|

市场调查报告书

商品编码

1766180

汽车量子点背光单元市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive Quantum Dot Backlight Units Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

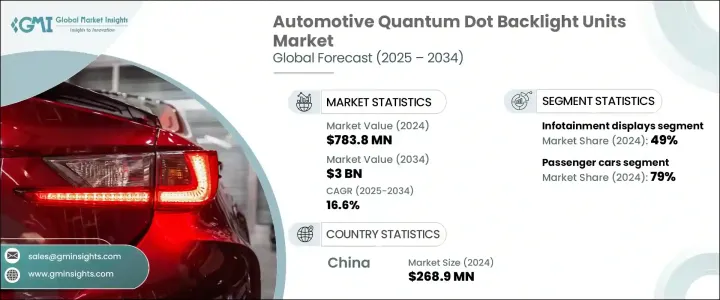

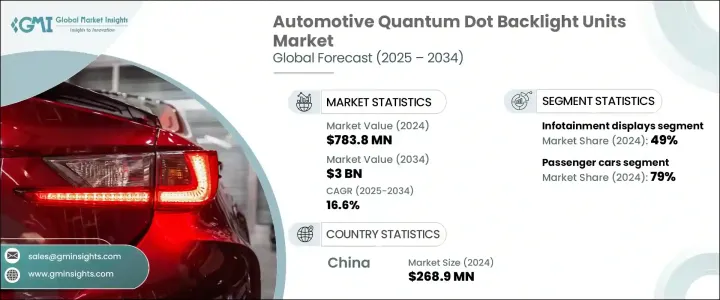

2024 年全球汽车量子点背光单元市场价值为 7.838 亿美元,预计到 2034 年将以 16.6% 的复合年增长率成长,达到 30 亿美元。这一增长是由消费者对沉浸式数位显示器的期望不断提高,以及车辆资讯娱乐和智慧驾驶舱系统的加速采用所推动的。随着汽车内装发展成为数位指挥中心,对提供卓越色彩保真度、更高对比度和增强亮度的显示器的需求正在迅速增长。量子点 (QD) 背光单元正在成为提供这些先进视觉功能的核心组件。随着对车载连接、即时驾驶资料和多媒体功能的需求不断增长,QD 增强型萤幕可提供当今连网汽车所需的效能、效率和耐用性。

汽车製造商正在重新思考其座舱设计,转向涵盖资讯娱乐、仪表板和平视显示器 (HUD) 的统一显示平台。这项转变有助于实现一致的使用者介面和精简的製造流程。随着模组化显示系统在从电动和混合动力车型到高端自动驾驶平台等各个汽车领域日益普及,QD 背光单元正成为标配。其适应性、色彩精准度和节能性正在巩固其在下一代数位汽车体验中的地位。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 7.838亿美元 |

| 预测值 | 30亿美元 |

| 复合年增长率 | 16.6% |

到2024年,乘用车领域将占据79%的市场份额,预计2025年至2034年的复合年增长率为18%。在这一领域,量子点(QD)背光单元透过提供更丰富的色彩还原、更高的亮度和更佳的能耗,正在彻底改变显示性能。这些增强功能使其特别适用于需要在各种光照条件下表现良好的资讯娱乐系统、平视显示器和数位驾驶仪錶板。由量子点增强膜(QDEF)驱动的高动态范围(HDR)视觉效果带来身临其境的体验,同时支援连网车辆系统的安全性和功能性。它们能够无缝整合到基于LCD和曲面的显示格式,使其成为现代驾驶舱布局的理想选择,尤其是在中檔到豪华电动车车型。量子点显示器也符合汽车级耐久性标准,这对于长期车载部署至关重要。

资讯娱乐显示器市场在2024年占据49%的市场份额,预计到2034年将以15%的复合年增长率成长。对响应迅速、色彩鲜艳且细节丰富的座舱数位体验的需求,推动了量子点(QD)在车载资讯娱乐系统中的整合。量子点背光单元增强了多媒体观看体验、导航清晰度和使用者介面的反应能力。玻璃上量子点(QD-on-Glass)和量子点显示(QDEF)等技术可提供中控显示器所需的宽色域、更快的更新率和高亮度。它们能够在明亮的环境中保持影像质量,从而增强驾驶员和乘客的互动体验。随着使用者体验成为竞争优势,这些显示器现已成为传统汽车和电动车中控台系统不可或缺的一部分。

中国汽车量子点背光模组市场占63%的市场份额,2024年市场规模达2.689亿美元,这得益于中国汽车的大规模生产和对高科技车载显示器的强劲需求。随着智慧座舱技术的扩展,中国汽车市场正迅速转向量子点增强系统,用于数位仪錶板、ADAS视觉化和车载娱乐系统。政府推出的支援技术开发、在地化生产和智慧出行的政策进一步增强了量子点显示器的应用势头。对高阶数位座舱解决方案的需求正在推动量子点显示器的集成,尤其是在日益增长的电动车和混合动力汽车领域,这些领域越来越多地将高端显示技术作为标配。

积极影响全球汽车量子点背光单元市场的关键参与者包括三星显示、京东方科技集团、夏普、Kyulux、友达光电股份有限公司 (AUO)、Nanosys、华星光电 (CSOT)、索尼、群创光电和 LG Display。为了巩固市场地位,汽车量子点背光单元领域的公司正专注于产品创新、策略联盟和产能扩张。各公司正大力投资研发,以提高 QD 技术的效率和耐用性,同时降低生产成本。与汽车原始设备製造商 (OEM) 和一级供应商的合作,使得先进的 QD 系统能够及早整合到新的汽车平台中。一些参与者也致力于垂直整合的生产模式,以确保供应链的稳定性和性能的一致性。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 对高解析度显示器的需求不断增长

- 资讯娱乐系统整合度不断提升

- 高级驾驶辅助系统 (ADAS) 的采用日益增多

- 量子点材料的技术进步

- 产业陷阱与挑战

- 量子点显示器成本高

- 镉基量子点的毒性问题

- 市场机会

- 整合到自动驾驶和半自动驾驶汽车中

- 售后市场显示器升级日益增多

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 成本細項分析

- 软体开发和授权成本

- 部署和整合成本

- 维护和支援成本

- 网路安全与合规成本

- 培训和变更管理成本

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

- 用例

- 最佳情况

- 消费者行为与采用趋势

- 使用者体验和介面趋势

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 轿车

- 掀背车

- 越野车

- 商用车

- 轻型

- 中型

- 重负

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 资讯娱乐显示器

- 仪表板

- 抬头显示器 (HUD)

- 后座娱乐系统

- 高级驾驶辅助系统 (ADAS) 显示器

第七章:市场估计与预测:依技术分类,2021 - 2034 年

- 主要趋势

- 量子点增强膜 (QDEF) 背光

- 玻璃量子点(QDOG)

- 量子点LED(QD-LED)

- 量子点彩色滤光片(QDCF)

第八章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- OEM

- 售后市场

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧人

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- AU Optronics Corp. (AUO)

- BOE Technology Group

- CSOT (China Star Optoelectronics Technology)

- Helio Display Materials

- Innolux Corporation

- Kyulux

- LG Display

- Luminit LLC

- Nanoco Group

- Nanosys

- Noctiluca

- OSRAM Continental

- PixelDisplay

- QD Laser

- Quantum Solutions

- Samsung Display

- Sharp Corporation

- Sony Corporation

- Toray Industries

- Visionox

The Global Automotive Quantum Dot Backlight Units Market was valued at USD 783.8 million in 2024 and is estimated to grow at a CAGR of 16.6% to reach USD 3 billion by 2034. This growth is driven by rising consumer expectations for immersive digital displays and the accelerating adoption of infotainment and smart cockpit systems in vehicles. As automotive interiors evolve into digital command centers, the need for displays that deliver superior color fidelity, higher contrast ratios, and enhanced brightness is growing rapidly. Quantum dot (QD) backlight units are emerging as core components for delivering these advanced visual capabilities. With demand increasing for in-vehicle connectivity, real-time driving data, and multimedia functions, QD-enhanced screens offer the performance, efficiency, and durability required by today's connected vehicles.

Automakers are rethinking their cabin designs, moving toward unified display platforms that encompass infotainment, clusters, and head-up displays (HUDs). This shift supports a consistent user interface and streamlined manufacturing. As modular display systems gain traction across vehicle segments-from electric and hybrid models to high-end autonomous platforms-QD backlight units are becoming a standard feature. Their adaptability, color precision, and energy savings are reinforcing their position in the next generation of digital automotive experiences.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $783.8 Million |

| Forecast Value | $3 Billion |

| CAGR | 16.6% |

By 2024, the passenger vehicles segment held a 79% share and is predicted to grow at a CAGR of 18% from 2025 to 2034. Within this segment, QD backlight units are transforming display performance by delivering richer color reproduction, elevated brightness, and improved energy use. These enhancements make them especially suitable for infotainment, head-up displays, and digital driver dashboards that need to perform well under variable lighting conditions. High-dynamic-range (HDR) visuals powered by Quantum Dot Enhancement Films (QDEF) bring an immersive experience while supporting safety and functionality in connected vehicle systems. Their seamless integration into LCD-based and curved display formats makes them ideal for modern cockpit layouts, particularly within mid-range to luxury EV models. QD displays also meet automotive-grade durability standards, which are essential for long-term in-vehicle deployment.

The infotainment displays segment held a 49% share in 2024 and is expected to grow at 15% CAGR through 2034. The demand for responsive, vibrant, and highly detailed in-cabin digital experiences is pushing QD integration within vehicle infotainment systems. QD backlight units enhance multimedia viewing, navigation clarity, and user interface responsiveness. Technologies such as QD-on-Glass and QDEF deliver wide color gamuts, faster refresh rates, and high brightness levels necessary for central control displays. Their ability to retain image quality in bright ambient environments enhances the interactive experience for both drivers and passengers. With user experience becoming a competitive differentiator, these displays are now integral to center-stack systems across both conventional and electric vehicles.

China Automotive Quantum Dot Backlight Units Market held a 63% share and generated USD 268.9 million in 2024, propelled by its large-scale vehicle production and strong demand for high-tech automotive displays. With the expansion of intelligent cockpit technologies, China's automotive market is rapidly shifting toward QD-enhanced systems for digital clusters, ADAS visualization, and in-car entertainment. Public policies supporting tech development, localized manufacturing, and smart mobility have further strengthened the momentum behind QD adoption. The push for high-end digital cockpit solutions is driving the integration of QD displays, especially in the growing electric and hybrid vehicle segments, which are increasingly adopting premium display technologies as standard features.

Key players actively shaping the Global Automotive Quantum Dot Backlight Units Market include Samsung Display, BOE Technology Group, Sharp, Kyulux, AU Optronics Corp. (AUO), Nanosys, CSOT (China Star Optoelectronics Technology), Sony, Innolux, and LG Display. To strengthen their market presence, companies in the automotive quantum dot backlight unit space are focusing on product innovation, strategic alliances, and capacity expansion. Firms are investing heavily in R&D to enhance the efficiency and durability of QD technologies while reducing production costs. Partnerships with automotive OEMs and Tier-1 suppliers are allowing for early integration of advanced QD systems into new vehicle platforms. Several players are also working on vertically integrated production models to ensure supply chain stability and performance consistency.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 – 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle

- 2.2.3 Application

- 2.2.4 Technology

- 2.2.5 Distribution Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for high-resolution displays

- 3.2.1.2 Rising integration of infotainment systems

- 3.2.1.3 Growing adoption of Advanced Driver Assistance Systems (ADAS)

- 3.2.1.4 Technological advancements in quantum dot materials

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of quantum dot displays

- 3.2.2.2 Toxicity concerns with cadmium-based QDs

- 3.2.3 Market opportunities

- 3.2.3.1 Integration in autonomous and semi-autonomous vehicles

- 3.2.3.2 Growing aftermarket display upgrades

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.8.1 Software development & licensing cost

- 3.8.2 Deployment & integration cost

- 3.8.3 Maintenance & support cost

- 3.8.4 Cybersecurity & compliance cost

- 3.8.5 Training & change management cost

- 3.9 Patent analysis

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly Initiatives

- 3.10.5 Carbon footprint considerations

- 3.11 Use cases

- 3.12 Best-case scenario

- 3.13 Consumer behaviour & adoption trends

- 3.14 User experience & interface trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Passenger cars

- 5.2.1 Sedans

- 5.2.2 Hatchbacks

- 5.2.3 SUV

- 5.3 Commercial vehicles

- 5.3.1 Light duty

- 5.3.2 Medium duty

- 5.3.3 Heavy duty

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Infotainment displays

- 6.3 Instrument clusters

- 6.4 Head-Up Displays (HUDs)

- 6.5 Rear-seat entertainment systems

- 6.6 Advanced Driver Assistance System (ADAS) displays

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Quantum Dot Enhancement Film (QDEF) backlights

- 7.3 Quantum Dot on Glass (QDOG)

- 7.4 Quantum Dot on LED (QD-LED)

- 7.5 Quantum Dot Color Filters (QDCF)

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AU Optronics Corp. (AUO)

- 10.2 BOE Technology Group

- 10.3 CSOT (China Star Optoelectronics Technology)

- 10.4 Helio Display Materials

- 10.5 Innolux Corporation

- 10.6 Kyulux

- 10.7 LG Display

- 10.8 Luminit LLC

- 10.9 Nanoco Group

- 10.10 Nanosys

- 10.11 Noctiluca

- 10.12 OSRAM Continental

- 10.13 PixelDisplay

- 10.14 QD Laser

- 10.15 Quantum Solutions

- 10.16 Samsung Display

- 10.17 Sharp Corporation

- 10.18 Sony Corporation

- 10.19 Toray Industries

- 10.20 Visionox