, AI is set to become indispensable in the automotive world, further accelerating market growth over the next decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.8 Billion |

| Forecast Value | $186.4 Billion |

| CAGR | 42.8% |

The surge in AI adoption is largely driven by the increasing implementation of technologies such as ADAS and autonomous driving solutions. AI significantly enhances vehicle safety and overall driving experience through seamless integration with advanced sensors, high-resolution cameras, radar, and LiDAR systems. Features like lane-keeping assistance, adaptive cruise control, automatic emergency braking, and pedestrian detection are powered by AI algorithms that enable vehicles to analyze their surroundings and make instant driving decisions, reducing accidents and improving road safety.

The market is primarily segmented based on processes like data mining and image recognition, with image recognition dominating the landscape. This segment is expected to generate over USD 110 billion by 2034, driven by its critical role in enabling autonomous vehicles and ADAS functionalities. Image recognition technology allows AI systems to process and interpret real-time environmental data, identifying pedestrians, traffic signs, vehicles, and lane markings with precision. The ability to perceive and understand dynamic road conditions makes image recognition a cornerstone of autonomous driving development.

In terms of components, the AI in automotive market is divided into hardware, software, and services, with hardware accounting for a significant 40% share in 2024. Automotive manufacturers are heavily investing in advanced hardware to support the computational demands of AI-powered vehicles. Specialized components such as AI chips, GPUs, sensors, and LiDAR systems are essential to handle vast streams of data for real-time processing, enabling seamless AI functionalities like automated driving, image detection, sensor fusion, and deep learning-based analytics.

The U.S. AI in automotive market commanded a notable 33% share and generated USD 1 billion in 2024, thanks to the country's robust technological infrastructure and rapid AI adoption. Major automakers and tech giants are leading the charge in developing AI-based autonomous driving technologies and advanced safety systems, firmly positioning the U.S. as a key player in shaping the global AI-driven automotive landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Technology providers

- 3.1.1.2 OEM Manufacturers

- 3.1.1.3 Distributors

- 3.1.1.4 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Technology & innovation landscape

- 3.3 Patent analysis

- 3.4 Regulatory landscape

- 3.5 Impact forces

- 3.5.1 Growth drivers

- 3.5.1.1 Advanced Driver Assistance Systems (ADAS) and Autonomous Vehicles

- 3.5.1.2 Enhanced Vehicle Safety and Collision Avoidance

- 3.5.1.3 Predictive Maintenance and Fleet Management

- 3.5.1.4 AI-powered In-Vehicle Infotainment and Voice Assistants

- 3.5.2 Industry pitfalls & challenges

- 3.5.2.1 High Implementation Costs and Integration Complexity

- 3.5.2.2 Data Privacy and Cybersecurity Concerns

- 3.5.1 Growth drivers

- 3.6 Growth potential analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Hardware

- 5.3 Software

- 5.4 Service

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Computer vision

- 6.3 Context awareness

- 6.4 Deep learning

- 6.5 Machine learning

- 6.6 Natural Language Processing (NLP)

Chapter 7 Market Estimates & Forecast, By Process, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Data mining

- 7.3 Image recognition

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Semi-Autonomous vehicles

- 8.3 Fully Autonomous vehicles

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Alphabet

- 10.2 Audi

- 10.3 Bayerische Motoren Werke (BMW)

- 10.4 Daimler

- 10.5 Didi Chuxing

- 10.6 Ford Motor

- 10.7 General Motors

- 10.8 Harman International Industries

- 10.9 Honda Motor

- 10.10 Intel

- 10.11 International Business Machines (IBM)

- 10.12 Microsoft

- 10.13 NVIDIA

- 10.14 Qualcomm

- 10.15 Tesla

- 10.16 Toyota Motor

- 10.17 Uber Technologies

- 10.18 Volvo Car

- 10.19 Waymo

- 10.20 Xilinx